Vacuum Pump Market

Vacuum Pump Market Size, Share & Trends Analysis Report by Type (Rotary Vacuum Pump, Reciprocating Vacuum Pump, Kinetic Vacuum Pump, Dynamic Vacuum Pump, and Specialized Vacuum Pump), and by End-User Industry (Chemical and Petrochemical, Semiconductor & Electronics, Manufacturing, Pharmaceutical, Food, and Beverage, and Others) Forecast Period (2024-2031)

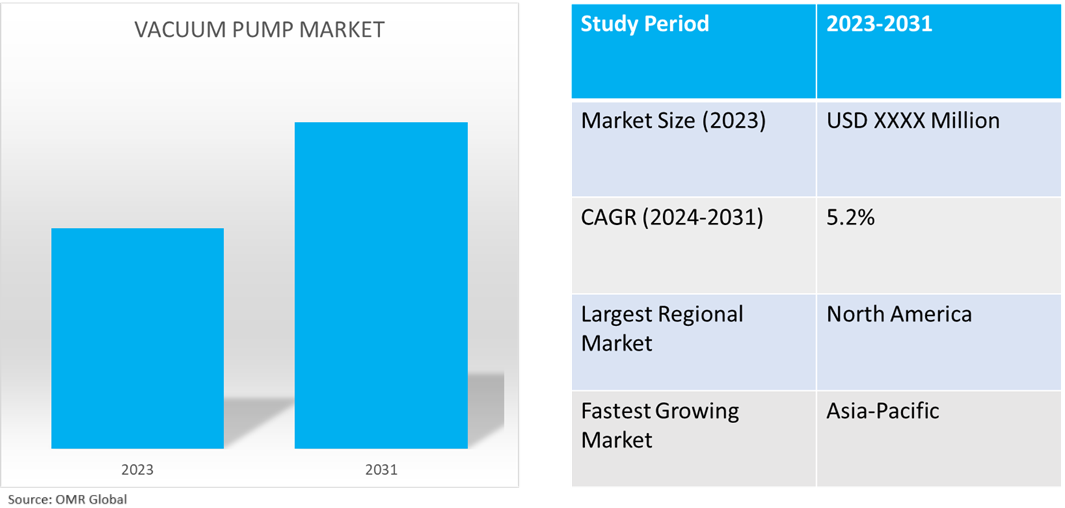

Vacuum pump market is anticipated to grow at a significant CAGR of 5.2% during the forecast period (2024-2031). The market growth is attributed to increasing automation, stricter industrial regulations, technical innovations, and the complexity of manufacturing processes in several industries. According to the Center for Collective Learning, in 2022, the top exporters of vacuum pumps were Germany ($1.12 billion), Japan ($865 million), South Korea ($550 million), China ($500 million), and the US ($397 million). In 2022, the top importers of Vacuum pumps were China ($945 million), the US ($934 million), Germany ($395 million), Chinese Taipei ($332 million), and South Korea ($322 million).

Market Dynamics

Growing Demand of Vacuum Pumps in End-Use Industry

With industries ranging from semiconductors, oil & gas, packaging, plastics, furniture manufacturing, pharmaceuticals, electronics, chemicals, and aerospace, industrial vacuum pumps are among the most extensively utilized instruments in the commercial and industrial landscape. Industrial vacuum pump systems with rotary lobes are widely utilized in the plastic and packaging sectors. They are made to last and are utilized as central vacuum systems. Applications like material handling and bulk solids conveying make use of them. In January 2021, Becker Pumps Corp. introduced two new series of vacuum pumps that are specifically designed for the primary packaging market. These new pumps are direct replacements for the pumps currently being offered by the competition and are more energy efficient.

Increasing Innovations in Vacuum Pump Technology

Advances in vacuum pump technology have led to significant improvements in terms of performance, efficiency, and dependability, making them indispensable for space exploration endeavors. Growing efforts by space agencies and private aerospace companies to reduce the size and weight of spacecraft payload have promoted manufacturers of vacuum pumps to develop lightweight, compact pump designs that are suitable for small satellites and CubeSats.

