Travel Insurance Market

Travel Insurance Market Size, Share & Trends Analysis Report by Type (Single-Trip Travel Insurance, and Annual Multi-Trip Travel Insurance), by Distribution Channel (Insurance Companies, Insurance Intermediaries, Banks, Insurance Brokers, and Others), and by End-User (Senior Citizens, Education Travelers, Family Travelers, and Others) Forecast Period (2024-2031)

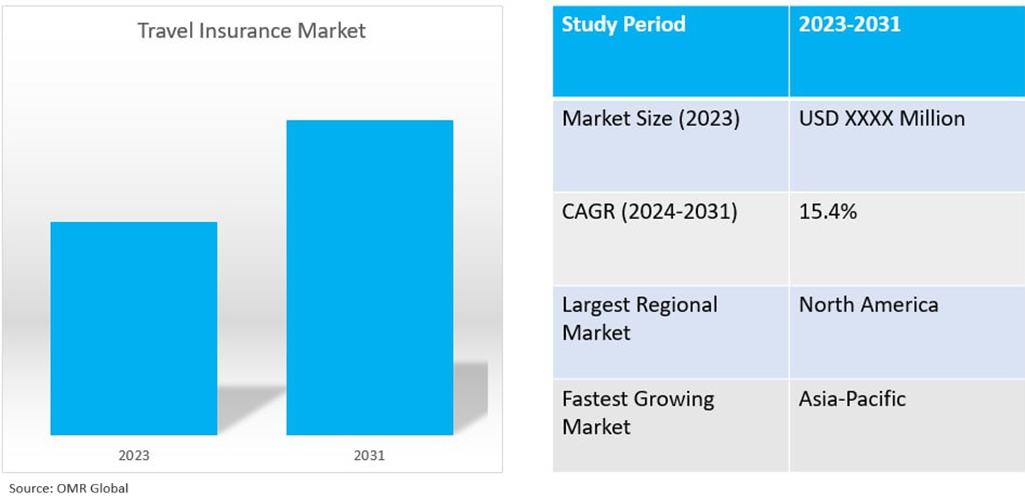

Travel insurance market is anticipated to grow at a CAGR of 15.4% during the forecast period (2024-2031). The travel insurance market is expanding owing to factors like increasing global tourism. The COVID-19 pandemic has increased demand for travel insurance. Technological advancements and product innovation have made it easier for consumers to compare and purchase policies. Demographic changes and strategic partnerships among providers, agencies, and airlines also contribute to market growth.

Market Dynamics

Increase in foreign arrivals

Growing international arrivals have led to a large increase in the number of travelers seeking insurance coverage for medical emergencies, trip cancellations, and other travel-related threats. According to, UN Tourism, in January 2024, at a substantial increase from pre-pandemic levels, the global tourist industry reached in 2023 with an expected 1.3 billion global arrivals.

Increasing Consumer Awareness and Engagement

Consumer awareness of travel insurance is increasing owing to global events and health crises, leading to more proactive planning and securing comprehensive coverage. For instance, in October 2022, India International Insurance launched i-Journey, a travel insurance policy for Singapore residents. The policy offers comprehensive coverage for terrorism, travel delays, child protection, baggage loss, personal money, and home contents. It also includes COVID-19 extended coverage, including medical expenses, repatriation, travel cancellations, quarantine allowances, and follow-up treatment. As travel borders open, Singapore residents are eager to travel, as many international borders require proof of sufficient travel insurance for visas or entry.

The demand for travel insurance coverage is also driven by increasing awareness of the potential risks associated with travel, such as interruptions, medical problems, and cancellations, which encourages tourists to safeguard vacations and finances. For instance, in January 2024, EaseMyTrip launched its new subsidiary, EaseMyTrip Insurance Broker Private Limited, to enter the booming Indian insurance market, estimated at ?7.9 trillion and growing at 32-34% annually. This move aims to diversify services and offer a complete travel ecosystem.

