Video Streaming Market

Video Streaming Market Size, Share & Trends Analysis Report By Solution (Transcoding & Processing, Video Analytics, Video Delivery & Distribution, Video Management, Video Security, and Others), by Streaming Type (Live Streaming, and On-Demand Streaming), by Deployment Type (On-Premises, and On-Cloud), and by End-User (BFSI, Education, Broadcasters, Media & Operators, Healthcare, Government, and Others) Forecast Period (2024-2031)

Video streaming market is anticipated to grow at a significant CAGR of 18.9% during the forecast period (2024-2031). The market growth is attributed to enhanced video quality innovations such as blockchain technology and artificial intelligence (AI). In many facets of video production and upload, including editing, voice-overs, cinematography, and scriptwriting, AI has grown indispensable. According to the International Federation of the Phonographic Industry (IFPI), in 2023, subscription streaming was the driver of growth (+10.3% to $12.7 billion). Overall streaming (including subscription and advertising supported), accounted for the highest proportion of the market, increasing to a 67.0% share of the overall market in 2022 up from a 65.5% share the prior year.

Market Dynamics

Growing Expansion of Over-the-top (OTT) Services

OTT providers are reaching out to new markets by bringing regional interfaces and content to their global reach. To accommodate regional preferences and cultural quirks, this globalization strategy entails not just translating platforms and material into local languages but also making investments in local content creation. OTT content providers and video streaming platforms are rapidly expanding the industry. Traditional cable TV market development is being hampered by customer behavior, which is changing from traditional TV-based scheduled content to OTT-based on-demand viewing.

Increasing Adoption of 5G Network with Smart Devices

The introduction of 5G networks may lead to easier download speeds and better streaming on mobile devices, which may change users' viewing preferences. Smart TVs, game consoles, and other connected devices are increasingly integrating streaming services to improve user convenience and streamline access. In terms of scalability, 5G could provide roughly ten times more capacity per base station. Furthermore, 5G can support a considerably denser network of base stations, which increases the amount of bandwidth accessible in hotspots such as concert halls and sports arenas.

Market Segmentation

- Based on the solution, the market is segmented into transcoding & processing, video analytics, video delivery & distribution, video management, video security, and others (internet protocol TV, over-the-top (OTT), and Pay-TV).

- Based on the streaming type, the market is segmented into live streaming and on-demand streaming.

- Based on the deployment type, the market is segmented into on-premises and on-cloud.

- Based on the end-user, the market is segmented into BFSI, education, broadcasters, media & operators, healthcare, government, and others (gaming).

Live Streaming Holds the Major Market Share

Live streaming is highly prevalent in the market for video streaming software. It allows users to broadcast live video material to international viewers over the internet. Recent advances in internet infrastructure, the widespread use of mobile devices, and the emergence of social media platforms have all contributed to the exponential expansion of this technology. With services such as Twitch, YouTube Live, and Facebook Live registering substantial user interaction and viewing figures, live streaming has emerged as a dominant force in the digital scene. A user-friendly platform for live and simulated streaming that enables these organizations to concurrently reach people online through social media sites such as Facebook, YouTube, and others, mobile and OTT apps, and embeddable web players. For instance, in October 2021, Haivision, a provider of mission-critical, real-time video streaming and networking solutions, announced the launch of an all-new cloud platform designed for churches – Haivision Connect. The livestreaming solution opens new possibilities for churches to easily connect and engage with audiences from anywhere.

On-Cloud Deployment to Hold a Considerable Market Share

The cloud-based deployment has been embraced by video streaming companies to facilitate high speeds and enormous bandwidth. Many streaming service providers have opted for cloud-based deployment over on-premises due to its capacity to manage larger amounts of data material and offer a better viewing experience. Furthermore, cloud scaling aids in boosting bandwidth and resolving latency and buffering problems. There is a great need for cloud-based deployment in the video streaming process as most businesses lack the networks and infrastructure necessary to handle high traffic levels in online streaming. For instance, in May 2024, Bharti Airtel and Google Cloud entered a long-term collaboration to deliver cloud solutions to Indian businesses. The strategic collaboration will offer a suite of cutting-edge cloud solutions from Google Cloud to fast-track cloud adoption and modernization for Airtel’s customers. In addition, Airtel will provide a suite of cloud-managed services to its customer base of more than 2,000 large enterprises and one million emerging businesses

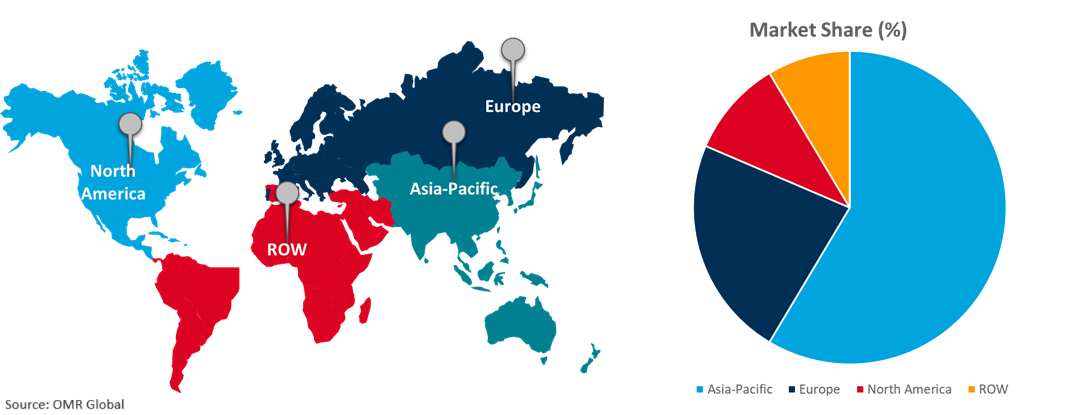

Regional Outlook

The global video streaming market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Video Streaming in Europe

