Vegan Ice Cream Market

Global Vegan Ice Cream Market Size, Share & Trends Analysis Report by Source (Almond Milk, Cashew Milk, Coconut Milk, Soy Milk, and Others (Oat Milk, Rice Milk)), by Flavor (Caramel, Chocolate, Coconut, Coffee, Fruit, Vanilla, and Others), and by Distribution Channel (Convenience Stores, Supermarkets/Hypermarkets, and Online Stores) Forecast Period (2020-2026) Update Available - Forecast 2025-2035

The global vegan ice cream market is projected to propagate at a CAGR of 8.5% during the forecast period (2020-2026). Vegan ice cream is made from the milk extracted from several sources including almond, coconut, oat, soy, cashew, and rice, among more. It is made available in a lot of flavors such as chocolate, caramel, coconut, coffee, vanilla, and various fruit flavors. An increasing number of vegans and health-conscious customers across the globe have been responsible for the growth of the vegan ice cream industry. In addition, increasing consciousness for lactose intolerance has seen individuals switching to non-dairy or vegan food products, which has stirred an increasing demand for vegan ice cream. In recent times, vegan ice cream has gained tremendous momentum in developed as well as developing countries, owing to the aforementioned facets.

Further, increasing disposable income coupled with increasing animal cruelty-free catering individuals will play an imperative role in the growth of the vegan ice cream market in the years to come. The rise of e-commerce will also play an important role in the vegan ice cream market growth with more and more brands increasingly offer online sales channels. There is a tremendous shift toward veganism as increasingly more consumers are exposed to information regarding veganism and animal welfare, in turn, inclined towards vegan ice cream.

Segmental Outlook

The vegan ice cream market is segmented based on source, flavor, and distribution channel. Based on the source, the vegan ice cream market is segmented into almond milk, cashew milk, coconut milk, soy milk, and others (oat milk, rice milk). Based on flavor, the market is classified into caramel, chocolate, coconut, coffee, fruit, vanilla, and others. Based on the distribution channel, the market is segmented into convenience stores, supermarkets/hypermarkets, and online stores.

Supermarkets/Hypermarkets to Dominate Distribution Channels

The supermarket/hypermarket sub-segment is estimated to be dominant in the base year, continuing to perceive remarkable growth during the forecast period. Expansion of supermarkets/hypermarkets format in developed and emerging economies has been the accountable factor for the growth of this category. In recent times, the major retailing giants such as Tesco and Walmart have expanded their businesses manifolds and recorded exceptional growth, which, in turn, could prove imperative for the vegan ice cream vendors.

Regional Outlook

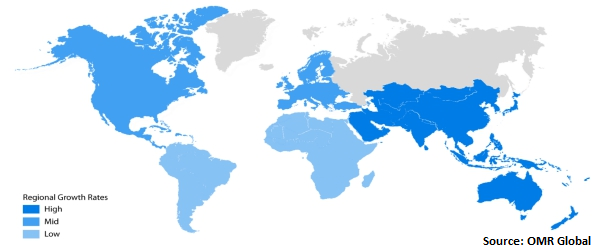

The global vegan ice cream market is further segmented based on geography including North America, Europe, Asia-Pacific, and the Rest of the World. The market in Europe is expected to hold considerable market share attributing to increasing veganism, majorly. The leaders in the European vegan ice cream market have been focusing on market expansion while bolstering their production capacities to enlarge their footprints in this growing market. According to the WHO (World Health Organization), about half of the population in the EU is obese. Correspondingly, the UK is estimated to be the largest market for vegan ice cream in Europe, owing to the prevalence of high levels of obesity. The market in Asia-Pacific is expected to record the highest growth rate and surpass North America by the end of the forecast period, owing to the growth in disposable income and increasing veganism, which has made the region, a profitable sector for the vendors.

Global Vegan Ice Cream Market Growth, by Region 2020-2026

Market Players Outlook

The companies have been expanding their geographic footprints across the globe, looking for potential markets to increase their customer base. Some of the industry leaders include Unilever Group, Danone S.A., Wells Enterprises, Inc., General Mills, Inc., and NADAMOO! (Little Red Rooster Ice Cream Company). The players are continuously introducing new flavors in the market in order to capture more market. For instance, in March 20202, Magnum (Unilever Group) launches vegan sea salt caramel ice cream in the US. Further, Magnum joins several ice-cream brands that are launching more dairy-free options in a bid to cater to the growing demand for plant-based options.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global vegan ice cream market. Based on the availability of data, information related to the products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Strategy Analysis

3.2. Key Company Analysis

3.2.1. Unilever Group

3.2.1.1. Overview

3.2.1.2. Financial Analysis

3.2.1.3. SWOT Analysis

3.2.1.4. Recent Developments

3.2.2. Danone S.A.

3.2.2.1. Overview

3.2.2.2. Financial Analysis

3.2.2.3. SWOT Analysis

3.2.2.4. Recent Developments

3.2.3. Wells Enterprises, Inc.

3.2.3.1. Overview

3.2.3.2. Financial Analysis

3.2.3.3. SWOT Analysis

3.2.3.4. Recent Developments

3.2.4. General Mills, Inc. (Häagen-Dazs)

3.2.4.1. Overview

3.2.4.2. Financial Analysis

3.2.4.3. SWOT Analysis

3.2.4.4. Recent Developments

3.2.5. NADAMOO! (Little Red Rooster Ice Cream Company)

3.2.5.1. Overview

3.2.5.2. Financial Analysis

3.2.5.3. SWOT Analysis

3.2.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Vegan Ice Cream Industry Market by Source

