Vehicle Scanner Market

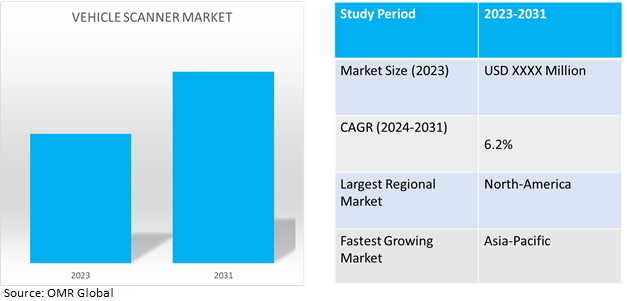

Vehicle Scanner Market Size, Share & Trends Analysis Report by Component (Portable, and Fixed). and by Structure Type (Drive-Through, and UVSS). by Application (Government, and Private). and by Components (Hardware, and Software). Forecast Period (2024-2031).

Vehicle scanner market is anticipated to grow at a considerable CAGR of 6.2% during the forecast period (2024-2031). Vehicle scanners are used by various government and private organizations to enhance the security and safety of their premises. It is used to screen or diagnose any external or internal threat by a vehicle such as ammunition, weapons, smuggled material, or any abnormality within the vehicle. It is widely used in airports, ports, crowded gatherings, corporate complexes, national borders, and other places.

Market Dynamics

Growing Smart Infrastructure Investments

In recent years governments globally have taken constant measures to enhance public safety through infrastructure development. As countries are willing to invest more in smart city initiatives, the demand for security systems such as vehicle scanners is expected to increase. For instance, as per the International Trade Administration, the Indian government has plans to invest approximately $30.0 billion in smart city initiatives. These projects are expected to provide opportunities for US safety and security companies. Related hardware will be in high demand, including surveillance and safety equipment, communication devices, displays and video surveillance, access control systems, and detectors and sensors that incorporate Internet-of-Things technologies, power backup systems, and traffic management systems.

Investments to Counter Illegal and Criminal Activities

As a tactic to counter security breaches and enhance safety, there is a constant demand for advanced scanning technologies to detect contraband, explosives, and other illicit materials at border crossings, ports, and high-security facilities. Governments are constantly allocating budgets to reduce issues such as immigration, smuggling, human trafficking, and others. For instance, n. US defense budget included nearly $25.0 billion for U.S. Customs and Border Protection (CBP) and Immigration and Customs Enforcement (ICE), an increase of almost $800.0 million over the 2023 enacted level. It also included funds for CBP to hire an additional 350 Border Patrol Agents, $535.0 million for border security technology at and between ports of entry, $40.0 million to combat fentanyl trafficking and disrupt transnational criminal organizations

Market Segmentation

Our in-depth analysis of the global vehicle scanner market includes the following segments by type, structure type, application, and component:

- Based on type, the market is bifurcated into portable, and fixed vehicle scanners.

- Based on structure type, the market is bifurcated into drive-through, and UVSS.

- Based on application, the market is bifurcated into government, and private sectors.

- Based on component, the market is bifurcated into hardware and software.

Fixed Vehicle Scanner to Remain as the Largest Segment

Based on the type, the fixed vehicle scanner sub-segment is expected to hold the largest share of the market. The primary factors supporting the segment are the usage of vehicle scanning devices at stationary locations, scanning device requirements at public places, system size, and feasibility of vehicle scanning devices for government usage.

Drive-Through Systems to Hold Substantial Share

Based on systems type, most organizations invest in drive-through systems as they provide better control in monitoring and exercising response to any threat. Also, drive-through scanning systems are scalable, adaptable, and critical for maintaining automobile safety and compliance providing seamless integration into existing traffic flow, while reducing interruptions while increasing security at critical checkpoints such as border crossings, airports, and high-security institutions.

Governments to Remain as the Largest Sub-segment

Government organization is the biggest consumer of vehicle scanner systems as it requires such systems to cover wide border areas, public premises, transportation facilities, and other confidential premises. The government is also the biggest investor in recent years into security and defense technologies making it one of the major consumers of such scanning systems.

Software is Projected to Dominate the Market

Vehicle scanning software is getting innovated through new technology and integration with high-profile sensors, artificial intelligence (AI), and machine learning (ML) technology making it the growing sub-segment among the two. Also, major players in the market have developed AI integrated scanners to improve current products. For instance, Gatekeeper’s launched an automatic under-vehicle inception system. IVUS finds foreign objects, changes, and anomalies within seconds and automatically compares the subject vehicle's undercarriage to a reference image (stored in the GEMS® database) and displays both on the screen, making it a fully automated vehicle inspection system.

