UHD Display Market

UHD Display Market Size, Share & Trends Analysis Report by Technology (Liquid Crystal Display (LCD), Light Emitting Diode (LED), Organic Light Emitting Diode (OLED), and Others), by Application (Consumer Electronics, Health Care, Media and Entertainment, and Others) and by Product (UHD Televisions, Digital Signage, Set-Top Boxes, Smart Phones/Tablets, Laptops And Personal Computers, Projectors, Cameras, and Others) Forecast Period (2024-2031)

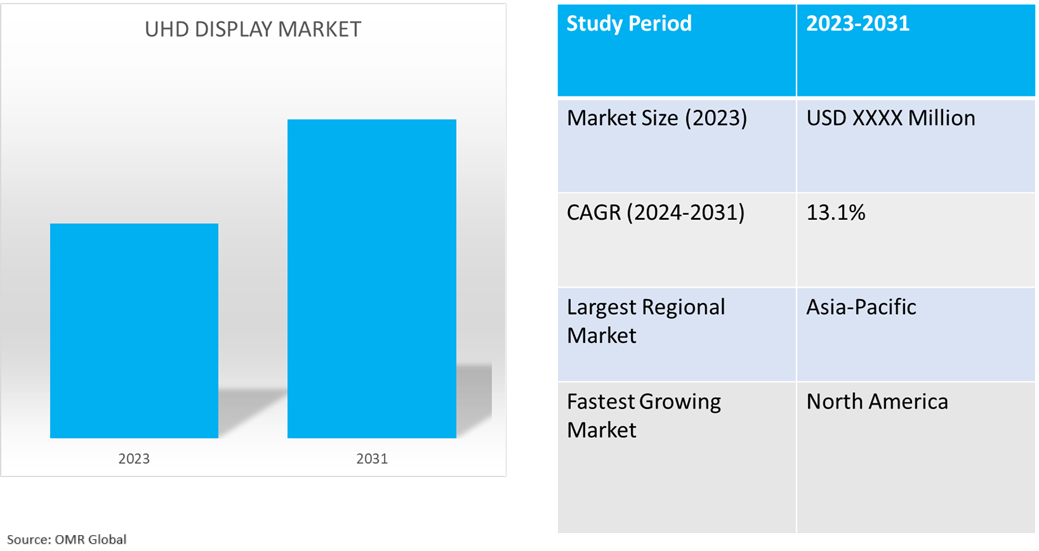

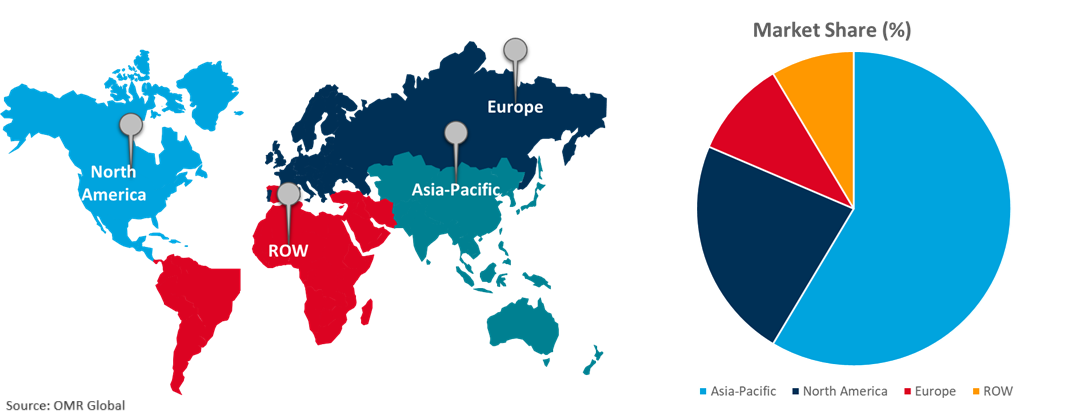

UHD display market is anticipated to grow at a significant CAGR of 13.1% during the forecast period (2024-2031). The market growth is attributed to the growing demand for UHD displays in consumer electronics, gaming, automotive, and digital signage. Additionally, advancements in display technologies and the increasing adoption of UHD content across various platforms are driving the industry growth. According to the National Center for Biotechnology Information (NCBI), in 2023, the size of the global electronics market will increase by 5.0% to $1.3 trillion by 2025. The Asia-Pacific region appeared as an important region covering about 49.4% of the 2020 global electronics market.

