Veterinary Healthcare Market

Global Veterinary Healthcare Market Size, Share & Trends Analysis Report by Therapeutics (Vaccines, Parasiticides, Anti-Infectives, and Others), By Animal Type (Companion Animals, Horses, Ruminants, Poultry, and Others), and Forecast 2020-2026 Update Available - Forecast 2025-2035

The global veterinary healthcare market is anticipated to grow at a significant CAGR during the forecast period. The market growth is attributed to the increasing trend of owning pets as a companion across the globe, which in turn, has increased the possibility of catching various zoonotic diseases. Hence, proper care of pets is promoted by vising vets regularly who acts as one of the major factors for the growth of the veterinary healthcare market across the globe. According to the Centers for Disease Control and Prevention (CDC), zoonotic diseases are very common in the US and Europe. Over 6 out of every 10 known infectious diseases in people are spread from animals.

Additionally, several other pivotal factors that are expected to offer growth to the veterinary healthcare market includes the initiatives taken by governments and animal wellness programs led by various animal welfare organizations. However, the high costs of veterinary visits will present restraint for the veterinary healthcare market growth. In addition to this, the less availability of veterinary hospitals and clinics in developing economies will also hamper the growth of the veterinary healthcare market.

Segmental Outlook

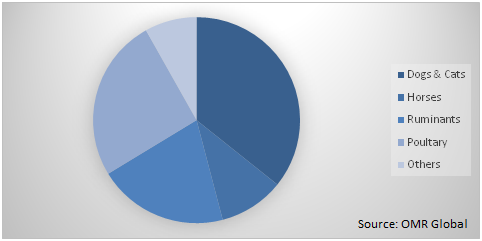

The global veterinary healthcare market is segmented on the basis of therapeutics and animal type. Based on the therapeutics, the market is sub-segmented into vaccines, parasiticides, anti-infectives, and others. The veterinary vaccine is estimated to exhibit significant growth during the forecast period. Based on the animal type, the market is sub-segmented into companion animals, horses, ruminants, poultry, and others.

Global Veterinary Healthcare Market Share by Animal Type, 2019 (%)

Dogs & Cats to Contribute a Prominent Share to the Market

Based on the animal type, dogs & cats segment is anticipated to contribute a prominent share in the veterinary healthcare market. The segmental growth is attributed to the increasing popularity of having a dog as a pet across the globe. Additionally, according to the American Veterinary Medical Association (AVMA), 82.8% of dog-owning households visit the veterinarian at least once a year. The trend to adopt companion animals is increasing across the globe, which further tends to drive the segmental growth of the market.

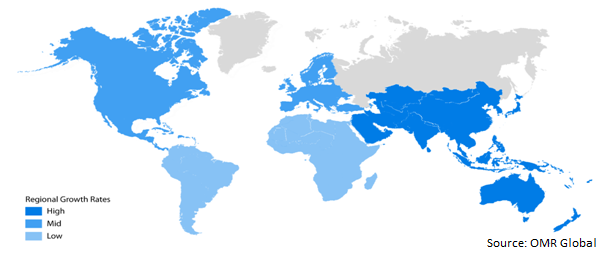

Regional Outlooks

The global veterinary healthcare market is further segmented based on geography into North America, Europe, Asia-Pacific, and the Rest of the World. North America is expected to hold the largest market share in veterinary healthcare during the forecast period. The regional growth is attributed to the increasing adoption of pets by US households and increasing animal healthcare expenditure. Additionally, the well developed and technologically advanced animal healthcare sector is also anticipated to drive the veterinary healthcare market in the region. Further, the growing awareness about regular vaccination in pet animals will also boost the veterinary healthcare market across the region.

Global Veterinary Healthcare Market Growth by Region, 2020-2026

Asia-Pacific will Augment with the Fastest Growth Rate in the Veterinary Healthcare Market

Asia-Pacific is anticipated to exhibit the fastest growth rate in the veterinary healthcare market due to the advancement in biotechnological research based on animal diseases across the region. Additionally, the increasing awareness for animal health coupled with a surge in the adoption of advanced medical technologies for the treatment of diseases in animals across the region will drive the veterinary healthcare market. Moreover, the veterinary healthcare market in Asia-Pacific has significant potential owing to the increasing animal husbandry practices with an improvement in the management of animal farms.

