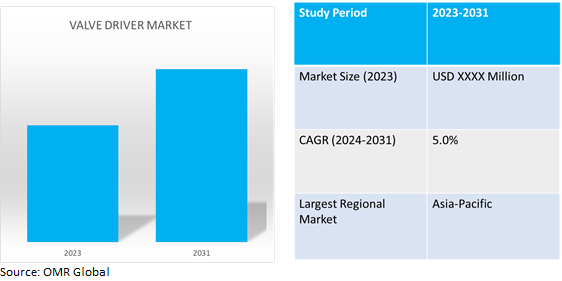

Valve Driver Market

Valve Driver Market Size, Share & Trends Analysis Report by Valve Type (Conventional Control Valve and Expansion Valve), by Function (Solenoid and Proportional), and by End-User (Commercial, Residential, and Industrial), Forecast Period (2024-2031)

Valve driver market is anticipated to grow at a considerable CAGR of 5.0% during the forecast period (2024-2031).The valve driver is a small potted module that's commonly used to drive proportional valves from an electronic joystick or potentiometer sources. It is designed to control proportional hydraulic valves, they are also well suited for many kinds of small control logic applications.

Market Dynamics

Rising Infrastructure Projects

Growing infrastructure project investments globallyin the fields of building, power generation, water treatment, and oil and gas pipelines are driving a significant need for valve drivers. Valve drivers are essential parts of these projects because they often require precise control over fluid or gas flow, which is necessary to maintain the efficient operation and maintenance of infrastructure systems. As governments and private investors commit funds to improve and extend infrastructure networks, there is an increasing demand for valve drivers. For instance, the U.S. Department Of The Treasury states that in 2021, it signed the Bipartisan Infrastructure Law (BIL) into law. The BIL directs $1.2 trillion of federal funds towardtransportation, energy, and climate infrastructure projects, most of which aredistributed via state and local governments. Recently, in November 2023, BIL funding announced to date is flowing to the states that need it most: states with the lowest-rated infrastructure are receiving more funding per capita than states with the highest-rated infrastructure. This indirectly increases the demand for valve drivers in the US.

Adoption of Connected Valve Drivers

Globally, the rise of connected valve drivers is revolutionizing the valve driver market.The integrated valve drivers with the Internet of Things (IoT) platforms provide real-time communication, data gathering, and analysis. Because of this connectivity, operators may remotely monitor valve performance data and use that information to reduce maintenance costs and downtime. Predictive maintenance is decreased and valve performance is improved by such connectivity and monitoring. Connected valve drivers enhance system design flexibility, scalability, and efficiency. They enable optimization and adaptive control, while data collected from these drivers aids in analytics-driven decision-making.

Market Segmentation

Our in-depth analysis of the global valve driver market includes the following segments by valve type, function, and end-user:

- Based on valve type, the market is segmented into conventional control valves and expansion valves.

- Based on function, the market is bifurcated into solenoid and proportional.

- Based on end-users, the market is segmented into commercial, residential, and industrial.

Conventional Control Valves is Projected to Emerge as the Largest Segment

The conventional control valvesegment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the features it carries. To regulate the flow of gases or liquids in various industrial processes, conventional control valves are crucial components of fluid control systems. A positioner, an actuator, and a valve body typically comprise them. In reaction to signals from the actuator, a moveable part within the valve body such as a plug or disc modifies the flow.For instance, in June 2022, CKD Corporation announced the release of a direct-acting 2, 3-port solenoid valve (Multi-fit valve) for multi-fluid control. The new series of fluid control valves is designed for high reliability, easy selection, and market ease, offering functions for various industrial applications and handling various fluids.

