Usage Based Insurance (Ubi) Market

Usage Based Insurance (Ubi) Market Size, Share & Trends Analysis Report By Type (Pay-As-You-Drive (Payd), Pay-How-You-Drive (Phyd), And Manage-How-You-Drive (Mhyd)), By Technology (Obd-Ii-Based Ubi Programs, Smartphone-Based Ubi Programs, Hybrid-Based Ubi Programs, And Black-Box-Based Ubi Programs), By Vehicle Age (On Road Vehicles And Used Vehicles), And By Vehicle Type (Light-Duty Vehicle (Ldv) And Heavy-Duty Vehicle (Hdv) Forecast Period (2023-2030) Update Available - Forecast 2025-2035

Usage based insurance market is anticipated to grow at a CAGR of 26.5% during the forecast period. The primary factor boosting the market growth includes the increasing number of insurance claims across the globe. UBI is a type of insurance that allows insurers to more accurately assess risk and set premiums based on how a policyholder uses their vehicle or other insured property. UBI typically involves the use of telematics devices, such as sensors or GPS systems that collect data on driving behavior, including things like speed, distance traveled, and frequency of hard braking. The adoption of UBI has been growing in recent years, particularly in the auto insurance market. This is due in part to advances in telematics technology, which have made it easier and more cost-effective for insurers to collect and analyze data on driving behavior. Additionally, consumers are increasingly comfortable with the idea of sharing data in exchange for more personalized and flexible insurance options. There are several potential benefits of UBI for both insurers and policyholders. For insurers, UBI can lead to more accurate pricing, reduced fraud, and improved loss ratios. For policyholders, UBI can offer lower premiums for safer drivers, as well as more flexible coverage options that allow them to pay for insurance only when they are using their vehicle. As a result, many businesses can save money while still employing industry experts at key points in their operations. For Instance, In June 2020 TATA AIG, launched an AutoSafe gadget based on telematics technology. AutoSafe will be included in all insurance and will give $0.02 million in personal accidental coverage for both the owner and the driver. The Auto Safe gadget is GPS-enabled and connected to a mobile app that saves all data, tracks distance travelled, and generates reports about the policyholder’s automobile and driving habits.

Segmental Outlook

The global usage based insurance market is segmented based on the type, technology, by vehicle age and vehicle type. Based on the type, the market is segmented into pay-as-you-drive (PAYD), pay-how-you-drive (PHYD), and manage-how-you-drive (MHYD). Based on the technology, the market is sub-segmented into OBD-II-based UBI programs, Smartphone-based UBI programs, hybrid-based UBI programs, and black-box-based UBI programs. Further, based on vehicle age, the market is segmented into on road vehicles and used vehicles. Based on vehicle type, the market is segmented into LDV and HDV. Among the technology, the black-box-based UBI programs sub-segment is anticipated to hold a considerable share of the market. The rising demand of telematics technology in UBI for heavy duty vehicles will increase the demand for the black-box-based UBI. Several market players are coming up with innovative solutions to cater to the increased demand for the insurance. In June 2019, UnipolSai launched real time adjustment, a process that allows the insured to receive a proposal from the adjuster within 24 hours of the claim, on the condition that there were no causalities. The process helps ease the use of the black box.

The Pay-As-You-Drive (PAYD), Sub-Segment is Anticipated to Hold Prominent Share in the Global Usage Based Insurance Market

The PAYD sub segment is expected to hold a prominent share in the global usage-based insurance (UBI) market. PAYD is a type of UBI that calculates premiums based on the distance driven by a vehicle. It is a fairer and more accurate way of pricing car insurance than traditional methods, which are typically based on factors such as age, gender, and location. The PAYD sub-segment is expected to grow in popularity as more people become aware of the benefits of UBI and as technology improves. Thus, the companies are also focusing on launching such types of insurance across the globe to cater larger consumer base. For instance, in January 2023, New India Assurance (NIA) launched the PAYD policy, with features such as discounts on renewals, coverage beyond distance limits, and enhanced protections such as nil depreciation, roadside help, and return to invoice, among others. Furthermore, several insurance companies are already offering PAYD policies, and it is expected that more will follow suit in the coming years. There are several companies, such as Insurethebox, Liberty Mutual Insurance, Mapfre S.A., Nationwide Mutual Insurance Company, and Progressive Corporation that provide PAYD policies.

Regional Outlook

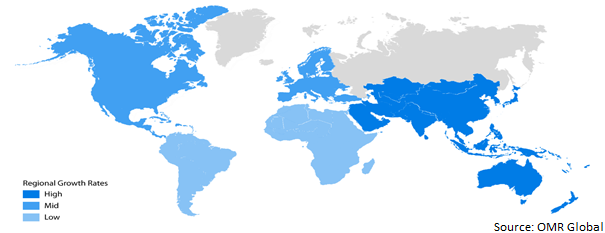

The global usage based insurance market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). Among these, the Asia-Pacific regional market is expected to grow over the forecast period, owing to consumer awareness and major player of the market entering in the developing countries of Asia-Pacific.

