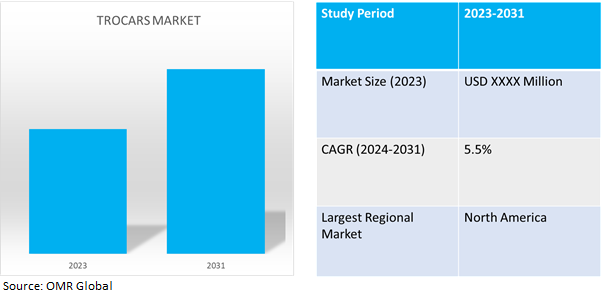

Trocars Market

Trocars Market Size, Share & Trends Analysis Report by Tip Type (Bladeless Trocars, Blunt Trocars, Bladed Trocars, and Optical Trocars), by Product Type (Disposable Trocars and Reusable Trocars), by Application (General Surgery, Gynecological Surgery, Urological Surgery, and Other (Pediatric Surgery and Laparoscopy Surgery)), and by End-User (Hospitals and Ambulatory Surgical Centers) Forecast Period (2024-2031)

Trocars market is anticipated to grow at a CAGR of 5.5% during the forecast period (2024-2031). Trocars are surgical instruments with a sharp, pointed tip attached to a hollow tube, often with a handle for manipulation. To make entrance sites through the body wall that permit the insertion of additional surgical equipment and devices into bodily cavities or spaces, they are used in minimally invasive surgical procedures.

Market Dynamics

Rising incidences of chronic diseases

The global increase in chronic conditions, such as obesity, gastrointestinal disorders, diabetes, and cardiovascular diseases is rapidly rising globally. These conditions affect a large proportion of the population, leading to an increased demand for surgical procedures. For instance, the American Heart Association reports that there are over 356,000 out-of-hospital cardiac arrests (OHCA) in the United States each year, with a significant fatality rate. The incidence of EMS-assessed non-traumatic OHCA in people of any age is estimated to be 356,461, or nearly 1,000 people each day. Survival to hospital discharge after EMS-treated cardiac arrest languishes at about 10%. As a result, the need for cardiovascular surgeries is growing, driving up the demand for trocars in the medical industry.

Increasing demand for minimally invasive surgeries

Globally, the growing need for minimally invasive operations has led to a rise in the trocars market (MIS). Trocar-assisted surgeries include benefits like shorter recovery periods and less discomfort following surgery. The adoption of MIS approaches across specialties is driven by the rising realization of these benefits by patients and healthcare practitioners. Technological developments in surgery also broaden the range of minimally invasive procedures, which drives market expansion. In addition, the aging population and growing healthcare costs drive up demand for trocars. The trend toward less invasive procedures is anticipated to continue as long as healthcare professionals prioritize patient outcomes, which will support the expansion of the trocars market further as well.

Market Segmentation

Our in-depth analysis of the global trocars market includes the following segments by tip type, product type, application, and end-user:

- Based on tip type, the market is sub-segmented into bladeless trocars, blunt trocars, bladed trocars, and optical trocars.

- Based on product type, the market is bifurcated into disposable trocars and reusable trocars.

- Based on application, the market is augmented into general surgery, gynecological surgery, urological surgery, and other surgery.

- Based on end-users, the market is sub-segmented into hospitals and ambulatory surgical centers.

Bladeless Trocars is Projected to Emerge as the Largest Segment

Based on the tip type, the global trocars market is sub-segmented into bladeless trocars, blunt trocars, bladed trocars, and optical trocars. Among these, the bladeless trocars sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the feature it carries of a blunt and atraumatic tip design, which minimizes tissue trauma during insertion and removal. Bladeless trocars reduce injury risk, improve surgical outcomes, and speed up recovery for patients undergoing minimally invasive surgeries, reducing tissue trauma and vascular lacerations.

