Transcatheter Valve Market

Transcatheter Valve Market Size, Share & Trends Analysis Report by Application (Transcatheter Aortic Valve, Transcatheter Pulmonary Valve, and Transcatheter Mitral Valve), By Technology (Balloon-Expanded Transcatheter Valve, and Self-Expanded Transcatheter Valve) and By End-User (Hospitals, Ambulatory Surgical Centers (ASCs), and Cardiac Catheterization Laboratories) Forecast Period (2025-2035)

Industry Overview

Global transcatheter valve market size was $6,840 million in 2024 and is anticipated to grow at a CAGR of 15.7% during the forecast period (2025-2035). The increasing prevalence of valvular heart diseases, growing geriatric populations, minimally invasive benefits, technological advancements, expanding indications, favorable regulatory approvals, increased healthcare spending, and strong clinical evidence, are driving factors. In March 2025, Medtronic plc announced the two-year findings from the SMall Annuli Randomized To Evolut or SAPIEN (SMART) Trial, the largest global study directly comparing transfemoral transcatheter aortic valve replacement (TAVR) devices. In patients with aortic stenosis and a small aortic annulus, both treatment groups showed similar rates of combined outcomes including death, disabling stroke, and hospitalization for heart failure. However, the Evolut TAVR demonstrated consistently better valve function at two years, based on bioprosthetic valve dysfunction (BVD) measures, compared to the SAPIEN valve.

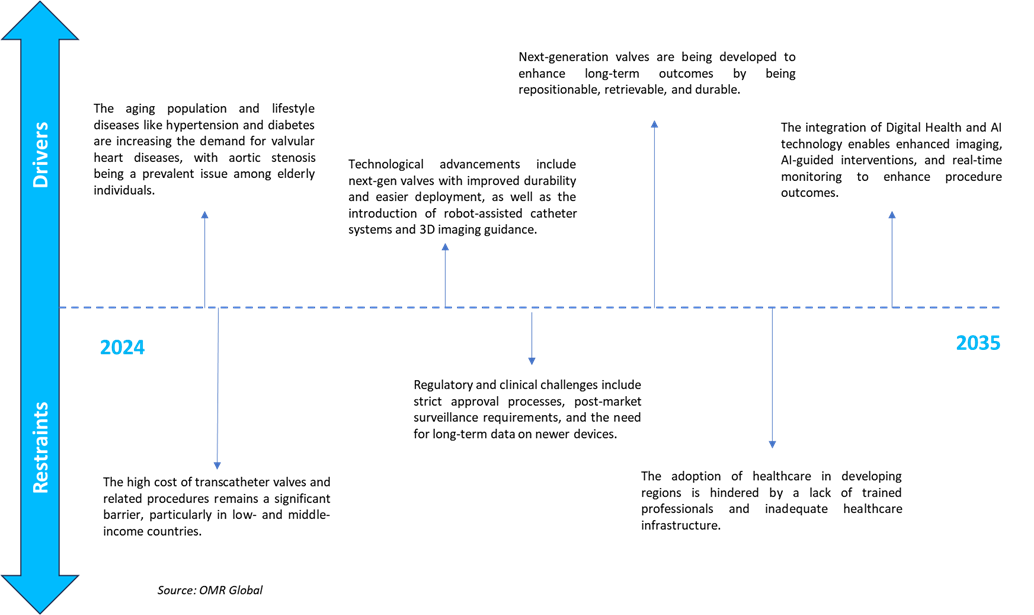

Market Dynamics

Technological Advancements

The market is experiencing growth owing to technological advancements such as AI software, next-gen delivery systems, valve designs, and imaging integration, which enhance device durability and long-term performance. For instance, in January 2025, Caranx Medical approved the FDA submission of TAVIPILOT Soft, the first AI software designed to provide real-time intra-operative guidance for transcatheter heart valve implantation. The software aims to facilitate precise positioning and delivery of heart valves by tracking anatomical and instrument landmarks. TAVIPILOT Soft is intended to broaden access to Transcatheter Aortic Valve Implantation (TAVI) by making it easier for a wider range of cardiologists to perform the procedure.

Regulatory Support & Clinical Trials

Regulatory bodies such as the FDA and funds raised are supporting early feasibility study pathways for transcatheter solutions, investing in clinical trials to boost data availability, and accelerating approvals. For instance, in March 2025, Laplace Interventional, a US-based medical device company specializing in transcatheter valve technology, secured $22 million in a Series C funding round. This capital supports an early feasibility study aimed at evaluating the clinical effectiveness and safety of their transcatheter tricuspid valve replacement system. Transcatheter valve replacement technologies continue to replace traditional open-heart procedures globally, the tricuspid valve device market remains relatively new and smaller compared to aortic and mitral valve replacements, yet it holds significant potential for growth and innovation.