Global Usage Based Insurance Market Growth, by Region 2023-2030

The North America Region is Expected to Hold Prominent Share in the Global Usage Based Insurance Market

Among all regions, the North America usage-based insurance market is expected to hold prominent share in the forecast period. The rising acceptance of connected automobile services and growing number of on road vehicles is the key factor propelling the growth of the North America usage-based insurance market. Further, the rise in the installation cost of telematics and the reluctance of insurers to accept this solution is further projected to impede the growth of the North America usage-based insurance market in the timeline period. In addition, developments in the technologies will further provide potential opportunities for the growth of the North America usage-based insurance market in the coming years. In November 2020, Insurance & Mobility Solutions entered a partnership with Nationwide as the technology provider for the SmartMiles pay-per-mile insurance program. As one of the world’s top three providers of connected car data solutions to insurers, mobility operators, and governments, IMS helps power two of Nationwide’s usage-based insurance programs, which also include Nationwide’s SmartRide discount program that launched in 2011.

Market Players Outlook

The major companies serving the global usage based insurance market include Unipolsai Assicurazioni S.P.A, Allstate Corporation, Allianz SE, Nationwide Mutual Insurance Company, Mapfre S.A. and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, In January 2021, the Allstate Corp. announced that it closed its $4 billion acquisition of National General Holdings Corp. The acquisition of National General advances the strategy of growing personal lines insurance with an increase of 1 percentage point in market share. Independent agents will now have more protection offerings for customers, with a strong technology platform creating growth opportunities for them and Allstate. National General’s accident and health business will also further expand Allstate’s circle of protection.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global usage based insurance (UBI) market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis (AXA Group, Aviva plc, Allianz SE)

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Usage Based Insurance (UBI) Market by Type

4.1.1. Pay-As-You-Drive (PAYD)

4.1.2. Pay-How-You-Drive (PHYD)

4.1.3. Manage-How-You-Drive (MHYD)

4.2. Global Usage Based Insurance (UBI) Market by Technology

4.2.1. OBD-II-based UBI programs

4.2.2. Smartphone-based UBI programs

4.2.3. Hybrid-based UBI programs

4.2.4. Black-box-based UBI programs

4.3. Global Usage Based Insurance (UBI) Market by Vehicle Age

4.3.1. On Road Vehicles

4.3.2. Used Vehicles

4.4. Global Usage Based Insurance (UBI) Market By Vehicle Type

4.4.1. Light-Duty Vehicle (LDV)

4.4.2. Heavy-Duty Vehicle (HDV)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Agero Inc

6.2. Insurance Management Servicrs Co. LLC

6.3. Insurethebox

6.4. Liberty Mutual Insurance Group

6.5. Masternaut Ltd

6.6. Meta System S.p.A.

6.7. MiX Telematics International (Pty) Ltd

6.8. Nationwide Mutual Insurance Company

6.9. Octo Group

6.10. Progressive Corporation

6.11. Sierra Wireless

6.12. TomTom International BV.

6.13. Trimble Inc

6.14. Verizon

1. GLOBAL USAGE BASED INSURANCE MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

2. GLOBAL PAY-AS-YOU-DRIVE (PAYD) BASED INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL PAY-HOW-YOU-DRIVE (PHYD) BASED INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL MANAGE-HOW-YOU-DRIVE (MHYD) BASED INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL USAGE BASED INSURANCE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

6. GLOBAL USAGE BASED INSURANCE FOR OBD-II-BASED UBI PROGRAMS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL USAGE BASED INSURANCE FOR SMARTPHONE-BASED UBI PROGRAMS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL USAGE BASED INSURANCE FOR HYBRID-BASED UBI PROGRAMS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL USAGE BASED INSURANCE FOR BLACK-BOX-BASED UBI PROGRAMS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL USAGE BASED INSURANCE MARKET RESEARCH AND ANALYSIS BY VEHICLE AGE, 2022-2030 ($ MILLION)

11. GLOBAL USAGE BASED INSURANCE FOR ON ROAD VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL USAGE BASED INSURANCE FOR USED VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

