Trade Finance Market

Global Trade Finance Market Size, Share, and Trends Analysis Report, by Type (Letters of Credit, Guarantees, Supply Chain Finance, Factoring, Documentary Collection, and Other), and By Service Providers (Banks, Trade Finance Companies, Insurance Companies, and Others), Forecast Period (2022-2028) Update Available - Forecast 2025-2031

The global trade finance market is anticipated to grow at a CAGR of 7.5% during the forecast period. Trade finance can help reduce the risk associated with global trade by reconciling the divergent needs of an exporter and importer. The rise in the need for safety and security of trading activities, surge in adoption of trade finance by SMEs and MSMEs in developing countries, increased competition, and new trade agreements are the major factors driving the growth of the trade finance market. The key advantage of trade finance is that it facilitates an easy way to arrange short-term finance and can improve efficiency and boost revenue.

However, the high cost associated with trade finance may hamper the growth of the market in developing countries due to the lower profit margin and currency hedging cost. This report will further analyze all the primary and secondary factors that are directly or indirectly influencing the growth of the trade finance market during the forecast period.

Impact of COVID-19 Pandemic on the Global Trade Finance Market

The COVID-19 pandemic has had a devastating effect on global economies due to which exporters are facing difficulties accessing trade financing in the market. Due to this reason a 60% increase in rejected applications for trade credit insurance. In addition, the International Chamber of Commerce (ICC) reports a retrenchment of banks from financial sectors deemed “high risk” as well as increases in the price of trade financing for SMEs. However, as the situation got normalized the market had bounced back to its pre-COVID-19 pandemic level.

Segmental Outlook

The global trade finance market is segmented based on the type and service providers. Based on the type, the market is sub-segmented into letters of credit, guarantees, supply chain finance, factoring, documentary collection, and others. Among these types, the supply chain finance segment is expected to grow fastest during the forecast period as it provides the advantage of working capital efficiency and cash conversion period to the corporates. It also provides the advantage to the service-providing bank to maintain a long-term partnership with the corporate and do cross-sell of services.

Based on service providers, the market is sub-segmented into banks, trade finance companies, insurance companies, and others. Among these service providers, the banks are the most trusted source for availing trade financing facilities, which is a major factor driving the growth of this segment. However, the trade finance companies are emerging as the fastest-growing segment with their customized offerings as per the varying customer requirements. These segments can further be customized as per the requested research requirements.

Regional Outlooks

The global trade finance market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can also be analyzed for a particular region or country level as per the requirement.

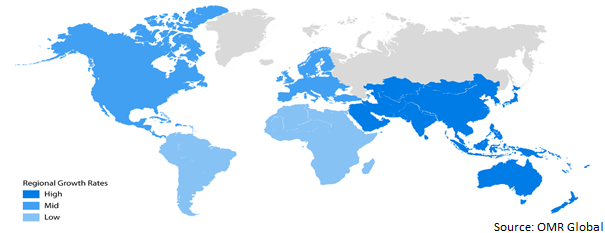

Global Trade Finance Market Growth by Region, 2022-2028

The North American Region Holds the Major Share in the Global Trade Finance Market

The North American region holds the major share in the global trade finance market. The triangular continent is one of the strongest economies, globally; it comprises around 23.9% of the global economy, as per World Economic Forum (2018), besides, having only 5% of the global population. As this region has a major impact on the global economy, thus, it generates immense opportunities for the growth of the trade finance market in this region.

The Asia-Pacific region is expected to grow fastest during the forecast period due to the major contribution of China and India as they are the fastest emerging economies globally. The shifting interest of industrialists from western countries towards the Asia-Pacific region due to the availability of labor and raw materials at economical cost is a major factor attracting the investors’ interest in this region, which in turn will drive the growth of the market during the forecast period.

Market Players Outlook

The major companies serving the global trade finance market include BNP Paribas, China Construction Bank, JPMorgan Chase & Co., Mizuho Financial Group, Standard Chartered Bank, Sumitomo Mitsui Banking Corp., and Citi group Inc., among others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, Russian firms had opened Chinese bank accounts in March 2022, amid the Ukraine crisis as the western governments are implementing restrictions on Russia's economy from the global financial system, pushing international companies to halt sales, cut ties and dump their funds worth of investments.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global trade finance market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Trade Finance Market

• Recovery Scenario of Global Trade Finance Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Segmentation

