Urea Market

Urea Market Size, Share & Trends Analysis Report by Grade (Fertilizer, Feed, and Technical), and by End-User Industry (Agriculture, Automotive, Medical, and Others), Forecast Period (2023-2030) Update Available - Forecast 2025-2035

Urea market is anticipated to grow at a considerable CAGR of 1.8% during the forecast period (2023-2030). The growing consumption of urea by end-user industries is a key factor driving the growth of the global urea market. The urea has the highest nitrogen content of all industrial chemicals and is in high demand as a fertilizer in agriculture. According to the American Chemical Society, more than 90.0% of urea production goes into agriculture. The remaining 20 million tons made annually goes into animal feed, urea–formaldehyde resins, emollients for skin care, and barbituric acid manufacture. Looking towards the growing demand for urea in agriculture industry several governments are investing in the production capacity expansion of urea plants.

According to the government of India, four new urea plants have been commissioned in 2021, and a fifth is expected in 2023. The lumpsum turnkey execution contract for the fifth plant has, incidentally, been awarded to the Chinese state-owned firm Wuhuan Engineering. The approval of the projects will make the country self-dependent in terms of urea production. The rising project launches to increase the urea production is anticipated to offer lucrative opportunity for the growth of the global urea market. However, the health related problems regarding urea usage may impede its market growth during the forecast period.

Impact of COVID-19 on Urea Market

The COVID-19 pandemic has made negative impact on the global urea market. According to the World Bank Group, fertilizer prices declined by 8.5% in May 2020 as lower input costs and weak seasonal demand outweighed the gradual easing of supply bottlenecks. Urea prices fell to a near three-year low in May due to low seasonal demand and sharply lower feedstock costs. The decline followed price increases in March and April as lockdowns, quarantines, and border controls temporarily affected supplies due to a shortage of workers and challenges to transportation systems. European natural gas, a key input to urea production, fell to multi-decade lows in May-almost 60.0% lower than at the start of 2020.

Segmental Outlook

The global urea market is segmented based on grade and end-user industry. Based on grade, the market is sub-segmented into fertilizer, feed, and technical. Based on end-user industry, the market is sub-segmented into agriculture, automotive, medical, and others. Among the end-user industry, the agriculture industry held considerable share in the urea market based on end-user industry. High usage of urea in agriculture industry as a fertilizer is a key factor driving the growth of this market segment

Fertilizer Grade Sub-Segment to Exhibit a Considerable Growth in the Global Urea Market

Among the grade segment, the fertilizer sub-segment is expected to hold a considerable share of the global urea market. The primary factor driving the market growth includes the high consumption of urea as a fertilizer among the various sectors including agriculture and others. Urea is a low-cost nitrogen fertilizer form, as its high nitrogen composition and consequent low transport and storage costs. Urea may be the fertilizer of choice when only nitrogen is needed in a soil fertility program.

Apart from this, the technical grade is anticipated to exhibit considerable growth in the urea market. The growing usage of technical grade urea in manufacturing of glue, medical drugs, dyes, disinfectants, and cosmetics is driving the growth of this market segment.

Regional Outlooks

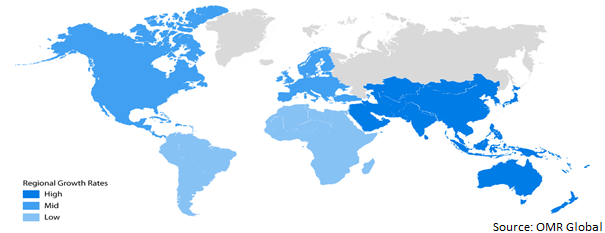

The global urea market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East & Africa and Latin America). Among these, the European regional market is anticipated to exhibit a considerable over the forecast period, followed by North America. Significant increase in urea projects across Germany, UK and the Netherlands is a key factor contributing towards the high share of the regional market. Further, the presence of key market players across the region and their contribution in establishment of new production plants across the region is another major contributor towards the high share of the regional market.

Global Urea Market Growth by Region 2023-2030

The Asia-Pacific Region is Anticipated to Hold a Considerable Share of the Global Urea Market

Among all the regions, the Asia-Pacific region is expected to hold a considerable market share in the global urea market. India and China are the key contributors to the growth of the regional market. India is an agriculture-based country with approximately 75.0% of the population is reliant on farming, directly or indirectly. The rising utility of agrochemicals in the country to meet the growing needs for sustainable crop production is a key factor contributing towards the growth of the regional market. Further, these countries have witnessed significant demand for urea owing to the increasing government focus towards food security and the increasing demand for biodegradable materials in the agriculture sector.

