Turbocharger Market

Turbocharger Market Size, Share & Trends Analysis Report by Industry (Automotive, Aerospace & Defense, Marine, and Agriculture & Construction), by Technology (Twin-Turbo Technology, Variable Geometry Technology, and Wastegate Technology), by Sales Channel (OEM, and Aftermarket) and by Engine Type (Diesel Engine, Gasoline Engine, and Hybrid Engines) Forecast Period (2024-2031)

Turbocharger market is anticipated to grow at a significant CAGR of 8.3% during the forecast period (2024-2031). The automotive industry’s shift from diesel to gasoline light-duty vehicles and a rise in vehicle hybridization is creating a huge demand for turbochargers. Harsh emission regulations and consumers' preference for high-performance vehicles are driving the growth of the turbocharger market. According to the US Environmental Protection Agency (EPA), in December 2023, In the model year 2022, 37.0% of all new vehicles were cars and 63.0% of all new vehicles were trucks under EPA’s light-duty GHG regulations. The combination of technology innovation and market trends has resulted in the average new vehicle fuel economy increasing by 35.0%, horsepower increasing by 23.0%, and weight increasing by 5.0%.

Market Dynamics

Increasing Demand for Plug-In Hybrid Electric Vehicles (PHEVs) and Hybrid Vehicles

Globally the share of hybrid electric passenger cars has increased. The operating range of internal combustion engines for hybrid electric vehicles is increasing compared with conventional ones and turbochargers are also required to be developed to address- this limitation. The key players such as Mitsubishi Heavy Industries Engine & Turbocharger, Ltd. (MHIET) have developed high-efficiency compressors that meet the requirements of HEVs, vaned nozzle turbines designed for higher efficiency, ball bearings designed to reduce mechanical loss and low-cost turbine housing materials that are designed by using data science and have been proposed to automobile manufacturers. According to the US Environmental Protection Agency (EPA), in December 2023, hybrid vehicles reached a new high of 10.0% of all production. Strong and mild hybrid production grew, with mild hybrids accounting for 41.0% of overall hybrid production. The combined category of electric vehicles (EVs), plug-in hybrid vehicles (PHEVs), and fuel cell electric vehicles (FCVs) increased from 4.0% of production in the model year 2021 to 7.0% of production in the model year 2022 and are projected to reach 12.0% of production in the model year 2023.

Rising Demand for Fuel Efficiency

Turbochargers are being used in cars to increase fuel economy and lower carbon emissions as governments all over the globe are enforcing more stringent emissions laws regarding the use of emission-free vehicles. Turbochargers enable smaller engines to generate more power, contributing to improved fuel economy and lower emissions. According to the US Environmental Protection Agency (EPA), in December 2023, four of the five vehicle types had their lowest CO2 emissions and highest fuel economy ever in model year 2022. Car SUVs decreased CO2 emissions by 27 g/mi, pickups decreased by 18 g/mi, sedan/wagons decreased by 11 g/mi, and truck SUVs decreased by 4 g/mi. Minivan/vans, which accounted for less than 3.0% of new vehicle production in model year 2022, were the only vehicle type that had higher CO2 emissions in 2022 compared to 2021, increasing by 17 g/mi.

Market Segmentation

- Based on the industry, the market is segmented into automotive, aerospace & defense, marine, and agriculture & construction.

- Based on the technology, the market is segmented into twin-turbo technology, variable geometry technology, and wastegate technology.

- Based on the sales channel, the market is segmented into OEM and aftermarket.

- Based on the engine type, the market is segmented into diesel engines, gasoline engines, and hybrid engines.

Twin-Turbo Technology is Projected to Hold the Largest Segment

Prominent automakers are implementing the dual automotive turbocharger technology to increase output. Additionally, growing consumer demand for high-performance automobiles and stricter emissions and fuel-efficiency standards further promote the use of this technology. When compared to single turbochargers, twin turbochargers improve power production and efficiency, which results in improved engine performance. To create lightweight, compact twin turbocharger systems that satisfy performance and reliability standards set by the automobile industry, major players are concentrating on innovation. For instance, in March 2022, Stellantis introduced its new, 3.0-liter, twin-turbo, inline, six-cylinder engine, named Hurricane, that delivers better fuel economy and fewer emissions than larger engines while at the same time generates more horsepower and torque than many competitors’ naturally aspirated V-8 and boosted six-cylinder power plants.

