Vacuum Packaging Market

Global Vacuum Packaging Market Size, Share & Trends Analysis Report by Material (Polyethylene (PE), Polyamide, Ethylene Vinyl Alcohol (EVA), and Other), by End-User (Food Industry and Other) Forecast Period (2020-2026)

Update Available - Forecast 2025-2031

The global vacuum packaging market is growing at a CAGR of 3.8% during the forecast period. Vacuum packaging is the process of packaging a product by eliminating all the air inside to reduce the chances of spoilage and wastage of the product. Vacuum packaging has been widely used to store various items, including meat, poultry, seafood, cheese, dry fruits, and agricultural produce. It is popular across geographies when it comes to preserving food and keeping away bacteria and microorganisms. Also, vacuum-packed products are protected from moisture, dust, and other environmental gases and are being increasingly preferred by most manufacturers in the global food industry. Convenient packaging and easy handling are strongly driving vacuum packaging. Increasing disposable incomes and urbanization have also increased the demand for vacuum-packed products. Changing consumer trends for ready-to-go and lightweight packaging are some key drivers of the vacuum packaging market.

COVID-19 has impacted the vacuum packaging industry across geographies. Despite wide macroeconomic headwinds, some packaging suppliers have been benefiting from the economic pace powering short-term sales growth. Moreover, consumer demand for protein products also increased significantly in the latter half of 2020, which is expected to create demand in the market for trays and flexible films. In addition, customers have increased demand for extended shelf life packaging due to a disruption in the supply chain amid COVID-19 measures, which will benefit the vacuum packaging market.

Segmental Outlook

The global vacuum packaging market is segmented based on material, pack, and end-user. Based on material, the vacuum packaging market is segmented into Polyethylene (PE), Polyamide, Ethylene Vinyl Alcohol (EVA), and Other. PE remains one of the most utilized materials, closely followed by other polymers such as PVC and PP. PE, with its two forms, LDPE and LLDPE, is used in a variety of food packaging and consumer applications (HDPE applications are on the lower side). Some more packaging applications include pet food and agricultural produce. Based on end-user, the market is classified into the food industry and others.

Demand for Lightweight Packaging

The demand for lightweight packaging has been on a rise in food, pet food, and other end-user segments as it reduces the cost of transportation and brings down the unit price associated with packaging. Vacuum packaging in flexible pack types has significant demand and could replace vacuum packaging of the rigid pack variety owing to the former’s lightweight characteristic. Also, the inexpensiveness of lightweight flexible packaging is a key driver. Along with the lesser cost of lightweight vacuum packaging of the flexible pack type, increased consumption of case-ready, single-serve packaging, and continued pressure from the government to reduce packaging waste have been significant influences.

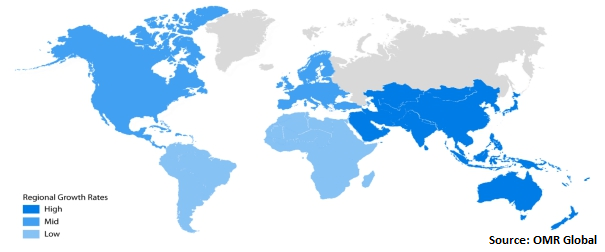

Regional Outlook

The global vacuum packaging market is dominated by the Asia Pacific region attributed to the growing retail landscape, along with organized packaging growth. The organized retail and packaging market has been pushing for advanced packaging techniques to provide quality products that can sustain for a longer duration. North America and Europe are the two regions that have more awareness of advanced packaging technologies and are the first to adopt any new trend. In vacuum packaging, meat, poultry, and seafood packaging are high potential market drivers, seeing as how their consumption will grow in the forecast period.

