Vetronics Market

Global Vetronics Market Size, Share & Trends Analysis Report, By Subsystem Type (Navigation System, C3 Systems, Sensors, Vehicle Electronics Warfare Systems, and Others), By Application (Defense and Homeland Security), By Vehicle Type (Amphibious Armored Vehicles, Main Battle Tank, Light Protected Vehicles, and Others) and Forecast, 2020-2026 Update Available - Forecast 2025-2035

The global vetronics market is estimated to grow at a CAGR of nearly 5.0% during the forecast period. Vetronics is a key element of military vehicles. Vetronics refers to electronic systems on a vehicle which is designed to control functions including communications, navigation, and weapons. Vehicle-equipped with information technology has been gaining significance in the battlefield as it offers advanced capabilities which is essential for both force protection and force projection. Increasing modernization and upgradation of military vehicles is the key factor that is contributing to the growth of the market. The military sector is one of the important concerns for governments and key leaders of a country. The competitiveness in the industry has increased substantially due to the advancement of the defense sector of the developed economies such as the US, and Japan.

Moreover, the modernization is directly proportional to the public and private investment. For instance, modernization is the fourth pillar of the US military which includes infrastructure and technology in the force structure, readiness, and sustainability. Additionally, emerging economies such as China, Israel, and India are moving rapidly towards the modernization of defense forces and vehicles to maintain the competitiveness of the armed forces. This, in turn, increased the need for military vehicles that are mounted with significantly optimized electronic command and information systems. This leads to the adoption of vetronics systems that supports to optimize computing resources and platform electronics, enabling the integration into the vehicles, and improving the supportability and logistics in operating conditions. The technology assists in both mission independent and mission-specific strategies.

Market Segmentation

The global vetronics market is classified into subsystem type, application, and vehicle type. Based on subsystem type, the market is classified into the navigation system, C3 systems, sensors, vehicle electronics warfare systems, and others. Based on application, the market is classified into defense and homeland security. Based on vehicle type, the market is classified into amphibious armored vehicles, main battle tank, light protected vehicles, and others.

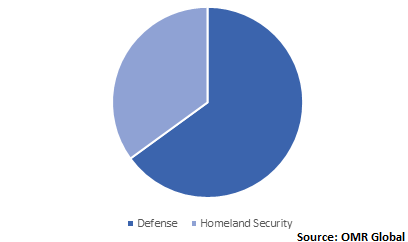

Defense segment is anticipated to hold significant share in the market

The adoption of vetronics is considerably used in the military applications owing to the rising military spending and significant demand for modernization of military vehicles to improve navigation, communications, and command capabilities and withstand cyber attacks in the sector. As per the Stockholm International Peace Research Institute (SIPRI), in 2019, the total global military spending increased to $1,917 billion, which represents a rise of 3.6% from 2018. The five major countries that significantly invests in military spending include the US, China, India, Russia and Saudi Arabia.

These countries accounted for 62% of the total global military spending. The rising defense expenditure has led the demand for modernization of armed forces and vehicles, which in turn, is encouraging the demand for vetronics in defense applications to perform basic functions and deliver new capabilities. Vetronics networks support for modular and a more distributed architecture and therefore, improving future upgradability and interoperability. The communication capabilities of the battlefield are evolving as a major importance in military operations. This results in the emerging vehicle electronics architectures which aim to ensure that military assets can potentially serve in terms of the holistic communications network.

Global Vetronics Market Share by Application, 2019 (%)

Regional Outlook

The global vetronics market is segmented into North America, Europe, Asia-Pacific, and Rest of the World (RoW). In 2019, North America is anticipated to hold a potential share in the market owing to the considerable spending on military operations and increasing focus on implementing advanced solutions in military operations. As per the SIPRI, in 2019, the US military expenditure increased by 5.3% to $732 billion and held 38% of global military expenditure. The country is the largest military spender and as a result, they focus on advancing and upgrading their military systems, which contributes to the significant adoption of vetronics in the region.