Regional Outlook

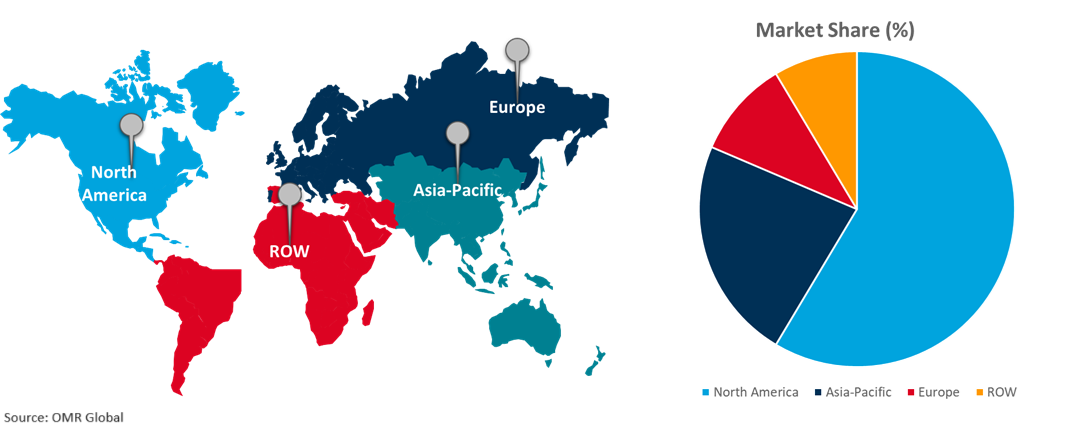

The global turbocharger market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Turbocharger in Asia-Pacific

Asia-Pacific accounts for the biggest production share of both passenger cars and commercial vehicles, Asia-Pacific is anticipated to be the largest market for automotive turbochargers. The demand for economy and mid-range vehicles (including Class A, B, and C) is stronger in major countries such as China and India, where gasoline engines will account for between 50.0% and 90.0% of sales in 2023. Small cars, such as SUVs and crossovers, are the most popular in Asia-Pacific. Additionally, the regional manufacturers concentrate on reducing their engines by using different turbocharger technology. The OEMs have adopted smaller gasoline direct injection (GDI) with turbochargers to obtain similar or superior power than naturally aspirated engines in light of recent government attempts to encourage alternative fuel cars.

Global Turbocharger Market Growth by Region 2024-2031

North America Holds Major Market Share

North America holds a significant share owing to the presence of the major turbocharger offering companies such as BorgWarner, Inc., Cummins, Inc., Honeywell International, Inc., and others. The market growth is attributed to the rapid uptake of turbocharged gasoline direct injection (TGDI) engines in gasoline-powered automobiles. As passenger cars are used so often in the region, passenger vehicle turbochargers account for more than 60.0% of the market. The key players have produced fuel cell car turbochargers, which increase power generation efficiencies by providing clean air to fuel cell batteries. It is also expected that the growth of fuel cell technology in the passenger car market will support the development above and propel the industry growth for turbochargers. For instance, in August 2022, Cummins, Inc. introduced the 8TH Generation Holset Series 400 Variable Geometry Turbocharger. Cummins Turbo Technologies (CTT) 7th generation 400 series Variable Geometry Turbocharger (VGT) to help engine manufacturers meet future emission standards and offer class fuel economy. It is specifically engineered for class performance, reliability, and durability for the 10-15L heavy-duty truck market.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the turbocharger market include BorgWarner, Inc., Continental AG, Cummins, Inc., Honeywell International, Inc., and Mitsubishi Electric Corp. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

Recent Development

- In April 2022, Mitsubishi Turbocharger and Engine Europe expanded the Mitsubishi & partners concept. Mitsubishi Turbocharger and Engine Europe (MTEE) introduced the Mitsubishi & Partners concept to the market. Initially, this concept looked to develop relationships and collaboration downstream in the supply chain by working closely with our valuable customers in sales, service, and marketing activities.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the turbocharger market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. BorgWarner, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Continental AG

