Truck Platooning Market

Truck Platooning Market Size, Share & Trends Analysis Report by Technology Type (Adaptive Cruise Control (ACC), Blind Spot Warning (BSW), Global Positioning System (GPS), Forward Collision Warning (FCW), Lane Keep Assist (LKA), and Others), by Autonomous Level (Semi-Autonomous, and Full-Autonomous), and by Communication Technology (Vehicle-to-Vehicle (V2V), Vehicle-to-Infrastructure (V2I), and Global Positioning System (GPS)) Forecast Period (2022-2028) Update Available - Forecast 2025-2031

Truck platooning market is anticipated to grow at an exponential CAGR of 28.9% during the forecast period. One of the key factors that are fueling the market is the reduction in operating costs. As per Scania, in 2022, the fuel cost books for more than 30% of the operational cost in normal transport operations in Europe. It indicates that a small drop in fuel consumption can show a significant impact on the total freight cost in the industry of transportation, which functions on small margins of profit. The application of platooning in the trucking industry can support decreasing fuel costs experienced by transportation service providers and vehicle manufacturers. As per Peloton, the decline in aerodynamic drag of two-truck platooning offers unprecedented fuel savings for both the leading truck and the trailing. As per the 2022 report of the European commission “Analysis of market needs, business models and life-cycle environmental impacts of multi-brand platooning”, the average fuel consumption of the test trucks was 31L/100km. It was assumed that the trucks were driven at an inter-vehicle distance of 4 to10 meters with a fuel savings potential of 5 and 10% in the lead and trailing trucks, respectively (Zhang et al., 2020).

Segmental Outlook

The global truck platooning market is segmented based on the technology type, autonomous level, and communication technology. Based on the technology type, the market is segmented into adaptive cruise control (ACC), blind-spot warning (BSW), a global positioning system (GPS), forward collision warning (FCW), lane-keep assist (LKA), and others. Based on the autonomous level, the market is sub-segmented into the semi-autonomous, and full-autonomous. Based on the communication technology, the market is sub-segmented into the vehicle-to-vehicle (V2V), vehicle-to-infrastructure (V2I), and global positioning system (GPS). The above-mentioned segments can be customized as per the requirements. Based on technology type, adaptive cruise control (ACC) is anticipated to grow at the fastest rate in the market owing to its crucial system for truck platooning operations while based on the autonomous level, the semi-autonomous segment is anticipated to hold the prominent share during the forecast period owing to the flexibility of the semi-autonomous system.

Based on technology type, adaptive cruise control (ACC) is anticipated to grow at the fastest rate in the market during the forecast period. ACC has been a crucial system for truck platooning operations. ACC support in automating the speed of the trucks with the support of V2V communication. A few projects, such as PATH, GCDC (Grand Cooperative Driving Challenge), SARTRE, SCANIA, and ENERGY-ITS (Intelligent Transport Systems), had been introduced and implied across various regions for testing and verifying automotive (majorly truck) platooning systems. For instance, in April 2022, the Federal Highway Administration's (FHWA) Exploratory Advanced Research (EAR) Program sponsored the research on strategies and technology for allowing 2 and 3 long-distance trucks for travelling close together in platoons using cooperative adaptive cruise control (CACC).

Regional Outlooks

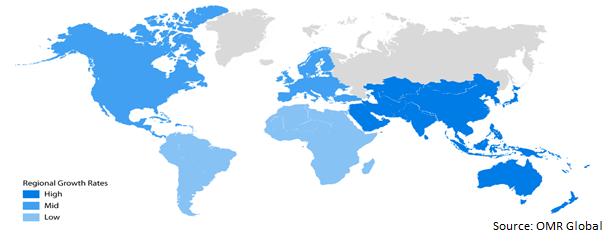

The global truck platooning market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Europe region is anticipated to grow at the fastest rate in the market while North America is anticipated to hold the prominent share during the forecast period.