General Surgery Sub-segment to Hold a Considerable Market Share

General surgery encompasses a diverse array of procedures involving the abdominal cavity, including appendectomies, cholecystectomies, hernia repairs, and colorectal surgeries. Trocars provide access channels for the insertion of surgical tools and camera systems into the abdominal cavity, making them a crucial minimally invasive surgical tool in laparoscopic and robotic-assisted general surgical operations. Trocars are an essential tool for surgeons conducting a variety of common surgical procedures because of their versatility. Trocars improve surgical workflow by facilitating instrument exchange during laparoscopic or robot-assisted procedures, allowing surgeons to perform various maneuvers. Their ergonomic design and intuitive operation allow for seamless instrument insertion and manipulation, making them a preferred choice for surgeons.

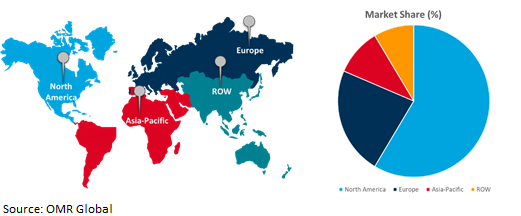

Regional Outlook

The global trocars market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Trocars Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to its advanced healthcare infrastructure, substantial investment in medical technologies, and role as an innovation hub. The healthcare system in North America is quite sophisticated, with well-equipped inpatient hospitals, outpatient clinics, and surgical centers. Trocars play a major role in the widespread adoption of minimally invasive surgical methods such as robotic-assisted surgery and laparoscopy, which are made possible by the region's advanced healthcare system.

Furthermore, with a large number of academic institutions, medical device businesses, and research institutes advancing surgical tools and methods, North America is a global leader in medical technology innovation. Trocars benefit from constant technological innovation; North American manufacturers are always creating new models, components, and features to improve surgical results and patient safety, which is further driving the expansion of the regional market.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global trocars market include Johnson & Johnson Service, Inc., Medtronic, The Cooper Companies, Teleflex Incorporated, B.Braun, and CONMED, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in May 2021, Fannin Ltd launched the Espiner Trocar designed for precision and control, providing straightforward and safe access to the peritoneal cavity. It provides smooth entry with low insertion force into the abdominal cavity.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global trocars market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Johnson & Johnson Services, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Medtronic plc

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Aesculap, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Trocars Market by Tip Type

4.1.1. Bladeless Trocars

4.1.2. Blunt Trocars

4.1.3. Bladed Trocars

4.1.4. Optical Trocars

4.2. Global Trocars Market by Product Type

4.2.1. Disposable Trocars

4.2.2. Reusable Trocars

4.3. Global Trocars Market by Application

4.3.1. General Surgery

4.3.2. Gynecological Surgery

4.3.3. Urological Surgery

4.3.4. Other (Pediatric Surgery and Laparoscopy Surgery)

4.4. Global Trocars Market by End-User

4.4.1. Hospitals

4.4.2. Ambulatory Surgical Centers

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Ackermann Instrumente GmbH

6.2. Applied Medical Resources Corporation

6.3. B. Braun Medical Inc.

6.4. BNR Co., Ltd.

6.5. CONMED Corp.

6.6. Fannin, Ltd.

6.7. Baxter International, Inc.

6.8. LaproSurge, Ltd.

6.9. LocaMed, Ltd.

6.10. Mölnlycke Health Care AB

6.11. Mediflex Surgical Products

6.12. Medline Industries, LP

6.13. Purple Surgical

6.14. Teleflex Inc.

6.15. The Cooper Companies

6.16. Unimax Medical Systems Inc.

6.17. Victor medical Co., Ltd.

1. GLOBAL TROCARS MARKET RESEARCH AND ANALYSIS BY TIP TYPE, 2023-2031 ($ MILLION)

2. GLOBAL BLADELESS TROCARS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL BLUNT TROCARS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL BLADED TROCARS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL OPTICAL TROCARS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL TROCARS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

7. GLOBAL DISPOSABLE TROCARS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL REUSABLE TROCARS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL TROCARS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

