Used Car Market

Used Car Market Size, Share & Trends Analysis Report by Vehicle Type (Hatchbacks, Sedan, and Sports Utility Vehicle (SUV)), by Vendor (Organized, and Unorganized), and by Fuel Type (Petrol, and Diesel) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

Used car market is anticipated to grow at a significant CAGR of 10.1% during the forecast period. One of the key factors that are fuelling the market is the rising online sales in the market. Online sites and applications in vehicle markets have been playing a crucial role in bringing access to customers with a single touch. A combination of such progress created a significant increase in the demand for used cars. These platforms have connected customers to the owners of the cars where consumers can find the car they want at a wide range of prices which makes it much more affordable than a new car. For instance, in 2019, Ebay Inc. introduced a new application named eBay Motors for enhancing the used car purchase and sale process online.

Segmental Outlook

The global used car market is segmented based on the vehicle type, vendor, and fuel type. Based on the vehicle type, the market is segmented into hatchbacks, sedans, and sports utility vehicles. Based on the vendor, the market is sub-segmented into the organized, and unorganized. Based on the fuel type, the market is sub-segmented into petrol and diesel. The above-mentioned segments can be customized as per the requirements. Based on vendor, the organized vendor segment is anticipated to grow significantly in the market owing to the growing number of franchised dealers while, based on fuel type, the petrol segment is anticipated to grow significantly during the forecast period owing to the decreasing usage of diesel vehicles with the rising governmental norms.

Based on vendor, the organized vendor segment is anticipated to grow significantly in the market during the forecast period owing to the growing number of franchised dealers across the globe. The entrance of new market players with new retail models has also developed as a key factor in growing the number of organized dealers. As per the 2021 annual report of NADA, in the U.S., the share of used vehicles is 8% street purchase, 24.6% by auction purchase, 27.1% by trade-in on a used vehicle, and 39.2% by trade-in on new vehicle sources. Moreover, the organized vendors take advantage of better consumer loyalty to the product across all age groups. In developed countries such as Germany, the U.S., the U.K., and others there are some key dealers such as Asbury Automotive Group and CarMax Business Services, LLC that contains a prominent share in the market.

Regional Outlooks

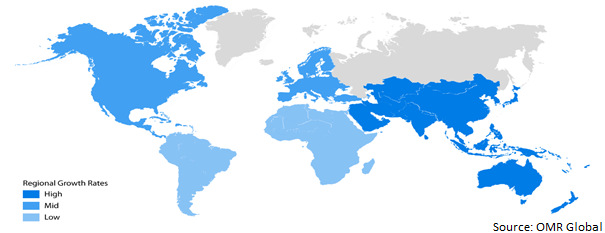

The global used car market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. The Asia-Pacific region is anticipated to grow at the fastest rate in the market while North America is anticipated to grow significantly during the forecast period.

Global Used Car Market Growth, by Region 2022-2028

The Asia-Pacific Region Anticipated to Grow Fastest in the Global Used Car Market

The Asia-Pacific region is anticipated to grow at the fastest rate in the market during the forecast period owing to the presence of China as the largest automobile market across the globe. As per the data of OICA 2021, the country registered a total of 21.4 million units of car production in 2021 which is more than 37% of the total production of cars across the globe. Owing to such a huge number of vehicles produced in a year in a country, the product influx for the used car market is vast in China. Moreover, China is the biggest market for electric vehicles as well which is influencing the owners of internal combustion (IC) engine vehicles for beginning to sell their current vehicles for transition to EVs. As per the 2021 report of IEA, China has more than 47% of the stock of EV cars of the total stock of EV cars across the globe. This has significantly grown the number of available vehicles for purchase in the used car industry and promises great potential in the upcoming years for the market. Moreover, India is another prominent market for the used car market owing to the long working life of vehicles in the country. In India, a used car purchase is motivated by the affordability of these vehicles.

Market Players Outlook

The major companies serving the global used car market include Emil Frey AG, Hertz Car Sales, LLC, Maruti Suzuki, Pendragon PLC, Penske Cars, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in April 2021, in India, Spinny upraised $65 million in a round of funding from a venture capital firm Tiger and Lightspeed Venture Partners.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global used car market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Recovery Scenario of Global Used Car Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Emil Frey AG

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Hertz Car Sales, LLC

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Maruti Suzuki

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Pendragon PLC

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Penske Cars

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Used Car Market by Vehicle Type

4.1.1. Hatchbacks

4.1.2. Sedan

4.1.3. Sports Utility Vehicle (SUV)

4.2. Global Used Car Market by Vendor

4.2.1. Organized

4.2.2. Unorganized

4.3. Global Used Car Market by Fuel Type

4.3.1. Petrol

4.3.2. Diesel

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Arnold Clark Automobiles Ltd.

