Veterinary Dental Equipment Market

Global Veterinary Dental Equipment Market Size, Share & Trends Analysis Report By Product Type (Dental X-Ray Systems, Electrosurgical Units, Dental Stations, Dental Lasers, Dental Powered Units, Others) By Animal Type (Large and Small) By End-User (Veterinary Hospitals, Veterinary Clinics, and Academic Institute) Forecast 2021-2027 Update Available - Forecast 2025-2035

The global veterinary dental equipment market is anticipated to grow at a CAGR of 6.8% during the forecast period (2021-2027). The global veterinary dental equipment market is driven by increasing periodontal diseases and increasing awareness of pet oral hygiene. Dental problems in animals such as periodontal disease, and gingivitis are similar to humans and require necessary tooth extraction at many times. According to the American Veterinary Medical Association (AVMA), periodontal diseases affect more than 70% of adult cats and 90% of adult dogs. Periodontal diseases are preventable. If left untreated, they can be a cause for other severe diseases such as liver infection, cardiac diseases, stroke, or kidney infection. This fact creates demand for more effective dental care products and increases the number of dental care practices by professionals which in turn drives the market growth. Moreover, the increasing number of pet ownerships, growing awareness of animal healthcare among pet owners, expenditure on animal healthcare, and increasing favorable initiatives and reimbursement policies by governments for animal welfare are other factors positively affecting the growth of the global veterinary dental equipment market.

Apart from these, the rise in the number of veterinary surgeries, and increasing disposable incomes in developed, as well as developing countries such as India and China, is expected to further drive market growth.According to the report from the American Pet Products Association (APPA) in 2018, the average US spending on the dental health of dogs was around $49.70. However, the lack of awareness about advanced developments in pet care among pet owners in lower-income countries may affect the market growth during the forecast period. Moreover, innovations, advancements, and new dental pet care product launches are projected to create growth opportunities for key players in the global market during the forecast period.

Impact of COVID-19 on Global Veterinary Dental Equipment Market

The veterinary dental equipment market is negatively affected by the impact of the COVID-19 pandemic. Due to increased awareness regarding the spreading of virus from animal to human, the adoption of pets was decreased. The COVID-19 pandemic has also weakened the supply chain and created a shortage of animal products and vaccines. Which results in a downfall in market growth.

Segmental Outlook

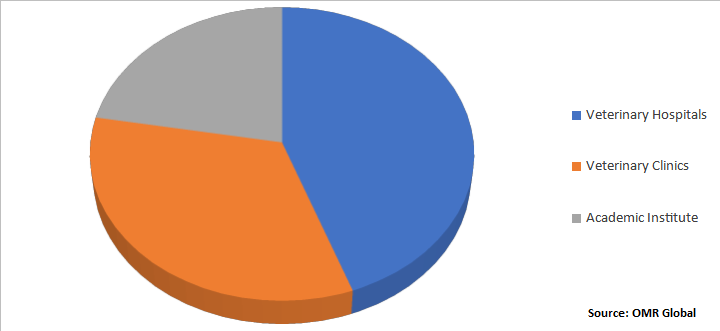

The global veterinary dental equipment market is segmented based on type, animal type, and end-user. Based on type, the market is sub-segmented into dental x-ray systems, electrosurgical units, dental stations, dental lasers, dental powered units, others. Based on animal type, the veterinary dental equipment market is bifurcated into large and small. Whereas, on the basis of end-user, the market is categorized into veterinary hospitals, veterinary clinics, and academic institutes. Among these, the veterinary hospital segment is anticipated to lead the market during the forecast period due to the growing number of veterinarians, and the increasing number of veterinary practices.

Global Veterinary Dental Equipment Market Share by End-User, 2020 (%)

Veterinary Hospitals Held the Significant Share in the Global Veterinary Dental Equipment Market

The increasing number of veterinary hospitals along with professionals, and rising adoption of veterinary dental equipment for veterinary practices in hospitals and clinics are the major factors driving the growth of the market. Apart from these, the rise in the adoption of pets globally is leading to the growth in hospitals and clinics which further increasing the adoption of equipment. As per the American Society for the Prevention of Cruelty to Animals (ASPCA), in the US, nearly 3.2 million shelter animals are adopted each year. In addition, according to a study in 2018, Americans spent about $17 billion on veterinary care in hospitals, clinics, and food. Due to increasing animal adoption, the health problems associated with animals such as periodontal diseasesare also increasing. Hence driving growth of this market segment.

Regional Outlook

Geographically, the global Veterinary Dental Equipment market is classified into four major regions including North America (the US and Canada), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, ASEAN, and Rest of Asia-Pacific), and Rest of the World (Latin America and the Middle East and Africa (MEA)). North America is anticipated to dominate the market during the forecast period. The US is the major economy in North America contributing significantly to the market growth. The major aspects driving the market growth in the US include the increasing number of pet adoption and growing veterinary hospitals and clinics. According to the survey conducted by American Pet Products Association (APPA), 85 million households in the US-owned a pet in the year 2017, and pet industry expenditure was estimated at $69.5 million in the year 2017. Due to the increased number of pet adoption, the demand for veterinary dental care is high in the region, which significantly increases the veterinary dental care practices that further raises the growth of the veterinary dental equipment market.