Market Segmentation

- Based on type, the market is segmented into single-trip travel insurance and annual multi-trip travel insurance.

- Based on distribution channel, the market is segmented into insurance companies, insurance intermediaries, banks, insurance brokers, and others (travel agencies & tour operators, retail stores, and specialty travel insurance providers).

- Based on end-users, the market is segmented into senior citizens, education travelers, family travelers, and others (business travelers, expatriates, and international assignees).

Insurance Intermediaries Sub-segment to Hold a Considerable Market Share

This model can increase insurance penetration in rural areas and cater to economic growth by boosting rural areas, particularly as travel increases. For instance, in October 2023, IRDAI introduced a new insurance intermediary business model, allowing Bima Vahaks to distribute life and general insurance policies in rural areas using a hand-held electronic device, 'Bima Vistaar', a digital platform.

Regional Outlook

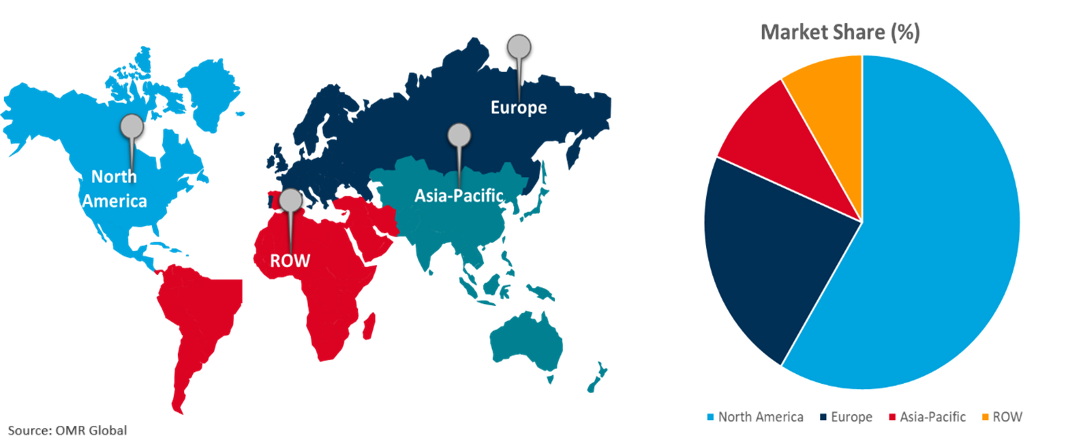

The travel insurance market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Inclusive Insurance In Asia-Pacific Region

Increased demand for comprehensive insurance policies in India that provide comprehensive healthcare coverage results from increased mobility globally. For instance, in December 2023, Reliance General Insurance Company Ltd launched Reliance Health Global, a policy offering comprehensive coverage for global healthcare accessible to Indians, including critical illnesses like cancer and bypass surgery, air ambulance, and organ donor expenses, without restrictions on room rent.

Travel Insurance Market Growth by Region 2024-2031

North America Holds Major Market Share

The travel industry is recovering and growing owing to increased travel volumes and demand for travel insurance to cover potential risks. According to the US Travel Association, in 2022, US travel spending reached $1.2 trillion, matching pre-pandemic levels. The economic influence was $2.6 million, with average domestic flight prices of $378 and daily costs of $354.5 in major US cities. The growing tourism across the region along with the high expenditure of citizens on insurance services is a key factor driving the regional market growth.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the travel insurance market include Allianz SE, American International Group, Inc., AXA Group, Berkshire Hathaway Specialty Insurance Co., and Generali Global Assistance & Insurance Services among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market. For instance, in May 2023, Easy Trip Planners plans acquired entities in cruise and tour package services, hotel reservation services, medical and educational tourism, and other regions in North America, UAE, South Pacific, and India, subject to regulatory and shareholder approval.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global travel insurance market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Competitive Landscape

