Transmission Coolers Market

Transmission Coolers Market Size, Share & Trends Analysis Report by Type (Fan Cooling and Water Cooling) and by Application (Commercial Vehicles and Passenger Vehicles) Forecast Period (2023-2030) Update Available - Forecast 2025-2031

Transmission coolers market is anticipated to grow at a CAGR of 10.0% during the forecast period. The growth of the market is attributed to factors such as increasing demand for efficient cooling systems in vehicles to enhance performance and prevent overheating. Factors such as rising commercial vehicle sales and increasing consumer awareness about the benefits of transmission coolers are anticipated to fuel the demand for transmission coolers. For instance, in the passenger vehicles segment, the adoption of transmission coolers to improve fuel efficiency and prolong transmission life is expected to drive market growth. For instance, JEGS 60385 is an 18,000 GVW automatic transmission cooler designed to help extend the life of the transmission and improve fuel efficiency and horsepower. JEGS high-performance transmission coolers are ultrasonically soldered, electrostatically powder-coated, and 100% pressure tested at 150 PSI for reliability. JEGS 53501 is a transmission cooler and cooling fan mount kit that fits JEGS 555-60370 to 555-60376 coolers. JEGS Auto Trans Oil Cooler is a high-performance transmission cooler with a 26,000 GVW rating that includes 4 ft. of 3/8 in. Hose and two 9/16 in fittings.

Segmental Outlook

The global transmission coolers market is segmented based on its type and application. Based on type, the market is segmented into fan cooling and water cooling. Based on the application, the market is categorized into commercial vehicles and passenger vehicles. Among type, fan cooling transmission coolers are widely used owing to their cost-effectiveness and ease of installation.

The commercial vehicles is Anticipated to Register Significant Growth over the Forecast Period

The commercial vehicles is anticipated to register significant growth over the forecast period. Commercial vehicles, including trucks and buses, require efficient transmission cooling systems to withstand heavy loads and continuous operation. The increasing demand for transmission coolers has propelled the growth of the transmission cooler adapter for facilitating seamless integration and enhanced functionality in automotive cooling systems. For instance, in February 2022, Improved Racing launched a new thermostatic automatic transmission fluid cooler adapter for certain six-speed, eight-speed, and ten-speed GM automatic transmissions. The new adapter is designed to reduce wear, improve horsepower, and eliminate other issues caused by overcooling of the transmission fluid. The Improved Racing Automatic Transmission Cooler Adapter with Thermostat is the first direct bolt-on, thermostatic transmission fluid cooler adapter for GM's 6L, 8L, and 10L automatic transmissions. The adapter comes with a built-in thermostat and is 100% bolt-on for easy installation.

Regional Outlook

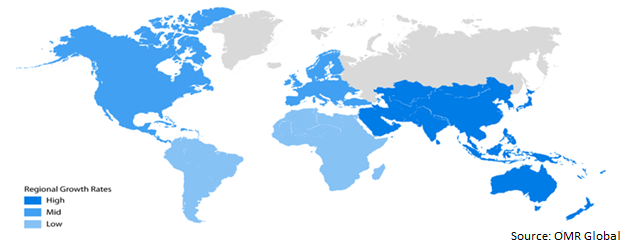

The global transmission coolers market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East & Africa and Latin America). The market can be analysed for a particular region or country level as per the requirement. Among these, the North America region is anticipated to hold a prominent share in the transmission coolers market during the forecast period. The growth of the market in North America is primarily driven by factors such as the presence of a large number of commercial vehicles and the demand for efficient cooling systems in passenger vehicles.

The Asia-Pacific region is also projected to experience considerable growth in the transmission coolers market due to the rapid expansion of the automotive industry and increasing awareness about the benefits of transmission cooling systems.

Global Transmission Coolers Market Growth by Region 2023-2030

The European Region is Anticipated to Hold a Significant Share in the Transmission Coolers Market

The European region is anticipated to hold a significant share in the transmission coolers market during the forecast period. Firstly, Europe holds a strong and well-established automotive industry with a continuously rising demand for commercial and passenger vehicles. As transmission coolers play a crucial role in enhancing vehicle performance and efficiency, their adoption is expected to be substantial in this region. Additionally, stringent regulations regarding vehicle emissions and fuel efficiency in Europe have compelled automakers to focus on advanced cooling systems, including transmission coolers. For instance, in November 2021, International Energy Agency’s latest update Global Fuel Economy Initiative’s report launched. The Global Fuel Economy Initiative (GFEI) has a goal of reducing greenhouse gas emissions and oil use by improving fuel economy in cars. They aim to increase the average fuel economy of the global light-duty vehicle fleet by at least 50%. By 2030, their long-term goal is to double the average fuel economy for new vehicles. The GFEI aims to stabilize greenhouse gas emissions by improving vehicle fuel economy.

