Vehicle Reseller Market

Global Vehicle Reseller Market Size, Share & Trends Analysis Report by Vehicle Type (Hatchback, Sedan, and Sports Utiity Vehicle (SUV)), By Vendor Type (Franchise Dealer and Independent Dealer), and by Propulsion Type (Internal Combustion Engine (ICE)) Forecast Period (2021-2027) Update Available - Forecast 2025-2031

The global vehicle reseller market is anticipated to grow at a significant CAGR of 8.0% during the forecast period. The market is primarily driven by the reduced per capita income of the population across various countries including Pakista, Somalia, and others, which led in shifting the customers towards the used cars. According to the CEIC Data released in 2019, the annual household income per capita of Pakistan has been reduced to $587.0 in Jun 2019, compared with the previous value of $650.6 estimated back in June 2016. Another major factor contributing in the growth of the market is social distancing and people perception towards public transport. Further, the country sold around 238,000 units of used vehilced within the year 2020-2021

However,the rise in implication of The biggest constraint for the market is the lack of regulation, hampering any growth of the market due to fear of government authority. Other constraints hindering the market growth is increase in implementation of strict government guidelines for pollution control due to which most of the vehicles areunable to get registrations. With an increase in e-commerce platforms, vehicle sharing services play an important role in the future growth in the vehicle reseller market.

Impact of COVID-19 Pandemic on Global Vehicle Reseller Market

The COVID-19 pandemic had disrupted the supply chain of many industries across the globe, which had moderately reduced the demand for used vehicles. Travel restriction, the rapid increase of oil prices, and shrinkage of disposable income also adversely affected the vehicle reseller industry but not on the same level as the new vehicle industry. According to CNBC as the COVID-19 pandemic situation normalizes, the vehicle reseller industry will be seeing rapid growth due to recovery of the supply chain, social distancing, and avoidance of public transport.

Segmental Outlook

The global vehicle reseller market is segmented based on the vehicle type, vendor type, and propulsion type. Based on the vehicle type, the market is segmented into hatchback, sedan, and sports utility vehicles (SUV). Based on the vendor type, the market is sub-segmented into the franchise dealer and independent dealer. Based on the propulsion type, the market is sub-segmented into the internal combustion engine (ICE), which comprises of petrol and diesel. Among the vendor type, the independent dealer segment is expected to provide significant growth to the global vehicle reseller market. Due to the rapidly establishment several numbers of independent delaers across the developed and emerging economies such as the US and India, among others. According to the National Independent Automobile Dealers Association data released in 2020, there were around 38,000 independent delaers for reselling of used cars. The above-mentioned segments can be customized as per the requirements.

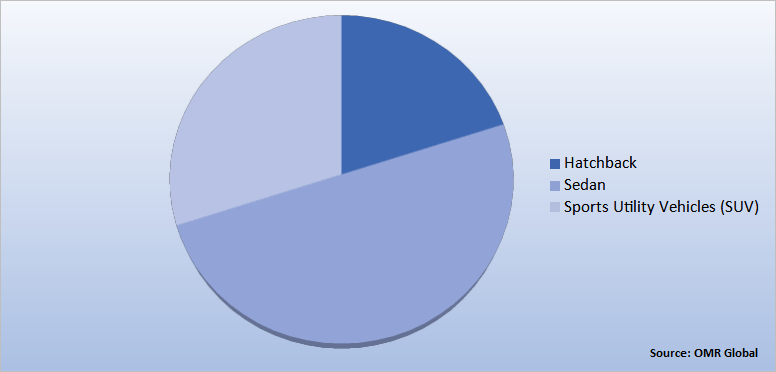

Global Vehicle Reseller Market Share by Vehicle Type, 2020 (%)

Sedan Vehicle Type Segment among others to Hold the Prominent Market Share in the Vehicle Reseller Market Globally

Among the vehicle type segment, the sedan vehicles are anticipated to drive the growth of the vehicle reseller maret during the forecast period (2021-2027). With the growing demand od luxury cars the market vehicle reseller is expected to cater significant boost. Owing to the high prices associated with the sedan vehicles, consumers avoid buying new vehicles. However, the heavy depreciation in sedan car prices have made these vehicles a preferred choice of the consumers in the vehicle reseller market. For instance, in 2019, as per the statistics revealed by the OLx Autos, more than 55,000 luxury cars each pricing above INR 15 lakh has been listed on OLX along with the sale of premium cars raised by over four times in 2019.

Regional Outlooks

The global Vehicle Reseller market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement.