These reduced-sized pumps offer high performance comparable to that of traditional versions while saving overall bulk and room within the spacecraft. The most recent designs and materials are used in modern vacuum pumps to increase efficiency and reduce energy usage. These pumps are ideal for extended space missions with restricted power supplies.

Market Segmentation

- Based on the type, the market is segmented into rotary vacuum pumps, reciprocating vacuum pumps, kinetic vacuum pumps, dynamic vacuum pumps, and specialized vacuum pumps.

- Based on the end-user industry, the market is segmented into chemical and petrochemical, semiconductor & electronics, manufacturing, pharmaceutical, food and beverage, and others.

Rotary Vacuum Pump is projected to Hold the Largest Segment

The rotary vacuum pump segment is expected to hold the largest share of the market. The rotary pumps typically remove air from lines and minimize the requirement for actual line air draining, hence they are highly preferred vacuum pumps. Although they are frequently used to pump oil, rotary vacuum pumps can also be used to operate dry with clean air or to pump other liquids such as gas and oil. Market players are offering modern technical designs for users to increase the economic efficiency of their processes with the rotary vane pump. For instance, in August 2022, Edwards Vacuum introduced a new series of oil-sealed rotary vane vacuum pumps. The company offers a reliable product in the form of the powerful, robust E2S series for low and medium vacuum in industry and research. The E2S has a simple design and is suitable for various standard applications.

Manufacturing Segment to Hold a Considerable Market Share

The manufacturing segment is expected to hold a considerable share of the market. The factors supporting segment growth include the high demand for vacuum pumps in several applications. The requirement for exact control of pressure, efficiency, and dependability in a variety of industrial processes drives product demand in the manufacturing sector. More automation and improvements in manufacturing technology support the demand's ongoing expansion. Market players offer innovative technology and vacuum solutions not only for innovative semiconductor manufacturing processes, but also for a wide range of industries, including analyzers, dries, LEDs, and lithium-ion batteries. For instance, in July 2022, EBARA Corp. introduced Dry Vacuum Pump the Model EV-X for medium-duty processes in the manufacturing process of semiconductors. Compared to our existing model, the product consumes 25.0% to 50.0% less power. At the same time, it improves process gas exhaust performance.

Regional Outlook

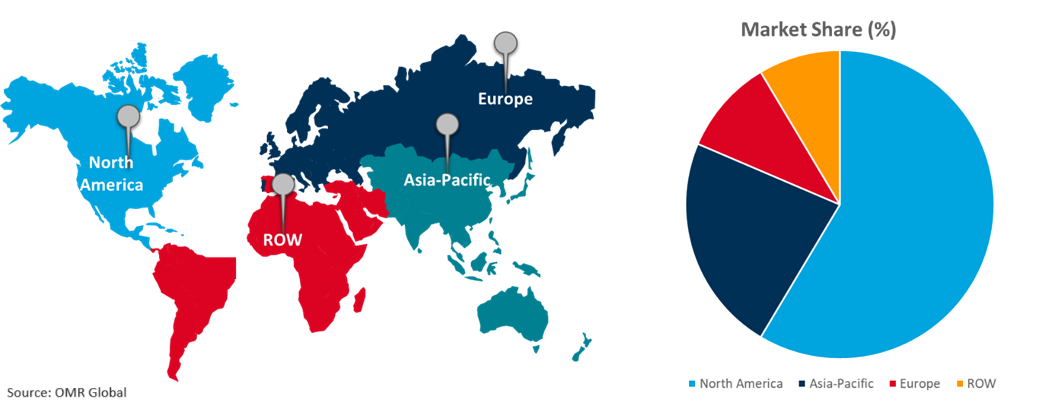

The global vacuum pump market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Vacuum Pumps in Asia-Pacific

- The regional growth is attributed to pivotal factors such as the increasing semiconductor & electronics industry in the region, particularly in countries like China, Japan, South Korea, and Taiwan. The fastest changing semiconductor production, where new products are always requiring better specifications and faster speeds. In turn, this procedure requires a consistent and dependable vacuum supply. Testing, holding, pick-and-place, and packaging procedures within the industry necessitate a clean, reliable home vacuum.

