Urology Devices Market

Global Urology Devices Market Size, Share & Trends Analysis Report by Product (Instruments and Consumables & Accessories) By Applications (Urological Cancer, Benign Prostate Hyperplasia, Kidney Disease, and Others) By End-user (Hospitals & Clinics, Dialysis Centers, and Research Institutions) Forecast, 2021-2027 Update Available - Forecast 2025-2031

The global urology devices market is anticipated to grow at a CAGR of around 5.1% during the forecast period. Urological devices are those that are used to treat urinary tract diseases. The rising prevalence of kidney stones, prostate cancer, urinary tract diseases, traumatic injury, congenital abnormalities, and stress incontinence is the primary driver of market growth. The increasing number of hospitals, as well as investments in endoscopy and laparoscopy facilities are also driving the growth of the market. Lifestyle habits such as unmanaged obesity, addiction to smoking have resulted in an increase in various urological disorders among different age groups. The growing demand for minimally invasive surgical procedures due to advantages offered by them that includes quick recovery periods, reduced blood loss and trauma, low risk of infections are also propelling the growth of the global urology devices market. However, poor reimbursement policies and the high cost of certain devices may restrain the market growth.

Impact of COVID-19 on Urology Devices Market

The COVID-19 has flooded many healthcare facilities with critically ill patients and medical devices such as endoscopes, lithotripsy devices, dialysis machines and others. The patients of COVID-19 have severe respiratory diseases that lead to kidney injury. When excess waste and fluids from the human body aren’t removed then it can lead to multi-organ failure along with kidney failure. As a result of the use of dialysis equipment in the treatment of patients, the urology device market has a positive impact on COVID-19. As per the Intensive Care National Audit and Research Centre, approximately 29% of COVID-19 ventilated patients require dialysis. Furthermore, The Urology Device Market's key players are developing and improving products to survive the COVID-19 crisis. For instance, in May 2020, CHF Solutions unveiled an educational delivery for Aquadex Ultrafiltration, a device that helps to stabilize patients when dialysis equipment is unavailable. Due to the COVID-19 crisis, the use of Aquadex Ultrafiltration has transformed to COVID-19 treatment, attributed to the increasing need for fluid management in COVID-19 patients. These developments are positively impacting the growth of the urology devices market during the COVID-19 pandemic.

Segmental Outlook

The global urology devices market is segmented into product, application, and end-users. Based on product, the market is further sub-segmented into instruments and consumables and accessories. Where the instrument is classified into endoscopes, laser & lithotripsy devices, robotic systems, and others (urodynamic system). Consumables and accessories are classified as dialysis consumables, guidewires, surgical dissectors, and others (biopsy devices, stents). Based on applications, the market is segregated into urological cancer, benign prostate hyperplasia, kidney disease, and others. Based on the end-user segment, the market is categorized into hospitals and clinics, dialysis centers, and research institutions.

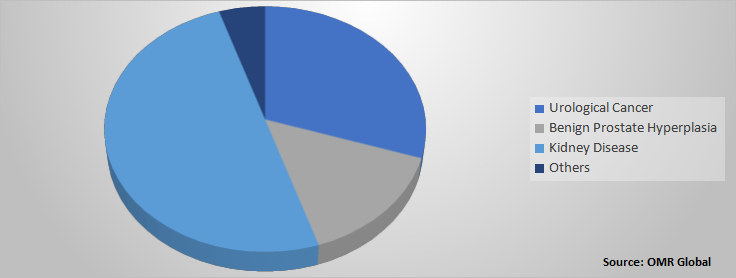

Global Urology Devices Market Share by Applications, 2020 (%)

The kidney diseases segment is estimated to have a major share in the global Urology Devices Market

Among applications, the kidney diseases segment is projected to have a significant share during the forecast period due to the rising number of kidney failure patients, as well as the introduction of advanced technologies such as low-maintenance dialysis devices and artificial kidneys. As per the National Kidney Foundation (NKD), chronic kidney disease affects approximately 10% of the global population, with people killed each year. According to the NKD, emerging economies such as China and India have a geriatric population that is suffering. Another factor driving segmental growth include the growing number of patients suffering from hypertension and diabetes. According to WHO statistics for 2019, approximately 1.13 billion people around the world have hypertension and almost 75% of kidney failure was due to hypertension. Therefore, these factors further projected to propel the growth of the segment.