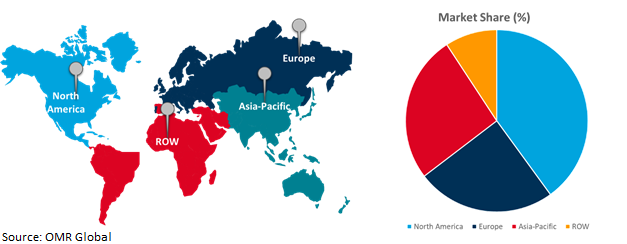

Regional Outlook

The global vehicle scanner market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Vehicle Scanner Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, the North American region has been one of the leading markets for vehicle scanning systems due to its huge defense budget, demand for high-tech security systems in cities and private buildings, government investment into scanning systems, longest border exposure with Canada, developed infrastructure and rising highway construction operations. Also, North American markets have two biggest players in the vehicle scanning space creating possibilities for exporting such high-tech scanners globally as well as for domestic consumption. Also, North American countries have made investments in upgrading state-run premise security. For instance, in January 2023, the US General Services Administration (GSA) and the US Department of Homeland Security Customs and Border Protection (CBP) held a groundbreaking ceremony with local, state, and federal officials to commemorate the start of the $308.0 million project to modernize and expand the San Luis I Land Port of Entry as part of President Biden's Investing in America Agenda. The project, funded by the Bipartisan Infrastructure Law and the Inflation Reduction Act, would replace the port's undersized 1980s infrastructure with new, larger buildings and greater inspection capacity. The project will increase the number of northbound vehicle inspection lanes from eight to sixteen, create a 16,000-square-foot canopy, and facilitate the installation of cutting-edge inspection technologies to assist CBP's security mandate. The project also includes a new 21,000-square-foot pedestrian inspection structure, which will increase the number of inspection booths from ten to fourteen while enhancing pedestrian traffic flow.

Asia-Pacific Remains as the Fastest Growing

- Asia-Pacific is one of the fastest growing regions globally, with rising demand for smart technology and infrastructure creating demand for vehicle scanning systems.

- Rising rate of cross-border smuggling and illegal activities, along with government investment to upgrade state-run premises to stimulate demand in the region.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global vehicle scanner market include E Include KTG GmbH (Secuscan), Gatekeeper Security Inc. (OSI Systems, Inc.), Godrej & Boyce Manufacturing Co. Ltd, Tescon AG, and International Road Dynamics Inc., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in October 2023, International Road Dynamics was awarded a $2.8 million contract for a Caltrans ramp e-screening system. The contract covers the supply of a high-speed Weigh-In-Motion ("WIM") pre-clearance system and a sophisticated Ramp E-screening system at the Cajon weigh station.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global vehicle scanner market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. International Road Dynamics Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. KTG GmbH (Secuscan)

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Gatekeeper Security Inc. (OSI Systems, Inc.)

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Godrej & Boyce Manufacturing Co. Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Tescon AG

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Vehicle Scanner Market by Type

4.1.1. Portable

4.1.2. Fixed

4.2. Global Vehicle Scanner Market by Structure Type

4.2.1. Drive-through

4.2.2. UVSS

4.3. Global Vehicle Scanner Market by Application

4.3.1. Government

4.3.2. Private

4.4. Global Vehicle Scanner Market by Component

4.4.1. Hardware

4.4.2. Software

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Advanced Detection Technology LLC

6.2. Chemring Group PLC

6.3. Chempolis Ltd.

6.4. Intelliscan

6.5. Leidos, Inc.

6.6. Omnitec Security Systems LLC

6.7. Rapiscan Systems, Inc.

6.8. SCANLAB GmbH

6.9. SecureOne International, BV (UV Scan)

6.10. Baotairan (Shenzhen) Technology Group Co., LTD.

6.11. UVeye Ltd.

6.12. Vehant Technologies

6.13. VMI Systems Corp.

6.14. Zhejiang Dahua Technology Co., Ltd

1. GLOBAL PORTABLE VEHICLE SCANNER MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL PORTABLE VEHICLE SCANNER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL FIXED VEHICLE SCANNER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL VEHICLE SCANNER MARKET RESEARCH AND ANALYSIS BY STRUCTURE TYPE, 2023-2031 ($ MILLION)