- Additionally, the demand for vacuum pump products is influenced by the expansion of the pharmaceutical sector in the area, particularly in fields like pharmaceutical manufacturing and medical device applications.

Global Vacuum Pump Market Growth by Region 2024-2031

North America Holds Major Market Share

North America holds a significant share owing to numerous prominent vacuum pump companies and providers such as Burkert Corp., Ingersoll Rand Inc., and Flowserve Corp. in the region. The market growth is attributed to the increasing demand for vacuum pumps in the region owing to the rising scope in end-use industries, where medium vacuum levels are often required for processes, such as distillation, packaging, and composite manufacturing. Vacuum pumps are being increasingly widely used in North America as a result of the region's industries' continued emphasis on efficiency, sustainability, and innovation. These pumps are essential for providing accurate control, dependability, and performance in a variety of applications.

Market players offer vacuum pumps that have high performance combined with low power consumption in a small footprint. The enhanced pump design retains all the benefits of the original vacuum pumps, such as complete electrical synchronization and oil-free operation. For instance, in March 2023, Flowserve Corp. introduced the new SIHI boost UltraPLUS dry-running vacuum pump. The new unit is designed to reduce cycle times for batch processes by up to 50.0% or more. The new and improved pump design retains all the advantages of the original SIHI Boost pump including oil-free operation and full electronic synchronization — and cuts re-acceleration time up to 50.0%.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the vacuum pump market include Ingersoll Rand Inc., Atlas Copco AB (Edwards), Flowserve Corp., Busch Vacuum Solutions (Busch group), and Pfeiffer Vacuum GmbH (Pfeiffer Vacuum Technology AG), among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

Recent Development

- In May 2024, Pfeiffer Vacuum GmbH introduced Explosion-proof HiScroll ATEX scroll pumps. The vacuum pumps in the HiScroll ATEX range meet the requirements of European directive ATEX 2014/34/EU and/or 1999/92/EC and are therefore suitable for handling potentially explosive gases. Pfeiffer Vacuum’s scroll pumps offer high pumping speeds during pump-down, even at atmospheric pressure.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the vacuum pump market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Atlas Copco AB (Edwards)

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Ingersoll Rand Inc. (Gardner Denver)

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. FlowKineticserve Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Vacuum Pump Market by Type

4.1.1. Rotary

4.1.2. Reciprocating

4.1.3. Kinetic

4.1.4. Dynamic

4.1.5. Specialized

4.2. Global Vacuum Pump Market by End-User Industry

4.2.1. Chemical and Petrochemical

4.2.2. Semiconductor & Electronics

4.2.3. Manufacturing

4.2.4. Pharmaceutical

4.2.5. Food and Beverage

4.2.6. Others (Energy & Utilities)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Aquarius Engineers Pvt Ltd.

6.2. Becker Pumps Corp.

6.3. Busch Vacuum Solutions (Busch group)

6.4. Ebara Corp.

6.5. Gast Manufacturing Inc.

6.6. Graham Corp.

6.7. Global Vac

6.8. Kashiyama Industries Ltd.

6.9. KNF Neuberger GmbH

6.10. Leybold GmbH

6.11. Peterson Products Company

6.12. Pfeiffer Vacuum GmbH (Pfeiffer Vacuum Technology AG)

6.13. Shimadzu Corp.

6.14. Tsurumi Manufacturing

6.15. ULVAC

6.16. US Vacuum Pumps Inc.

6.17. Wintek Corp.

1. GLOBAL VACUUM PUMP MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL ROTARY VACUUM PUMP MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL RECIPROCATING VACUUM PUMP MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL VACUUM PUMP MARKET RESEARCH AND ANALYSIS BY VACUUM LEVEL, 2023-2031 ($ MILLION)