Global Vacuum Packaging Market Growth, by Region 2020-2026

Market Players Outlook

Larger players have used their technological strength and high-volume product lines to offset cost variations. Therefore, the vacuum packaging market has been changing for a few years due to innovations in packaging that increase the quality and shelf life of products. Smaller companies focus on customization, as competition in the market is mainly based on two aspects – features and price. Some of the major players operating in the vacuum packaging market include Amcor plc; Berry Global, Inc.; DuPont Teijin Films USA; G.Mondini spa; Mondi Group; Sealed Air Corp.; Smurfit Kappa Group plc; and Winpak, Ltd.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global vacuum packaging market. Based on the availability of data, information related to the products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Strategy Analysis

3.2. Key Company Analysis

3.2.1. Amcor plc

3.2.1.1. Overview

3.2.1.2. Financial Analysis

3.2.1.3. SWOT Analysis

3.2.1.4. Recent Developments

3.2.2. Berry Global, Inc.

3.2.2.1. Overview

3.2.2.2. Financial Analysis

3.2.2.3. SWOT Analysis

3.2.2.4. Recent Developments

3.2.3. Mondi Group

3.2.3.1. Overview

3.2.3.2. Financial Analysis

3.2.3.3. SWOT Analysis

3.2.3.4. Recent Developments

3.2.4. Sealed Air Corp.

3.2.4.1. Overview

3.2.4.2. Financial Analysis

3.2.4.3. SWOT Analysis

3.2.4.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Vacuum Packaging Market by Material

5.1.1. Polyethylene (PE)

5.1.2. Polyamide

5.1.3. Ethylene Vinyl Alcohol (EVA)

5.1.4. Other (PVC (Polyvinylchloride) and PP (Polypropylene))

5.2. Global Vacuum Packaging Market by End-User

5.2.1. Food Industry

5.2.2. Other

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Amcor plc (Bemis Company, Inc.)

7.2. Berry Global, Inc.

7.3. DuPont Teijin Films USA

7.4. G. Mondini spa

7.5. Klöckner Pentaplast Group

7.6. M&Q Packaging, LLC

7.7. Mondi Group

7.8. Plastissimo Film Co.,Ltd

7.9. Plastopil Hazorea Co., Ltd.

7.10. Schur Flexibles Holding GesmbH

7.11. Sealed Air Corp.

7.12. Smurfit Kappa Group plc

7.13. Swiss Pac USA

7.14. The Middleby Corp.

7.15. ULMA Packaging (ULMA Group)

7.16. WestRock Co.

7.17. Winpak, Ltd.

1. GLOBAL VACUUM PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

2. GLOBAL PE (POLYETHYLENE) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL POLYAMIDE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL ETHYLENE VINYL ALCOHOL (EVA)MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL VACUUM PACKAGING MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

7. GLOBAL FOOD INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. NORTH AMERICAN VACUUM PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

10. NORTH AMERICAN VACUUM PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

11. NORTH AMERICAN VACUUM PACKAGING MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

12. EUROPEAN VACUUM PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

13. EUROPEAN VACUUM PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

14. EUROPEAN VACUUM PACKAGING MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

15. ASIA-PACIFIC VACUUM PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

16. ASIA-PACIFIC VACUUM PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

17. ASIA-PACIFIC VACUUM PACKAGING MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

18. REST OF THE WORLD VACUUM PACKAGING MARKET RESEARCH AND ANALYSIS BY MACHINERY, 2019-2026 ($ MILLION)

19. REST OF THE WORLD VACUUM PACKAGING MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

1. GLOBAL VACUUM PACKAGING MARKET SHARE BY MATERIAL, 2019 VS 2026 (%)

2. GLOBAL VACUUM PACKAGING MARKET SHARE BY END-USER, 2019 VS 2026 (%)

3. GLOBAL VACUUM PACKAGING MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. THE US VACUUM PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA VACUUM PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

6. UK VACUUM PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE VACUUM PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY VACUUM PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY VACUUM PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN VACUUM PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE VACUUM PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

12. CHINA VACUUM PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA VACUUM PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN VACUUM PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC VACUUM PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD VACUUM PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)