Urometer Market

Urometer Market Size, Share & Trends Analysis Report by Product (200 ML, 400 ML, 450 ML, 500 ML), by Application (Operative Procedures, Emergency Trauma, Palliative Care, and Others), and by (Hospitals, Clinics, Home Healthcare, and Others) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

Urometer market is anticipated to grow at a significant CAGR of 6.9% during the forecast period. The increasing prevalence of urological disorders, such as urinary retention, benign prostatic, cystitis, hyperplasia, kidney diseases, and others is boosting the demand for urometer across the globe. According to the National Kidney Foundation report, around 10% of the population across the globe is affected by chronic kidney disease (CKD) such as kidney stones, due to which millions die each year because they do not have access to affordable treatment. Kidney stones can block urine flow and cause a considerable amount of pain. Many people end up expelling small stones from the body without medical help, but larger stones may result in blockage, which creates the problem. over 2 million people across the globe currently receiving treatment with dialysis or a kidney transplant to stay alive, yet this number may only represent 10% of people who need treatment to live. It is anticipated that the number of cases of kidney failure will increase extremely in developing countries, such as China and India, where the number of elderly people is increasing, and these diseases lead to bladder dysfunction also. In these diseases, urometers play a major role in collecting urine, especially in patients with restricted mobility and bedbound patients who are unable to move. Hence, the increasing number of diseases like kidney stones is propelling the urometer market during the forecast period.

Segmental Outlook

The global urometer market is segmented based on product, application, and end-user. Based on the product, the market is segmented into 200ml, 400ml, 450 ml, and 500 ml. Based on application, the market is sub-segmented into operative procedures, emergency trauma, palliative care, and others. based on end-user the market is segmented into hospitals, clinics, home healthcare, and others. The above-mentioned segments can be customized as per the requirements.

Among the product, the 500 ml product segment is anticipated to grow at a significant rate during the forecast period due to the rising incidence of urinary bladder cancer with associated urological disorders. Additionally, the rising number of urology and gynecology surgeries, removal of kidney stones, with further long surgical procedures which leads to demand for 500 ml urometers. According to the World Bladder Cancer Patient Coalition and International Agency for Research on Cancer data, around 573,278 people were diagnosed with bladder cancer in 2020 across the globe, placing bladder cancer as the 10th most commonly diagnosed cancer in the world. Hence, these increasing cases are propelling the demand for a 500 ml urometer, as it is used for bedridden patients for urination who cannot move and are advised to stay in bed due to serious diseases or treatment.

Regional Outlooks

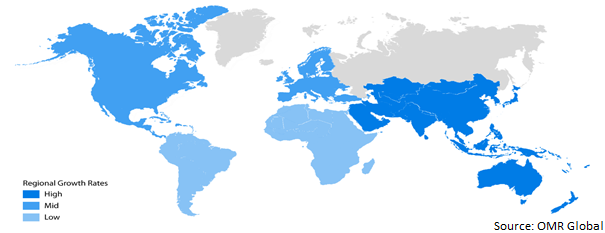

The global urometer market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. North America is anticipated to grow at the fastest rate during the forecast period owing to the increasing home healthcare demand coupled with the rising budget for government healthcare.

Global Urometer Market Growth, by Region 2022-2028

The Asia-Pacific Region is Expected to Hold the Considerable Share in the Global Urometer Market

The Asia-Pacific region is anticipated to hold a considerable share in the global urometer market during the forecast period. The rising patient pool in countries, such as China and India, is the major factor driving the market growth. The Asia-Pacific region is also home to the largest elderly population, who are more prone to diseases such as urological diseases which will further boost the product demand. According to the US Census Bureau data, in 2020, the population of the region exceeded 4.5 billion, which is more than one-half of the global population. Further, there were an estimated 414 million Asian people, aged 65 and above. It is also projected that there will be more than 1.2 billion Asian people with age 65 and above by 2060. Such factors will significantly boost the demand for urometer in the forecast period.

Market Players Outlook

The major companies serving the global urometer market include Becton Dickinson and Co., Cardinal Health, Inc., Convatec Inc., Forlong Medical Co., Ltd., Teleflex, Inc., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in December 2021, Becton Dickinson Co. acquired Venclose, Inc. to extend treatment innovations in chronic venous insufficiency (CVI). CVI is a disease that is the result of malfunctioning valves and can lead to varicose veins. The acquisition will allow BD Co. to offer a more robust portfolio of solutions to physicians who are treating the full range of venous conditions.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global urometer market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Urometer Market by Product

4.1.1. 200ml

4.1.2. 400ml

4.1.3. 450ml

4.1.4. 500ml

4.2. Global Urometer Market by Application

4.2.1. Operative Procedures

4.2.2. Emergency Trauma

4.2.3. Palliative Care

4.2.4. Others

4.3. Global Urometer Market by End-User

4.3.1. Hospitals

4.3.2. Clinics

4.3.3. Home Healthcare

4.3.4. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Becton, Dickinson and Co.

