US Pharmaceutical Contract Manufacturing Market

US Pharmaceutical Contract Manufacturing Market Research By Category (Human Based Drugs and Animals Based Drugs), By Product (Over-The-Counter (OTC) Drugs, Active Pharmaceutical Ingredients (API), Finished Dosage Formulation and Other), and By Services (Manufacturing Services, Non-Clinical Services and Research and Development) Forecast Period 2021-2027 Update Available - Forecast 2025-2035

The US pharmaceutical contract manufacturing is growing at a considerable CAGR of 4.8% during the forecast period. Rising demand for innovative drug and medical devices is one of the prime factors affecting and driving the market. Increasing drug discovery and outsourcing of manufacturing along with patent cliffs are also estimated to be the prime factors that are contributing significantly towards the growth of the market. However, rising costs related with logistics along with strict rules and regulations by government are some of the major factors constraints that are hindering the growth of the US pharmaceutical contract manufacturing.

Moreover, offering effective services at low cost is one of the key factors that are creating opportunity for the market. New product launches in the market are likely to drive the growth of the global wheelchair market. For instance, in December 2019, Thermo Fisher Scientific Inc. which is considered as one of the serving science companies had extended its contract development and manufacturing organization (CDMO) in Lexington, Mass. The company invested around $90 million with 50,000 square foot facility that will offer and support development, testing and manufacturing of viral vectors. Additionally, through this investment the company will add around 200 jobs along with offering a range of services through increasing speed for commercialization of new therapies.

Impact of COVID-19 on the US Pharmaceutical Contract Manufacturing

The US pharmaceutical contract manufacturing market is hardly hit by the COVID-19 pandemic since December 2019. The COVID-19 pandemic had disrupted the activities related with transportation along with supply chain. The manufacturing operations were also being halted due to implementation of the lock-down. Manufactures in the US those who produced active pharmaceutical ingredients (API) have been affected the most. Moreover, with the unlock process the operation are likely to increase the output of the market for its customer.

Segmental Outlook

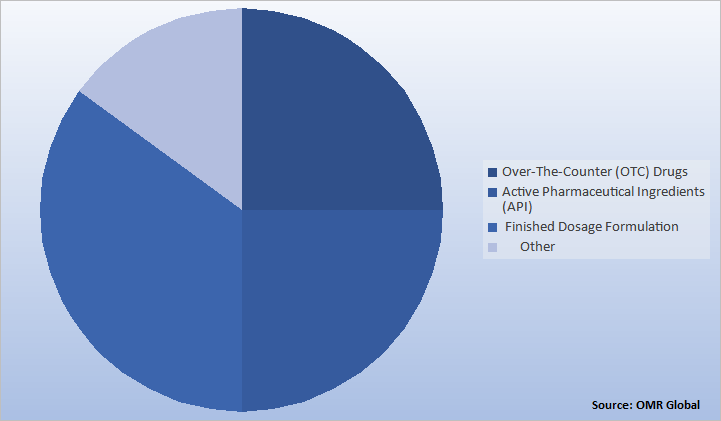

The market is segmented based on category, product and services. Based on category, the market is segmented into human based drugs and animals based drugs. By product, the market is segmented into over-the-counter (OTC) drugs, active pharmaceutical ingredients (API), finished dosage formulation and other. Further, by services, market is segmented into manufacturing services, non-clinical services and research and development

US Pharmaceutical Contract Manufacturing Share by Product 2020 (%)

Based on the Product, Finished dosage formulations holds significant share in the market. Finished dosage formulations are primarily driven by demand with regards to its broad ranges that are included in the development and manufacturing of drugs. The solid dose offered is considered to be convenient, flexible and cost-effective form of dosage along with its manufacturing could be done in large number in less time. One of manufacturers of the vitamin and nutritional supplements that is Paragon Laboratories which offers its products in the form of capsules, powders, and tablets as dietary supplements. Moreover, Liquid dose are also offered for external and internal applications. Therefore, the high demand of finished dosage formulations product in solid dose and liquid dose are to drive the growth of US pharmaceutical contract manufacturing in this segment.