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Cummins, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Honeywell International, Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Mitsubishi Electric Corp.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Turbocharger Market by Industry

4.1.1. Automotive

4.1.2. Aerospace & Defense

4.1.3. Marine

4.1.4. Agriculture & Construction

4.2. Global Turbocharger Market by Technology

4.2.1. Twin-Turbo Technology

4.2.2. Variable Geometry Technology

4.2.3. Wastegate Technology

4.3. Global Turbocharger Market by Sales Channel

4.3.1. OEM

4.3.2. Aftermarket

4.4. Global Turbocharger Market by Engine Type

4.4.1. Diesel Engine

4.4.2. Gasoline Engine

4.4.3. Hybrid Engines

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Accelleron Group

6.2. Eaton Corp. PLC

6.3. Fengcheng Pacific Shenlong Turbocharger Co., Ltd.

6.4. Hunan Rugidove Turbocharging Systems Co. Ltd.

6.5. Ihi Turbo America

6.6. Kangyue Technology Co., Ltd.

6.7. Kompressorenbau Bannewitz GmbH

6.8. Magnum Performance Turbos, Inc.

6.9. MAHLE GmbH

6.10. MAN Energy Solutions

6.11. MCGILL Industries, Inc.

6.12. Napier Turbochargers Ltd.

6.13. Okiya Group Co., Ltd.

6.14. Precision Turbo & Engine Rebuilders, Inc.

6.15. Rotomaster International

6.16. Turbo Energy Pvt. Ltd. (Tel)

6.17. Turbo One Pte. Ltd.

6.18. Turbo Systems United Co., Ltd.

6.19. Zhejiang Rongfa Motor Engine Co., Ltd.

1. Global Turbocharger Market Research and Analysis by Industry, 2023-2031 ($ Million)

2. Global Automotive Turbocharger Market Research and Analysis by Region, 2023-2031 ($ Million)

3. Global Aerospace & Defense Turbocharger Market Research and Analysis by Region, 2023-2031 ($ Million)

4. Global Marine Turbocharger Market Research and Analysis by Region, 2023-2031 ($ Million)

5. Global Agriculture & Construction Turbocharger Market Research and Analysis by Region, 2023-2031 ($ Million)

6. Global Turbocharger Market Research and Analysis by Technology, 2023-2031 ($ Million)

7. Global Twin-Turbo Technology based Turbocharger Market Research and Analysis by Region, 2023-2031 ($ Million)

8. Global Variable Geometry Technology based Turbocharger Market Research and Analysis by Region, 2023-2031 ($ Million)

9. Global Wastegate Technology based Turbocharger Market Research and Analysis by Region, 2023-2031 ($ Million)

10. Global Turbocharger Market Research and Analysis by Sales Channel, 2023-2031 ($ Million)

11. Global OEM Turbocharger Market Research and Analysis by Region, 2023-2031 ($ Million)

12. Global Aftermarket Turbocharger Market Research and Analysis by Region, 2023-2031 ($ Million)

13. Global Turbocharger Market Research and Analysis by Engine Type, 2023-2031 ($ Million)

14. Global Turbocharger for Diesel Engine Market Research and Analysis by Region, 2023-2031 ($ Million)

15. Global Turbocharger for Gasoline Engine Market Research and Analysis by Region, 2023-2031 ($ Million)

16. Global Turbocharger for Hybrid Engines Market Research and Analysis by Region, 2023-2031 ($ Million)

17. Global Turbocharger Market Research and Analysis by Region, 2023-2031 ($ Million)

18. North American Turbocharger Market Research and Analysis by Country, 2023-2031 ($ Million)

19. North American Turbocharger Market Research and Analysis by Industry, 2023-2031 ($ Million)

20. North American Turbocharger Market Research and Analysis by Technology, 2023-2031 ($ Million)

21. North American Turbocharger Market Research and Analysis by Sales Channel, 2023-2031 ($ Million)

22. North American Turbocharger Market Research and Analysis by Engine Type, 2023-2031 ($ Million)

23. European Turbocharger Market Research and Analysis by Country, 2023-2031 ($ Million)