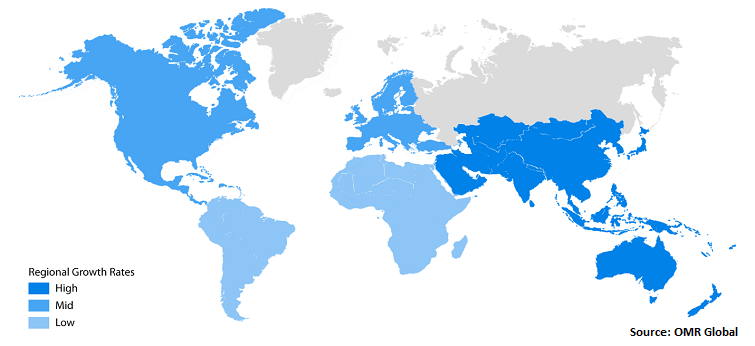

Global Vehicle Reseller Market Growth, by Region 2021-2027

The Asia-Pacific Region Holds the Major Share in the Global Vehicle Reseller Market

The Asia-pacific region is considered to hold the majority share in the vehicle reseller market. The major factor contributing to the growth of the market is the presence of used cars market giants in China which dominates the regional market. Additionally, with the introduction of new standards concerned to BS-VI emission implemented by the Government of economies such as India and others, the technological cost of cars to meet the standards will be undertaken by consumers. According to the MD and CEO of Mahindra First Choice Wheels (MFCW) in 2020, the company shifted its focus on reducing the production of diesel cars, with Maruti Suzuki's decision with an aim to divest the diesel car segment by April 2020.Market Players Outlook

The major companies serving the global vehicle reseller market include AutoNation, Inc., Cars24 Services Pvt. Ltd., Olx Autos, Maruti TrueValue, Olx Autos, TrueCar, Inc., Vroom, Inc., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in August 2021, CarMax announced its expansion in Dallas with a new technology innovation center, which offers new auction facility and new remote customer experience center trough which they can sale an buy used cars.

The Report Covers

• Market value data analysis of 2020 and forecast to 2027.

• Annualized market revenues ($ million) for each market segment.

• Country-wise analysis of major geographical regions.

• Key companies operating in the global vehicle reseller market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

• Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

• Analysis of market entry and market expansion strategies.

• Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Vehicle Reseller Market

• Recovery Scenario of Global Vehicle Reseller Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Vehicle Reseller Market by Vehicle Type

4.1.1. Hatchback

4.1.2. Sedan

4.1.3. Sports Utility Vehicle (SUV)

4.2. Global Vehicle Reseller Market by Vendor Type

4.2.1. Franchise Dealer

4.2.2. Independent Dealer

4.3. Global Vehicle Reseller Market by Propulsion Type

4.3.1. Internal Combustion Engine(ICE)

4.3.1.1. Petrol

4.3.1.2. Diesel

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Asbury Automotive Group, Inc.

6.2. AutoNation, Inc.

6.3. Big Boy Toyz ltd.

6.4. CarMax Business Services, LLC

6.5. Cars24 Services Pvt.Ltd.

6.6. Carvana Co.

6.7. Copart Inc.

6.8. Cox Automobile.com, Inc.

6.9. Group1 Automotive Inc.

6.10. Hendrick Automotive Group

6.11. Kar Auction Services Inc.

6.12. Lithia Motors, Inc.

6.13. Mahindra & Mahindra Limited

6.14. Maruti Suzuki India Limited

6.15. Olx Autos

6.16. Scout24 SE

6.17. TrueCar, Inc.

6.18. Vroom, Inc.

1. GLOBAL VEHICLE RESELLER MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2020-2027 ($ MILLION)

2. GLOBAL HATCHBACK VEHICLE RESELLER MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL SEDAN VEHICLE RESELLER MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL SPORTS UTILITY VEHICLE (SUV) RESELLER MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL VEHICLE RESELLER MARKET RESEARCH AND ANALYSIS BY VENDOR TYPE, 2020-2027 ($ MILLION)

6. GLOBAL VEHICLE RESELLER IN FRANCHISE DEALER MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL VEHICLE RESELLER IN INDEPENDENT DEALER MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL VEHICLE RESELLER MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2020-2027 ($ MILLION)

9. GLOBAL INTERNAL COMBUSTION ENGINE (ICE) VEHICLE RESELLER MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL PETROL ICE VEHICLE RESELLER MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL DIESEL ICE VEHICLE RESELLER MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL VEHICLE RESELLER MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($MILLION)

