Usage-based Insurance Market

Usage-based Insurance Market Size, Share & Trends Analysis Report, By Type (Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), Manage-How-You-Drive (MHYD), and Others), By Technology (OBD II, Black Box, Smartphones, and Others), By Vehicle Type (Light-duty Vehicle (LDV), and Heavy-duty Vehicle (HDV)), and By Vehicle Age (New Vehicles, and Used Vehicles), Forecast (2022-2028). Update Available - Forecast 2025-2035

Usage-based insurance market is anticipated to grow at a significant CAGR of nearly 27.9% during the forecast period. The major factors that drive the growth of the UBI market include the growing automobile industry across the globe, along with the increasing technological advancements in both developing & developed countries. For instance, In July 2018, the Canadian Automobile Association (CAA) introduced a new auto insurance program, CAA MyPace for infrequent drivers, letting drivers pay for every 1,000 km they drive. The new program enabled to reform of insurance in Ontario by enabling motorists to monitor how much they drive and pay for insurance based on that mileage.

Another factor includes the shifting of consumer demand toward more efficient smart vehicles that have remote vehicle diagnostic systems. The demand for remote vehicle diagnostic systems is increasing due to data-driven technology. The remote diagnostic technology brings a safety mechanism that will allow the vehicle to be monitored, and controlled using a remote operator. For instance, In June 2019, UnipolSai launched Real-Time adjustment, which is a process that allows the insured to receive a proposal from the adjuster within 24 hours of the claim, on the condition that there were no casualties. The process enabled ease of the use of the black box.

However, different requirements for automotive insurance in different regions create operational roadblocks for cross-state fleets. Hence, hamper the market growth. For instance, Illinois requires carriers to advertise their underwriting models, while California limits parameters for product pricing. Inconsistent requirements force insurance companies to provide innovative products and services that comply with regional regulations. Thus, the companies have to expand their overall product portfolio. In automotive usage-based insurance, the regulatory framework favors lower premiums for good driving behavior. Thus, uncertainty over regulations and legislative environments can restrict the growth of the usage-based insurance market for automotive.

Segmental Outlook

The global usage-based insurance market is segmented based on type, technology, vehicle type, and vehicle age. Based on the type, the market is segmented into pay-as-you-drive (PAYD), pay-how-you-drive (PHYD), manage-how-you-drive (MHYD), and other UBI types. Based on the technology, the market is sub-segmented into the OBD II, black box, smartphones, and others. Based on the vehicle type, the market is sub-segmented into light-duty vehicles (LDV), and heavy-duty vehicles (HDV). Based on the vehicle age, the market is sub-segmented into new vehicles, and used vehicles. Among the type segment, the manage-how-you-drive segment is expected to grow at a considerable market share during the forecast period due to the increasing technological advancement along with the rise in awareness among the youth.

Based on the technology, the black box holds a prominent share during the forecast period. The black box is one of the traditional forms of UBI technology which is generally preferred by vehicle owners. The increasing use of telematics insurance in UBI for heavy-duty vehicles increases the demand for the black box. At this time, the penetration is highest in Europe, particularly in Italy. The black box is very accurate, and it captures a wide array of data. However, black box devices are expensive and need to be installed by a specialist, thereby increasing the overall initial cost of the service. Also, the UBI market is witnessing a shift from a black box to an embedded system. Smartphone, OBD-II UBI technologies. Hence, the segment may affect its market share in the future but will remain the widely adopted UBI technology.

Regional Outlook

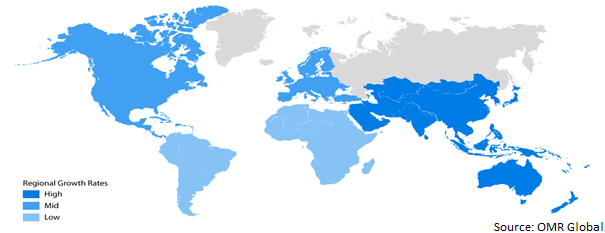

The global Usage-based Insurance market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Germany, Italy, Spain, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The Asia-pacific region is expected to hold a considerable market share during the forecast period owing to growing consumer awareness. Further, the market players are targeting developing countries of Asia-Pacific which is further supporting the growth of the usage-based insurance market.