Global Veterinary Dental Equipment Market Growth, By Region 2021-2027

Asia-Pacific Is Projected To Be The Fastest Growing Region In Global Veterinary Dental Equipment Market

Geographically, Asia-Pacific is anticipated to grow at the fastest CAGR during the forecast period. In Asia-Pacific, China, India, and Japan are the major contributor to the market growth. The factors augmenting the growth of the veterinary equipment market in the Asia-Pacific region include increasing adoption of pets for residential as well as domestic purposes, increasing animal health awareness among pet owners, increasing income levels, and the growing per capita animal health expenditure in several Asia-Pacific major countries. Among all animals, dogs and cats are the largest adopted pet companions in Asia-Pacific countries. As per the National Bureau of Statistics of China, it has been estimated that China is the third-largest country, in terms of dog ownership, a total of 27.4 million pet dogs. In line with this, the country’s pet owners in urban areas have reached 73.55 million. In 2018, Chinese dog and cat owners have spent 5,000 yuan ($773.83) per petan increase of 15% from 2017.The increasing number of pet adoption leading to an increase in the number of diseases in animals. Periodontal disease is the most common disease in small pet animals. Periodontal disease affects over 70% of adults cats and 90% of adult dogs. In order to cure these diseases, dental care is a necessity in pet animals, hence drives the market for dental equipment.

Market Players Outlook

The key players in the veterinary dental equipment market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include Dentalaire International, Dispomed ltd, IM3 Pty Ltd, MAI Animal Health, and Midmark Corp.among others. These market players are adopting several market strategies including product launch and approvals, merger and acquisition, partnership collaboration, business, and capacity expansion, and others. For instance, in June 2021, Covetrus has acquired VCP, one of the market-leading platforms administering veterinary wellness plans to nearly 1,000 veterinary practices, through a definitive agreement. The plan will allow Covetrus to arm their veterinarian heroes with the tools they need to create accessible, highly tailored, veterinarian-administered wellness plans for today’s pet parents.

The Report Covers

• Market value data analysis of 2020 and forecast to 2027.

• Annualized market revenues ($ million) for each market segment.

• Country-wise analysis of major geographical regions.

• Key companies operating in the global Veterinary Dental Equipment market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

• Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

• Analysis of market-entry and market expansion strategies.

• Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Veterinary Dental Equipment Industry

• Recovery Scenario of Global Veterinary Dental Equipment Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on key players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Veterinary Dental Equipment Market, By TYPE

5.1.1. Dental X-Ray Systems

5.1.2. Electrosurgical Units

5.1.3. Dental Stations

5.1.4. Dental Lasers

5.1.5. Dental Powered Units

5.1.6. Others

5.2. Global Veterinary Dental Equipment Market, By Animal Type

5.2.1. Large

5.2.2. Small

5.3. Global Veterinary Dental Equipment Market, By End-User

5.3.1. Veterinary Hospitals

5.3.2. Veterinary Clinics

5.3.3. Academic Institute

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

6.4.1. Latin America

6.4.2. Middle East & Africa

7. Company Profiles

7.1. Acteon Group

7.2. Aribex, Inc.

7.3. Avante Health Solutions

7.4. Charles Brungart, Inc.

7.5. Cislak Manufacturing, Inc.

7.6. Covertus Tm

7.7. Dispomed ltd.

7.8. Healthy Mouth LLC

7.9. Henry Schein, Inc.

7.10. IM3 Pty Ltd.

7.11. Integra LifeSciences Corp.

7.12. J & J Instruments, Inc.

7.13. MAI Animal Health

7.14. Midmark Corp.

7.15. MyVet Imaging, Inc.

7.16. Planmeca Oy

7.17. SCIL animal care company GmbH

7.18. TECHNIK Veterinary Ltd.

1. GLOBAL VETERINARY DENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

2. GLOBAL DENTAL STATIONS IN VETERINARY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL DENTAL X-RAY SYSTEMS IN VETERINARY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL DENTAL POWERED UNITS IN VETERINARY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL DENTAL LASERS IN VETERINARY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL DENTAL ELECTRO SURGICAL UNITS IN VETERINARY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL OTHER DENTAL EQUIPMENT IN VETERINARY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL VETERINARY DENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2020-2027 ($ MILLION)

9. GLOBAL VETERINARY DENTAL EQUIPMENT FOR LARGE ANIMAL MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL VETERINARY DENTAL EQUIPMENT FOR SMALL ANIMAL MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL VETERINARY DENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

