Train Seats Market

Train Seats Market Size, Share & Trends Analysis Report by Type (Regular Seat, Recliner Seat, Folding Seat, Business Class Seat, and First-Class Seat), by Application (Normal Train, High-Speed Train, Subway, Tram, and Monorail), and by Distribution Channel (Original Equipment Manufacturer (OEM), and Aftermarket) Forecast Period (2023-2030) Update Available - Forecast 2025-2031

Train seats market is anticipated to grow at a considerable CAGR of 4.5% during the forecast period. The growth of the market is attributed to factors such as increasing demand for comfortable seating options in trains, advancements in train seat technology, and the expansion of rail networks in various regions. Further, the rising disposable income and changing consumer preferences towards enhanced travel experiences are also expected to fuel the demand for train seats. The arrival of new trains or coaches with luxurious and comfortable seats, which may include rotating seats and improved designs, is expected to greatly boost the demand for train seats. For instance, Vistadome coaches offer scenic travel experience with large windows, glass roofs, and panoramic views on Indian train routes. They feature observation lounges, snack bars, and air conditioning, attracting passengers and generating revenue for Indian railways. They exemplify the transformation of Indian railways to enhance the travel experience. In addition to their scenic features, Vistadome coaches also offer luxurious seats, including rotational seats, which contribute to the growth of the train seats market by providing a premium and comfortable travel experience.

Segmental Outlook

The global train seats market is segmented based on its type, application, and distribution channel. Based on type, the market is sub-segmented into regular seat, recliner seat, folding seat, business class seat, and first-class seat. Based on the application, the market is categorized into normal train, high-speed train, subway, tram, and monorail. Further, based on the distribution channel, the market is bifurcated into OEM and aftermarket. Among the segments, the business class seat segment is anticipated to hold a prominent market share due to the increasing demand for premium and luxurious seating options in trains.

The High-Speed Train Segment is Anticipated to Register Significant Growth During the Forecast Period

Among the application segments, the high-speed train sub-segment is anticipated to register significant growth during the forecast period. The growth of this segment is attributed to the factors including the expansion of high-speed rail networks and the growing preference for faster and efficient transportation. For instance, in November 2022, China's high-speed rail network started operating in 2008 between Beijing and Tianjin and has since grown too nearly 40,000km (25,000 miles), making it the largest for bullet trains that can travel up to 350km/h (220mph). The country further plans to to extend the network to 50,000km by 2025 and 200,000km by 2035. Furthermore, in July 2021, China unveiled a maglev train capable of traveling at a top speed of 600km/h. The expansion of China's high-speed rail network and the introduction of advanced technologies like the maglev train are likely to propel the demand for train seats.

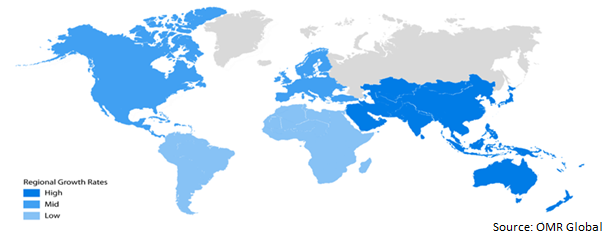

Regional Outlook

The global train seats market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East & Africa and Latin America). Among these, the European market is anticipated to experience prominent growth over the forecast period, driven by factors such as increasing investments in rail infrastructure and the demand for comfortable and luxurious train travel experiences. However, the Asia-Pacific region is projected to witness considerable growth in the train seats market due to the rapid development of rail networks, particularly in countries such as China and India.

Global Train Seats Market Growth by Region 2023-2030

North America Region is anticipated to Hold a Significant Share in the Global Train Seats Market

Among all the regions, North America is anticipated to account for a significant share in the train seats market during the forecast period. The regional market growth is primarily driven by factors such as the presence of well-established rail infrastructure, increasing investments in rail transportation, and the rising demand for comfortable and ergonomic seating options in trains. For instance, Amtrak Airo in the US is a new passenger experience that offers spacious seating with enhanced comfort and ergonomics. The seats are designed to provide plenty of legroom, bigger and sturdier tray tables, moveable headrests, and other features that prioritize ergonomics and comfort.

Market Players Outlook

The major companies serving the global train seats market include Stadler Rail AG, Faurecia, Grammer AG, Freedman Seating Co., and Fenix Group International, LLC., among others. These market players are considerably contributing to the market growth by adopting various strategies, including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. Additionally, they are focusing on developing technologically advanced and innovative train seat solutions to meet the evolving demands of consumers. For instance, in January 2019, Freedman seats have been chosen to provide exceptional comfort and reliability for the seats in the new train project. The Massachusetts Bay Transportation Authority (MBTA) took a significant step towards enhancing passenger comfort and supporting American manufacturing when they introduced the first of 24 new Green Line vehicles into service. These state-of-the-art rail cars are equipped with top-quality Freedman seats, ensuring a comfortable and enjoyable experience for commuters and travelers.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global train seats market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who stands where’ in the market

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Faurecia

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Fenix Group International, LLC

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Freedman Seating Co.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Grammer AG

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Stadler Rail AG

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Train Seats Market by Type

4.1.1. Regular Seat

4.1.2. Recliner Seat

4.1.3. Folding Seat

4.1.4. Business Class Seat

4.1.5. First-Class Seat

4.2. Global Train Seats Market by Application

4.2.1. Normal Train

4.2.2. High-Speed Train

4.2.3. Subway

4.2.4. Tram

4.2.5. Monorail

4.3. Global Train Seats Market by Distribution Channel

4.3.1. OEM (Original Equipment Manufacturer)

4.3.2. Aftermarket

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Amtek Railcar Ltd.