Market Dynamics

Growing Advancement in Display Technology

The more widely used OLED and QLED technologies provide improved color accuracy, contrast, and energy economy. Additionally, MicroLED is emerging as a potential technology with a longer lifespan and better brightness than OLED for UHD displays. Moreover, HDR (High Dynamic Range) improves the viewing experience by bringing out more vibrant colors and contrast. Together with advancements in image processing technologies, the creation of smaller and more densely packed pixels allowed for this resolution increase. Viewers can thus have a realistic and immersive experience, especially when using larger screens.

Increasing Demand for Content and Streaming Services

Demand for compatible displays is being driven by the growing availability of 4K UHD content from streaming services such as Netflix, Amazon Prime Video, and Disney+Hotstar. Additionally, advances in semiconductor manufacturing enable the creation of chips that are more potent and efficient, improving 4K device performance without raising prices. A wider range of consumers are drawn in by the improved accessibility and cost, which promotes market growth. For instance, in January 2023, Samsung introduced "Mini-LLD" Quantum Dot technology, enhancing the brightness and precision of High Dynamic Range (f IDR) for 4K TVs. The company also launched the world's first 8K QLLD TV with a 1,000 units peak brightness. Samsung partnered with leading streaming services, such as Netflix and Prime Video, to expand the availability of 4K of IDR content.

Market Segmentation

- Based on the technology, the market is segmented into liquid crystal display (LCD), light emitting diode (LED), organic light emitting diode (OLED), and others (high dynamic range (hdr), quantum dot technology).

- Based on the product, the market is segmented into UHD televisions, digital signage, set-top boxes, smartphones/tablets, laptops and personal computers, projectors, cameras, and others (projectors, gaming consoles).

- Based on the applications, the market is segmented into consumer electronics, health care, media and entertainment, and others (education and training).

Light Emitting Diode (LED) is Projected to Hold the Largest Segment

The primary factors supporting the growth include the advancements in display technology, increased demand for higher quality content, and the proliferation of digital media. Deep blacks and brilliant colors are produced by LED display technology, which brings life to images. The LED chip alignment and surface treatment technologies improve white uniformity and lessen color distortion, while the Micro Pixel Pitch technology helps with color clarity and precision. Together, these technologies produce exceptional image fidelity over a broad viewing angle. For instance, in August 2023, LG Electronics (LG) introduced a new Micro LED signage solution, the LG MAGNIT All-in-One (model LAAA). Ideal for corporate meeting rooms, the impressive 136-inch model combines a premium screen featuring LG’s advanced Micro LED technology and a 1.56-millimeter pixel pitch with a built-in controller and speaker. Along with outstanding picture quality, LG MAGNIT All-in-One offers a convenient user experience with the webOS platform, seamless compatibility with AV control systems, and easy installation.

Consumer Electronics to Hold a Considerable Market Share

The factors supporting segment growth include increasing demand for high-quality and blur-free images, high-quality video recording, availability of electronic devices, multiple utilization in many sectors, especially in consumer electronics, a growing number of tech enthusiasts, and shifting consumer preferences. According to the India Brand Equity Foundation, in April 2024, India considered a popular manufacturing hub, grew its domestic electronics production from $29 billion in 2014-15 to $101.0 billion in 2022-23. Recently, the Ministry of Electronics & Information Technology released the second volume of the Vision document on Electronics Manufacturing in India, which stated that the electronics manufacturing industry will grow from the current $75 billion in 2020-21 to $300 billion by 2025-26. Additionally, UHD LED panels are increasingly seen in commercial and industrial environments. UHD LED screens are used in digital signage, video conferencing systems, and medical imaging equipment. Furthermore, UHD LED panels find application in industrial domains such as robotics and machine vision. For instance, in May 2024, TCL, a consumer electronics company, introduced the more advanced QD-Mini LED in its QM7 and QM8 series, including the largest QD-Mini LED TV in a mega 115” screen size. TCL QD-Mini LED proves that all Mini LEDs are not created equal. Mini LED series features an incredibly high number of dimming zones, up to over 5,000, remarkably high brightness, up to 5,000 Nits Peak, and QLED ULTRA with 97%+ of DCI-P3 Color Gamut and 100% Color Volume for rich color.

Regional Outlook

The global UHD display market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for UHD Display in North America

The regional growth is attributed to the growing popularity of 4K and 8K resolution displays in home entertainment systems, gaming consoles, and digital signage. The rising demand for high-definition content streaming services and the proliferation of UHD content production are also contributing factors. For instance, in July 2022, ViewSonic introduced a 4K UHD All-in-One LED Display with advanced packaging technology. Adopting advanced Chip-on-Board (COB) LED packaging technology with the flip chip, the brand-new series delivers up to 216” large images in 4K UHD resolutions with ultra-high contrast, a wider viewing angle, and superior audio from Harman Kardon speakers.