Global Usage-based Insurance Market Growth by Region, 2022-2028

North American Region Holds the Prominent Share in the Global Usage-based Insurance Market.

The North American region dominates the usage-based Insurance market. The market in North America is expected to grow due to the increasing adoption of mobility as a service and increasing collaborations between telematics and insurance companies. The presence of leading UBI companies such as Progressive Casualty Insurance Company, Allstate Insurance Company, State Farm Automobile Mutual Insurance Company, and Liberty Mutual Insurance Company is also expected to drive the market.

The insurance companies offering telematics insurance are constantly leveraging various factors to enhance solutions and deliver better packages and schemes. For instance, in January 2021, Webfleet Solutions announced that Mercedes-Benz connectivity services have joined its OEM. Connect partner program. The Mercedes-Benz passenger cars and vans with line-fitted connectivity are ready to connect with Webfleet Solutions’ service platform WEBFLEET. Eliminating the need for after-market hardware installations, the integrated solution makes it faster, easier and cheaper for fleet managers to utilize telematics technology.

Market Players Outlook

The major companies serving the global usage-based insurance market UnipolSai Assicurazioni S.p.A., TomTom International BV, Progressive Corp., Mapfre, S.A., and Liberty Mutual Insurance Company. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, partnerships and collaborations, and geographical expansion, to stay competitive in the market. For instance, in May 2020, Edelweiss General Insurance (EGI) a cloud-native insurer, launched an innovative app-based Motor OD floater policy Edelweiss SWITCH. The new UBI solution launched under IRDAI's Regulatory Sandbox will allow vehicle owners to SWITCH their motor insurance on and off based on usage. This launch helped the company to strengthen its portfolio and acquire a competitive position in the market.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Usage-based Insurance market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Liberty Mutual Insurance Co.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. MAPFRE S.A.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Progressive Casualty Insurance Co.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. TomTom International BV

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. UNIPOLSAI ASSICURAZIONI S.P.A

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Usage-based Insurance (UBI)Market by Type

4.1.1. Pay-As-You-Drive (PAYD)

4.1.2. Pay-How-You-Drive (PHYD)

4.1.3. Manage-How-You-Drive (MHYD)

4.1.4. Others

4.2. Global Usage-based Insurance (UBI) Market by Technology

4.2.1. OBD II

4.2.2. Black Box

4.2.3. Smartphones

4.2.4. Others

4.3. Global Usage-based Insurance (UBI) Market by Vehicle Type

4.3.1. Light-duty Vehicle (LDV)

4.3.2. Heavy-duty Vehicle (HDV)

4.4. Global Usage-based Insurance (UBI) Market by Vehicle Age

4.4.1. New Vehicles

4.4.2. Used Vehicles

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Aioi Nissay Dowa Insurance UK Ltd.

6.2. Allianz SE

6.3. Allstate Insurance Co.

6.4. American International Group Inc.

6.5. Assicurazioni Generali S.p.A.

6.6. AVIVA Plc

6.7. AXA

6.8. Cambridge Mobile Telematics

6.9. Danlaw, Inc.

6.10. Desjardins Group

6.11. Insure The Box Ltd.

6.12. Intelligent Mechatronic Systems Inc.

6.13. Metromile Inc.

6.14. Nationwide Mutual Insurance Co.

6.15. Octo Technology

6.16. Progressive Casualty Insurance Co.

6.17. Sierra Wireless

6.18. State Farm Automobile Mutual Insurance Co.

6.19. UnipolSai Assicurazioni S.p.A.

6.20. Verizon Communication Inc.

6.21. Vodafone Automotive SpA

6.22. Zubie, Inc.

1. GLOBAL USAGE-BASED INSURANCE (UBI) MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL USAGE-BASED INSURANCE (UBI) FOR PAY-AS-YOU-DRIVE (PAYD) MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL USAGE-BASED INSURANCE (UBI) FOR PAY-HOW-YOU-DRIVE (PHYD) MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL USAGE-BASED INSURANCE (UBI) FOR MANAGE-HOW-YOU-DRIVE (MHYD) MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL USAGE-BASED INSURANCE (UBI) FOR OTHER TYPE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL USAGE-BASED INSURANCE (UBI) MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