4.1. Global Trade Finance Market by Type

4.1.1. Letters of Credit

4.1.2. Guarantees

4.1.3. Supply Chain Finance

4.1.4. Factoring

4.1.5. Documentary Collection

4.1.6. Others

4.2. Global Trade Finance Market by Service Providers

4.2.1. Banks

4.2.2. Trade Finance Companies

4.2.3. Insurance Companies

4.2.4. Others

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Arab Bank

6.2. BNP Paribas

6.3. China Construction Bank

6.4. Citi group Inc.

6.5. Commerzbank

6.6. JPMorgan Chase & Co.

6.7. Mizuho Financial Group

6.8. Nordea Group

6.9. Rabobank

6.10. Rand Merchant Bank

6.11. Santander Bank

6.12. Scotiabank

6.13. Societe Generale

6.14. Standard Chartered Bank

6.15. Sumitomo Mitsui Banking Corp.

1. GLOBAL TRADE FINANCE MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL LETTERS OF CREDIT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL GUARANTEES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL SUPPLY CHAIN FINANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL FACTORING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL DOCUMENTARY COLLECTION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL TRADE FINANCE MARKET RESEARCH AND ANALYSIS BY SERVICE PROVIDERS, 2021-2028 ($ MILLION)

9. GLOBAL BANKS TRADE FINANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL TRADE FINANCE BY FINANCE COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL TRADE FINANCE BY INSURANCE COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL OTHER TRADE FINANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL TRADE FINANCE MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

14. NORTH AMERICAN TRADE FINANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

15. NORTH AMERICAN TRADE FINANCE MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

16. NORTH AMERICAN TRADE FINANCE MARKET RESEARCH AND ANALYSIS BY SERVICE PROVIDERS, 2021-2028 ($ MILLION)

17. EUROPEAN TRADE FINANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

18. EUROPEAN TRADE FINANCE MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

19. EUROPEAN TRADE FINANCE MARKET RESEARCH AND ANALYSIS BY SERVICE PROVIDERS, 2021-2028 ($ MILLION)

20. ASIA-PACIFIC TRADE FINANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

21. ASIA-PACIFIC TRADE FINANCE MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

22. ASIA-PACIFIC TRADE FINANCE MARKET RESEARCH AND ANALYSIS BY SERVICE PROVIDERS, 2021-2028 ($ MILLION)

23. REST OF THE WORLD TRADE FINANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

24. REST OF THE WORLD TRADE FINANCE MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

25. REST OF THE WORLD TRADE FINANCE MARKET RESEARCH AND ANALYSIS BY SERVICE PROVIDERS, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL TRADE FINANCE MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL TRADE FINANCE MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL TRADE FINANCE MARKET, 2022-2028 (%)

4. GLOBAL TRADE FINANCE MARKET SHARE BY TYPE, 2021 VS 2028 (%)

5. GLOBAL LETTERS OF CREDIT MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL GUARANTEES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL SUPPLY CHAIN FINANCE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL FACTORING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL DOCUMENTARY COLLECTION TRADE FINANCE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL OTHERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL TRADE FINANCE MARKET SHARE BY SERVICE PROVIDERS, 2021 VS 2028 (%)

12. GLOBAL BANKS TRADE FINANCE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL TRADE FINANCE BY FINANCE COMPANIES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL TRADE FINANCE BY INSURANCE COMPANIES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. GLOBAL OTHER TRADE FINANCE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16. GLOBAL TRADE FINANCE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

17. US TRADE FINANCE MARKET SIZE, 2021-2028 ($ MILLION)

18. CANADA TRADE FINANCE MARKET SIZE, 2021-2028 ($ MILLION)

19. UK TRADE FINANCE MARKET SIZE, 2021-2028 ($ MILLION)

20. FRANCE TRADE FINANCE MARKET SIZE, 2021-2028 ($ MILLION)

21. GERMANY TRADE FINANCE MARKET SIZE, 2021-2028 ($ MILLION)

22. ITALY TRADE FINANCE MARKET SIZE, 2021-2028 ($ MILLION)

23. SPAIN TRADE FINANCE MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF EUROPE TRADE FINANCE MARKET SIZE, 2021-2028 ($ MILLION)

25. INDIA TRADE FINANCE MARKET SIZE, 2021-2028 ($ MILLION)

26. CHINA TRADE FINANCE MARKET SIZE, 2021-2028 ($ MILLION)

27. JAPAN TRADE FINANCE MARKET SIZE, 2021-2028 ($ MILLION)

28. REST OF ASIA-PACIFIC TRADE FINANCE MARKET SIZE, 2021-2028 ($ MILLION)

29. REST OF THE WORLD TRADE FINANCE MARKET SIZE, 2021-2028 ($ MILLION)