Market Player Outlook

Key players of the US pharmaceutical contract manufacturing are AbbVie Inc., Cardinal Health., Catalent, Inc., Pfizer Inc., and Thermo Fisher Scientific Inc., among others. To survive in the market, these players adopt different marketing strategies such as product launches. For instance, In May 2019, Catalent, Inc. had set forth the acquisition of paragon bio services Inc. The acquired company is considered as manufacturing partner for gene therapy. The acquisition was done in around for $1.2 billion and through this the company makes its strong position in market for therapies related to gene.

In March 2019, Ajinomoto Bio-Pharma provided an update on several of its capital projects currently underway in both the United States and Belgium. These projects total over $100 Million and will further expand Aji Bio-Pharma’s offerings and capabilities across the globe.

In October 2018, Ajinomoto althea and omini chem both are the company dealing in large and small molecule contract manufacturing services had integrated their business for contract manufacturing and changed its name to Ajinomoto Bio-Pharma Services.

The Report Covers

• Market value data analysis of 2020 and forecast to 2027.

• Annualized market revenues ($ million) for each market segment.

• Country-wise analysis of major geographical regions.

• Key companies operating in the US pharmaceutical contract manufacturing. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

• Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

• Analysis of market-entry and market expansion strategies.

• Competitive strategies by identifying ‘who-stands-where in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the US Pharmaceutical Contract Manufacturing Industry

• Recovery Scenario of US Pharmaceutical Contract Manufacturing Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. US Pharmaceutical Contract Manufacturing Market by Category

5.1.1. Human Based Drugs

5.1.2. Animals Based Drugs

5.2. US Pharmaceutical Contract Manufacturing Market by Product

5.2.1. Over-The-Counter (OTC) Drugs

5.2.2. Active Pharmaceutical Ingredients (API)

5.2.3. Finished Dosage Formulation

5.2.4. Other

5.3. The US Pharmaceutical Contract Manufacturing by Services

5.3.1. Manufacturing Services

5.3.2. Non-Clinical Services

5.3.3. Research and Development

6. Company Profiles

6.1. AbbVie Inc.

6.2. Ajinomoto Bio-Pharma

6.3. Catalent, Inc

6.4. Cardinal Health.

6.5. Denison Pharmaceuticals

6.6. Dravon Medical Inc.

6.7. East West Manufacturing

6.8. HISUN USA, inc.

6.9. HTI Plastics

6.10. Hikma Pharmaceuticals PLC

6.11. Lonza Capsules & Health Ingredients

6.12. McGuff Pharmaceuticals, Inc.

6.13. Medix Biochemica

6.14. NEEDLETECH, Corp.

6.15. Nextphase Medical Devices, LLC.

6.16. Nutra Solutions USA

6.17. Nutrafill, LLC

6.18. Pfizer Inc.

6.19. Phoenix Deventures Inc.

6.20. SMC Ltd.

6.21. Stason Pharmaceuticals

6.22. Superior Supplement Manufacturing

6.23. Thermo Fisher Scientific Inc.

6.24. West Pharmaceutical Services, Inc.

6.25. Zoetis

1. US PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, 2020-2027 ($ MILLION)

2. US PHARMACEUTICAL CONTRACT MANUFACTURING BY CATEGORY, 2020-2027 ($ MILLION)

3. US HUMAN BASED DRUGS CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

4. US ANIMALS BASED DRUGS CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

5. US PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

6. US OTC DRUGS CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

7. US API CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

8. US FINISHED DOSAGE FORMULATION CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

9. US OTHER PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

10. US PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY SERVICES, 2020-2027 ($ MILLION)

11. US MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

12. US NON-CLINICAL SERVICES MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

13. US RESEARCH AND DEVELOPMENT MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON US PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON US PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SHARE BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF US PHARMACEUTICAL CONTRACT MANUFACTURING MARKET 2021-2027 (%)

4. US PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SHARE BY CATEGORY, 2020 VS 2027 (%)

5. US PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SHARE BY PRODUCT, 2020 VS 2027 (%)

6. US PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SHARE BY SERVICES, 2020 VS 2027 (%)