6.2. Cardinal Health, Inc.

6.3. Convatec Inc.

6.4. Fannin Ltd.

6.5. Forlong Medical Co.,Ltd.

6.6. Hitec Medical Co., Ltd.

6.7. Laborie

6.8. Medical Measurement Systems BV

6.9. Medline Industries, Inc.

6.10. Observe Medical ASA (Cant find Co.)

6.11. Teleflex, Inc.

1. GLOBAL UROMETER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

2. GLOBAL UROMETER OF 200ML MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL UROMETER OF 400ML MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL UROMETER OF 450ML MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL UROMETER OF 600ML MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL UROMETER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

7. GLOBAL UROMETER IN OPERATIVE PROCEDURES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL UROMETER IN EMERGENCY TRAUMA MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL UROMETER IN PALLIATIVE CARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL UROMETER IN OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL UROMETER MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

12. GLOBAL UROMETER FOR HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL UROMETER FOR CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL UROMETER FOR HOME HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. GLOBAL UROMETER FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

16. GLOBAL UROMETER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

17. NORTH AMERICAN UROMETER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

18. NORTH AMERICAN UROMETER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

19. NORTH AMERICAN UROMETER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

20. NORTH AMERICAN UROMETER MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

21. EUROPEAN UROMETER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

22. EUROPEAN UROMETER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

23. EUROPEAN UROMETER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

24. EUROPEAN UROMETER MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

25. ASIA-PACIFIC UROMETER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

26. ASIA-PACIFIC UROMETER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

27. ASIA-PACIFIC UROMETER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

28. ASIA-PACIFIC UROMETER MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

29. REST OF THE WORLD UROMETER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

30. REST OF THE WORLD UROMETER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

31. REST OF THE WORLD UROMETER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

32. REST OF THE WORLD UROMETER MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

1. GLOBAL UROMETER MARKET SHARE BY PRODUCT, 2021 VS 2028 (%)

2. GLOBAL UROMETER OF 200ML MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL UROMETER OF 400ML MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL UROMETER OF 450ML MARKET SHARE BY REGION, 2021 VS 2028 (%)

5. GLOBAL UROMETER OF 500ML MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL UROMETER MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

7. GLOBAL UROMETER IN OPERATIVE PROCEDURES MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL UROMETER IN EMERGENCY TRAUMA MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL UROMETER IN PALLIATIVE CARE MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL UROMETER IN OTHERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. GLOBAL UROMETER MARKET SHARE BY END-USER, 2021 VS 2028 (%)

12. GLOBAL UROMETER FOR HOSPITALS MARKET SHARE BY REGION, 2021 VS 2028 (%)

13. GLOBAL UROMETER FOR CLINICS MARKET SHARE BY REGION, 2021 VS 2028 (%)

14. GLOBAL UROMETER FOR HOME HEALTHCARE MARKET SHARE BY REGION, 2021 VS 2028 (%)

15. GLOBAL UROMETER FOR OTHERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

16. GLOBAL UROMETER MARKET SHARE BY REGION, 2021 VS 2028 (%)

17. US UROMETER MARKET SIZE, 2021-2028 ($ MILLION)

18. CANADA UROMETER MARKET SIZE, 2021-2028 ($ MILLION)

19. UK UROMETER MARKET SIZE, 2021-2028 ($ MILLION)

20. FRANCE UROMETER MARKET SIZE, 2021-2028 ($ MILLION)

21. GERMANY UROMETER MARKET SIZE, 2021-2028 ($ MILLION)

22. ITALY UROMETER MARKET SIZE, 2021-2028 ($ MILLION)

23. SPAIN UROMETER MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF EUROPE UROMETER MARKET SIZE, 2021-2028 ($ MILLION)

25. INDIA UROMETER MARKET SIZE, 2021-2028 ($ MILLION)

26. CHINA UROMETER MARKET SIZE, 2021-2028 ($ MILLION)

27. JAPAN UROMETER MARKET SIZE, 2021-2028 ($ MILLION)

28. SOUTH KOREA UROMETER MARKET SIZE, 2021-2028 ($ MILLION)

29. REST OF ASIA-PACIFIC UROMETER MARKET SIZE, 2021-2028 ($ MILLION)

30. REST OF THE WORLD UROMETER MARKET SIZE, 2021-2028 ($ MILLION)