Urban Air Mobility Market

Urban Air Mobility Market Size, Share & Trends Analysis Report by Component (Infrastructure and Platform) and by Operation (Piloted and Autonomous) and Forecast, 2019-2025 Update Available - Forecast 2025-2035

The rapid urbanization along with increased road congestion has led the manufacturers and service providers to offer efficient and cost-effective transportation and goods-delivery system. Urban air mobility provides transportation of human resource and goods over urban areas via flying vehicles. Urban air mobility offers a cost-effective mode of travel and enhances consumer travel experience at a relatively lesser time as compared to traditional transportation services. Urban air mobility serves as a replacement of modern transportation services and provides an alternative solution in urban areas where traffic congestion is affecting the economic growth of the area. For instance, according to a report of global vehicular traffic by INRIX, in 2018, the traffic congestion cost $305 billion in the US. Moreover, in Los Angeles, the driver spends an average of 102 hours sitting in traffic every year, which cost more than $19 billion annually. The technological advancement in aircraft technology along with enhanced electric propulsion has led to the emergence of the urban air mobility industry. Increasing demand for autonomous flight technology coupled with the developed communication system tends to increase the market share of urban air mobility. Integration of AI with air mobility along with the advancement in autonomy, data analytics, and hybrid and automated electric propulsion has offered the opportunity to the service providers to tap into the potential market.

Segmental Outlook

The urban air mobility market is segmented on the basis of component and operation. Based on the component, the market is segmented into infrastructure and platform. The infrastructure segment is further segmented into charging stations, traffic management, and others, whereas, the platform segment is segmented into air taxi, personal air vehicle, air ambulance, and others. Based on operation, the market is bifurcated into piloted and autonomous.

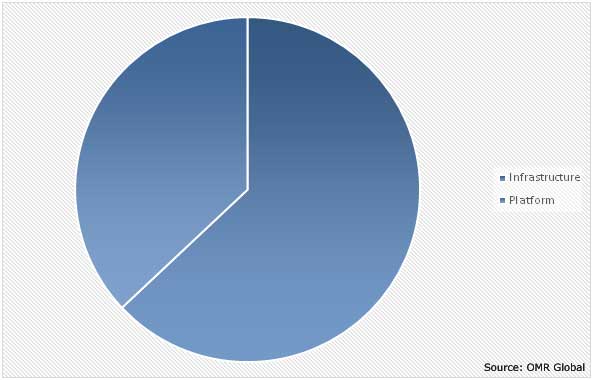

Global Urban Air Mobility Market Share by Component, 2018 (%)

The platform segment is estimated to have significant market share in the market

Platform segment consists of air taxi, personal air vehicle, cargo air vehicle, and air ambulance. The segment is expected to register significant growth in the market during the forecast period owing to the rising investment from various private organizations to enhance the consumer flying experience by providing urban air mobility for commercial applications such as air taxi, personal air travel, and air ambulance. Growing demand for electric vertical take-off and landing (eVTOL) vehicles has increased the market share of the platform segment due to enhanced efficiency and reduced noise as compared to conventional vertical take-off and landing solutions. For instance, in May 2019, Volocopter GmbH along with UK-based Skysports and Brandlab, design agency, has announced that it would create a prototype landing hub to trial its airborne taxi.

Autonomous operation segment is projected to have significant growth in the urban air mobility market

Autonomous segment is expected to register significant growth in the market during the forecast period, as the autonomous air mobility vehicle is the preferred solution for cargo transportation. Moreover, improvement in high-quality sensors and technological innovation have leveraged the development of unmanned aerial vehicles. Moreover, the integration of urban air mobility in the airspace system can provide the transportation of goods and passengers using autonomous aircraft including ride on-demand air taxis. For instance, in January 2019, Aurora Flight Sciences, a subsidiary of aerospace Boeing, has conducted the first test flight of its all-electric autonomous passenger air vehicle. The autonomous passenger air vehicle consists of the electric propulsion system and is designed with a range of up to 50 miles.

Regional Outlook

The global urban air mobility market is further classified on the basis of geography, including North America, Europe, Asia-Pacific, and Rest of the World. North America accounts to hold a significant share in the global urban air mobility market due to the presence of major players in the region, such as Lockheed Martin Corp. Rising investment by private and public organizations for the development of advanced transportation system and rising number of urban air mobility projects in the region tends to drive the market share in North America.

Global Urban Air Mobility Market Growth, by Region 2019-2025

Market Players Outlook

The major players that contribute to the growth of the urban air mobility market include Kitty Hawk Corp., Lilium GmbH, Airbus SAS, Airspace Experience Technologies, Inc., Guangzhou EHang Intelligent Technology Co. Ltd., Lockheed Martin Corp. These market players are contributing to the market by adopting various market approaches including product launch and approvals, merger and acquisition, partnerships collaborations, and others for gaining a strong position in the market.