Market Players Outlook

Some of the key players of the veterinary healthcare market include Boehringer Ingelheim International GmbH, Zoetis Inc., Zydus Cadila, Vetoquinol Group, Virbac SA, Merck & Co. Inc., Elanco Animal Health, Phibro Animal Health, and others. The market players are considerably contributing to the market growth by adopting various strategies including new product launch, merger, and acquisition, collaborations to stay competitive in the market. In May 2020, Merck & Co. Inc.’s division Merck Animal Health has signed an agreement with Virbac to acquire the SENTINEL branded products in the US. The deal costs $400 million to the company. This agreement will aid the company in strengthening its position in the US market in the companion animal category.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global veterinary healthcare market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Business Functions and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Strategy Analysis

3.2. Key Company Analysis

3.2.1. Boehringer Ingelheim International GmbH

3.2.1.1. Overview

3.2.1.2. Financial Analysis

3.2.1.3. SWOT Analysis

3.2.1.4. Recent Developments

3.2.2. Virbac SA

3.2.2.1. Overview

3.2.2.2. Financial Analysis

3.2.2.3. SWOT Analysis

3.2.2.4. Recent Developments

3.2.3. Vetoquinol Group

3.2.3.1. Overview

3.2.3.2. Financial Analysis

3.2.3.3. SWOT Analysis

3.2.3.4. Recent Developments

3.2.3.5. Zoetis Inc.

3.2.3.6. Overview

3.2.3.7. Financial Analysis

3.2.3.8. SWOT Analysis

3.2.3.9. Recent Developments

3.2.4. Zydus Cadila

3.2.4.1. Overview

3.2.4.2. Financial Analysis

3.2.4.3. SWOT Analysis

3.2.4.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Veterinary Healthcare Market by Therapeutics

5.1.1. Vaccines

5.1.2. Parasiticides

5.1.3. Anti-infectives

5.1.4. Others (Medical Food Additives)

5.2. Veterinary Healthcare Market by Animal Type

5.2.1. Dogs and Cats

5.2.2. Horses

5.2.3. Ruminants

5.2.4. Poultry

5.2.5. Others

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Bayer AG

7.2. Boehringer Ingelheim International GmbH

7.3. Cargill Inc.

7.4. Ceva Animal Health LLC

7.5. Elanco Animal Health

7.6. Hester Biosciences Ltd.

7.7. HIPRA

7.8. IDEXX Laboratories Inc.

7.9. Indovax Pvt. Ltd.

7.10. Mankind Pharma Ltd.

7.11. Merck & Co. Inc.

7.12. Neogen Corp.

7.13. Nisseiken Co. Ltd.

7.14. Phibro Animal Health Corp.

7.15. Sanofi S.A.

7.16. SeQuent Scientific Ltd.

7.17. United Vaccines, Inc.

7.18. Vetoquinol Group

7.19. Virbac SA

7.20. Zoetis Inc.

7.21. Zydus Cadila

1. GLOBAL VETERINARY HEALTHCARE MARKET RESEARCH AND ANALYSIS BY THERAPEUTICS, 2019-2026 ($ MILLION)

2. GLOBAL VETERINARY VACCINES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL VETERINARY PARASITICIDES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL VETERINARY ANTI-INFECTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL OTHER VETERINARY THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL VETERINARY HEALTHCARE MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2019-2026 ($ MILLION)

7. GLOBAL DOGS & CATS HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL HORSE HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL RUMINANTS HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL SWINE HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL POULTRY HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL OTHER VETERINARY HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL VETERINARY HEALTHCARE MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

14. NORTH AMERICAN VETERINARY HEALTHCARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. NORTH AMERICAN VETERINARY HEALTHCARE MARKET RESEARCH AND ANALYSIS BY THERAPEUTICS, 2019-2026 ($ MILLION)

16. NORTH AMERICAN VETERINARY HEALTHCARE MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2019-2026 ($ MILLION)

17. EUROPEAN VETERINARY HEALTHCARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. EUROPEAN VETERINARY HEALTHCARE MARKET RESEARCH AND ANALYSIS BY THERAPEUTICS, 2019-2026 ($ MILLION)

19. EUROPEAN VETERINARY HEALTHCARE MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2019-2026 ($ MILLION)

20. ASIA-PACIFIC VETERINARY HEALTHCARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC VETERINARY HEALTHCARE MARKET RESEARCH AND ANALYSIS BY THERAPEUTICS, 2019-2026 ($ MILLION)

22. ASIA-PACIFIC VETERINARY HEALTHCARE MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2019-2026 ($ MILLION)

23. REST OF THE WORLD VETERINARY HEALTHCARE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

24. REST OF THE WORLD VETERINARY HEALTHCARE MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2019-2026 ($ MILLION)

1. GLOBAL VETERINARY HEALTHCARE MARKET SHARE BY THERAPEUTICS, 2019 VS 2026 (%)

2. GLOBAL VETERINARY HEALTHCARE MARKET SHARE BY ANIMAL TYPE, 2019 VS 2026 (%)

3. GLOBAL VETERINARY HEALTHCARE MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US VETERINARY HEALTHCARE MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA VETERINARY HEALTHCARE MARKET SIZE, 2019-2026 ($ MILLION)

6. UK VETERINARY HEALTHCARE MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE VETERINARY HEALTHCARE MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY VETERINARY HEALTHCARE MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY VETERINARY HEALTHCARE MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN VETERINARY HEALTHCARE MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE VETERINARY HEALTHCARE MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA VETERINARY HEALTHCARE MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA VETERINARY HEALTHCARE MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN VETERINARY HEALTHCARE MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC VETERINARY HEALTHCARE MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD VETERINARY HEALTHCARE MARKET SIZE, 2019-2026 ($ MILLION)