Veterinary Drug Market

Global Veterinary Drug Market Size, Share & Trends Analysis Report, By Animal (Livestock, Companion, Other), By Type (Anti-Parasitic, Anti-inflammatory, Anti-infective, Others), By Route of Administration (Oral, Injection, Topical, Other) and Forecast, 2020-2026 Update Available - Forecast 2025-2035

The veterinary drug market is expected to grow at a CAGR of around 5.5% during the forecast period 2020-2026. The veterinary drug is used to prevent and/or treat diseases in the animals including companion animals, livestock and other animals. Rising trend for pets as a companion, increases the possibility of zoonotic diseases (disease passing from animals & insect to people), and rising meat and dairy consumption are the key factors for the growth of the market across the globe.

High adoption of pet animals is one of the major factor boosting the market. As per 2019-20, American Pet Products Association survey, 67% of the US household owns a pet as compared to 56% in 1988. Moreover, the total number of households in the US with pets has increased from around 90 million in 1988 to 130 million in 2019. Moreover, around $95.7 billion were spent on pets in 2019 in the US out of which $36.9 billion goes to pet food and treats and $19.2 billion goes to supplies, live animals, and OTC medicines. Growth in animal insurance is another major factor for the growth of the market. As per the North American Pet Health Insurance Association (NAPHIA), around 2.43 million pets were insured in North America in 2018 with an increase of 17% YoY.

Moreover, factory farming for meat is also driving the market. In factory farming, a large number of animals including cows, pigs, turkeys, goats, sheep, pigs, or chickens are held in order to increase the production of eggs, meat, beef, and milk at the lowest possible cost. In the US, more than 95% of animals are produced in factory farming for maximizing agribusiness profit. The bulk of animals are kept and raised in the farm which significantly increases the chances of spreading diseases among animals. This, in turn, will increase the demand for veterinary drugs to protect the animals on the farm from infectious diseases.

Market Segmentation

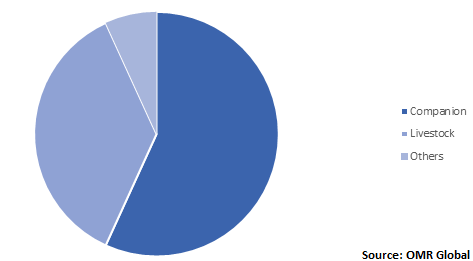

The global veterinary drug market is segmented based on animal, type and route of administration. By animal, the market is further segmented into livestock, companion, other. Livestock animals include poultry, swine, cattle, aquatic and other animals. Companion animals include dogs, cats, horses, birds, and fish. Others include wild animals including elephants, deer, and so on. Companion animal is expected to maintain a significant market share during the forecast period owing to better facilities reach to them provided by their owners. Moreover, by type, the market is segmented into anti-parasitic, anti-inflammatory, anti-infective, and others. On the basis of the route of administration, the veterinary drug market is segmented into oral, injection, and topical. Oral route holds a significant market share in the market. Technological advancements in the route of administration such as collars, dips, and sprays are further expected to provide significant market growth.

Global Veterinary Drug Market Share by Animal, 2019 (%)

Regional Outlook

On the basis of geography, the global veterinary drug market is segmented into four major regions that include North America, Europe, Asia-Pacific, and the Rest of the World (RoW). North America is expected to hold the major market share during the forecast period. High pet animal ownership, high cost of the drug, cohesive government regulation, better healthcare facilities for animals, high per capita meat consumption are the major factor for the significant market share of the region. As per the American Pet Products Association, 84.9 million households own at least a pet animal in 2019. Out of this, 63.4 million households own a dog, 42.7 million owns a cat, 5.7 million owns a bird and 1.6 million owns a horse.

Asia-Pacific is expected to have significant market growth during the forecast period. The increasing trend of pet ownership, increasing penetration of private veterinary hospitals in emerging economies, considerable growth in the meat consumption, and overall increasing disposable income are some of the major factors for the growth of the market in the region.

Global Veterinary Drug Market Growth, by Region 2020-2026

Market Players Outlook

The veterinary drug market is a fragmented market with small drug manufacturers all across the globe however; a large market share is occupied by a few multinational companies. Some of the major players operating in the market include Zoetis, Inc., Bayer AG, BOEHRINGER Ingelheim International GmbH, Ceva Santé Animale, Merck & Co., Inc., Elanco Animal Health Inc., Vetoquinol S.A., and Virbac S.A. The market players are adopting growth strategies including mergers and acquisitions, product launches, and partnerships & collaborations to gain a competitive edge in the market. For instance, in February 2020, Zoetis, Inc., got the US FDA approval for the Simparica Trio. It is a new combination parasite preventative for dogs against heartworm disease, ticks, and fleas, roundworms, and hookworms.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Veterinary drug market.

- Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdowns

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Zoetis, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Merck & Co., Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Boehringer Ingelheim International GmbH

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Bayer AG

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Elanco Animal Health Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Veterinary Drug Market by Animal

5.1.1. Livestock

5.1.1.1. Poultry

5.1.1.2. Swine

5.1.1.3. Cattle

5.1.1.4. Aquatic

5.1.1.5. Others (Sheep)

5.1.2. Companion

5.1.3. Other

5.2. Global Veterinary Drug Market by Type

5.2.1. Anti-Parasitic

5.2.2. Anti-inflammatory

5.2.3. Anti-infective

5.2.4. Others

5.3. Global Veterinary Drug Market by Route of Administration

5.3.1. Oral

5.3.2. Topical

5.3.3. Injection

5.3.4. Other

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Akorn Animal Health, Inc.

7.2. Bayer AG

7.3. Bimeda Holdings PLC

7.4. Biogenesis Bago A.S.

7.5. BOEHRINGER Ingelheim International GmbH

7.6. Ceva Santé Animale

7.7. Dechra Pharmaceuticals PLC

7.8. Elanco Animal Health Inc.

7.9. Hipra S.A.

7.10. Huvepharma EOOD

7.11. Hygieia Biological Laboratories

7.12. Intervet International B.V

7.13. Merck & Co., Inc.

7.14. Neogen Corp.

7.15. Pharmgate LLC

7.16. Phibro Animal Health Corp.

7.17. Vetoquinol S.A.

7.18. Virbac S.A.

7.19. Zoetis, Inc.

1. GLOBAL VETERINARY DRUG MARKET RESEARCH AND ANALYSIS BY ANIMAL, 2019-2026 ($ MILLION)

2. GLOBAL LIVESTOCK DRUG MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

3. GLOBAL POULTRY DRUG MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

4. GLOBAL ANIMAL DRUG MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

5. GLOBAL CATTLE DRUG MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

6. GLOBAL AQUATIC DRUG MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

7. GLOBAL OTHERS LIVESTOCK ANIMAL DRUG MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

8. GLOBAL COMPANION ANIMAL DRUG MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

9. GLOBAL OTHER ANIMAL DRUG MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

10. GLOBAL VETERINARY DRUG MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

11. GLOBAL ANTI-PARASITIC DRUG MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

12. GLOBAL ANTI-INFLAMMATORY DRUG MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

13. GLOBAL ANTI-INFECTIVE DRUG MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

14. GLOBAL OTHERS DRUG MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

15. GLOBAL VETERINARY DRUG MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2019-2026 ($ MILLION)

16. GLOBAL ORAL ROUTE OF ADMINISTRATION MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

17. GLOBAL TOPICAL ROUTE OF ADMINISTRATION MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

18. GLOBAL INJECTION ROUTE OF ADMINISTRATION MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

19. GLOBAL OTHER ROUTE OF ADMINISTRATION MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

20. NORTH AMERICAN VETERINARY DRUG MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

21. NORTH AMERICAN VETERINARY DRUG MARKET RESEARCH AND ANALYSIS BY ANIMAL, 2019-2026 ($ MILLION)

22. NORTH AMERICAN VETERINARY DRUG MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

23. NORTH AMERICAN VETERINARY DRUG MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2019-2026 ($ MILLION)

24. EUROPEAN VETERINARY DRUG MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

25. EUROPEAN VETERINARY DRUG MARKET RESEARCH AND ANALYSIS BY ANIMAL, 2019-2026 ($ MILLION)

26. EUROPEAN VETERINARY DRUG MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

27. EUROPEAN VETERINARY DRUG MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2019-2026 ($ MILLION)

28. ASIA PACIFIC VETERINARY DRUG MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

29. ASIA PACIFIC VETERINARY DRUG MARKET RESEARCH AND ANALYSIS BY ANIMAL, 2019-2026 ($ MILLION)

30. ASIA PACIFIC VETERINARY DRUG MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

31. ASIA PACIFIC VETERINARY DRUG MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2019-2026 ($ MILLION)

32. REST OF THE WORLD VETERINARY DRUG MARKET RESEARCH AND ANALYSIS BY ANIMAL, 2019-2026 ($ MILLION)

33. REST OF THE WORLD VETERINARY DRUG MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

34. REST OF THE WORLD VETERINARY DRUG MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2019-2026 ($ MILLION)

1. GLOBAL VETERINARY DRUG MARKET SHARE BY ANIMAL, 2019 VS 2026 (%)

2. GLOBAL VETERINARY DRUG MARKET SHARE BY TYPE, 2019 VS 2026 (%)

3. GLOBAL VETERINARY DRUG MARKET SHARE BY ROUTE OF ADMINISTRATION, 2019 VS 2026 (%)

4. GLOBAL VETERINARY DRUG MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US VETERINARY DRUG MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA VETERINARY DRUG MARKET SIZE, 2019-2026 ($ MILLION)

7. UK VETERINARY DRUG MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE VETERINARY DRUG MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY VETERINARY DRUG MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY VETERINARY DRUG MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN VETERINARY DRUG MARKET SIZE, 2019-2026 ($ MILLION)

12. REST OF EUROPE VETERINARY DRUG MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA VETERINARY DRUG MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA VETERINARY DRUG MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN VETERINARY DRUG MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC VETERINARY DRUG MARKET SIZE, 2019-2026 ($ MILLION)