Transgenic Seeds Market

Global Transgenic Seeds Market Size, Share & Trends Analysis Report by Traits (Herbicide Tolerance, Insect- Resistance, and Others), By Crops (Maize, Cotton, Rice, Soybean, Canola, and Others), Forecast Period (2022-2028) Update Available - Forecast 2025-2031

The global transgenic seeds market is anticipated to grow at a significant CAGR of around 7.5% during the forecast period. Factors such as increasing awareness of farmers about the increasing toxicity of the agrochemicals and growing strive for yield maximization across the globe are encouraging the farmers to adopt transgenic seeds for better and high yield crops. Moreover, various governments and farmers are targeting initiatives to cultivate transgenic seeds crops for a better future. For instance, in February 2022, Maharashtra farmers belonging to the Shetkari Sanghatana set to re-launch the pro-GM crop movement, from 2019, more than thousands of farmers have been openly sowed and cultivativated the herbicide-tolerant Bt (HTBt) cotton and Bt brinjal.

In addition, rising agricultural food production due to increasing food demand from the growing population and the surging cost of seeds, crop rotation, fertilizers & pesticides has accelerated the demand for transgenic seeds. Moreover, the adoption of modern agriculture practices & technology is given rise to market growth and offered new growth opportunities.

Impact Of COVID-19 Pandemic On Global Transgenic Seeds Market

During COVID-19 there has been a delay in the supply of agricultural various products such as seeds, cereals, grains, other, to farmers. Limits on the mobility of people across borders and lockdowns are contributed to labor shortages for agricultural sectors in many countries. In China, the production of seeds and pesticides declined sharply. Closing borders or slowing down the transboundary movement of seeds potentially hampered the seed supply chains and on-time delivery of seeds with negative impacts on agriculture, feed and food production during pandemic. Moreover, small farmers were unable to move their products from their farms to markets due to travel restrictions and that in turn cause the crops or other agricultural products to damaged and been affected.

Segmental Outlook

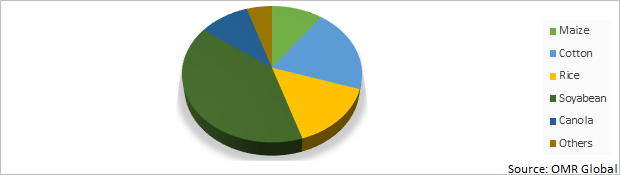

The global transgenic seeds market is segmented based on the traits, crops. On the basis of traits, the market is segmented into herbicide tolerance, insect- resistance, and others. Based on the crops the market is sub-divided into maize, cotton, rice, soybean, canola, and others. Among crops segment the canola sub-segment is expected to be the fastest growing in the forecast period owing to it is genetically engineered to be tolerant to herbicides and also the met production all over the globe is increasing the demand for canola oil is also increasing due to it is commonly used for farm animals in meat and milk production.

Global Transgenic Seeds Market Share By Fruits and Vegetable Crops, 2021 (%)

The Soyabean Segment is Likely to Dominate in the Global Transgenic Seeds Market

Soybean crop among the crop segment is projected to dominate in the market owing to the use of the soybean in various processes such as in oil production, in drug and diseases, in processed foods and among others. Furthermore, owing to various benefits offered by soybean such as it helps in reducing the risk range of health problems, such as cardiovascular disease, stroke, coronary heart disease (CHD), some cancers as well as improving bone health makes it demanding among consumer. Apart from these factors, the usage of soybean as a biofuel has increased the demand for soybean and hence its multilateral usage and significance have led to a subtaintical increase in demand for soyabean seeds.

Regional Outlooks

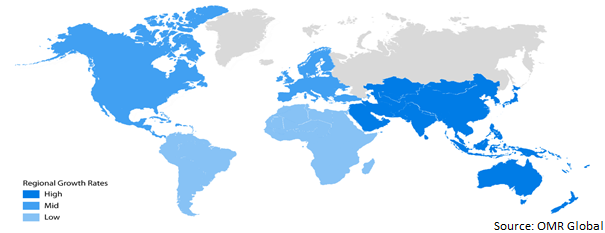

The global Transgenic Seeds market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East &Africa, and Latin America. North America is dominating owing to be the largest cultivator of transgenic seeds crops such as soybean, corn, cotton among others.