13. NORTH AMERICAN VEHICLE RESELLER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

14. NORTH AMERICAN VEHICLE RESELLER MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2020-2027 ($ MILLION)

15. NORTH AMERICAN VEHICLE RESELLER MARKET RESEARCH AND ANALYSIS BY VENDOR TYPE, 2020-2027 ($ MILLION)

16. NORTH AMERICAN VEHICLE RESELLER MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2020-2027 ($ MILLION)

17. EUROPEAN VEHICLE RESELLER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

18. EUROPEAN VEHICLE RESELLER MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2020-2027 ($ MILLION)

19. EUROPEAN VEHICLE RESELLER MARKET RESEARCH AND ANALYSIS BY VENDOR TYPE , 2020-2027 ($ MILLION)

20. EUROPEAN VEHICLE RESELLER MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE , 2020-2027 ($ MILLION)

21. ASIA-PACIFIC VEHICLE RESELLER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

22. ASIA-PACIFIC VEHICLE RESELLER MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2020-2027 ($ MILLION)

23. ASIA-PACIFIC VEHICLE RESELLER MARKET RESEARCH AND ANALYSIS BY VENDOR TYPE, 2020-2027 ($ MILLION)

24. ASIA-PACIFIC VEHICLE RESELLER MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2020-2027 ($ MILLION)

25. REST OF THE WORLD VEHICLE RESELLER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

26. REST OF THE WORLD VEHICLE RESELLER MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2020-2027 ($ MILLION)

27. REST OF THE WORLD VEHICLE RESELLER MARKET RESEARCH AND ANALYSIS BY VENDOR TYPE, 2020-2027 ($ MILLION)

28. REST OF THE WORLD VEHICLE RESELLER MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL VEHICLE RESELLER MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL VEHICLE RESELLER MARKET BY SEGMENT,2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL VEHICLE RESELLER MARKET, 2021-2027 (%)

4. GLOBAL VEHICLE RESELLER MARKET SHARE BY VEHICLE TYPE, 2020 VS 2027 (%)

5. GLOBAL HATCHBACK VEHICLE RESELLER MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

6. GLOBAL SEDAN VEHICLE RESELLER MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL SPORTS UTILITY VEHICLE (SUV) RESELLER MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL VEHICLE RESELLER MARKET SHARE BY VENDOR TYPE, 2020 VS 2027 (%)

9. GLOBAL VEHICLE RESELLER IN FRANCHISE DREALER MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

10. GLOBAL VEHICLE RESELLER IN INDEPENDENT DEALER MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

11. GLOBAL VEHICLE RESELLER MARKET SHARE BY PROPULSION TYPE, 2020 VS 2027 (%)

12. GLOBAL INTERNAL COMBUSTION ENGINE (ICE) VEHICLE RESELLER MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

13. GLOBAL PETROL ICE VEHICLE RESELLER MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

14. GLOBAL DIESEL ICE VEHICLE RESELLER MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

15. GLOBAL VEHICLE RESELLER MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

16. US VEHICLE RESELLER MARKET SIZE, 2020-2027 ($ MILLION)

17. CANADA VEHICLE RESELLER MARKET SIZE, 2020-2027 ($ MILLION)

18. UK VEHICLE RESELLER MARKET SIZE, 2020-2027 ($ MILLION)

19. FRANCE VEHICLE RESELLER MARKET SIZE, 2020-2027 ($ MILLION)

20. GERMANY VEHICLE RESELLER MARKET SIZE, 2020-2027 ($ MILLION)

21. ITALY VEHICLE RESELLER MARKET SIZE, 2020-2027 ($ MILLION)

22. SPAIN VEHICLE RESELLER MARKET SIZE, 2020-2027 ($ MILLION)

23. REST OF EUROPE VEHICLE RESELLER MARKET SIZE, 2020-2027 ($ MILLION)

24. INDIA VEHICLE RESELLER MARKET SIZE, 2020-2027 ($ MILLION)

25. CHINA VEHICLE RESELLER MARKET SIZE, 2020-2027 ($ MILLION)

26. JAPAN VEHICLE RESELLER MARKET SIZE, 2020-2027 ($ MILLION)

27. SOUTH KOREA VEHICLE RESELLER MARKET SIZE, 2020-2027 ($ MILLION)

28. REST OF ASIA-PACIFIC VEHICLE RESELLER MARKET SIZE, 2020-2027 ($ MILLION)

29. REST OF THE WORLD VEHICLE RESELLER MARKET SIZE, 2020-2027 ($ MILLION)