10. GLOBAL TROCARS FOR GENERAL SURGERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL TROCARS FOR GYNECOLOGICAL SURGERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL TROCARS FOR UROLOGICAL SURGERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL TROCARS FOR OTHER SURGERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL TROCARS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

15. GLOBAL TROCARS IN HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL TROCARS IN AMBULATORY SURGICAL CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL TROCARS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. NORTH AMERICAN TROCARS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. NORTH AMERICAN TROCARS MARKET RESEARCH AND ANALYSIS BY TIP TYPE, 2023-2031 ($ MILLION)

20. NORTH AMERICAN TROCARS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

21. NORTH AMERICAN TROCARS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

22. NORTH AMERICAN TROCARS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

23. EUROPEAN TROCARS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. EUROPEAN TROCARS MARKET RESEARCH AND ANALYSIS BY TIP TYPE, 2023-2031 ($ MILLION)

25. EUROPEAN TROCARS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

26. EUROPEAN TROCARS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

27. EUROPEAN TROCARS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC TROCARS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC TROCARS MARKET RESEARCH AND ANALYSIS BY TIP TYPE, 2023-2031 ($ MILLION)

30. ASIA-PACIFIC TROCARS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

31. ASIA-PACIFIC TROCARS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

32. ASIA-PACIFIC TROCARS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

33. REST OF THE WORLD TROCARS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

34. REST OF THE WORLD TROCARS MARKET RESEARCH AND ANALYSIS BY TIP TYPE, 2023-2031 ($ MILLION)

35. REST OF THE WORLD TROCARS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

36. REST OF THE WORLD TROCARS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

37. REST OF THE WORLD TROCARS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL TROCARS MARKET SHARE BY TIP TYPE, 2023 VS 2031 (%)

2. GLOBAL BLADELESS TROCARS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL BLUNT TROCARS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL BLADED TROCARS MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL OPTICAL TROCARS MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL TROCARS MARKET SHARE BY PRODUCT TYPE, 2023 VS 2031 (%)

7. GLOBAL DISPOSABLE TROCARS MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL REUSABLE TROCARS MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL TROCARS MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

10. GLOBAL TROCARS FOR GENERAL SURGERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL TROCARS FOR GYNECOLOGICAL SURGERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL TROCARS FOR UROLOGICAL SURGERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL TROCARS FOR OTHER SURGERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL TROCARS MARKET SHARE BY END-USER, 2023 VS 2031 (%)

15. GLOBAL TROCARS IN HOSPITALS MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL TROCARS IN AMBULATORY SURGICAL CENTERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL TROCARS MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. US TROCARS MARKET SIZE, 2023-2031 ($ MILLION)

19. CANADA TROCARS MARKET SIZE, 2023-2031 ($ MILLION)

20. UK TROCARS MARKET SIZE, 2023-2031 ($ MILLION)

21. FRANCE TROCARS MARKET SIZE, 2023-2031 ($ MILLION)

22. GERMANY TROCARS MARKET SIZE, 2023-2031 ($ MILLION)

23. ITALY TROCARS MARKET SIZE, 2023-2031 ($ MILLION)

24. SPAIN TROCARS MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF EUROPE TROCARS MARKET SIZE, 2023-2031 ($ MILLION)

26. INDIA TROCARS MARKET SIZE, 2023-2031 ($ MILLION)

27. CHINA TROCARS MARKET SIZE, 2023-2031 ($ MILLION)

28. JAPAN TROCARS MARKET SIZE, 2023-2031 ($ MILLION)

29. SOUTH KOREA TROCARS MARKET SIZE, 2023-2031 ($ MILLION)

30. REST OF ASIA-PACIFIC TROCARS MARKET SIZE, 2023-2031 ($ MILLION)

31. LATIN AMERICA TROCARS MARKET SIZE, 2023-2031 ($ MILLION)

32. MIDDLE EAST AND AFRICA TROCARS MARKET SIZE, 2023-2031 ($ MILLION)