5. GLOBAL VEHICLE SCANNER FOR DRIVE-THROUGH MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL VEHICLE SCANNER FOR UVSS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL VEHICLE SCANNER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

8. GLOBAL VEHICLE SCANNER IN GOVERNMENT SECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL VEHICLE SCANNER IN PRIVATE SECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL VEHICLE SCANNER MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

11. GLOBALVEHICLE SCANNER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBALVEHICLE SCANNER HARDWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL VEHICLE SCANNER SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. NORTH AMERICAN VEHICLE SCANNER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. NORTH AMERICAN VEHICLE SCANNER MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

16. NORTH AMERICAN VEHICLE SCANNER MARKET RESEARCH AND ANALYSIS BY STRUCTURE TYPE, 2023-2031 ($ MILLION)

17. NORTH AMERICAN VEHICLE SCANNER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

18. NORTH AMERICAN VEHICLE SCANNER MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

19. EUROPEAN VEHICLE SCANNER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. EUROPEAN VEHICLE SCANNER MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

21. EUROPEAN VEHICLE SCANNER MARKET RESEARCH AND ANALYSIS BY STRUCTURE TYPE, 2023-2031 ($ MILLION)

22. EUROPEAN VEHICLE SCANNER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

23. EUROPEAN VEHICLE SCANNER MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC VEHICLE SCANNER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC VEHICLE SCANNER MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC VEHICLE SCANNER MARKET RESEARCH AND ANALYSIS BY STRUCTURE TYPE, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC VEHICLE SCANNER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC VEHICLE SCANNER MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

29. REST OF THE WORLD VEHICLE SCANNER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

30. REST OF THE WORLD VEHICLE SCANNER MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

31. REST OF THE WORLD VEHICLE SCANNER MARKET RESEARCH AND ANALYSIS BY STRUCTURE TYPE, 2023-2031 ($ MILLION)

32. REST OF THE WORLD VEHICLE SCANNER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

33. REST OF THE WORLD VEHICLE SCANNER MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

1. GLOBAL VEHICLE SCANNER MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL PORTABLE VEHICLE SCANNER MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL FIXED VEHICLE SCANNER MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL VEHICLE SCANNER MARKET SHARE BY STRUCTURE TYPE, 2023 VS 2031 (%)

5. GLOBAL VEHICLE SCANNER FOR DRIVE-THROUGH MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL VEHICLE SCANNER FOR UVSS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL VEHICLE SCANNER MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

8. GLOBAL VEHICLE SCANNER IN GOVERNMENT SECTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL VEHICLE SCANNER IN PRIVATE SECTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL VEHICLE SCANNER MARKET SHARE BY COMPONENT, 2023 VS 2031 (%)

11. GLOBAL VEHICLE SCANNER HARDWARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL VEHICLE SCANNER SOFTWARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL VEHICLE SCANNER MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. US VEHICLE SCANNER MARKET SIZE, 2023-2031 ($ MILLION)

15. CANADA VEHICLE SCANNER MARKET SIZE, 2023-2031 ($ MILLION)

16. UK VEHICLE SCANNER MARKET SIZE, 2023-2031 ($ MILLION)

17. FRANCE VEHICLE SCANNER MARKET SIZE, 2023-2031 ($ MILLION)

18. GERMANY VEHICLE SCANNER MARKET SIZE, 2023-2031 ($ MILLION)

19. ITALY VEHICLE SCANNER MARKET SIZE, 2023-2031 ($ MILLION)

20. SPAIN VEHICLE SCANNER MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF EUROPE VEHICLE SCANNER MARKET SIZE, 2023-2031 ($ MILLION)

22. INDIA VEHICLE SCANNER MARKET SIZE, 2023-2031 ($ MILLION)

23. CHINA VEHICLE SCANNER MARKET SIZE, 2023-2031 ($ MILLION)

24. JAPAN VEHICLE SCANNER MARKET SIZE, 2023-2031 ($ MILLION)

25. SOUTH KOREA VEHICLE SCANNER MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF ASIA-PACIFIC VEHICLE SCANNER MARKET SIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICA VEHICLE SCANNER MARKET SIZE, 2023-2031 ($ MILLION)

28. MIDDLE EAST AND AFRICA VEHICLE SCANNER MARKET SIZE, 2023-2031 ($ MILLION)