5. GLOBAL KINETIC VACUUM PUMP MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL DYNAMIC VACUUM PUMP MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL SPECIALIZED VACUUM PUMP MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL VACUUM PUMPS MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

9. GLOBAL VACUUM PUMPS FOR CHEMICAL AND PETROCHEMICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL VACUUM PUMPS FOR SEMICONDUCTOR & ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL VACUUM PUMPS FOR MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL VACUUM PUMPS FOR PHARMACEUTICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL VACUUM PUMPS FOR FOOD AND BEVERAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL VACUUM PUMPS FOR OTHER END-USER INDUSTRIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL VACUUM PUMPS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. NORTH AMERICAN VACUUM PUMPS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

17. NORTH AMERICAN VACUUM PUMPS MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

18. EUROPEAN VACUUM PUMPS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. EUROPEAN VACUUM PUMPS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

20. EUROPEAN VACUUM PUMPS MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC VACUUM PUMPS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC VACUUM PUMPS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC VACUUM PUMPS MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

24. REST OF THE WORLD VACUUM PUMPS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

25. REST OF THE WORLD VACUUM PUMPS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

26. REST OF THE WORLD VACUUM PUMPS MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

1. GLOBAL VACUUM PUMPS MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL ROTARY VACUUM PUMPS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL RECIPROCATING VACUUM PUMPS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL KINETIC VACUUM PUMPS MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL DYNAMIC VACUUM PUMPS MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL SPECIALIZED VACUUM PUMPS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL VACUUM PUMPS MARKET SHARE BY END-USER INDUSTRY, 2023 VS 2031 (%)

8. GLOBAL VACUUM PUMPS FOR CHEMICAL AND PETROCHEMICAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL VACUUM PUMPS FOR SEMICONDUCTOR & ELECTRONICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL VACUUM PUMPS FOR MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL VACUUM PUMPS FOR PHARMACEUTICAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL VACUUM PUMPS FOR FOOD AND BEVERAGE MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL VACUUM PUMPS FOR OTHER END-USER INDUSTRIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL VACUUM PUMPS MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. US VACUUM PUMPS MARKET SIZE, 2023-2031 ($ MILLION)

16. CANADA VACUUM PUMPS MARKET SIZE, 2023-2031 ($ MILLION)

17. UK VACUUM PUMPS MARKET SIZE, 2023-2031 ($ MILLION)

18. FRANCE VACUUM PUMPS MARKET SIZE, 2023-2031 ($ MILLION)

19. GERMANY VACUUM PUMPS MARKET SIZE, 2023-2031 ($ MILLION)

20. ITALY VACUUM PUMPS MARKET SIZE, 2023-2031 ($ MILLION)

21. SPAIN VACUUM PUMPS MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF EUROPE VACUUM PUMPS MARKET SIZE, 2023-2031 ($ MILLION)

23. INDIA VACUUM PUMPS MARKET SIZE, 2023-2031 ($ MILLION)

24. CHINA VACUUM PUMPS MARKET SIZE, 2023-2031 ($ MILLION)

25. JAPAN VACUUM PUMPS MARKET SIZE, 2023-2031 ($ MILLION)

26. SOUTH KOREA VACUUM PUMPS MARKET SIZE, 2023-2031 ($ MILLION)

27. REST OF ASIA-PACIFIC VACUUM PUMPS MARKET SIZE, 2023-2031 ($ MILLION)

28. LATIN AMERICA VACUUM PUMPS MARKET SIZE, 2023-2031 ($ MILLION)

29. MIDDLE EAST AND AFRICA VACUUM PUMPS MARKET SIZE, 2023-2031 ($ MILLION)