Used Cooking Oil Market

Used Cooking Oil Market Size, Share & Trends Analysis Report by Source (Household Sector, and Commercial Sector), and by Application (Biodiesel, Oleo, Chemicals, and Animal Feed), Forecast Period (2024-2031)

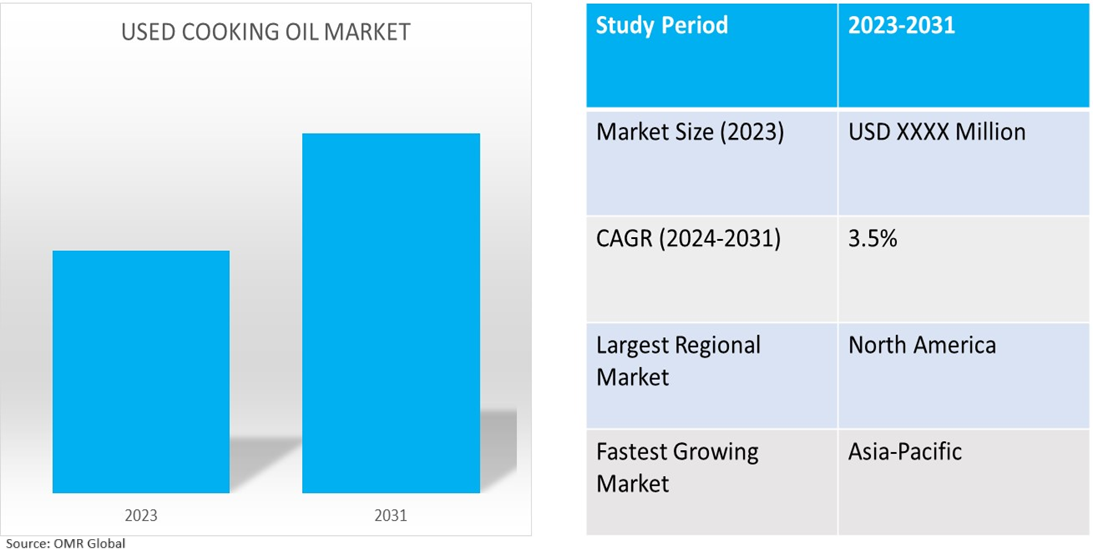

Used cooking oil market is anticipated to grow at a CAGR of 3.5% during the forecast period (2024–2021). Used cooking oil is the oil collected from households and commercial restaurants post-usage in cooking or frying food. The market growth is attributed to the growing demand for biodiesel, the expansion of the food service industry, and the growth of the animal feed industry among others. Further, the market is expected to be influenced by government initiatives and incentive programs, an increasing number of collection programs, and the expansion of the circular economy.

Market Dynamics

Government Regulations and Incentives

The ongoing efforts by state-run organizations to promote the use and incorporation of used cooking oil in the economy are key factors driving the global market. Several countries globally are implementing regulations or imposing policies alongside offering incentives to increase the use of sustainable oils. Such as blending regulations require the blending of biodiesel with conventional diesel fuel among others. The efforts are aimed at reducing carbon emissions and increasing the share of sustainable processes and fuels in the economy. For instance, in September 2023, the European Parliament approved a new regulation to expand the use of sustainable fuels in aviation, such as advanced biofuels or hydrogen. The RefuelEU aviation standards are part of the EU's "Fit for 55 package," which aims to reduce greenhouse gas emissions by at least 55.0% by 2030 compared to 1990 levels and ensure the EU is climate neutral by 2050. It aims to encourage the aviation industry to use sustainable fuels to reduce emissions. The term 'sustainable aviation fuels' will include synthetic fuels, certain biofuels derived from agriculture or forestry wastes, algae, bio-waste, used cooking oil, and certain animal fats.

Growth in the Animal Feed Industry

The increasing demand for used cooking oil from the animal feed industry further contributes to the market growth. Recycled cooking oil is processed and used as an ingredient in animal feed through refinement and blending with other ingredients to create a nutritious feed supplement for livestock and poultry. Further, the growing demand for livestock feed, especially in regions with extensive agricultural activities, is expected to benefit the universal cooking oil market. For instance, according to the International Feed Industry Federation, world compound feed production is estimated to be just over one billion tons annually. Global commercial feed manufacturing generates an estimated annual turnover of over $400.0 billion. Additionally, the United Nations Food and Agriculture Organization (FAO) estimates that by 2050, the demand for food will grow by 60.0% and that between 2010 and 2050, the production of animal proteins is expected to grow by around 1.7% per year, with meat production projected to rise by nearly 70.0%, aquaculture by 90.0%, and dairy by 55.0%.

Segmental Outlook

- Based on the source, the market is segmented into the household sector, and commercial sector.

- Based on application, the market is segmented into biodiesel, oleo, chemicals, and animal feed.