Regional Outlooks

The global urology devices market is further segmented based on geography including North America, Europe, Asia-Pacific, and the Rest of the World. The North American market is projected to have a significant share during the forecasted period due to the rising prevalence of chronic and lifestyle diseases, rising healthcare expenditure, the highly developed healthcare systems in the US and Canada, and the presence of a better reimbursement framework. Furthermore, the region's market is also expected to benefit from the adoption of opportunistic technologies such as robotic surgery. The major players operating in the market include Olympus Corp, Richard Wolf GmbH, Karl Storz SE & Co. KG, Lumenis Ltd. Among others. Some of the key players of the market include Boston Scientific Corp, Stryker Corp, Cook Medical, Inc and others.

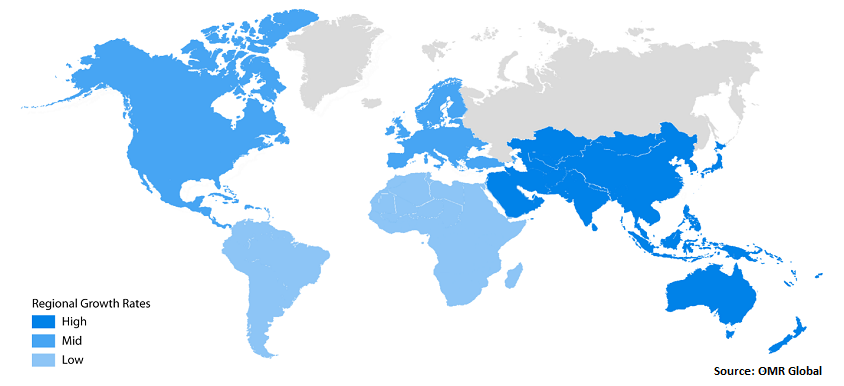

Global Urology Devices Market Growth, by Region 2021-2027

Asia-Pacific is projected to be the fastest-growing region in the global Urology Devices Market

Geographically, Asia-Pacific is estimated to be the fastest-growing region in the urology devices market due to the growing number of urology-related disorders in patients, such as urinary calculi, urolithiasis, bladder cancer, and prostate diseases, which has significantly increased the demand for urology devices in the region. According to the National Center for Biotechnology Information (NCBI), the prevalence of urological disorders ranges from 5% to 19.1% in Southeast Asia, West Asia, South Asia, and some developed economies such as South Korea and Japan. Additionally, the growing need for kidney stone treatment, as well as advancements in the healthcare industry, are also driving demand for urology devices in Asia-Pacific.

Market Players Outlook

The key players of the urology devices market include Abbott Laboratories, Medtronic Plc, Baxter International Inc., Olympus Corp., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers, and acquisitions, collaborations, and new product launches, to stay competitive in the market. For instance, in February 2018, Baxter International Inc announced a collaboration with the International Society of Nephrology to address the growing prevalence of kidney diseases. This five-year agreement supports access to education and research, integrated renal care through building awareness in countries with low to middle-income levels. This collaboration will be focusing on diagnosing and treating chronic kidney diseases and reducing the rate of disease progression.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Urology Devices market

- Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying 'who-stands-where in the market.

1. Report Summary

1.1. Research Methods and Tools

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Urology Devices Industry

• Recovery Scenario of Global Urology Devices Industry

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Regulations

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on key players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Urology Devices Market by Product

5.1.1. Instruments

5.1.1.1. Endoscopes

5.1.1.2. Laser & Lithotripsy Devices

5.1.1.3. Robotic Systems

5.1.1.4. Others (Urodynamic System)

5.1.2. Consumables and Accessories

5.1.2.1. Dialysis Consumable

5.1.2.2. Guidewires

5.1.2.3. Surgical Dissectors

5.1.2.4. Others (Biopsy Devices, Stents)

5.2. Global Urology Devices Market by Application

5.2.1. Urological Cancer

5.2.2. Benign Prostate Hyperplasia

5.2.3. Kidney Disease

5.2.4. Others

5.3. Global Urology Devices Market by End-User

5.3.1. Hospitals and Clinics

5.3.2. Dialysis Centers

5.3.3. Research Institutions

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Abbott Laboratories

7.2. Apricus Biosciences, Inc.

7.3. B. Braun Melsungen AG

7.4. Baxter International Inc.

7.5. Boston Scientific Corp.

7.6. C. R. Bard, Inc.

7.7. Coloplast A/S Group

7.8. Cook Medical Inc.

7.9. Devon Innovations Pvt. Ltd.

7.10. Dornier Medtech

7.11. Fresenius Medical Care

7.12. General Electronic Co.

7.13. Intuitive Surgical Inc.

7.14. Karl Storz Se & Co. Kg

7.15. Medtronic PLC

7.16. Olympus Corp.

7.17. Plethora Solutions Holdings PLC

7.18. Red Leaf Medical Inc.

7.19. Richard Wolf GmbH

7.20. Laboratorios Salvat, S.A.

1. GLOBAL UROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

2. GLOBAL UROLOGY INSTRUMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL UROLOGY CONSUMABLES AND ACCESSORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL UROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