Global Truck Platooning Market Growth, by Region 2022-2028

The Europe Region Anticipated to Grow Fastest in the Global Truck Platooning Market

The Europe region is anticipated to grow at the fastest rate in the market during the forecast period owing to the rising heavily investing in truck platooning technology for catering to various needs of people. As per the Eurostat report, in April 2022, over 77% of inland cargo transport within the European Union, which was about billions of ton-kilometers (tkm), travel by road. Whereas, in some European countries, this percentage reached 90% or more such as Ireland (99%), Greece (97%), and Spain (96%). The major factors fueling the growth of the market included pioneering efforts in technological advancements, truck platooning, and stringent vehicle safety norms in the region. The technological advancements factors responsible for fueling the growth in the European markets are the such as the integrated application of IoT and the implementation of strict regulations such as ACEA’s EU General Safety Regulation norms pertaining to vehicle safety.

Market Players Outlook

The major companies serving the global truck platooning market include Mercedes-Benz Group AG, PACCAR Holding B.V. (DAF), Peloton Technology, Scania CV AB, Volvo Group, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in November 2020, Scania acquired Nantong Gaokai, a Chinese truck company, to start manufacturing trucks for the first time in the global’s biggest auto market. The emphasis of acquisition is to carry safer and more fuel-efficient vehicles by encouraging technologies such as truck platooning in the market.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global truck platooning market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Recovery Scenario of Global Truck Platooning Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Mercedes-Benz Group AG

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. PACCAR Holding B.V. (DAF)

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Peloton Technology

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Scania CV AB

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Volvo Group

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Truck Platooning Market by Technology Type

4.1.1. Adaptive Cruise Control (ACC)

4.1.2. Blind Spot Warning (BSW)

4.1.3. Global Positioning System (GPS)

4.1.4. Forward Collision Warning (FCW)

4.1.5. Lane Keep Assist (LKA)

4.1.6. Others (Active Brake Assist (ABA))

4.2. Global Truck Platooning Market by Autonomous Level

4.2.1. Semi-Autonomous

4.2.2. Full-Autonomous

4.3. Global Truck Platooning Market by Communication Technology

4.3.1. Vehicle-to-Vehicle (V2V)

4.3.2. Vehicle-to-Infrastructure (V2I)

4.3.3. Global Positioning System (GPS)

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Continental AG

6.2. Delphi Powertrain Systems Operations Luxembourg S. à r.l.

6.3. Knorr-Bremse AG

6.4. Navistar, Inc.

6.5. NVIDIA

6.6. Robert Bosch GmbH

6.7. ZF Friedrichshafen AG

1. GLOBAL TRUCK PLATOONING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL ACC TRUCK PLATOONING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL BSW TRUCK PLATOONING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL GPS TRUCK PLATOONING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL FCW TRUCK PLATOONING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL LKA TRUCK PLATOONING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL ABA TRUCK PLATOONING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL TRUCK PLATOONING MARKET RESEARCH AND ANALYSIS BY AUTONOMOUS LEVEL, 2021-2028 ($ MILLION)

9. GLOBAL SEMI-AUTONOMOUS TRUCK PLATOONING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL FULL-AUTONOMOUS TRUCK PLATOONING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL TRUCK PLATOONING MARKET RESEARCH AND ANALYSIS BY COMMUNICATION TECHNOLOGY, 2021-2028 ($ MILLION)

12. GLOBAL V2V TRUCK PLATOONING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL V2I TRUCK PLATOONING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL GPS TRUCK PLATOONING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. GLOBAL TRUCK PLATOONING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

16. NORTH AMERICAN TRUCK PLATOONING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. NORTH AMERICAN TRUCK PLATOONING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY TYPE, 2021-2028 ($ MILLION)

18. NORTH AMERICAN TRUCK PLATOONING MARKET RESEARCH AND ANALYSIS BY AUTONOMOUS LEVEL, 2021-2028 ($ MILLION)

19. NORTH AMERICAN TRUCK PLATOONING MARKET RESEARCH AND ANALYSIS BY COMMUNICATION TECHNOLOGY, 2021-2028 ($ MILLION)

20. EUROPEAN TRUCK PLATOONING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

21. EUROPEAN TRUCK PLATOONING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY TYPE, 2021-2028 ($ MILLION)

22. EUROPEAN TRUCK PLATOONING MARKET RESEARCH AND ANALYSIS BY AUTONOMOUS LEVEL, 2021-2028 ($ MILLION)

23. EUROPEAN TRUCK PLATOONING MARKET RESEARCH AND ANALYSIS BY COMMUNICATION TECHNOLOGY, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC TRUCK PLATOONING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