Global Vetronics Market Growth, by Region 2020-2026

Market Players Outlook

The major players operating in the market include Thales Group, Saab AB, Lockheed Martin Corp., Curtiss-Wright Corp., and Raytheon Technologies Corp. The strategies adopted by the market players include mergers and acquisitions, product launches, and partnerships and collaborations to expand market share and gain a competitive advantage. For instance, in January 2020, Curtiss-Wright Corporation acquired 901D Holdings, LLC, a designer and manufacturer of ruggedized shipboard enclosure solutions, mission-critical integrated electronic systems, and subsystems, as well as, supporting every major US Navy shipbuilding program. The acquisition widens the range of the company’s instrumentation and controls systems technologies and will expand the footprint of Curtis-Wright on critical US Navy shipbuilding programs.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global vetronics market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Thales Group

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Saab AB

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Lockheed Martin Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Curtiss-Wright Corp.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Raytheon Technologies Corp.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Vetronics Market by Subsystem Type

5.1.1. Navigation System

5.1.2. C3 Systems

5.1.3. Sensors (EO and IR)

5.1.4. Vehicle Electronic Warfare System

5.1.5. Others

5.2. Global Vetronics Market by Application

5.2.1. Defense

5.2.2. Homeland Security

5.3. Global Vetronics Market by Vehicle Type

5.3.1. Amphibious Armored Vehicles

5.3.2. Main Battle Tank

5.3.3. Light Protected Vehicles

5.3.4. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. BAE Systems plc

7.2. Cubic Corp.

7.3. Curtiss-Wright Corp.

7.4. ECRIN Systems

7.5. Elbit Systems Ltd.

7.6. GACI Rugged Systems

7.7. General Dynamics Corp.

7.8. Kratos Defense & Security Solutions, Inc.

7.9. L3 Technologies, Inc.

7.10. Leonardo S.p.A.

7.11. Lockheed Martin Corp.

7.12. Northrop Grumman Corp.

7.13. Pleora Technologies Inc.

7.14. Rafael Advanced Defese Systems Ltd.

7.15. Raytheon Technologies Corp.

7.16. Rheinmetall AG

7.17. Saab AB

7.18. Serco, Inc.

7.19. Thales Group

1. GLOBAL VETRONICS MARKET RESEARCH AND ANALYSIS BY SUBSYSTEM TYPE, 2019-2026 ($ MILLION)

2. GLOBAL VETRONICS NAVIGATION SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL VETRONICS C3 SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL VETRONICS SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL VEHICLE ELECTRONIC WARFARE SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL OTHER VETRONICS SUBSYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL VETRONICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

8. GLOBAL VETRONICS IN DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL VETRONICS IN HOMELAND SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL VETRONICS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

11. GLOBAL VETRONICS IN AMPHIBIOUS ARMORED VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL VETRONICS IN MAIN BATTLE TANK MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL VETRONICS IN LIGHT PROTECTED VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL VETRONICS IN OTHER VEHICLE TYPES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

15. GLOBAL VETRONICS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

16. NORTH AMERICAN VETRONICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. NORTH AMERICAN VETRONICS MARKET RESEARCH AND ANALYSIS BY SUBSYSTEM TYPE, 2019-2026 ($ MILLION)

18. NORTH AMERICAN VETRONICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

19. NORTH AMERICAN VETRONICS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

20. EUROPEAN VETRONICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

21. EUROPEAN VETRONICS MARKET RESEARCH AND ANALYSIS BY SUBSYSTEM TYPE, 2019-2026 ($ MILLION)

22. EUROPEAN VETRONICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

23. EUROPEAN VETRONICS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

24. ASIA-PACIFIC VETRONICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

25. ASIA-PACIFIC VETRONICS MARKET RESEARCH AND ANALYSIS BY SUBSYSTEM TYPE, 2019-2026 ($ MILLION)

26. ASIA-PACIFIC VETRONICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

27. ASIA-PACIFIC VETRONICS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

28. REST OF THE WORLD VETRONICS MARKET RESEARCH AND ANALYSIS BY SUBSYSTEM TYPE, 2019-2026 ($ MILLION)

29. REST OF THE WORLD VETRONICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

30. REST OF THE WORLD VETRONICS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

1. GLOBAL VETRONICS MARKET SHARE BY SUBSYSTEM TYPE, 2019 VS 2026 (%)

2. GLOBAL VETRONICS MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

3. GLOBAL VETRONICS MARKET SHARE BY VEHICLE TYPE, 2019 VS 2026 (%)

4. GLOBAL VETRONICS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US VETRONICS MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA VETRONICS MARKET SIZE, 2019-2026 ($ MILLION)

7. UK VETRONICS MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE VETRONICS MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY VETRONICS MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY VETRONICS MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN VETRONICS MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE VETRONICS MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA VETRONICS MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA VETRONICS MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN VETRONICS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC VETRONICS MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD VETRONICS MARKET SIZE, 2019-2026 ($ MILLION)