Global UHD Display Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Asia-Pacific holds a significant share owing to the presence of UHD Display offering companies such as LG Electronics Inc., Panasonic Corp., Samsung Electronics Co., Ltd., Sony Corp., and others. The market growth is attributed to the increasing demand for high-resolution displays in various consumer electronics, healthcare, and retail applications. UHD displays offer superior image clarity, enhanced color accuracy, and an immersive viewing experience, which has fueled their adoption across industries. Technological advancements in display manufacturing have reduced production costs and improved accessibility of UHD displays, further driving market growth. Key players in the market continue to innovate, introducing larger screen sizes, HDR (High Dynamic Range) capabilities, and energy-efficient solutions to cater to diverse consumer needs. For instance, in June 2024, Samsung Electronics introduced the New Odyssey OLED, smart monitor, and ViewFinity Lineups. Next-level experiences are prevented from burn-in with new proprietary technology on the latest Odyssey OLED series. Smart features powered by AI enhance entertainment to smart monitor M8 and Odyssey OLED G8, while new ViewFinity models enable more efficient workplaces.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the UHD display market include LG Electronics Inc., Panasonic Corp., Samsung Electronics Co., Ltd., Sony Corp., and TCL Technology Group Corp. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

Recent Developments

- In June 2024, Sharp introduced New 4K UHD Projectors. The new Sharp P Series projectors – the XP-P601Q and XP-P721Q. The Sharp P Series projectors provide viewers with a stunning 4K ultra-high-definition (UHD) image that is bright enough for commercial use across several industries and signage applications, including in corporate conference rooms, museums, and higher education classrooms.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the UHD display market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. LG Electronics

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Panasonic Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Samsung Electronics Co., Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Sony Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. TCL Technology Group Corp.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global UHD Display Market by Technology

4.1.1. Liquid Crystal Display (LCD)

4.1.2. Light Emitting Diode (LED)

4.1.3. Organic Light Emitting Diode (OLED)

4.1.4. Others (High Dynamic Range (HDR) and Quantum Dot Technology)

4.2. Global UHD Display Market by Product

4.2.1. UHD Televisions

4.2.2. Digital Signage

4.2.3. Set-Top Boxes

4.2.4. Smart Phones/Tablets

4.2.5. Laptops And Personal Computers

4.2.6. Projectors

4.2.7. Cameras

4.2.8. Others (Projectors, Gaming Consoles)

4.3. Global UHD Display Market by Application

4.3.1. Consumer Electronics

4.3.2. Healthcare

4.3.3. Media And Entertainment

4.3.4. Others (Education and Training)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Acer Inc.

6.2. AOC International

6.3. AsusTek Computer Inc.

6.4. BenQ Corp.

6.5. BOE Technology Group Co., Ltd.

6.6. Changhong Electric Co., Ltd.

6.7. Dell Technologies Inc.

6.8. Haier Group Corp.

6.9. Hisense Group

6.10. HP Inc.

6.11. Koninklijke Philips N.V (TP Vision)

6.12. Konka Group Co., Ltd.

6.13. Lenovo Group Ltd.

6.14. Sharp Corp.

6.15. Skyworth Group

6.16. Toshiba Corp.

6.17. ViewSonic Corp.

6.18. Vizio Inc.

6.19. Xiaomi Corp.

1. Global UHD Display Market Research And Analysis By Technology, 2023-2031 ($ Million)

2. Global Liquid Crystal Display (LCD) Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Light Emitting Diode (LED) Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Organic Light Emitting Diode (OLED) Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Other UHD Display Technology Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global UHD Display Market Research And Analysis By Product, 2023-2031 ($ Million)

7. Global UHD Televisions Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global UHD Digital Signage Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global UHD Set-Top Boxes Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global UHD Smart Phones/Tablets Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global UHD Laptops And Personal Computers Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global UHD Projectors Market Research And Analysis By Region, 2023-2031 ($ Million)