5.1.1. Almond Milk

5.1.2. Cashew Milk

5.1.3. Coconut Milk

5.1.4. Soy Milk

5.1.5. Others (Oat Milk, Rice Milk)

5.2. Global Vegan Ice Cream Market by Flavor

5.2.1. Caramel

5.2.2. Chocolate

5.2.3. Coconut

5.2.4. Coffee

5.2.5. Fruit

5.2.6. Vanilla

5.2.7. Others

5.3. Global Vegan Ice Cream Market by Distribution Channel

5.3.1. Convenience Stores

5.3.2. Supermarkets/Hypermarkets

5.3.3. Online Stores

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Alden’s Organic (Oregon Ice Cream)

7.2. Arctic Zero, Inc.

7.3. Beyond Better Foods, LLC (Enlightened)

7.4. Bliss Unlimited, LLC

7.5. Coolhaus

7.6. Danone S.A.

7.7. Double Rainbow Ice Creams, Inc.

7.8. General Mills, Inc. (Häagen-Dazs)

7.9. Happy Cow,Ltd.

7.10. NADAMOO! (Little Red Rooster Ice Cream Company)

7.11. O’MY Foods, LLC

7.12. Oatly AB

7.13. Over The Moo Pty, Ltd.

7.14. Papacream

7.15. Perry's Ice Cream

7.16. Target Brands, Inc.

7.17. The Booja-Booja Company

7.18. The Hain Celestial Group

7.19. Wells Enterprises, Inc.

7.20. Wonderlab Doozy, Inc.

7.21. Unilever Group

7.22. Veganarke Enterprises Pvt. Ltd.

1. GLOBAL VEGAN ICE CREAM MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

2. GLOBAL ALMOND MILK MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL CASHEW MILK MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL COCONUT MILK MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL SOY MILK MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL OTHERS (OAT MILK, RICE MILK) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL VEGAN ICE CREAM MARKET RESEARCH AND ANALYSIS BY FLAVOR, 2019-2026 ($ MILLION)

8. GLOBAL CARAMEL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL CHOCOLATE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL COCONUT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL COFFEE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL FRUIT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL VANILLA MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

15. GLOBAL VEGAN ICE CREAM MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

16. GLOBAL CONVENIENCE STORES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

17. GLOBAL SUPERMARKETS/HYPERMARKETS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

18. GLOBAL ONLINE STORES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

19. NORTH AMERICAN VEGAN ICE CREAM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

20. NORTH AMERICAN VEGAN ICE CREAM MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

21. NORTH AMERICAN VEGAN ICE CREAM MARKET RESEARCH AND ANALYSIS BY FLAVOR, 2019-2026 ($ MILLION)

22. NORTH AMERICAN VEGAN ICE CREAM MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

23. EUROPEAN VEGAN ICE CREAM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

24. EUROPEAN VEGAN ICE CREAM MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

25. EUROPEAN VEGAN ICE CREAM MARKET RESEARCH AND ANALYSIS BY FLAVOR, 2019-2026 ($ MILLION)

26. EUROPEAN VEGAN ICE CREAM MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

27. ASIA-PACIFIC VEGAN ICE CREAM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

28. ASIA-PACIFIC VEGAN ICE CREAM MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

29. ASIA-PACIFIC VEGAN ICE CREAM MARKET RESEARCH AND ANALYSIS BY FLAVOR, 2019-2026 ($ MILLION)

30. ASIA-PACIFIC VEGAN ICE CREAM MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

31. REST OF THE WORLD VEGAN ICE CREAM MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

32. REST OF THE WORLD VEGAN ICE CREAM MARKET RESEARCH AND ANALYSIS BY FLAVOR, 2019-2026 ($ MILLION)

33. REST OF THE WORLD VEGAN ICE CREAM MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

1. GLOBAL VEGAN ICE CREAM MARKET SHARE BY SOURCE, 2019 VS 2026 (%)

2. GLOBAL VEGAN ICE CREAM MARKET SHARE BY FLAVOR, 2019 VS 2026 (%)

3. GLOBAL VEGAN ICE CREAM MARKET SHARE BY DISTRIBUTION CHANNEL, 2019 VS 2026 (%)

4. GLOBAL VEGAN ICE CREAM MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. THE US VEGAN ICE CREAM MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA VEGAN ICE CREAM MARKET SIZE, 2019-2026 ($ MILLION)

7. UK VEGAN ICE CREAM MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE VEGAN ICE CREAM MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY VEGAN ICE CREAM MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY VEGAN ICE CREAM MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN VEGAN ICE CREAM MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE VEGAN ICE CREAM MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA VEGAN ICE CREAM MARKET SIZE, 2019-2026 ($ MILLION)

14. INDIA VEGAN ICE CREAM MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN VEGAN ICE CREAM MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC VEGAN ICE CREAM MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD VEGAN ICE CREAM MARKET SIZE, 2019-2026 ($ MILLION)