Global Transgenic Seeds Market Growth, By Region 2022-2028

The Asia-Pacific Region is Considered as a Fastest Growing in the Global Transgenic Seeds Market

Asia-Pacific region in the global transgenic seeds market is anticipated to register the fastest growth owing to the adoption of these seeds that are linked to different advantages like cost savings on the use of insecticides and enhanced crop yields. Growing adoption of biofuels increasing population and rising demand for animal feed arekey factors the are propelling the market to grow at a fastest. Furthermore, the emerging countries in the region such as India, China among others are highly adopting transgenic seeds to increase crop production. High price volatility and unpredictable climatic conditions have led the farmers to prefer treated seeds over the untreated seeds, thereby driving the market growth.

Market Players Outlook

The major companies serving the global Transgenic Seeds market include BASF SE, Bayer AG, J. R. Simplot Co., JK Agri Genetics Ltd., Syngenta Group Vikima Seed A/S, VILMORIN & CIE, Sakata Seed America, United Genetics India Pvt. Ltd., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in August 2020, Calyxt, Inc. the company’s first commercially available gene-edited product are high-oleic soybeans available in the US through the company’s TALEN technology. The company's pipeline includes products such as high-fiber wheat, hemp with a more than current marketable yield, cold-tolerant oat crops, and pulses with new improved protein profiles and flavor under portfolio. By early 2023 the company is planning to launch high-oleic, low-linolenic (HOLL) soybeans. It has also targeted the upcoming year for various other projects such as 2022 as the commercial planting year for high-fiber wheat, 2023 as the commercial planting year for hemp, and 2026 as the commercial planting year for cold-tolerant oat crops.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Transgenic Seeds market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Transgenic Seeds Market

• Recovery Scenario of Global Transgenic Seeds Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. BASF SE

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Bayer AG

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. J. R. Simplot Co.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. JK Agri Genetics Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Syngenta Group

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

3.7. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Transgenic Seeds Market by Trait

4.1.1. Herbicide Tolerance

4.1.2. Insect- Resistance

4.1.3. Others

4.2. Global Transgenic Seeds Market by Crops

4.2.1. Maize

4.2.2. Cotton

4.2.3. Rice

4.2.4. Soybean

4.2.5. Canola

4.2.6. Others

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Advantaseeds

6.2. Ampac Seed Co.

6.3. Bejo Zaden B.V.

6.4. Calyxt, Inc.

6.5. Corteva Agriscience

6.6. DLF Seeds

6.7. KWS SAAT SE & Co.

6.8. Mahyco Pvt. Ltd.

6.9. Nufarm Ltd

6.10. Rasi Seeds (P) Ltd

6.11. Rijk Zwaan Zaadteelt en Zaadhandel B.V.

6.12. Sakata Seed America

6.13. Stine Seed Co.

6.14. SL-Agritech

6.15. Suntory Holdings Ltd.

6.16. United Genetics India Pvt. Ltd.

6.17. Vikima Seed A/S

6.18. VILMORIN & CIE

1. GLOBAL TRANSGENIC SEEDS MARKET RESEARCH AND ANALYSIS BY TRAIT, 2021-2028 ($ MILLION)

2. GLOBAL HERBICIDE TOLERANCE TRANSGENIC SEEDS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL INSECT- RESISTANCE TRANSGENIC SEEDS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($MILLION)

4. GLOBAL OTHERS TRANSGENIC SEEDS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($MILLION)

5. GLOBAL TRANSGENIC SEEDS MARKET RESEARCH AND ANALYSIS BY CROPS, 2021-2028 ($ MILLION)

6. GLOBAL MAIZE TRANSGENIC SEEDS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL COTTON TRANSGENIC SEEDS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL RICE TRANSGENIC SEEDS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL SOYABEAN TRANSGENIC SEEDS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL CANOLA TRANSGENIC SEEDS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL OTHER TRANSGENIC SEEDS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. NORTH AMERICAN TRANSGENIC SEEDS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