Market Segmentation

- Based on the application, the market is segmented into transcatheter aortic valve, transcatheter pulmonary valve, and transcatheter mitral valve.

- Based on the technology, the market is segmented into balloon-expanded transcatheter valves and self-expanded transcatheter valves.

- Based on the end-user, the market is segmented into hospitals, ambulatory surgical centers (ASCs), and cardiac catheterization laboratories.

Transcatheter Aortic Valve: A Key Segment in Market Growth

Transcatheter Aortic Valve (TAV) is a minimally invasive procedure used to replace a diseased aortic valve, typically narrowed due to aortic stenosis, by inserting a prosthetic valve into the old valve using a catheter. Treatment for severe aortic stenosis, bicuspid aortic valve disease, degenerative bioprosthetic valve failure, and low-risk patients, including elderly patients, valve-in-valve procedures, and younger, lower-risk patient populations. Furthermore, TAVR is a procedure that replaces narrowed or diseased aortic valves with a smaller one using a catheter, avoiding open-heart surgery and providing an alternative to surgical aortic valve replacement (SAVR) for high-risk patients. For instance, in January 2025, Abbott introduced Navitor Vision in India for patients with essential aortic stenosis at high or extreme surgical risk. The device is Abbott's Navitor TAVI/TAVR system, renowned for stable delivery, performance, and forward readiness. The device has been upgraded with three large Vision markers for enhanced visibility and more convenient valve deployment in TAVI/TAVR procedures. Aortic stenosis is a prevalent and lethal heart valve disorder, restricting blood flow and potentially causing heart failure and sudden cardiac death. The Navitor Vision valve is implanted with Abbott's FlexNav delivery system, treating vessels as small as 5.0 mm. The device has superb blood flow and durability and is future-proof with big frame cells for easy coronary artery access.

Regional Outlook

The global transcatheter valve market is further divided by geography, including North America (the US and Canada), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), and the Rest of the World (the Middle East & Africa, and Latin America).

North America Region Dominates the Market with Major Share

North America holds a significant share, owing to the heart valve disease occurs when any valve in the heart is damaged or diseased. Causes include damage to the mitral, tricuspid, aortic, and pulmonary valves. The aortic valve is most commonly affected. Diseased valves can cause regurgitation, where blood leaks back into the chamber, or stenosis, where the valve's opening is narrowed and stiff, preventing full blood flow. These valves play an essential role in controlling blood flow within the heart. According to the US Centers for Disease Control and Prevention, in September 2024, a significant number of US adults, approximately 75%, have limited knowledge about heart valve disease, including those most at risk, such as individuals aged 65 and older. Annually, over 5 million people in the US receive a heart valve disease diagnosis, and the condition is responsible for more than 25,000 deaths each year. Heart valve disease is frequently misdiagnosed and untreated, particularly among African American, Hispanic, and Asian communities, leading to worse health outcomes for women.

Market Players Outlook

The major companies operating in the global transcatheter valve market include Abbott Laboratories, Boston Scientific Corp., Edwards Lifesciences Corp., and Medtronic plc, among others. Market players are leveraging partnerships, collaborations, mergers and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In September 2024, Pi-Cardia received FDA market clearance for ShortCut, the globe's first dedicated leaflet modification device for valve-in-valve TAVR procedures in patients at risk of coronary obstruction. As bioprosthetic valves degenerate, a significant portion of patients at risk will require leaflet splitting with ShortCut. By 2035, over 42,000 TAVR procedures will be performed in the US.

- In December 2024, Meril Life Sciences launched its next-generation Myval Octapro transcatheter heart valve, which has received CE Mark approval for transcatheter aortic valve replacement. The valve features reduced frame foreshortening for improved operator control and a large-size matrix for bioprosthetic valve sizing.

- In July 2023, Edwards Lifesciences completed a $300 million acquisition of Innovalve Bio Medical, a company specializing in transcatheter heart valve devices. The acquisition strengthens Edwards Lifesciences' valve repair and replacement offerings as the market shifts towards more minimally invasive devices. Innovalve's Innostay device received FDA approval for limited clinical trials in the US.