7. GLOBAL USAGE-BASED INSURANCE (UBI) FOR OBD II MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

8. GLOBAL USAGE-BASED INSURANCE (UBI) FOR BLACK BOX MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

9. GLOBAL USAGE-BASED INSURANCE (UBI) FOR SMARTPHONES MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

10. GLOBAL USAGE-BASED INSURANCE (UBI) FOR OTHER TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

11. GLOBAL USAGE-BASED INSURANCE (UBI) MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

12. GLOBAL USAGE-BASED INSURANCE (UBI) FOR LIGHT-DUTY VEHICLE (LDV) MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

13. GLOBAL USAGE-BASED INSURANCE (UBI) FOR HEAVY-DUTY VEHICLE (HDV) MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

14. GLOBAL USAGE-BASED INSURANCE (UBI) MARKET RESEARCH AND ANALYSIS BY VEHICLE AGE, 2021-2028 ($ MILLION)

15. GLOBAL USAGE-BASED INSURANCE (UBI) FOR NEW VEHICLES MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

16. GLOBAL USAGE-BASED INSURANCE (UBI) FOR USED VEHICLES MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

17. GLOBAL USAGE-BASED INSURANCE (UBI) MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

18. NORTH AMERICAN USAGE-BASED INSURANCE (UBI) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. NORTH AMERICAN USAGE-BASED INSURANCE (UBI) MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