Industrial Segment to Hold a Considerable Market Share

In automation, manufacturing, and process control applications, industrial valve drivers are essential components that control how industrial valves operate. These drivers work as actuators in response to input signals from control systems, exerting the necessary force to open, close, or change the position of the valve. There are three different kinds of industrial valve drivers: electric, hydraulic, and pneumatic. Each is suitable for a particular combination of ambient conditions and operating parameters. Digital communication interfaces, programmable control algorithms, and remote monitoring are just a few of the sophisticated features that industrial valve drivers offer to enable improved functionality and interaction with sophisticated automation systems. They are essential for providing precise and trustworthy control over the flow of fluids or gases, which enhances the effectiveness, security, and efficiency of industrial processes.

Regional Outlook

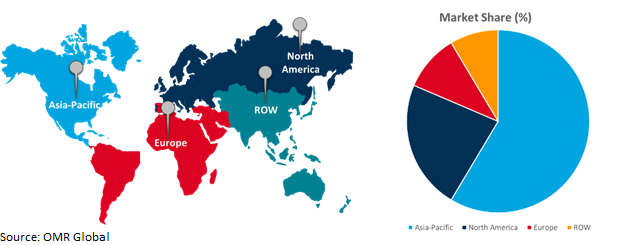

The globalvalve driver market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North American countries to invest in biofuels and biorefineries

- The US has a strong presence in sectors like oil & gas, manufacturing, and chemicals. These industries rely heavily on valves to control and regulate fluids and gases, and consequently, require specialized equipment to operate them.

- Canada focuses on automation and implementing advanced technologies which is further propelling investment in the market as valve drivers play a crucial role in automating valve operations, leading to increased efficiency and safety for workers.

Global Valve Driver Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the regions, Asia-Pacific holds a significant share owing to the presence ofeconomies in the Asia-Pacific region, including China, India, and Japan, which are growing due to fast urbanization and industrialization.This means that industries that primarily rely on valves to control fluid flow, such as manufacturing, construction, oil and gas, and power generation, will grow significantly. As a result, there is a corresponding increase in demand for valve drivers, which automate and regulate these valves. The governments of the Asia-Pacific area are aggressively pushing industrial projects and the construction of infrastructure. This translates to large sums of money being spent on the construction of new factories, power plants, and refineries all of which need sturdy valve systems and dependable drivers to run well.

In addition, the increasing population of the APAC countries demands attention to better water and wastewater treatment infrastructure. These facilities further contribute to the growth of the regional market because they too rely on valves and valve drivers for efficient operation.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global valve driver market includeCarel Industries S.p.A., Emerson Electric Co., Flowserve, Honeywell International Inc., Parker Hannifin Corporation, and Siemens AG, among others.The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.For instance,in May 2022, Flowserve Corporation, a flow control products and services provider for the infrastructure markets, acquired a contract to provide control and ball valves to OMV's chemical recycling demonstration plant at Schwechat, Austria located approximately 16 km (10 miles) southeast of Vienna.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global valve drivermarket. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Carel Industries S.p.A.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Emerson Electric Co.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Flowserve

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Valve Driver Market by Valve Type

4.1.1. Conventional Control Valve

4.1.2. Expansion Valve

4.2. Global Valve Driver Market by Function

4.2.1. Solenoid

4.2.2. Proportional

4.3. Global Valve Driver Market by End-User

4.3.1. Commercial

4.3.2. Residential

4.3.3. Industrial

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Applied Processor and Measurement, Inc.

6.2. Bucher Hydraulics, Inc.

6.3. Clippard Instrument Laboratory, Inc.

6.4. Danfoss

6.5. Eliwell Controls

6.6. Fujikoki Corporation

6.7. Humphrey Products

6.8. Honeywell International Inc.

6.9. Hussmann Corporation

6.10. Hydraforce

6.11. IQ Valves Co.

6.12. MKS Instruments, Inc.

6.13. Parker Hannifin Corporation

6.14. Sanhua Group

6.15. Schneider Electric

6.16. Siemens AG

6.17. Spirax-Sarco Engineering plc

1. GLOBAL VALVE DRIVER MARKET RESEARCH AND ANALYSIS BY VALVE TYPE, 2023-2031 ($ MILLION)

2. GLOBAL CONVENTIONAL CONTROL VALVE DRIVER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL EXPANSION VALVE DRIVER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL VALVE DRIVER MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2023-2031 ($ MILLION)