- In September 2022, Medtronic launched its Evolut FX next-generation TAVR system in the US, enhancing ease of use and predictable valve deployment for physicians. The system has received FDA approval and received positive feedback from participating physicians. The Evolut FX system includes gold markers for implanter visualization, a redesigned catheter tip, and a more flexible delivery system with an optimized stability layer.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global transcatheter valve market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Transcatheter Valve Market Sales Analysis – Application | Technology | End User | End-User($ Million)

• Transcatheter Valve Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Transcatheter Valve Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Transcatheter Valve Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Transcatheter Valve Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Transcatheter Valve Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Transcatheter Valve Market Revenue and Share by Manufacturers

• Transcatheter Valve Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Abbott Laboratories

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Boston Scientific Corp.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Edwards Lifesciences Corp.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Medical Technologies

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Medtronic plc

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Transcatheter Valve Market Sales Analysis by Application ($ Million)

5.1. Transcatheter Aortic Valve

5.2. Transcatheter Pulmonary Valve

5.3. Transcatheter Mitral Valve

6. Global Transcatheter Valve Market Sales Analysis by Technology ($ Million)

6.1. Balloon-Expanded Transcatheter Valve

6.2. Self-Expanded Transcatheter Valve

7. Global Transcatheter Valve Market Sales Analysis by End User ($ Million)

7.1. Hospitals

7.2. Ambulatory Surgical Centers (ASCs)

7.3. Cardiac Catheterization Laboratories

8. Regional Analysis

8.1. North American Transcatheter Valve Market Sales Analysis – Application | Technology | End User | Country ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European Transcatheter Valve Market Sales Analysis – Application | Technology | End User | Country ($ Million)

• Macroeconomic Factors for Europe

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific Transcatheter Valve Market Sales Analysis – Application | Technology | End User | Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World Transcatheter Valve Market Sales Analysis – Application | Technology | End User | Country ($ Million)

• Macroeconomic Factors for the Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. Abbott Laboratories

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. Anteris Technologies Global Corp.

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. Boston Scientific Corp.

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. Braile Biomédica

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. Cardiovalve Ltd.

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. Colibri Heart Valve LLC

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. CoreMedic

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. Edwards Lifesciences Corp.

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. Foldax Inc.

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. HighLife Medical

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. InnovHeart s.r.l.

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. JenaValve

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. LivaNova PLC

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.13.4. Business Strategies

9.14. Medical Technologies

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. Medtronic plc

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. Meril Life Sciences Pvt. Ltd.

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. MicroPort Medical (Group) Co.? Ltd.

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

9.18. NeoChord, Inc.

9.18.1. Quick Facts

9.18.2. Company Overview

9.18.3. Product Portfolio

9.18.4. Business Strategies

9.19. Peijia Medical Ltd.

9.19.1. Quick Facts

9.19.2. Company Overview

9.19.3. Product Portfolio

9.19.4. Business Strategies

9.20. Polares Medical Inc.

9.20.1. Quick Facts

9.20.2. Company Overview

9.20.3. Product Portfolio

9.20.4. Business Strategies

9.21. Trisol Medical

9.21.1. Quick Facts

9.21.2. Company Overview

9.21.3. Product Portfolio

9.21.4. Business Strategies

9.22. Venus Medtech (Hangzhou) Inc.

9.22.1. Quick Facts

9.22.2. Company Overview

9.22.3. Product Portfolio

9.22.4. Business Strategies

1. Global Transcatheter Valve Market Research And Analysis By Application, 2024-2035 ($ Million)

2. Global Transcatheter Aortic Valve Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Transcatheter Pulmonary Valve Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Transcatheter Mitral Valve Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Transcatheter Valve Market Research And Analysis By Technology, 2024-2035 ($ Million)

6. Global Balloon Expanded Transcatheter Valve Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Self-Expanded Transcatheter Valve Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Transcatheter Valve Market Research And Analysis By End User, 2024-2035 ($ Million)

9. Global Transcatheter Valve For Hospitals Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Transcatheter Valve For Ambulatory Surgical Centers (ASCs) Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Transcatheter Valve For Cardiac Catheterization Laboratories Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Transcatheter Valve Market Research And Analysis By Region, 2024-2035 ($ Million)

