Vehicle Security Systems Market

Vehicle Security Systems Market Size, Share & Trends Analysis Report, By Vehicle Type (Passenger Car and Commercial Vehicle), By Product Type (Alarm, Immobilizer, Central Locking System, and Keyless Entry), and Forecast 2019-2025. Update Available - Forecast 2025-2035

The global vehicle security systems market is estimated to grow at a CAGR of 6.9% during the forecast period. The major factor contributing to the growth of the market include increasing incidences of vehicle theft. Significant incidences of vehicle theft have been reported across the globe. For instance, as per the Federal Bureau of Investigation, in the US, an estimated 773,139 motor vehicle thefts reported in 2017. The estimated rate of motor vehicle thefts was 237.4 per 100,000 inhabitants. In 2017, the cost of stolen vehicles was valued at nearly $6 billion and automobiles comprised of 75.4% of those vehicles.

This leads to the adoption of anti-theft security systems to prevent such concerns to a greater extent. The system gives an alarm when someone tries to break into the vehicle. The primarily adopted security systems include immobilizers, keyless entry systems, and alarm systems. Currently, a large number of vehicles have a remote keyless entry system that alerts the vehicle against the lock, unlock, and theft. Such systems use a frequency of 433.92 MegaHz in Europe, and 315 MegaHz in the US and Japan. Several companies are establishing a partnership for the development of most effective vehicle security systems.

For instance, in September 2018, DENSO Corp. inked a joint venture agreement with NRI SecureTechnologies, Ltd. This agreement is aimed at detecting and diagnosing the security risks of in-vehicle electronic products. Both these companies opened NDIAS, Ltd., a new cybersecurity company, which is equally owned by NRI and Denso. NDIAS will harness the expertise of Denso in the development of in-vehicle quality and cybersecurity technology and the proprietary machine learning technology of NRI to protect consumers against the growing cyber-attacks threats in the automotive industry.

This collaboration will provide combined security diagnosis and consulting services for in-vehicle electronic products, ranging from the vehicle development phase to the actions needed after bulk production. This, in turn, improve the security and efficiency of vehicle security systems and allows vehicle owners to adopt these systems to prevent vehicle thefts concerns.

Segmentation

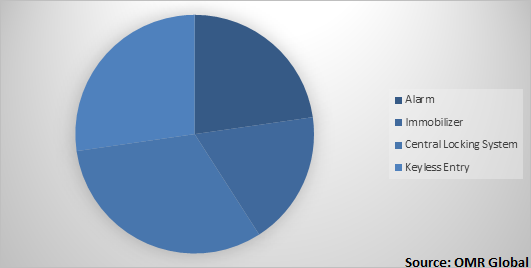

The global vehicle security systems market is segmented based on vehicle type and product type. Based on the vehicle type, the market is classified into passenger cars and commercial vehicles. Among these, passenger vehicle is expected to hold a significant share in the market. Based on product type, the market is classified into alarm, immobilizer, central locking system, and keyless entry. The trend of remote keyless entry systems is gaining traction in the Asia-Pacific region and tends to present an ample opportunity for the future growth of the market.

Global Vehicle Security Systems Market Share by Product Type, 2018 (%)

Immobilizer has Witnessed Significant Growth in the Product Type Segment in 2018

The immobilizer is one of the most common ways of limiting access to unauthorized drivers. The immobilizer system prevents the theft of vehicles by allowing only the authorized key to start the engine. The transponder inside the key communicates with the immobilizer installed in the key box, and the system permits the engine to start after confirming the encrypted coding from the engine ECU. The engine immobilizer is considered a secure way to stop thieves from stealing cars through hotwiring or conventional techniques, such as hammering the ignition with a screwdriver to force it to start.

Further, the immobilizer is mandatory in countries, such as UK and Germany and is found in most modern cars. The major benefit of immobilizer is that it doesn’t require to be activated by the car owner and thereby functions automatically and the computer control of the vehicle detects the absence of a key and wrong code.

Regional Outlook

Geographically, the global vehicle security systems market is segmented into four major regions, including North America, Europe, Asia-Pacific, and the Rest of the World (RoW). North America is estimated to hold a significant share in the market, owing to the rising number of vehicle thefts coupled with the increasing awareness regarding the anti-theft vehicle system in the region. In addition, a significant rise in the demand for autonomous vehicles is further expected to drive the market growth in the region.

However, Asia-Pacific is estimated to witness substantial growth during the forecast period owing to the increasing automobile production coupled with the growing disposable income in the region. As per the International Organization of Motor Vehicle Manufacturers (OICA), in India, automobile production, including passenger and commercial vehicles increased by 8% to 5.2 million units in 2018. The major automobile manufacturers in the country have been significantly focusing on the integration of advanced technologies in their vehicles to increase the user experience and enhance vehicle security.