5. GLOBAL UROLOGY DEVICES FOR UROLOGICAL CANCER MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL UROLOGY DEVICES FOR BENIGN PROSTATE HYPERPLASIA MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL UROLOGY DEVICES FOR KIDNEY DISEASE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL UROLOGY DEVICES FOR OTHER APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL UROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

10. GLOBAL UROLOGY DEVICES FOR HOSPITALS AND CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL UROLOGY DEVICES FOR DIALYSIS CENTERS MARKET RESEARCH AND ANALYSIS BY REGION 2020-2027 ($ MILLION)

12. GLOBAL UROLOGY DEVICES FOR RESEARCH INSTITUTIONS MARKET RESEARCH AND ANALYSIS BY REGION 2020-2027 ($ MILLION)

13. GLOBAL UROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

14. NORTH AMERICAN UROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

15. NORTH AMERICAN UROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

16. NORTH AMERICAN UROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

17. NORTH AMERICAN UROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

18. EUROPEAN UROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

19. EUROPEAN UROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

20. EUROPEAN UROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

21. EUROPEAN UROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

22. ASIA-PACIFIC UROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

23. ASIA-PACIFIC UROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

24. ASIA-PACIFIC UROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

25. ASIA-PACIFIC UROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

26. REST OF THE WORLD UROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

27. REST OF THE WORLD UROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT 2020-2027 ($ MILLION)

28. REST OF THE WORLD UROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

29. REST OF THE WORLD UROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL UROLOGY DEVICES MARKET, 2020-2027 (% MILLION)

2. IMPACT OF COVID-19 ON GLOBAL UROLOGY DEVICES MARKET BY SEGMENT, 2020-2027 (% MILLION)

3. RECOVERY OF GLOBAL UROLOGY DEVICES MARKET, 2020-2027 (%)

4. GLOBAL UROLOGY DEVICES MARKET SHARE BY PRODUCT, 2020 VS 2027 (%)

5. GLOBAL UROLOGY DEVICES MARKET SHARE BY APPLICATION, 2020 VS 2027 (%)

6. GLOBAL UROLOGY DEVICES MARKET SHARE BY END-USER 2020 VS 2027 (%)

7. GLOBAL UROLOGY DEVICES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL UROLOGY INSTRUMENTS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

9. GLOBAL UROLOGY CONSUMABLES AND ACCESSORIES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

10. GLOBAL UROLOGY DEVICES FOR UROLOGICAL CANCER MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

11. GLOBAL UROLOGY DEVICES FOR BENIGN PROSTATE HYPERPLASIA MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

12. GLOBAL UROLOGY DEVICES FOR KIDNEY DISEASE MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

13. GLOBAL UROLOGY DEVICES FOR OTHER APPLICATION MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

14. GLOBAL UROLOGY DEVICES FOR HOSPITALS AND CLINICS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

15. GLOBAL UROLOGY DEVICES FOR DIALYSIS CENTERS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

16. GLOBAL UROLOGY DEVICES FOR RESEARCH INSTITUTIONS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

17. US UROLOGY DEVICES MARKET SIZE, 2020-2027($ MILLION)

18. CANADA UROLOGY DEVICES MARKET SIZE, 2020-2027($ MILLION)

19. UK UROLOGY DEVICES MARKET SIZE, 2020-2027($ MILLION)

20. FRANCE UROLOGY DEVICES MARKET SIZE, 2020-2027($ MILLION)

21. GERMANY UROLOGY DEVICES MARKET SIZE, 2020-2027($ MILLION)

22. ITALY UROLOGY DEVICES MARKET SIZE, 2020-2027($ MILLION)

23. SPAIN UROLOGY DEVICES MARKET SIZE, 2020-2027($ MILLION)

24. REST OF EUROPE UROLOGY DEVICES MARKET SIZE, 2020-2027($ MILLION)

25. INDIA UROLOGY DEVICES MARKET SIZE, 2020-2027($ MILLION)

26. CHINA UROLOGY DEVICES MARKET SIZE, 2020-2027($ MILLION)

27. JAPAN UROLOGY DEVICES MARKET SIZE, 2020-2027($ MILLION)

28. SOUTH KOREA UROLOGY DEVICES MARKET SIZE, 2020-2027($ MILLION)

29. REST OF ASIA-PACIFIC UROLOGY DEVICES MARKET SIZE, 2020-2027($ MILLION)

30. REST OF THE WORLD UROLOGY DEVICES MARKET SIZE, 2020-2027($ MILLION)