Commercial Sector Is the Most Prominent Used Cooking Oil Source

The commercial sector is the dominant source for the procurement of used cooking oil owing to the higher volume of used cooking oil collection, regulatory compliances for waste reduction, increasing tie-ups to promote a circular economy, and the monitoring benefits of supplying used cooking oil to processing companies. For instance, in October 2021, Neste and Hesburger, a Finnish restaurant chain, formed an important circular economy relationship. Used cooking oil from over 300 Hesburger restaurants in Finland and the Baltics will be repurposed to create renewable diesel. Hesburger will utilize Neste MY Renewable DieselTM in its Finnish transport vehicles.

Biodiesel is the Biggest Application Segment

Biodiesel remains the biggest application for used cooking oil owing to increasing demand for sustainable fuel alternatives, substantial support from state-run organizations to promote biodiesel, and regulatory requirements to reduce carbon emissions to achieve emission reduction targets.

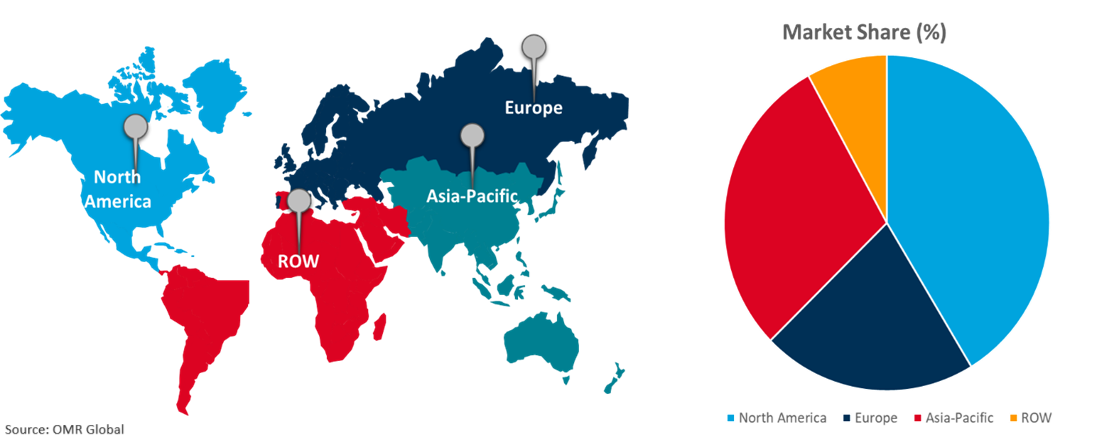

Regional Outlook

The global used cooking oil market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America Holds Highest Share in Used Cooking Oil Market

North America is predicted to dominate the used cooking oil market in the future owing to the ongoing increase in consumption of biofuels in the region, rising efforts by regional governments to promote a circular economy and optimize waste management, an increasing number of food service restaurants, regional emission reduction targets, and the presence of major used cooking oil collection and processing companies such as ABP Food Group (Olleco) and Baker Commodities Inc., among others. For instance, U.S. Department of Agriculture (USDA) Secretary Tom Vilsack stated that the USDA intends to invest up to $500 million from President Biden's Inflation Reduction Act to enhance the availability of domestic biofuels and provide Americans with more clean fuel options at the pump.

Global Used Cooking Oil Market Growth by Region 2024-2031

Asia-pacific is the Fastest Growing Used Cooking Oil Market

- Asian countries such as China, India, and Myanmar are increasingly investing in reducing carbon emissions caused by rapid industrialization, creating scope for increasing demand for biodiesel production through used cooking oil.

- The Asia-Pacific region is also recording an increase in the number of commercial restaurants, for which it is expected to impose policies and regulations to promote waste management and circular economy initiatives

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global used cooking oil market include ABP Food Group (Olleco), Baker Commodities Inc., and Changsha Stin Uco Renewable Energy Co., Ltd. among others. The market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, in October 2022, Bunge, a prominent producer of plant-based oils, and Olleco, ABP Food Group's renewables subsidiary, announced a 50/50 joint venture to develop a business that covers the entire life cycle of edible oils. The joint venture is anticipated to deliver oils to food service and food manufacturing customers across Europe (except the United Kingdom and Ireland) while also ensuring that used cooking oil is efficiently collected and used as a feedstock in renewable fuel manufacturing. The solutions and services to be provided will help address environmental and energy security problems in important European markets.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global used cooking oil market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. ABP Food Group (Olleco)

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Baker Commodities Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Key Strategy Analysis

4. Market Segmentation

4.1. Global Used Cooking Oil Market by Source

4.1.1. Household Sector

4.1.2. Commercial Sector

4.2. Global Used Cooking Oil Market by Application

4.2.1. Biodiesel

4.2.2. Oleo

4.2.3. Chemicals

4.2.4. Animal Feed

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. ABP Food Group (Olleco)