For instance, in June 2018, Maruti Suzuki launched a telematics solution, Suzuki Connect for its NEXA customers. The solution is intended to increase user experience and convenience by integrating advanced technology for vehicle tracking, emergency alerts, preventive maintenance calls, and live vehicle status. The solution will be available as an alternative that can be installed by customers in their cars across the NEXA network in India. This growing emphasis on the use of advanced technologies to increase vehicle security and efficiency is expected to propel the growth of the market in the region.

Market Players Outlook

Some of the major players in the market include Robert Bosch GmbH, Delphi Automotive PLC, Continental AG, Denso Corp., and Mitsubishi Electric Corp. Mergers and acquisitions, partnerships and collaborations, and product launches are some of the strategies adopted by the market players to expand market share and gain a competitive advantage over their competitors.

For instance, in January 2019, Mitsubishi Electric Corp. developed a multi-layered defense technology that aims to protect connected vehicles from cyber-attacks with the reinforcement of their head unit's defense capabilities. This will enable to achieve more secure vehicle systems coupled with the rising popularity of vehicles that are equipped for connection to external networks. The company’s new multi-layered defense technology prevents cyber-attacks with a range of potential security features, such as an intrusion detection system without a secure-boot technology and high-load processing that rapidly verifies software integrity throughout the boot process.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global vehicle security systems market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Robert Bosch GmbH

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Delphi Automotive PLC

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Continental AG

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Denso Corp.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Mitsubishi Electric Corp.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Vehicle Security Systems Market by Vehicle Type

5.1.1. Passenger Car

5.1.2. Commercial Vehicle

5.2. Global Vehicle Security Systems Market by Product Type

5.2.1. Alarm

5.2.2. Immobilizer

5.2.3. Central Locking System

5.2.4. Keyless Entry

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Alps Electric Co., Ltd.

7.2. ATT Systems Group

7.3. Continental AG

7.4. DEI Holdings, Inc.

7.5. Delphi Automotive PLC

7.6. Denso Corp.

7.7. Ford Motor Co.

7.8. GPS Security Group

7.9. HELLA GmbH & Co. KGaA

7.10. Lear Corp.

7.11. Mitsubishi Electric Corp.

7.12. Mongoose New Zealand Ltd.

7.13. Moving Intelligence B.V.

7.14. PFK Electronics (Pty) Ltd.

7.15. Robert Bosch GmbH

7.16. Safe & Sound Vehicle Systems Ltd.

7.17. Scorpion Automotive Ltd.

7.18. Tokai Rika Co., Ltd.

7.19. Trailmycar Solutions Ltd.

7.20. Valeo SA

7.21. Yellow Hat Security Solutions Ltd.

7.22. ZF Friedrichshafen AG

1. GLOBAL VEHICLE SECURITY SYSTEMS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2018-2025 ($ MILLION)

2. GLOBAL PASSENGER CAR SECURITY SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL COMMERCIAL VEHICLE SECURITY SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL VEHICLE SECURITY SYSTEMS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

5. GLOBAL ALARM IN VEHICLE SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL IMMOBILIZER IN VEHICLE SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL CENTRAL LOCKING IN VEHICLE SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL KEYLESS ENTRY IN VEHICLE SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL PASSIVE KEYLESS ENTRY VEHICLE SECURITY SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL VEHICLE SECURITY SYSTEMS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

11. NORTH AMERICAN VEHICLE SECURITY SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

12. NORTH AMERICAN VEHICLE SECURITY SYSTEMS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2018-2025 ($ MILLION)

13. NORTH AMERICAN VEHICLE SECURITY SYSTEMS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

14. EUROPEAN VEHICLE SECURITY SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

15. EUROPEAN VEHICLE SECURITY SYSTEMS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2018-2025 ($ MILLION)

16. EUROPEAN VEHICLE SECURITY SYSTEMS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

17. ASIA-PACIFIC VEHICLE SECURITY SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC VEHICLE SECURITY SYSTEMS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC VEHICLE SECURITY SYSTEMS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

20. REST OF THE WORLD VEHICLE SECURITY SYSTEMS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2018-2025 ($ MILLION)

21. REST OF THE WORLD VEHICLE SECURITY SYSTEMS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

1. GLOBAL VEHICLE SECURITY SYSTEMS MARKET SHARE BY VEHICLE TYPE, 2018 VS 2025 (%)

2. GLOBAL VEHICLE SECURITY SYSTEMS MARKET SHARE BY PRODUCT TYPE, 2018 VS 2025 (%)

3. GLOBAL VEHICLE SECURITY SYSTEMS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US VEHICLE SECURITY SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA VEHICLE SECURITY SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

6. UK VEHICLE SECURITY SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE VEHICLE SECURITY SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY VEHICLE SECURITY SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY VEHICLE SECURITY SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN VEHICLE SECURITY SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE VEHICLE SECURITY SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA VEHICLE SECURITY SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA VEHICLE SECURITY SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN VEHICLE SECURITY SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC VEHICLE SECURITY SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD VEHICLE SECURITY SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)