13. Global UHD Cameras Market Research And Analysis By Region, 2023-2031 ($ Million)

14. Global Other UHD Display Product Market Research And Analysis By Region, 2023-2031 ($ Million)

15. Global UHD Display Market Research And Analysis By Application, 2023-2031 ($ Million)

16. Global UHD Display For Consumer Electronics Market Research And Analysis By Region, 2023-2031 ($ Million)

17. Global UHD Display For Healthcare Market Research And Analysis By Region, 2023-2031 ($ Million)

18. Global UHD Display For Media And Entertainment Market Research And Analysis By Region, 2023-2031 ($ Million)

19. Global UHD Display For Other Application Market Research And Analysis By Region, 2023-2031 ($ Million)

20. Global UHD Display Market Research And Analysis By Region, 2023-2031 ($ Million)

21. North American UHD Display Market Research And Analysis By Country, 2023-2031 ($ Million)

22. North American UHD Display Market Research And Analysis By Technology, 2023-2031 ($ Million)

23. North American UHD Display Market Research And Analysis By Product, 2023-2031 ($ Million)

24. North American UHD Display Market Research And Analysis By Application, 2023-2031 ($ Million)

25. European UHD Display Market Research And Analysis By Country, 2023-2031 ($ Million)

26. European UHD Display Market Research And Analysis By Technology, 2023-2031 ($ Million)

27. European UHD Display Market Research And Analysis By Product, 2023-2031 ($ Million)

28. European UHD Display Market Research And Analysis By Application, 2023-2031 ($ Million)

29. Asia-Pacific UHD Display Market Research And Analysis By Country, 2023-2031 ($ Million)

30. Asia-Pacific UHD Display Market Research And Analysis By Technology, 2023-2031 ($ Million)

31. Asia-Pacific UHD Display Market Research And Analysis By Product, 2023-2031 ($ Million)

32. Asia-Pacific UHD Display Market Research And Analysis By Application, 2023-2031 ($ Million)

33. Rest Of The World UHD Display Market Research And Analysis By Region, 2023-2031 ($ Million)

34. Rest Of The World UHD Display Market Research And Analysis By Technology, 2023-2031 ($ Million)

35. Rest Of The World UHD Display Market Research And Analysis By Product, 2023-2031 ($ Million)

36. Rest Of The World UHD Display Market Research And Analysis By Application, 2023-2031 ($ Million)

1. Global UHD Display Market Research And Analysis By Technology, 2023 Vs 2031 (%)

2. Global Liquid Crystal Display (LCD) Market Share By Region, 2023 Vs 2031 (%)

3. Global Light Emitting Diode (LED) Market Share By Region, 2023 Vs 2031 (%)

4. Global Organic Light Emitting Diode (OLED) Market Share By Region, 2023 Vs 2031 (%)

5. Global Others UHD Display Technology Market Share By Region, 2023 Vs 2031 (%)

6. Global UHD Display Market Research And Analysis By Product, 2023 Vs 2031 (%)

7. Global UHD Televisions Market Share By Region, 2023 Vs 2031 (%)

8. Global Digital Signage Market Share By Region, 2023 Vs 2031 (%)

9. Global Set-Top Boxes Market Share By Region, 2023 Vs 2031 (%)

10. Global Smart Phones/Tablets Market Share By Region, 2023 Vs 2031 (%)

11. Global Laptops And Personal Computers Market Share By Region, 2023 Vs 2031 (%)

12. Global Projectors Market Share By Region, 2023 Vs 2031 (%)

13. Global Cameras Market Share By Region, 2023 Vs 2031 (%)

14. Global Other UHD Display Product Market Share By Region, 2023 Vs 2031 (%)

15. Global UHD Display Market Research And Analysis By Application, 2023 Vs 2031 (%)

16. Global UHD Display For Consumer Electronics Market Share By Region, 2023 Vs 2031 (%)

17. Global UHD Display For Healthcare Market Share By Region, 2023 Vs 2031 (%)

18. Global UHD Display For Media And Entertainment Market Share By Region, 2023 Vs 2031 (%)

19. Global UHD Display For Other Application Market Share By Region, 2023 Vs 2031 (%)

20. Global UHD Display Market Share By Region, 2023 Vs 2031 (%)

21. US UHD Display Market Size, 2023-2031 ($ Million)

22. Canada UHD Display Market Size, 2023-2031 ($ Million)

23. UK UHD Display Market Size, 2023-2031 ($ Million)

24. France UHD Display Market Size, 2023-2031 ($ Million)

25. Germany UHD Display Market Size, 2023-2031 ($ Million)

26. Italy UHD Display Market Size, 2023-2031 ($ Million)

27. Spain UHD Display Market Size, 2023-2031 ($ Million)

28. Rest Of Europe UHD Display Market Size, 2023-2031 ($ Million)

29. India UHD Display Market Size, 2023-2031 ($ Million)

30. China UHD Display Market Size, 2023-2031 ($ Million)

31. Japan UHD Display Market Size, 2023-2031 ($ Million)

32. South Korea UHD Display Market Size, 2023-2031 ($ Million)

33. Rest Of Asia-Pacific UHD Display Market Size, 2023-2031 ($ Million)

34. Rest Of The World UHD Display Market Size, 2023-2031 ($ Million)

35. Latin America UHD Display Market Size, 2023-2031 ($ Million)

36. Middle East And Africa UHD Display Market Size, 2023-2031 ($ Million)