13. NORTH AMERICAN TRANSGENIC SEEDS MARKET RESEARCH AND ANALYSIS BY TRAITS, 2021-2028 ($ MILLION)

14. NORTH AMERICAN TRANSGENIC SEEDS MARKET RESEARCH AND ANALYSIS BY CROPS, 2021-2028 ($ MILLION)

15. EUROPEAN TRANSGENIC SEEDS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

16. EUROPEAN TRANSGENIC SEEDS MARKET RESEARCH AND ANALYSIS BY TRAITS, 2021-2028 ($ MILLION)

17. EUROPEAN TRANSGENIC SEED MARKET RESEARCH AND ANALYSIS BY CROPS, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC TRANSGENIC SEEDS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. ASIA-PACIFIC TRANSGENIC SEEDS MARKET RESEARCH AND ANALYSIS BY TRAIT, 2021-2028 ($ MILLION)

20. ASIA-PACIFIC TRANSGENIC SEEDS MARKET RESEARCH AND ANALYSIS BY CROPS, 2021-2028 ($ MILLION)

21. REST OF THE WORLD TRANSGENIC SEEDS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

22. REST OF THE WORLD TRANSGENIC SEEDS MARKET RESEARCH AND ANALYSIS BY TRAIT, 2021-2028 ($ MILLION)

23. REST OF THE WORLD TRANSGENIC SEEDS MARKET RESEARCH AND ANALYSIS BY CROPS, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL TRANSGENIC SEEDS MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL TRANSGENIC SEEDS MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL TRANSGENIC SEEDS MARKET, 2021-2028 (%)

4. GLOBAL TRANSGENIC SEEDS MARKET SHARE BY TRAITS, 2021 VS 2028 (%)

5. GLOBAL HERBICIDE TOLERANCE TRANSGENIC SEEDS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL INSECT- RESISTANCE TRANSGENIC SEEDS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL OTHERS TRANSGENIC SEEDS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL TRANSGENIC SEEDS MARKET SHARE BY CROP, 2021 VS 2028 (%)

9. GLOBAL MAIZE TRANSGENIC SEEDS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL COTTON TRANSGENIC SEEDS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL RICE TRANSGENIC SEEDS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL SOYABEAN TRANSGENIC SEEDS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL CANOLATRANSGENIC SEEDSMARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL OTHER TRANSGENIC SEEDSMARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. GLOBAL TRANSGENIC SEEDS MARKET SHARE BY DURATION, 2021 VS 2028 (%)

16. GLOBAL SHORT TERM TRANSGENIC SEEDS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

17. GLOBAL MEDIUM TERM TRANSGENIC SEEDS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

18. GLOBAL LONG TERM TRANSGENIC SEEDS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

19. GLOBAL TRANSGENIC SEEDS MARKET SHARE BY SEED TREATMENT, 2021 VS 2028 (%)

20. GLOBAL TREATED TRANSGENIC SEEDS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

21. GLOBAL UNTREATED TRANSGENIC SEEDS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

22. GLOBAL TRANSGENIC SEEDS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

23. US TRANSGENIC SEEDS MARKET SIZE, 2021-2028 ($ MILLION)

24. CANADA TRANSGENIC SEEDS MARKET SIZE, 2021-2028 ($ MILLION)

25. UK TRANSGENIC SEEDS MARKET SIZE, 2021-2028 ($ MILLION)

26. FRANCE TRANSGENIC SEEDS MARKET SIZE, 2021-2028 ($ MILLION)

27. GERMANY TRANSGENIC SEEDS MARKET SIZE, 2021-2028 ($ MILLION)

28. ITALY TRANSGENIC SEEDS MARKET SIZE, 2021-2028 ($ MILLION)

29. SPAIN TRANSGENIC SEED MARKET SIZE, 2021-2028 ($ MILLION)

30. REST OF EUROPE TRANSGENIC SEEDS MARKET SIZE, 2021-2028 ($ MILLION)

31. INDIA TRANSGENIC SEEDS MARKET SIZE, 2021-2028 ($ MILLION)

32. CHINA TRANSGENIC SEEDS MARKET SIZE, 2021-2028 ($ MILLION)

33. JAPAN TRANSGENIC SEEDS MARKET SIZE, 2021-2028 ($ MILLION)

34. SOUTH KOREA TRANSGENIC SEEDS MARKET SIZE, 2021-2028 ($ MILLION)

35. REST OF ASIA-PACIFIC TRANSGENIC SEEDS MARKET SIZE, 2021-2028 ($ MILLION)

36. REST OF THE WORLD TRANSGENIC SEEDS MARKET SIZE, 2021-2028 ($ MILLION)