5. GLOBAL SOLENOID VALVE DRIVER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL PROPORTIONAL VALVE DRIVER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL VALVE DRIVER MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

8. GLOBAL VALVE DRIVER FOR COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL VALVE DRIVER FOR RESIDENTIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL VALVE DRIVER FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL VALVE DRIVER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. NORTH AMERICAN VALVE DRIVER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. NORTH AMERICAN VALVE DRIVER MARKET RESEARCH AND ANALYSIS BY VALVE TYPE, 2023-2031 ($ MILLION)

14. NORTH AMERICAN VALVE DRIVER MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2023-2031 ($ MILLION)

15. NORTH AMERICAN VALVE DRIVER MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

16. EUROPEAN VALVE DRIVER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. EUROPEAN VALVE DRIVER MARKET RESEARCH AND ANALYSIS BY VALVE TYPE, 2023-2031 ($ MILLION)

18. EUROPEAN VALVE DRIVER MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2023-2031 ($ MILLION)

19. EUROPEAN VALVE DRIVER MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC VALVE DRIVER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC VALVE DRIVER MARKET RESEARCH AND ANALYSIS BY VALVE TYPE, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC VALVE DRIVER MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC VALVE DRIVER MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

24. REST OF THE WORLD VALVE DRIVER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

25. REST OF THE WORLD VALVE DRIVER MARKET RESEARCH AND ANALYSIS BY VALVE TYPE, 2023-2031 ($ MILLION)

26. REST OF THE WORLD VALVE DRIVER MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2023-2031 ($ MILLION)

27. REST OF THE WORLD VALVE DRIVER MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL VALVE DRIVER MARKET SHARE BY VALVE TYPE, 2023 VS 2031 (%)

2. GLOBAL CONVENTIONAL CONTROL VALVE DRIVER MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL EXPANSION VALVE DRIVER MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL VALVE DRIVER MARKET SHARE BY FUNCTION, 2023 VS 2031 (%)

5. GLOBAL SOLENOID VALVE DRIVER MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL PROPORTIONAL VALVE DRIVER MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL VALVE DRIVER MARKET SHARE BY END-USER, 2023 VS 2031 (%)

8. GLOBAL VALVE DRIVER FOR COMMERCIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL VALVE DRIVER FOR RESIDENTIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL VALVE DRIVER FOR INDUSTRIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL VALVE DRIVER MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. US VALVE DRIVER MARKET SIZE, 2023-2031 ($ MILLION)

13. CANADA VALVE DRIVER MARKET SIZE, 2023-2031 ($ MILLION)

14. UK VALVE DRIVER MARKET SIZE, 2023-2031 ($ MILLION)

15. FRANCE VALVE DRIVER MARKET SIZE, 2023-2031 ($ MILLION)

16. GERMANY VALVE DRIVER MARKET SIZE, 2023-2031 ($ MILLION)

17. ITALY VALVE DRIVER MARKET SIZE, 2023-2031 ($ MILLION)

18. SPAIN VALVE DRIVER MARKET SIZE, 2023-2031 ($ MILLION)

19. REST OF EUROPE VALVE DRIVER MARKET SIZE, 2023-2031 ($ MILLION)

20. INDIA VALVE DRIVER MARKET SIZE, 2023-2031 ($ MILLION)

21. CHINA VALVE DRIVER MARKET SIZE, 2023-2031 ($ MILLION)

22. JAPAN VALVE DRIVER MARKET SIZE, 2023-2031 ($ MILLION)

23. SOUTH KOREA VALVE DRIVER MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF ASIA-PACIFIC VALVE DRIVER MARKET SIZE, 2023-2031 ($ MILLION)

25. LATIN AMERICA VALVE DRIVER MARKET SIZE, 2023-2031 ($ MILLION)

26. MIDDLE EAST AND AFRICA VALVE DRIVER MARKET SIZE, 2023-2031 ($ MILLION)