Recent Developments

- In April 2019, Honeywell International Inc. and Volocopter GmbH have entered into an agreement to jointly test and develop new navigation landing systems for Volocopter GmbH vertical take-off and landing aircraft to develop safer and more enhance air vehicles.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global urban air mobility market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Airbus SAS

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Lilium GmbH

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Kitty Hawk Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Guangzhou EHang Intelligent Technology Co. Ltd.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Lockheed Martin Corp.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Urban Air Mobility Market by Component

5.1.1. Infrastructure

5.1.1.1. Charging Stations

5.1.1.2. Traffic Management

5.1.1.3. Others (Vertiports)

5.1.2. Platform

5.1.2.1. Air Taxi

5.1.2.2. Personal Air Vehicle

5.1.2.3. Air Ambulance

5.1.2.4. Others (Cargo Aerial Vehicle)

5.2. Global Urban Air Mobility Market by Operation

5.2.1. Piloted

5.2.2. Autonomous

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Airbus SAS

7.2. Airspace Experience Technologies, LLC

7.3. Aurora Flight Sciences Corp., a Boeing Company

7.4. Bell Textron Inc.

7.5. DeLorean Aerospace, LLC

7.6. Embraer SA

7.7. Honeywell International Inc.

7.8. Hoversurf

7.9. Kitty Hawk Corp.

7.10. Lilium GmbH

7.11. Lockheed Martin Corp.

7.12. Neva Aerospace Ltd.

7.13. Opener, Inc.

7.14. Safran S.A.

7.15. Sumitomo Corp. Group

7.16. Terrafugia, a company of Zhejiang Geely Holding Group

7.17. Thales Group

7.18. VerdeGo Aero, Inc.

7.19. Volocopter GmbH

7.20. Workhorse Group, Inc.

7.21. XTI Aircraft Co

1. GLOBAL URBAN AIR MOBILITY MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2018-2025 ($ MILLION)

2. GLOBAL INFRASTRUCTURE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL PLATFORM MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL URBAN AIR MOBILITY MARKET RESEARCH AND ANALYSIS BY OPERATION, 2018-2025 ($ MILLION)

5. GLOBAL PILOTED MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL AUTONOMOUS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL URBAN AIR MOBILITY MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

8. NORTH AMERICAN URBAN AIR MOBILITY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

9. NORTH AMERICAN URBAN AIR MOBILITY MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2018-2025 ($ MILLION)

10. NORTH AMERICAN URBAN AIR MOBILITY MARKET RESEARCH AND ANALYSIS BY OPERATION, 2018-2025 ($ MILLION)

11. EUROPEAN URBAN AIR MOBILITY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

12. EUROPEAN URBAN AIR MOBILITY MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2018-2025 ($ MILLION)

13. EUROPEAN URBAN AIR MOBILITY MARKET RESEARCH AND ANALYSIS BY OPERATION, 2018-2025 ($ MILLION)

14. ASIA-PACIFIC URBAN AIR MOBILITY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

15. ASIA-PACIFIC URBAN AIR MOBILITY MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2018-2025 ($ MILLION)

16. ASIA-PACIFIC URBAN AIR MOBILITY MARKET RESEARCH AND ANALYSIS BY OPERATION, 2018-2025 ($ MILLION)

17. REST OF THE WORLD URBAN AIR MOBILITY MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2018-2025 ($ MILLION)

18. REST OF THE WORLD URBAN AIR MOBILITY MARKET RESEARCH AND ANALYSIS BY OPERATION, 2018-2025 ($ MILLION)

1. GLOBAL URBAN AIR MOBILITY MARKET SHARE BY COMPONENT, 2018 VS 2025 (%)

2. GLOBAL URBAN AIR MOBILITY MARKET SHARE BY OPERATION, 2018 VS 2025 (%)

3. GLOBAL URBAN AIR MOBILITY MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US URBAN AIR MOBILITY MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA URBAN AIR MOBILITY MARKET SIZE, 2018-2025 ($ MILLION)

6. UK URBAN AIR MOBILITY MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE URBAN AIR MOBILITY MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY URBAN AIR MOBILITY MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY URBAN AIR MOBILITY MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN URBAN AIR MOBILITY MARKET SIZE, 2018-2025 ($ MILLION)

11. REST OF EUROPE URBAN AIR MOBILITY MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA URBAN AIR MOBILITY MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA URBAN AIR MOBILITY MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN URBAN AIR MOBILITY MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC URBAN AIR MOBILITY MARKET SIZE, 2018-2025 ($ MILLION)