13. GLOBAL USAGE BASED INSURANCE MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2022-2030 ($ MILLION)

14. GLOBAL USAGE BASED INSURANCE FOR LIGHT-DUTY VEHICLE (LDV) MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

15. GLOBAL USAGE BASED INSURANCE FOR HEAVY-DUTY VEHICLE (HDV) MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

16. GLOBAL USAGE BASED INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

17. NORTH AMERICAN USAGE BASED INSURANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

18. NORTH AMERICAN USAGE BASED INSURANCE MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

19. NORTH AMERICAN USAGE BASED INSURANCE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

20. NORTH AMERICAN USAGE BASED INSURANCE MARKET RESEARCH AND ANALYSIS BY VEHICLE AGE, 2022-2030 ($ MILLION)

21. NORTH AMERICAN USAGE BASED INSURANCE MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2022-2030 ($ MILLION)

22. EUROPEAN USAGE BASED INSURANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

23. EUROPEAN USAGE BASED INSURANCE MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

24. EUROPEAN USAGE BASED INSURANCE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

25. EUROPEAN USAGE BASED INSURANCE MARKET RESEARCH AND ANALYSIS BY VEHICLE AGE, 2022-2030 ($ MILLION)

26. EUROPEAN USAGE BASED INSURANCE MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2022-2030 ($ MILLION)

27. ASIA-PACIFIC USAGE BASED INSURANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

28. ASIA-PACIFIC USAGE BASED INSURANCE MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

29. ASIA-PACIFIC USAGE BASED INSURANCE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

30. ASIA-PACIFIC USAGE BASED INSURANCE MARKET RESEARCH AND ANALYSIS BY VEHICLE AGE, 2022-2030 ($ MILLION)

31. ASIA-PACIFIC USAGE BASED INSURANCE MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2022-2030 ($ MILLION)

32. REST OF THE WORLD USAGE BASED INSURANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

33. REST OF THE WORLD USAGE BASED INSURANCE MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

34. REST OF THE WORLD USAGE BASED INSURANCE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

35. REST OF THE WORLD USAGE BASED INSURANCE MARKET RESEARCH AND ANALYSIS BY VEHICLE AGE, 2022-2030 ($ MILLION)

36. REST OF THE WORLD USAGE BASED INSURANCE MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2022-2030 ($ MILLION)

1. GLOBAL USAGE BASED INSURANCE MARKET SHARE BY TYPE, 2022 VS 2030 (%)

2. GLOBAL PAY-AS-YOU-DRIVE (PAYD) BASED INSURANCE MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL PAY-HOW-YOU-DRIVE (PHYD) BASED INSURANCE MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL MANAGE-HOW-YOU-DRIVE (MHYD) BASED INSURANCE MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL USAGE BASED INSURANCE MARKET SHARE BY TECHNOLOGY, 2022 VS 2030 (%)

6. GLOBAL OBD-II-BASED UBI PROGRAMS BASED INSURANCE MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL SMARTPHONE-BASED UBI PROGRAMS BASED INSURANCE MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL HYBRID-BASED UBI PROGRAMS BASED INSURANCE MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL BLACK-BOX-BASED UBI PROGRAMS BASED INSURANCE MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL USAGE BASED INSURANCE MARKET SHARE BY VEHICLE AGE, 2022 VS 2030 (%)

11. GLOBAL USAGE BASED INSURANCE FOR VEHICLE AGE MARKET SHARE BY REGION, 2022 VS 2030 (%)

12. GLOBAL USAGE BASED INSURANCE FOR USED VEHICLES MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. GLOBAL USAGE BASED INSURANCE MARKET SHARE BY VEHICLE TYPE, 2022 VS 2030 (%)

14. GLOBAL USAGE BASED INSURANCE FOR LIGHT-DUTY VEHICLE (LDV) MARKET SHARE BY REGION, 2022 VS 2030 (%)

15. GLOBAL USAGE BASED INSURANCE FOR HEAVY-DUTY VEHICLE (HDV) MARKET SHARE BY REGION, 2022 VS 2030 (%)

16. GLOBAL USAGE BASED INSURANCE MARKET SHARE BY REGION, 2022 VS 2030 (%)

17. US USAGE BASED INSURANCE MARKET SIZE, 2022-2030 ($ MILLION)

18. CANADA USAGE BASED INSURANCE MARKET SIZE, 2022-2030 ($ MILLION)

19. UK USAGE BASED INSURANCE MARKET SIZE, 2022-2030 ($ MILLION)

20. FRANCE USAGE BASED INSURANCE MARKET SIZE, 2022-2030 ($ MILLION)

21. GERMANY USAGE BASED INSURANCE MARKET SIZE, 2022-2030 ($ MILLION)

22. ITALY USAGE BASED INSURANCE MARKET SIZE, 2022-2030 ($ MILLION)

23. SPAIN USAGE BASED INSURANCE MARKET SIZE, 2022-2030 ($ MILLION)

24. REST OF EUROPE USAGE BASED INSURANCE MARKET SIZE, 2022-2030 ($ MILLION)

25. INDIA USAGE BASED INSURANCE MARKET SIZE, 2022-2030 ($ MILLION)

26. CHINA USAGE BASED INSURANCE MARKET SIZE, 2022-2030 ($ MILLION)

27. JAPAN USAGE BASED INSURANCE MARKET SIZE, 2022-2030 ($ MILLION)

28. SOUTH KOREA USAGE BASED INSURANCE MARKET SIZE, 2022-2030 ($ MILLION)

29. REST OF ASIA-PACIFIC USAGE BASED INSURANCE MARKET SIZE, 2022-2030 ($ MILLION)

30. REST OF THE WORLD USAGE BASED INSURANCE MARKET SIZE, 2022-2030 ($ MILLION)