6.2. ArisBioEnergy Pvt. Ltd.

6.3. ARABO IMPEX PVT. LTD.

6.4. Arrow Oils Ltd.

6.5. Baker Commodities Inc.

6.6. Brocklesby Ltd.

6.7. Cleanaway Operations Pty Ltd

6.8. CHANGSHA STIN UCO RENEWABLE ENERGY CO., LTD

6.9. Darling Ingredients Inc.

6.10. Ekotron d.o.o. (Ltd.)

6.11. Geasecycle

6.12. Go Green Bioenergy India Pvt Ltd.

6.13. Grand Natural Inc.

6.14. Mahoney Environmental Solutions

6.15. Northwest Biofuel

6.16. Oz Oils Pty Ltd

6.17. PanOleo Energy

6.18. SAPI GREEN OIL SRL

6.19. Waste Oil Recyclers, Inc.

6.20. Quatra

1. Global Used Cooking Oil Market Research And Analysis By Source, 2023-2031 ($ Million)

2. Global Household Sector Used Cooking Oil Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Commercial Sector Used Cooking Oil Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Used Cooking Oil Market Research And Analysis By Application, 2023-2031 ($ Million)

5. Global Used Cooking Oil For Biodiesel Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global Used Cooking Oil For Oleo Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Used Cooking Oil For Animal Feed Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Used Cooking Oil Market Research And Analysis By Region, 2023-2031 ($ Million)

9. North American Used Cooking Oil Market Research And Analysis By Country, 2023-2031 ($ Million)

10. North American Used Cooking Oil Market Research And Analysis By Source, 2023-2031 ($ Million)

11. North American Used Cooking Oil Market Research And Analysis By Application, 2023-2031 ($ Million)

12. European Used Cooking Oil Market Research And Analysis By Country, 2023-2031 ($ Million)

13. European Used Cooking Oil Market Research And Analysis By Source, 2023-2031 ($ Million)

14. European Used Cooking Oil Market Research And Analysis By Application, 2023-2031 ($ Million)

15. Asia-Pacific Used Cooking Oil Market Research And Analysis By Country, 2023-2031 ($ Million)

16. Asia-Pacific Used Cooking Oil Market Research And Analysis By Source, 2023-2031 ($ Million)

17. Asia-Pacific Used Cooking Oil Market Research And Analysis By Application, 2023-2031 ($ Million)

18. Rest Of The World Used Cooking Oil Market Research And Analysis By Region, 2023-2031 ($ Million)

19. Rest Of The World Used Cooking Oil Market Research And Analysis By Source, 2023-2031 ($ Million)

20. Rest Of The World Used Cooking Oil Market Research And Analysis By Application, 2023-2031 ($ Million)

1. Global Used Cooking Oil Market Share By Source, 2023 Vs 2031 (%)

2. Global Household Sector Used Cooking Oil Market Share By Region, 2023 Vs 2031 (%)

3. Global Commercial Sector Used Cooking Oil Market Share By Region, 2023 Vs 2031 (%)

4. Global Used Cooking Oil Market Share By Application, 2023 Vs 2031 (%)

5. Global Used Cooking Oil For Biodiesel Market Share By Region, 2023 Vs 2031 (%)

6. Global Used Cooking Oil For Oleo Market Share By Region, 2023 Vs 2031 (%)

7. Global Used Cooking Oil For Animal Feed Market Share By Region, 2023 Vs 2031 (%)

8. Global Used Cooking Oil Market Share By Region, 2023 Vs 2031 (%)

9. US Used Cooking Oil Market Size, 2023-2031 ($ Million)

10. Canada Used Cooking Oil Market Size, 2023-2031 ($ Million)

11. UK Used Cooking Oil Market Size, 2023-2031 ($ Million)

12. France Used Cooking Oil Market Size, 2023-2031 ($ Million)

13. Germany Used Cooking Oil Market Size, 2023-2031 ($ Million)

14. Italy Used Cooking Oil Market Size, 2023-2031 ($ Million)

15. Spain Used Cooking Oil Market Size, 2023-2031 ($ Million)

16. Rest Of Europe Used Cooking Oil Market Size, 2023-2031 ($ Million)

17. India Used Cooking Oil Market Size, 2023-2031 ($ Million)

18. China Used Cooking Oil Market Size, 2023-2031 ($ Million)

19. Japan Used Cooking Oil Market Size, 2023-2031 ($ Million)

20. South Korea Used Cooking Oil Market Size, 2023-2031 ($ Million)

21. Rest Of Asia-Pacific Used Cooking Oil Market Size, 2023-2031 ($ Million)

22. Latin America Used Cooking Oil Market Size, 2023-2031 ($ Million)

23. Middle East And Africa Used Cooking Oil Market Size, 2023-2031 ($ Million)