2.4. Key Company Analysis

2.5. Allianz SE

2.5.1. Overview

2.5.2. Financial Analysis

2.5.3. SWOT Analysis

2.5.4. Recent Developments

2.6. American International Group, Inc.

2.6.1. Overview

2.6.2. Financial Analysis

2.6.3. SWOT Analysis

2.6.4. Recent Developments

2.7. AXA Group

2.7.1. Overview

2.7.2. Financial Analysis

2.7.3. SWOT Analysis

2.7.4. Recent Developments

2.8. Key Strategy Analysis

3. Market Segmentation

3.1. Global Travel Insurance Market by Type

3.1.1. Single-Trip Travel Insurance

3.1.2. Annual Multi-Trip Travel Insurance

3.2. Global Travel Insurance Market by Distribution Channel

3.2.1. Insurance Companies

3.2.2. Insurance Intermediaries

3.2.3. Banks

3.2.4. Insurance Brokers

3.2.5. Other (Travel Agencies and Tour Operators, Retail Stores, and Specialty Travel Insurance Providers)

3.3. Global Travel Insurance Market by End-User

3.3.1. Senior Citizens

3.3.2. Education Travelers

3.3.3. Family Travelers

3.3.4. Other (Business Travelers, Expatriates, and International Assignees)

4. Regional Analysis

4.1. North America

4.1.1. United States

4.1.2. Canada

4.2. Europe

4.2.1. UK

4.2.2. Germany

4.2.3. Italy

4.2.4. Spain

4.2.5. France

4.2.6. Rest of Europe

4.3. Asia-Pacific

4.3.1. China

4.3.2. India

4.3.3. Japan

4.3.4. South Korea

4.3.5. Rest of Asia-Pacific

4.4. Rest of the World

4.4.1. Latin America

4.4.2. Middle East and Africa

5. Company Profiles

5.1. Battleface Inc.

5.2. Berkshire Hathaway Specialty Insurance Co.

5.3. CETA Insurance Ltd

5.4. Generali Global Assistance & Insurance Services

5.5. InsureandGo Complaints

5.6. Nationwide Mutual Insurance Co.

5.7. Ping An Insurance

5.8. Seven Corners Inc.

5.9. Sompo International Holdings Ltd.

5.10. The Hanover Insurance Group, Inc.

5.11. Tokio Marine Group

5.12. Travelex Foreign Coin Services Ltd.

5.13. TravelSafe Insurance

5.14. Trip.com Travel Singapore Pte. Ltd.

5.15. United States Fire Insurance Co.

5.16. USI Insurance Services

5.17. Zurich Insurance Co. Ltd

1. Global Travel Insurance Market Research And Analysis By Type, 2023-2031 ($ Million)

2. Global Single-Trip Travel Insurance Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Annual Multi-Trip Travel Insurance Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Travel Insurance Market Research And Analysis By Distribution Channel, 2023-2031 ($ Million)

5. Global Travel Insurance Companies Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global Travel Insurance Intermediaries Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Travel Insurance Banks Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Travel Insurance Brokers Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global Travel Insurance Other Distribution Channel Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Travel Insurance Market Research And Analysis By End User, 2023-2031 ($ Million)

11. Global Travel Insurance For Senior Citizens Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global Travel Insurance For Education Travelers Market Research And Analysis By Region, 2023-2031 ($ Million)