Market Players Outlook

The major players operating in the market include SKW Stickstoffwerke Piesteritz GmbH, Yara International Ltd., BAF SE, Nutrien Ltd., EuroChem Group and so on. These companies are making continuous investments in R&D to make progress in producing technologically advanced urea. Mergers & acquisitions, geographical expansion, production capacity expansion, partnerships, and collaborations are some of the key strategies adopted by the market players to remain competitive in the market place. For instance, in March 2021, Koch Fertilizer (KF) invested around $150 million at its Enid, Oklahoma, the US, nitrogen production facility to increase urea production and enhance the reliability of existing production units as well as improve rail infrastructure and ammonia truck loading facilities. The project will increase production of ammonia upgrade products such as urea. Once complete, it will be able to supply up to 1.8 million tpy of ammonia upgrade products.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global urea market. Based on the availability of data, information related to new project launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. BASF SE

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Kimberly-Clark Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Reckitt Benckiser Group plc

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Urea Market by Grade

4.1.1. Fertilizer

4.1.2. Feed

4.1.3. Technical

4.2. Global Urea Market by End-User Industry

4.2.1. Agriculture

4.2.2. Automotive

4.2.3. Medical

4.2.4. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. AB "Achema"

6.2. Acron

6.3. BIP (OLDBURY) Ltd.

6.4. China National Petroleum Corp.

6.5. EuroChem Group

6.6. Industries Qatar Q.P.S.C.

6.7. Koch Fertilizer LLC

6.8. Notore Chemical Industries PLC

6.9. Nutrien Ltd.

6.10. OCI NV

6.11. Petrobras

6.12. PT Pupuk Kalimantan Timur (PKT)

6.13. SABIC

6.14. Sinochem Holdings Ltd.

6.15. Sinofert Holdings Ltd.

6.16. SKW Stickstoffwerke Piesteritz GmbH

6.17. The Chemical Company

6.18. URALCHEM JSC

6.19. Yara International ASA

1. GLOBAL UREA MARKET BY GRADE, 2022-2030 ($ MILLION)

2. GLOBAL UREA FERTILIZER MARKET BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL UREA FEED MARKET BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL TECHNICAL UREA MARKET BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL UREA MARKET BY END-USER INDUSTRY, 2022-2030 ($ MILLION)

6. GLOBAL UREA FOR AGRICULTURE INDUSTRY MARKET BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL UREA FOR AUTOMOTIVE INDUSTRY MARKET BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL UREA FOR MEDICAL INDUSTRY MARKET BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL UREA FOR OTHER END-USER INDUSTRIES MARKET BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL UREA MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. NORTH AMERICAN UREA MARKET RESEARCH AND ANALYSIS BY GRADE, 2022-2030 ($ MILLION)

12. NORTH AMERICAN UREA MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2022-2030 ($ MILLION)

13. NORTH AMERICAN UREA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

14. EUROPEAN UREA MARKET RESEARCH AND ANALYSIS BY GRADE, 2022-2030 ($ MILLION)

15. EUROPEAN UREA MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2022-2030 ($ MILLION)

16. EUROPEAN UREA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

17. ASIA-PACIFIC UREA MARKET RESEARCH AND ANALYSIS BY GRADE, 2022-2030 ($ MILLION)

18. ASIA-PACIFIC UREA MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2022-2030 ($ MILLION)

19. ASIA-PACIFIC UREA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

20. REST OF THE WORLD UREA MARKET RESEARCH AND ANALYSIS BY GRADE, 2022-2030 ($ MILLION)

21. REST OF THE WORLD UREA MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2022-2030 ($ MILLION)

1. GLOBAL UREA MARKET SHARE BY GRADE, 2022 VS 2030 (%)

2. GLOBAL UREA FERTILIZER MARKET BY REGION, 2022 VS 2030 (%)

3. GLOBAL UREA FEED MARKET BY REGION, 2022 VS 2030 (%)

4. GLOBAL TECHNICAL UREA MARKET BY REGION, 2022 VS 2030 (%)

5. GLOBAL UREA MARKET SHARE BY END-USER INDUSTRY, 2022 VS 2030 (%)

6. GLOBAL UREA FOR AGRICULTURE INDUSTRY MARKET BY REGION, 2022 VS 2030 (%)

7. GLOBAL UREA FOR AUTOMOTIVE INDUSTRY MARKET BY REGION, 2022 VS 2030 (%)

8. GLOBAL UREA FOR MEDICAL INDUSTRY MARKET BY REGION, 2022 VS 2030 (%)

9. GLOBAL UREA FOR OTHER END-USER INDUSTRY MARKET BY REGION, 2022 VS 2030 (%)

10. GLOBAL UREA MARKET SHARE BY REGION, 2022 VS 2030, (%)

11. US UREA MARKET SIZE, 2022-2030 ($ MILLION)

12. CANADA MARKET UREA MARKET SIZE, 2022-2030 ($ MILLION)

13. UK UREA MARKET SIZE, 2022-2030 ($ MILLION)

14. GERMANY UREA MARKET SIZE, 2022-2030 ($ MILLION)

15. SPAIN UREA MARKET SIZE, 2022-2030 ($ MILLION)

16. FRANCE UREA MARKET SIZE, 2022-2030 ($ MILLION)

17. ITALY UREA MARKET SIZE, 2022-2030 ($ MILLION)

18. REST OF EUROPE UREA MARKET SIZE, 2022-2030 ($ MILLION)

19. INDIA UREA MARKET SIZE, 2022-2030 ($ MILLION)

20. CHINA UREA MARKET SIZE, 2022-2030 ($ MILLION)

21. JAPAN UREA MARKET SIZE, 2022-2030 ($ MILLION)

22. REST OFASIA-PACIFIC UREA MARKET SIZE, 2022-2030 ($ MILLION)

23. REST OF WORLD UREA MARKET SIZE, 2022-2030 ($ MILLION)