20. NORTH AMERICAN USAGE-BASED INSURANCE (UBI) MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

21. NORTH AMERICAN USAGE-BASED INSURANCE (UBI) MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

22. NORTH AMERICAN USAGE-BASED INSURANCE (UBI) MARKET RESEARCH AND ANALYSIS BY VEHICLE AGE, 2021-2028 ($ MILLION)

23. EUROPEAN USAGE-BASED INSURANCE (UBI) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

24. EUROPEAN USAGE-BASED INSURANCE (UBI) MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

25. EUROPEAN USAGE-BASED INSURANCE (UBI) MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

26. EUROPEAN USAGE-BASED INSURANCE (UBI) MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

27. EUROPEAN USAGE-BASED INSURANCE (UBI) MARKET RESEARCH AND ANALYSIS BY VEHICLE AGE, 2021-2028 ($ MILLION)

28. ASIA-PACIFIC USAGE-BASED INSURANCE (UBI) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

29. ASIA-PACIFIC USAGE-BASED INSURANCE (UBI) MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

30. ASIA-PACIFIC USAGE-BASED INSURANCE (UBI) MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

31. ASIA-PACIFIC USAGE-BASED INSURANCE (UBI) MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

32. ASIA-PACIFIC USAGE-BASED INSURANCE (UBI) MARKET RESEARCH AND ANALYSIS BY VEHICLE AGE, 2021-2028 ($ MILLION)

33. REST OF THE WORLD USAGE-BASED INSURANCE (UBI) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

34. REST OF THE WORLD USAGE-BASED INSURANCE (UBI) MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

35. REST OF THE WORLD USAGE-BASED INSURANCE (UBI) MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

36. REST OF THE WORLD USAGE-BASED INSURANCE (UBI) MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

37. REST OF THE WORLD USAGE-BASED INSURANCE (UBI) MARKET RESEARCH AND ANALYSIS BY VEHICLE AGE, 2021-2028 ($ MILLION)

1. GLOBAL USAGE-BASED INSURANCE (UBI) MARKET SHARE BY TYPE, 2021 VS 2028 (%)

2. GLOBAL USAGE-BASED INSURANCE (UBI) FOR PAY-AS-YOU-DRIVE (PAYD) MARKET REGION BY REGION, 2021 VS 2028 (%)

3. GLOBAL USAGE-BASED INSURANCE (UBI) FOR PAY-HOW-YOU-DRIVE (PHYD) MARKET REGION BY REGION, 2021 VS 2028 (%)

4. GLOBAL USAGE-BASED INSURANCE (UBI) FOR MANAGE-HOW-YOU-DRIVE (MHYD) MARKET REGION BY REGION, 2021 VS 2028 (%)

5. GLOBAL USAGE-BASED INSURANCE (UBI) FOR OTHER TYPE MARKET REGION BY REGION, 2021 VS 2028 (%)

6. GLOBAL USAGE-BASED INSURANCE (UBI) MARKET SHARE BY TECHNOLOGY, 2021 VS 2028 (%)

7. GLOBAL USAGE-BASED INSURANCE (UBI) FOR OBD II MARKET REGION BY REGION, 2021 VS 2028 (%)

8. GLOBAL USAGE-BASED INSURANCE (UBI) FOR BLACK BOX MARKET REGION BY REGION, 2021 VS 2028 (%)

9. GLOBAL USAGE-BASED INSURANCE (UBI) FOR SMARTPHONES MARKET REGION BY REGION, 2021 VS 2028 (%)

10. GLOBAL USAGE-BASED INSURANCE (UBI) FOR OTHERS MARKET REGION BY REGION, 2021 VS 2028 (%)

11. GLOBAL USAGE-BASED INSURANCE (UBI) MARKET SHARE BY VEHICLE TYPE, 2021 VS 2028 (%)

12. GLOBAL USAGE-BASED INSURANCE (UBI) FOR LIGHT-DUTY VEHICLE (LDV) MARKET REGION BY REGION, 2021 VS 2028 (%)

13. GLOBAL USAGE-BASED INSURANCE (UBI) FOR HEAVY-DUTY VEHICLE (HDV) MARKET REGION BY REGION, 2021 VS 2028 (%)

14. GLOBAL USAGE-BASED INSURANCE (UBI) MARKET SHARE BY VEHICLE AGE, 2021 VS 2028 (%)

15. GLOBAL USAGE-BASED INSURANCE (UBI) FOR NEW VEHICLES MARKET REGION BY REGION, 2021 VS 2028 (%)

16. GLOBAL USAGE-BASED INSURANCE (UBI) FOR USED VEHICLES MARKET REGION BY REGION, 2021 VS 2028 (%)

17. GLOBAL USAGE-BASED INSURANCE (UBI) MARKET SHARE BY REGION, 2021 VS 2028 (%)

18. US USAGE-BASED INSURANCE (UBI) MARKET SIZE, 2021-2028 ($ MILLION)

19. CANADA USAGE-BASED INSURANCE (UBI) MARKET SIZE, 2021-2028 ($ MILLION)

20. UK USAGE-BASED INSURANCE (UBI) MARKET SIZE, 2021-2028 ($ MILLION)

21. FRANCE USAGE-BASED INSURANCE (UBI) MARKET SIZE, 2021-2028 ($ MILLION)

22. GERMANY USAGE-BASED INSURANCE (UBI) MARKET SIZE, 2021-2028 ($ MILLION)

23. ITALY USAGE-BASED INSURANCE (UBI) MARKET SIZE, 2021-2028 ($ MILLION)

24. SPAIN USAGE-BASED INSURANCE (UBI) MARKET SIZE, 2021-2028 ($ MILLION)

25. REST OF EUROPE USAGE-BASED INSURANCE (UBI) MARKET SIZE, 2021-2028 ($ MILLION)

26. INDIA USAGE-BASED INSURANCE (UBI) MARKET SIZE, 2021-2028 ($ MILLION)

27. CHINA USAGE-BASED INSURANCE (UBI) MARKET SIZE, 2021-2028 ($ MILLION)

28. JAPAN USAGE-BASED INSURANCE (UBI) MARKET SIZE, 2021-2028 ($ MILLION)

29. SOUTH KOREA USAGE-BASED INSURANCE (UBI) MARKET SIZE, 2021-2028 ($ MILLION)

30. REST OF ASIA-PACIFIC USAGE-BASED INSURANCE (UBI) MARKET SIZE, 2021-2028 ($ MILLION)

31. REST OF THE WORLD USAGE-BASED INSURANCE (UBI) MARKET SIZE, 2021-2028 ($ MILLION)