13. Global Travel Insurance For Family Travelers Market Research And Analysis By Region, 2023-2031 ($ Million)

14. Global Travel Insurance For Other End-User Market Research And Analysis By Region, 2023-2031 ($ Million)

15. Global Travel Insurance Market Research And Analysis By Region, 2023-2031 ($ Million)

16. North American Travel Insurance Market Research And Analysis By Country, 2023-2031 ($ Million)

17. North American Travel Insurance Market Research And Analysis By Type, 2023-2031 ($ Million)

18. North American Travel Insurance Market Research And Analysis By Distribution Channel, 2023-2031 ($ Million)

19. North American Travel Insurance Market Research And Analysis By End-User, 2023-2031 ($ Million)

20. European Travel Insurance Market Research And Analysis By Country, 2023-2031 ($ Million)

21. European Travel Insurance Market Research And Analysis By Type, 2023-2031 ($ Million)

22. European Travel Insurance Market Research And Analysis By Distribution Channel, 2023-2031 ($ Million)

23. European Travel Insurance Market Research And Analysis By End-User, 2023-2031 ($ Million)

24. Asia-Pacific Travel Insurance Market Research And Analysis By Country, 2023-2031 ($ Million)

25. Asia-Pacific Travel Insurance Market Research And Analysis By Type, 2023-2031 ($ Million)

26. Asia-Pacific Travel Insurance Market Research And Analysis By Distribution Channel, 2023-2031 ($ Million)

27. Asia-Pacific Travel Insurance Market Research And Analysis By End-User, 2023-2031 ($ Million)

28. Rest Of The World Travel Insurance Market Research And Analysis By Region, 2023-2031 ($ Million)

29. Rest Of The World Travel Insurance Market Research And Analysis By Type, 2023-2031 ($ Million)

30. Rest Of The World Travel Insurance Market Research And Analysis By Distribution Channel, 2023-2031 ($ Million)

31. Rest Of The World Travel Insurance Market Research And Analysis By End-User, 2023-2031 ($ Million)

1. Global Travel Insurance Market Share By Type, 2023 Vs 2031 (%)

2. Global Single-Trip Travel Insurance Market Share By Region, 2023 Vs 2031 (%)

3. Global Annual Multi-Trip Travel Insurance Market Share By Region, 2023 Vs 2031 (%)

4. Global Travel Insurance Market Share By Distribution Channel, 2023 Vs 2031 (%)

5. Global Travel Insurance Companies Market Share By Region, 2023 Vs 2031 (%)

6. Global Travel Insurance Intermediaries Market Share By Region, 2023 Vs 2031 (%)

7. Global Travel Insurance Banks Market Share By Region, 2023 Vs 2031 (%)

8. Global Travel Insurance Brokers Market Share By Region, 2023 Vs 2031 (%)

9. Global Travel Insurance Other Distribution Channel Market Share By Region, 2023 Vs 2031 (%)

10. Global Travel Insurance Market Share By End-User, 2023 Vs 2031 (%)

11. Global Travel Insurance For Senior Citizens Market Share By Region, 2023 Vs 2031 (%)

12. Global Travel Insurance For Education Travelers Market Share By Region, 2023 Vs 2031 (%)

13. Global Travel Insurance For Family Travelers Market Share By Region, 2023 Vs 2031 (%)

14. Global Travel Insurance For Other End-User Market Share By Region, 2023 Vs 2031 (%)

15. Global Travel Insurance Market Share By Region, 2023 Vs 2031 (%)

16. US Travel Insurance Market Size, 2023-2031 ($ Million)

17. Canada Travel Insurance Market Size, 2023-2031 ($ Million)

18. UK Travel Insurance Market Size, 2023-2031 ($ Million)

19. France Travel Insurance Market Size, 2023-2031 ($ Million)

20. Germany Travel Insurance Market Size, 2023-2031 ($ Million)

21. Italy Travel Insurance Market Size, 2023-2031 ($ Million)

22. Spain Travel Insurance Market Size, 2023-2031 ($ Million)

23. Rest Of Europe Travel Insurance Market Size, 2023-2031 ($ Million)

24. India Travel Insurance Market Size, 2023-2031 ($ Million)

25. China Travel Insurance Market Size, 2023-2031 ($ Million)

26. Japan Travel Insurance Market Size, 2023-2031 ($ Million)

27. South Korea Travel Insurance Market Size, 2023-2031 ($ Million)

28. Rest Of Asia-Pacific Travel Insurance Market Size, 2023-2031 ($ Million)

29. Latin America Travel Insurance Market Size, 2023-2031 ($ Million)

30. Middle East And Africa Travel Insurance Market Size, 2023-2031 ($ Million)