Market Players Outlook

The major companies serving the global transmission coolers market include US Motor Works LLC, Hayden Agencies, Mishimoto, DBA, Resource Intl. Inc., Taylored Investments Ltd., aFe POWER and others. These market players are considerably contributing to the market growth by adopting various strategies such as mergers and acquisitions, partnerships, collaborations, designs patented, funding, and new product launches to stay competitive in the market. Continuous innovation in transmission cooling technology and focus on product development are key strategies adopted by market players to cater to the evolving needs of the automotive industry. For instance, in August 2020, TYC/Genera Corp. transmission cooler designs patented, as shown and described in US Patent D892, 878. The patent is for the ornamental design of a transmission cooler for automotive applications. The transmission oil coolers have different features such as outlet fitting design of quick connect, inlet fitting design of quick connect, outlet diameter of 0.49, inlet diameter of 0.49, core thickness of 0.75, inlet fitting design of hose clamp, outlet diameter of 0.39, inlet diameter of 0.39, core thickness of 0.63, core length of 24.06, core height of 3.07, and flow configuration.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global transmission coolers market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. aFe POWER

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Hayden Agencies

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Mishimoto, DBA Resource Intl. Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. TYC/Genera Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. US Motor Works LLC

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Transmission Coolers Market by Type

4.1.1. Fan Cooling

4.1.2. Water Cooling

4.2. Global Transmission Coolers Market by Application

4.2.1. Commercial Vehicles

4.2.2. Passenger Vehicles

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Behr-Hella Thermocontrol GmbH

6.2. BorgWarner Inc.

6.3. CSF

6.4. Delphi

6.5. Denso Corp.

6.6. G&M Radiator

6.7. Magna International Inc.

6.8. MAHLE GmbH

6.9. Marelli Holdings Co., Ltd.

6.10. Mechatronics Group Pty Ltd.

6.11. Modine Manufacturing Co.

6.12. Nissens

6.13. RPM International Inc.

6.14. Rugged Ridge

6.15. Spectra Premium Mobility Solutions

6.16. Transmission Cooler Guide

6.17. Valeo Powertrain GmbH

6.18. Visteon Corp.

6.19. ZF Friedrichshafen AG

1. GLOBAL TRANSMISSION COOLERS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

2. GLOBAL TRANSMISSION FAN COOLING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL TRANSMISSION WATER COOLING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL TRANSMISSION COOLERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

5. GLOBAL TRANSMISSION COOLERS FOR COMMERCIAL VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL TRANSMISSION COOLERS FOR PASSENGER VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL TRANSMISSION COOLERS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. NORTH AMERICAN TRANSMISSION COOLERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

9. NORTH AMERICAN TRANSMISSION COOLERS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

10. NORTH AMERICAN TRANSMISSION COOLERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

11. EUROPEAN TRANSMISSION COOLERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

12. EUROPEAN TRANSMISSION COOLERS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

13. EUROPEAN TRANSMISSION COOLERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

14. ASIA-PACIFIC TRANSMISSION COOLERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

15. ASIA-PACIFIC TRANSMISSION COOLERS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

16. ASIA-PACIFIC TRANSMISSION COOLERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

17. REST OF THE WORLD TRANSMISSION COOLERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

18. REST OF THE WORLD TRANSMISSION COOLERS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

19. REST OF THE WORLD TRANSMISSION COOLERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

1. GLOBAL TRANSMISSION COOLERS MARKET SHARE BY TYPE, 2022 VS 2030 (%)

2. GLOBAL TRANSMISSION FAN COOLING MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL TRANSMISSION WATER COOLING MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL TRANSMISSION COOLERS MARKET SHARE BY APPLICATION, 2022 VS 2030 (%)

5. GLOBAL TRANSMISSION COOLERS FOR COMMERCIAL VEHICLES MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL TRANSMISSION COOLERS FOR PASSENGER VEHICLES MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL TRANSMISSION COOLERS MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. US TRANSMISSION COOLERS MARKET SIZE, 2022-2030 ($ MILLION)

9. CANADA TRANSMISSION COOLERS MARKET SIZE, 2022-2030 ($ MILLION)

10. UK TRANSMISSION COOLERS MARKET SIZE, 2022-2030 ($ MILLION)

11. FRANCE TRANSMISSION COOLERS MARKET SIZE, 2022-2030 ($ MILLION)

12. GERMANY TRANSMISSION COOLERS MARKET SIZE, 2022-2030 ($ MILLION)

13. ITALY TRANSMISSION COOLERS MARKET SIZE, 2022-2030 ($ MILLION)

14. SPAIN TRANSMISSION COOLERS MARKET SIZE, 2022-2030 ($ MILLION)

15. REST OF EUROPE TRANSMISSION COOLERS MARKET SIZE, 2022-2030 ($ MILLION)

16. INDIA TRANSMISSION COOLERS MARKET SIZE, 2022-2030 ($ MILLION)

17. CHINA TRANSMISSION COOLERS MARKET SIZE, 2022-2030 ($ MILLION)

18. JAPAN TRANSMISSION COOLERS MARKET SIZE, 2022-2030 ($ MILLION)

19. SOUTH KOREA TRANSMISSION COOLERS MARKET SIZE, 2022-2030 ($ MILLION)

20. REST OF ASIA-PACIFIC TRANSMISSION COOLERS MARKET SIZE, 2022-2030 ($ MILLION)

21. REST OF THE WORLD TRANSMISSION COOLERS MARKET SIZE, 2022-2030 ($ MILLION)