6.2. Asbury Automotive Group

6.3. AutoNation

6.4. CarMax

6.5. Cars24 Services Pvt Ltd.

6.6. Cox Automotive

6.7. Hyundai H Promise

6.8. Mahindra First Choice Wheels Ltd.

6.9. OLX India Pvt Ltd.

6.10. Trusty Cars Pte. Ltd. (Carro)

1. GLOBAL USED CAR MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

2. GLOBAL HATCHBACKS USED CAR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL SEDAN USED CAR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL SUV USED CAR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL USED CAR MARKET RESEARCH AND ANALYSIS BY VENDOR, 2021-2028 ($ MILLION)

6. GLOBAL ORGANIZED USED CAR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL UNORGANIZED USED CAR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL USED CAR MARKET RESEARCH AND ANALYSIS BY FUEL TYPE, 2021-2028 ($ MILLION)

9. GLOBAL USED PETROL CAR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL USED DIESEL CAR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL USED CAR MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

12. NORTH AMERICAN USED CAR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

13. NORTH AMERICAN USED CAR MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

14. NORTH AMERICAN USED CAR MARKET RESEARCH AND ANALYSIS BY VENDOR, 2021-2028 ($ MILLION)

15. NORTH AMERICAN USED CAR MARKET RESEARCH AND ANALYSIS BY FUEL TYPE, 2021-2028 ($ MILLION)

16. EUROPEAN USED CAR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. EUROPEAN USED CAR MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

18. EUROPEAN USED CAR MARKET RESEARCH AND ANALYSIS BY VENDOR, 2021-2028 ($ MILLION)

19. EUROPEAN USED CAR MARKET RESEARCH AND ANALYSIS BY FUEL TYPE, 2021-2028 ($ MILLION)

20. ASIA-PACIFIC USED CAR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

21. ASIA-PACIFIC USED CAR MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

22. ASIA-PACIFIC USED CAR MARKET RESEARCH AND ANALYSIS BY VENDOR, 2021-2028 ($ MILLION)

23. ASIA-PACIFIC USED CAR MARKET RESEARCH AND ANALYSIS BY FUEL TYPE, 2021-2028 ($ MILLION)

24. REST OF THE WORLD USED CAR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

25. REST OF THE WORLD USED CAR MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

26. REST OF THE WORLD USED CAR MARKET RESEARCH AND ANALYSIS BY VENDOR, 2021-2028 ($ MILLION)

27. REST OF THE WORLD USED CAR MARKET RESEARCH AND ANALYSIS BY FUEL TYPE, 2021-2028 ($ MILLION)

1. GLOBAL USED CAR MARKET SHARE BY VEHICLE TYPE, 2021 VS 2028 (%)

2. GLOBAL HATCHBACKS USED CAR MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

3. GLOBAL SEDAN USED CAR MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

4. GLOBAL SUV USED CAR MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

5. GLOBAL USED CAR MARKET SHARE BY VENDOR, 2021 VS 2028 (%)

6. GLOBAL ORGANIZED USED CAR MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL UNORGANIZED USED CAR MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL USED CAR MARKET SHARE BY FUEL TYPE, 2021 VS 2028 (%)

9. GLOBAL USED PETROL CAR MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL USED DIESEL CAR MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL USED CAR MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. US USED CAR MARKET SIZE, 2021-2028 ($ MILLION)

13. CANADA USED CAR MARKET SIZE, 2021-2028 ($ MILLION)

14. UK USED CAR MARKET SIZE, 2021-2028 ($ MILLION)

15. FRANCE USED CAR MARKET SIZE, 2021-2028 ($ MILLION)

16. GERMANY USED CAR MARKET SIZE, 2021-2028 ($ MILLION)

17. ITALY USED CAR MARKET SIZE, 2021-2028 ($ MILLION)

18. SPAIN USED CAR MARKET SIZE, 2021-2028 ($ MILLION)

19. REST OF EUROPE USED CAR MARKET SIZE, 2021-2028 ($ MILLION)

20. INDIA USED CAR MARKET SIZE, 2021-2028 ($ MILLION)

21. CHINA USED CAR MARKET SIZE, 2021-2028 ($ MILLION)

22. JAPAN USED CAR MARKET SIZE, 2021-2028 ($ MILLION)

23. SOUTH KOREA USED CAR MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF ASIA-PACIFIC USED CAR MARKET SIZE, 2021-2028 ($ MILLION)

25. REST OF THE WORLD USED CAR MARKET SIZE, 2021-2028 ($ MILLION)