12. GLOBAL VETERINARY DENTAL EQUIPMENT IN VETERINARY HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

13. GLOBAL VETERINARY DENTAL EQUIPMENT IN VETERINARY CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

14. GLOBAL VETERINARY DENTAL EQUIPMENT IN ACADEMIC INSTITUTE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

15. NORTH AMERICAN VETERINARY DENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

16. NORTH AMERICAN VETERINARY DENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPE,2020-2027 ($ MILLION)

17. NORTH AMERICAN VETERINARY DENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2020-2027 ($ MILLION)

18. NORTH AMERICAN VETERINARY DENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

19. EUROPEAN VETERINARY DENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

20. EUROPEAN VETERINARY DENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

21. EUROPEAN VETERINARY DENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BYANIMAL TYPE, 2020-2027 ($ MILLION)

22. EUROPEAN VETERINARY DENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BYEND-USER, 2020-2027 ($ MILLION

23. ASIA-PACIFIC VETERINARY DENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

24. ASIA-PACIFIC VETERINARY DENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

25. ASIA-PACIFIC VETERINARY DENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BYANIMAL TYPE, 2020-2027 ($ MILLION)

26. ASIA-PACIFIC VETERINARY DENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

27. REST OF THE WORLD VETERINARY DENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

28. REST OF THE WORLD VETERINARY DENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

29. REST OF THE WORLD VETERINARY DENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2020-2027 ($ MILLION)

30. REST OF THE WORLD VETERINARY DENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL VETERINARY DENTAL EQUIPMENT MARKET, 2020-2027 (% MILLION)

2. IMPACT OF COVID-19 ON GLOBAL VETERINARY DENTAL EQUIPMENT MARKET BY SEGMENT, 2020-2027 (% MILLION)

3. RECOVERY OF GLOBAL VETERINARY DENTAL EQUIPMENT MARKET, 2020-2027 (%)

4. GLOBAL VETERINARY DENTAL EQUIPMENT MARKET SHARE BY TYPE,2020 VS 2027 (%)

5. GLOBAL VETERINARY DENTAL EQUIPMENT MARKET SHARE BY ANIMAL TYPE, 2020 VS 2027 (%)

6. GLOBAL VETERINARY DENTAL EQUIPMENT MARKET SHARE BY END-USER, 2020 VS 2027 (%)

7. GLOBAL VETERINARY DENTAL EQUIPMENT MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL DENTAL EQUIPMENT IN VETERINARY MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

9. GLOBAL DENTAL EQUIPMENT IN VETERINARY MARKET SHARE BY TYPE, 2020-2027 ($ MILLION)

10. GLOBAL DENTAL STATION IN VETERIANRY MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

11. GLOBAL DENTAL X-RAY SYSTEMS DENTAL POWERED UNITS IN VETERIANRY MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

12. GLOBAL DENTAL LASERS IN VETERIANRY MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

13. GLOBAL DENTAL ELECTRO SURGICAL UNITS IN VETERIANRY MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

14. GLOBAL OTHER DENTAL EQUIPMENT IN VETERIANRY MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

15. GLOBAL VETERINARY DENTAL EQUIPMENT FOR LARGE ANIMAL MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

16. GLOBAL VETERINARY DENTAL EQUIPMENT FOR SMALL ANIMAL MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

17. GLOBAL VETERINARY DENTAL EQUIPMENT IN VETERINARY HOSPITALS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

18. GLOBAL VETERINARY DENTAL EQUIPMENT IN VETERINARY CLINICS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

19. GLOBAL VETERINARY DENTAL EQUIPMENT IN ACADEMIC INSTITUTE MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

20. US VETERINARY DENTAL EQUIPMENT MARKET SIZE, 2020-2027 ($ MILLION)

21. CANADA VETERINARY DENTAL EQUIPMENT MARKET SIZE, 2020-2027 ($ MILLION)

22. UK VETERINARY DENTAL EQUIPMENT MARKET SIZE, 2020-2027 ($ MILLION)

23. FRANCE VETERINARY DENTAL EQUIPMENT MARKET SIZE, 2020-2027 ($ MILLION)

24. GERMANY VETERINARY DENTAL EQUIPMENT MARKET SIZE, 2020-2027 ($ MILLION)

25. ITALY VETERINARY DENTAL EQUIPMENT MARKET SIZE, 2020-2027 ($ MILLION)

26. SPAIN VETERINARY DENTAL EQUIPMENT MARKET SIZE, 2020-2027 ($ MILLION)

27. REST OF EUROPE VETERINARY DENTAL EQUIPMENT MARKET SIZE, 2020-2027 ($ MILLION)

28. INDIA VETERINARY DENTAL EQUIPMENT MARKET SIZE, 2020-2027 ($ MILLION)

29. CHINA VETERINARY DENTAL EQUIPMENT MARKET SIZE, 2020-2027 ($ MILLION)

30. JAPAN VETERINARY DENTAL EQUIPMENT MARKET SIZE, 2020-2027 ($ MILLION)

31. SOUTH KOREA VETERINARY DENTAL EQUIPMENT MARKET SIZE, 2020-2027 ($ MILLION)

32. REST OF ASIA-PACIFIC VETERINARY DENTAL EQUIPMENT MARKET SIZE, 2020-2027 ($ MILLION)

33. REST OF THE WORLD VETERINARY DENTAL EQUIPMENT MARKET SIZE, 2021-2027($ MILLION