13. North American Transcatheter Valve Market Research And Analysis By Country, 2024-2035 ($ Million)

14. North American Transcatheter Valve Market Research And Analysis By Application, 2024-2035 ($ Million)

15. North American Transcatheter Valve Market Research And Analysis By Technology, 2024-2035 ($ Million)

16. North American Transcatheter Valve Market Research And Analysis By End User, 2024-2035 ($ Million)

17. European Transcatheter Valve Market Research And Analysis By Country, 2024-2035 ($ Million)

18. European Transcatheter Valve Market Research And Analysis By Application, 2024-2035 ($ Million)

19. European Transcatheter Valve Market Research And Analysis By Technology, 2024-2035 ($ Million)

20. European Transcatheter Valve Market Research And Analysis By End-User, 2024-2035 ($ Million)

21. Asia-Pacific Transcatheter Valve Market Research And Analysis By Country, 2024-2035 ($ Million)

22. Asia-Pacific Transcatheter Valve Market Research And Analysis By Application, 2024-2035 ($ Million)

23. Asia-Pacific Transcatheter Valve Market Research And Analysis By Technology, 2024-2035 ($ Million)

24. Asia-Pacific Transcatheter Valve Market Research And Analysis By End User, 2024-2035 ($ Million)

25. Rest Of The World Transcatheter Valve Market Research And Analysis By Region, 2024-2035 ($ Million)

26. Rest Of The World Transcatheter Valve Market Research And Analysis By Application, 2024-2035 ($ Million)

27. Rest Of The World Transcatheter Valve Market Research And Analysis By Technology, 2024-2035 ($ Million)

28. Rest Of The World Transcatheter Valve Market Research And Analysis By End User, 2024-2035 ($ Million)

1. Global Transcatheter Valve Market Research And Analysis By Application, 2024 Vs 2035 (%)

2. Global Transcatheter Aortic Valve Market Share By Region, 2024 Vs 2035 (%)

3. Global Transcatheter Pulmonary Valve Market Share By Region, 2024 Vs 2035 (%)

4. Global Transcatheter Mitral Valve Market Share By Region, 2024 Vs 2035 (%)

5. Global Transcatheter Valve Market Research And Analysis By Technology, 2024 Vs 2035 (%)

6. Global Balloon-Expanded Transcatheter Valve Market Share By Region, 2024 Vs 2035 (%)

7. Global Self-Expanded Transcatheter Valve Market Share By Region, 2024 Vs 2035 (%)

8. Global Transcatheter Valve Market Research And Analysis By End User, 2024 Vs 2035 (%)

9. Global Transcatheter Valve For Hospitals Market Share By Region, 2024 Vs 2035 (%)

10. Global Transcatheter Valve For Ambulatory Surgical Centers (ASCs) Market Share By Region, 2024 Vs 2035 (%)

11. Global Transcatheter Valve For Cardiac Catheterization Laboratories Market Share By Region, 2024 Vs 2035 (%)

12. Global Transcatheter Valve Market Share By Region, 2024 Vs 2035 (%)

13. US Transcatheter Valve Market Size, 2024-2035 ($ Million)

14. Canada Transcatheter Valve Market Size, 2024-2035 ($ Million)

15. UK Transcatheter Valve Market Size, 2024-2035 ($ Million)

16. France Transcatheter Valve Market Size, 2024-2035 ($ Million)

17. Germany Transcatheter Valve Market Size, 2024-2035 ($ Million)

18. Italy Transcatheter Valve Market Size, 2024-2035 ($ Million)

19. Spain Transcatheter Valve Market Size, 2024-2035 ($ Million)

20. Russia Transcatheter Valve Market Size, 2024-2035 ($ Million)

21. Rest Of Europe Transcatheter Valve Market Size, 2024-2035 ($ Million)

22. India Transcatheter Valve Market Size, 2024-2035 ($ Million)

23. China Transcatheter Valve Market Size, 2024-2035 ($ Million)

24. Japan Transcatheter Valve Market Size, 2024-2035 ($ Million)

25. South Korea Transcatheter Valve Market Size, 2024-2035 ($ Million)

26. ASEAN Transcatheter Valve Market Size, 2024-2035 ($ Million)

27. Australia and New Zealand Transcatheter Valve Market Size, 2024-2035 ($ Million)

28. Rest Of Asia-Pacific Transcatheter Valve Market Size, 2024-2035 ($ Million)

29. Latin America Transcatheter Valve Market Size, 2024-2035 ($ Million)

30. Middle East And Africa Transcatheter Valve Market Size, 2024-2035 ($ Million)

FAQS

The size of the Transcatheter Valve market in 2024 is estimated to be around USD 5.4 billion.

North America holds the largest share in the Transcatheter Valve market.

Leading players in the Transcatheter Valve market include Abbott Laboratories, Boston Scientific Corp., Edwards Lifesciences Corp., and Medtronic plc, among others.

Transcatheter Valve market is expected to grow at a CAGR of 15.7% from 2025 to 2035.

Technological advancements and growing demand for interactive and dynamic content are driving Transcatheter Valve market growth.