25. ASIA-PACIFIC TRUCK PLATOONING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY TYPE, 2021-2028 ($ MILLION)

26. ASIA-PACIFIC TRUCK PLATOONING MARKET RESEARCH AND ANALYSIS BY AUTONOMOUS LEVEL, 2021-2028 ($ MILLION)

27. ASIA-PACIFIC TRUCK PLATOONING MARKET RESEARCH AND ANALYSIS BY COMMUNICATION TECHNOLOGY, 2021-2028 ($ MILLION)

28. REST OF THE WORLD TRUCK PLATOONING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

29. REST OF THE WORLD TRUCK PLATOONING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY TYPE, 2021-2028 ($ MILLION)

30. REST OF THE WORLD TRUCK PLATOONING MARKET RESEARCH AND ANALYSIS BY AUTONOMOUS LEVEL, 2021-2028 ($ MILLION)

31. REST OF THE WORLD TRUCK PLATOONING MARKET RESEARCH AND ANALYSIS BY COMMUNICATION TECHNOLOGY, 2021-2028 ($ MILLION)

1. GLOBAL TRUCK PLATOONING MARKET SHARE BY TECHNOLOGY TYPE, 2021 VS 2028 (%)

2. GLOBAL ACC TRUCK PLATOONING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

3. GLOBAL BSW TRUCK PLATOONING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

4. GLOBAL GPS TRUCK PLATOONING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

5. GLOBAL FCW TRUCK PLATOONING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL LKA TRUCK PLATOONING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL ABA TRUCK PLATOONING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL TRUCK PLATOONING MARKET SHARE BY AUTONOMOUS LEVEL, 2021 VS 2028 (%)

9. GLOBAL SEMI-AUTONOMOUS TRUCK PLATOONING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL FULL-AUTONOMOUS TRUCK PLATOONING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL TRUCK PLATOONING MARKET SHARE BY COMMUNICATION TECHNOLOGY, 2021 VS 2028 (%)

12. GLOBAL V2V TRUCK PLATOONING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL V2I TRUCK PLATOONING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL GPS TRUCK PLATOONING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. GLOBAL TRUCK PLATOONING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16. US TRUCK PLATOONING MARKET SIZE, 2021-2028 ($ MILLION)

17. CANADA TRUCK PLATOONING MARKET SIZE, 2021-2028 ($ MILLION)

18. UK TRUCK PLATOONING MARKET SIZE, 2021-2028 ($ MILLION)

19. FRANCE TRUCK PLATOONING MARKET SIZE, 2021-2028 ($ MILLION)

20. GERMANY TRUCK PLATOONING MARKET SIZE, 2021-2028 ($ MILLION)

21. ITALY TRUCK PLATOONING MARKET SIZE, 2021-2028 ($ MILLION)

22. SPAIN TRUCK PLATOONING MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF EUROPE TRUCK PLATOONING MARKET SIZE, 2021-2028 ($ MILLION)

24. INDIA TRUCK PLATOONING MARKET SIZE, 2021-2028 ($ MILLION)

25. CHINA TRUCK PLATOONING MARKET SIZE, 2021-2028 ($ MILLION)

26. JAPAN TRUCK PLATOONING MARKET SIZE, 2021-2028 ($ MILLION)

27. SOUTH KOREA TRUCK PLATOONING MARKET SIZE, 2021-2028 ($ MILLION)

28. REST OF ASIA-PACIFIC TRUCK PLATOONING MARKET SIZE, 2021-2028 ($ MILLION)

29. REST OF THE WORLD TRUCK PLATOONING MARKET SIZE, 2021-2028 ($ MILLION)