6.2. Bharat Seats Ltd.

6.3. BORCAD cz s.r.o.

6.4. Camira Fabrics Ltd.

6.5. COMPIN FAINSA

6.6. Compin Group

6.7. Franz Kiel GmbH

6.8. Kustom Seating Unlimited, Inc.

6.9. Lazzerini S.r.l.

6.10. Magna International Inc.

6.11. Progressive Manufacturing, Inc.

6.12. Rescroft®

6.13. Saira International

6.14. Service Corp. International

6.15. UN Global Compact

6.16. United Safety & Survivability Corp.

1. GLOBAL TRAIN SEATS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

2. GLOBAL REGULAR SEAT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL RECLINER SEAT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL FOLDING SEAT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL BUSINESS CLASS SEAT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL FIRST-CLASS SEAT MARKET REEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL TRAIN SEATS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

8. GLOBAL TRAIN SEATS FOR NORMAL TRAIN MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL TRAIN SEATS FOR HIGH-SPEED TRAIN MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL TRAIN SEATS FOR SUBWAY MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL TRAIN SEATS FOR TRAM MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL TRAIN SEATS FOR MONORAIL MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

13. GLOBAL TRAIN SEATS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2022-2030 ($ MILLION)

14. GLOBAL TRAIN SEATS FOR OEM MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

15. GLOBAL TRAIN SEATS FOR AFTERMARKET MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

16. GLOBAL TRAIN SEATS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

17. NORTH AMERICAN TRAIN SEATS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

18. NORTH AMERICAN TRAIN SEATS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

19. NORTH AMERICAN TRAIN SEATS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

20. NORTH AMERICAN TRAIN SEATS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2022-2030 ($ MILLION)

21. EUROPEAN TRAIN SEATS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

22. EUROPEAN TRAIN SEATS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

23. EUROPEAN TRAIN SEATS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

24. EUROPEAN TRAIN SEATS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2022-2030 ($ MILLION)

25. ASIA-PACIFIC TRAIN SEATS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

26. ASIA-PACIFIC TRAIN SEATS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

27. ASIA-PACIFIC TRAIN SEATS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

28. ASIA-PACIFIC TRAIN SEATS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2022-2030 ($ MILLION)

29. REST OF THE WORLD TRAIN SEATS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

30. REST OF THE WORLD TRAIN SEATS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

31. REST OF THE WORLD TRAIN SEATS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

32. REST OF THE WORLD TRAIN SEATS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2022-2030 ($ MILLION)

1. GLOBAL TRAIN SEATS MARKET SHARE BY TYPE, 2022 VS 2030 (%)

2. GLOBAL REGULAR SEAT MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL RECLINER SEAT MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL FOLDING SEAT BY MARKET SHARE REGION, 2022 VS 2030 (%)

5. GLOBAL BUSINESS CLASS SEAT BY MARKET SHARE REGION, 2022 VS 2030 (%)

6. GLOBAL FIRST-CLASS SEAT BY MARKET SHARE REGION, 2022 VS 2030 (%)

7. GLOBAL TRAIN SEATS MARKET SHARE BY APPLICATION, 2022 VS 2030 (%)

8. GLOBAL TRAIN SEATS FOR NORMAL TRAIN MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL TRAIN SEATS FOR HIGH-SPEED TRAIN MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL TRAIN SEATS FOR SUBWAY MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL TRAIN SEATS FOR TRAM MARKET SHARE BY REGION, 2022 VS 2030 (%)

12. GLOBAL TRAIN SEATS FOR MONORAIL MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. GLOBAL TRAIN SEATS MARKET SHARE BY DISTRIBUTION CHANNEL, 2022 VS 2030 (%)

14. GLOBAL TRAIN SEATS FOR OEM MARKET SHARE BY REGION, 2022 VS 2030 (%)

15. GLOBAL TRAIN SEATS FOR AFTERMARKET MARKET SHARE BY REGION, 2022 VS 2030 (%)

16. GLOBAL TRAIN SEATS MARKET SHARE BY REGION, 2022 VS 2030 (%)

17. US TRAIN SEATS MARKET SIZE, 2022-2030 ($ MILLION)

18. CANADA TRAIN SEATS MARKET SIZE, 2022-2030 ($ MILLION)

19. UK TRAIN SEATS MARKET SIZE, 2022-2030 ($ MILLION)

20. FRANCE TRAIN SEATS MARKET SIZE, 2022-2030 ($ MILLION)

21. GERMANY TRAIN SEATS MARKET SIZE, 2022-2030 ($ MILLION)

22. ITALY TRAIN SEATS MARKET SIZE, 2022-2030 ($ MILLION)

23. SPAIN TRAIN SEATS MARKET SIZE, 2022-2030 ($ MILLION)

24. REST OF EUROPE TRAIN SEATS MARKET SIZE, 2022-2030 ($ MILLION)

25. INDIA TRAIN SEATS MARKET SIZE, 2022-2030 ($ MILLION)

26. CHINA TRAIN SEATS MARKET SIZE, 2022-2030 ($ MILLION)

27. JAPAN TRAIN SEATS MARKET SIZE, 2022-2030 ($ MILLION)

28. SOUTH KOREA TRAIN SEATS MARKET SIZE, 2022-2030 ($ MILLION)

29. REST OF ASIA-PACIFIC TRAIN SEATS MARKET SIZE, 2022-2030 ($ MILLION)

30. REST OF THE WORLD TRAIN SEATS MARKET SIZE, 2022-2030 ($ MILLION)