24. European Turbocharger Market Research and Analysis by Industry, 2023-2031 ($ Million)

25. European Turbocharger Market Research and Analysis by Technology, 2023-2031 ($ Million)

26. European Turbocharger Market Research and Analysis by Sales Channel, 2023-2031 ($ Million)

27. European Turbocharger Market Research and Analysis by Engine Type, 2023-2031 ($ Million)

28. Asia-Pacific Turbocharger Market Research and Analysis by Country, 2023-2031 ($ Million)

29. Asia-Pacific Turbocharger Market Research and Analysis by Industry, 2023-2031 ($ Million)

30. Asia-Pacific Turbocharger Market Research and Analysis by Technology, 2023-2031 ($ Million)

31. Asia-Pacific Turbocharger Market Research and Analysis by Sales Channel, 2023-2031 ($ Million)

32. Asia-Pacific Turbocharger Market Research and Analysis by Engine Type, 2023-2031 ($ Million)

33. Rest of the World Turbocharger Market Research and Analysis by Region, 2023-2031 ($ Million)

34. Rest of the World Turbocharger Market Research and Analysis by Industry, 2023-2031 ($ Million)

35. Rest of the World Turbocharger Market Research and Analysis by Technology, 2023-2031 ($ Million)

36. Rest of the World Turbocharger Market Research and Analysis by Sales Channel, 2023-2031 ($ Million)

37. Rest of the World Turbocharger Market Research and Analysis by Engine Type, 2023-2031 ($ Million)

1. Global Turbocharger Market Research and Analysis by Industry, 2023 Vs 2031 (%)

2. Global Automotive Turbocharger Market Share by Region, 2023 Vs 2031 (%)

3. Global Aerospace & Defense Turbocharger Market Share by Region, 2023 Vs 2031 (%)

4. Global Marine Turbocharger Market Share by Region, 2023 Vs 2031 (%)

5. Global Agriculture & Construction Turbocharger Market Share by Region, 2023 Vs 2031 (%)

6. Global Turbocharger Market Research and Analysis by Technology, 2023 Vs 2031 (%)

7. Global Twin-Turbo Technology based Turbocharger Market Share by Region, 2023 Vs 2031 (%)

8. Global Variable Geometry Technology based Turbocharger Market Share by Region, 2023 Vs 2031 (%)

9. Global Wastegate Technology based Turbocharger Market Share by Region, 2023 Vs 2031 (%)

10. Global Turbocharger Market Share by Sales Channel, 2023 Vs 2031 (%)

11. Global OEM Turbocharger Market Share by Region, 2023 Vs 2031 (%)

12. Global Aftermarket Turbocharger Market Share by Region, 2023 Vs 2031 (%)

13. Global Turbocharger Market Share by Engine Type, 2023 Vs 2031 (%)

14. Global Turbocharger for Diesel Engine Market Share by Region, 2023 Vs 2031 (%)

15. Global Turbocharger for Gasoline Engine Market Share by Region, 2023 Vs 2031 (%)

16. Global Turbocharger for Hybrid Engines Market Share by Region, 2023 Vs 2031 (%)

17. Global Turbocharger Market Share by Region, 2023 Vs 2031 (%)

18. US Turbocharger Market Size, 2023-2031 ($ Million)

19. Canada Turbocharger Market Size, 2023-2031 ($ Million)

20. UK Turbocharger Market Size, 2023-2031 ($ Million)

21. France Turbocharger Market Size, 2023-2031 ($ Million)

22. Germany Turbocharger Market Size, 2023-2031 ($ Million)

23. Italy Turbocharger Market Size, 2023-2031 ($ Million)

24. Spain Turbocharger Market Size, 2023-2031 ($ Million)

25. Rest of Europe Turbocharger Market Size, 2023-2031 ($ Million)

26. India Turbocharger Market Size, 2023-2031 ($ Million)

27. China Turbocharger Market Size, 2023-2031 ($ Million)

28. Japan Turbocharger Market Size, 2023-2031 ($ Million)

29. South Korea Turbocharger Market Size, 2023-2031 ($ Million)

30. Rest of Asia-Pacific Turbocharger Market Size, 2023-2031 ($ Million)

31. Rest of the World Turbocharger Market Size, 2023-2031 ($ Million)

32. Latin America Turbocharger Market Size, 2023-2031 ($ Million)

33. Middle East and Africa Turbocharger Market Size, 2023-2031 ($ Million)