The regional growth is attributed to a sizable and active internet following across the region. This growth is also fueled by a rise in disposable income and a variety of content options, including locally made originals. According to the British Film Institute, in February 2024, the UK/Ireland box office generated £986 million ($1066.1 million) over the year, with Barbie the biggest film of 2023 and The Great Escaper leading the UK independent chart. Four toy, game, and video-based/inspired adaptations ranked amongst the top 20 releases at the UK/ROI box office, Barbie, The Super Mario Bros Movie, Trolls Band Together, and Dungeons and Dragons: Honour Amongst Thieves. Their total box office was £179.7 million ($194.3 million), or 18.7% of the year’s total revenue.

Global Video Streaming Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Asia-Pacific holds a significant share owing to the presence of video streaming offering companies such as Tencent Video, iQIYI, Youku Tudou, and others. The market growth is attributed to rapid developments in technology, a rise in the popularity of internet streaming, and the use of smartphones and tablets. According to the Asia Video Industry Report 2024, there are 797.8 million pay-TV subscribers and 4.2 billion broadband subscribers in Asia. Television remains the dominant segment in India, accounting for ~70.0% of the video industry revenue. Nevertheless, TV’s growth is expected to remain subdued in the future largely because of a contraction in the pay-TV universe. This revenue is offset by a modest growth in TV advertising. The online video sector generated an estimated $54 billion in revenue in 2023, according to Media Partners Asia. Five markets will contribute >90.0% in aggregate, led by China at over 50.0%, followed by Japan with ~20.0%, Australia, with 10.0%, while Korea and India contribute a combined 13.0%. China, the online video revenue reached an estimated $27.0 billion in 2023, with $12.0 billion from UGC / social video (led by YouTube, Meta, and others), $12.0 billion from subscription-video-on demand (SVOD) (led by Netflix with various global, and local and regional players also in the mix); and $3.0 billion from premium AVOD (driven by local players in Australia, India, Indonesia and Japan).

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the video streaming market include Amazon Web Services, Inc., Google LLC, Hulu, LLC, Microsoft Corp., and Netflix Inc. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

Recent Development

- In February 2023, Brightcove Inc., the streaming technology company, announced the launch of Brightcove Communications Studio, a new video-first solution designed to help HR and communications professionals build deeper relationships and better engage with their internal stakeholders. The solution features new video carousels for a highly visual discovery experience and organized collections that internal communications teams can curate to provide a tailored viewing experience for their audience

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the video streaming market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Amazon Web Services, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Google, LLC

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Hulu, LLC

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Microsoft Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Netflix, Inc.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Video Streaming Market by Solution

4.1.1. Transcoding & Processing

4.1.2. Video Analytics

4.1.3. Video Delivery & Distribution

4.1.4. Video Management

4.1.5. Video Security

4.1.6. Others (Internet Protocol TV, Over-the-Top (OTT) and Pay-TV)

4.2. Global Video Streaming Market by Streaming Type

4.2.1. Live Streaming

4.2.2. On-Demand Streaming

4.3. Global Video Streaming Market by Deployment Type

4.3.1. On-Premises Deployment

4.3.2. On-Cloud Deployment

4.4. Global Video Streaming Market by End-Users

4.4.1. BFSI

4.4.2. Education

4.4.3. Broadcasters, Media & Operators

4.4.4. Healthcare

4.4.5. Government

4.4.6. Others (Gaming)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Adobe Systems, Inc.

6.2. Akamai Technologies, Inc.

6.3. Apple Inc.

6.4. Brightcove Inc.

6.5. China Global Television Network

6.6. Crackle Plus, LLC

6.7. Degreed, Inc.

6.8. ESPN Enterprises, Inc.

6.9. Haivision

6.10. Home Box Office, Inc.

6.11. IBM Corp.

6.12. IQIYI International Singapore Pte. Ltd.

6.13. Kaltura, Inc.

6.14. Kollective Technology, Inc.

6.15. Panopto, Inc.

6.16. Peacock TV LLC

6.17. Qumu Corp.

6.18. Sonic Foundry, Inc.

6.19. Tubi, Inc.

6.20. Twitch Interactive, Inc.

6.21. Vimeo.com, Inc.

6.22. Wowza Media Systems, LLC

1. Global Video Streaming Market Research And Analysis By Solution, 2023-2031 ($ Million)

2. Global Video Transcoding & Processing Streaming Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Video Analytics Streaming Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Video Delivery And Distribution Streaming Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Video Management Streaming Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global Video Security Streaming Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Video Others Streaming Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Video Streaming Market Research And Analysis By Streaming Type, 2023-2031 ($ Million)

9. Global Video Live Streaming Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Video On Demand Streaming Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global Video Streaming Market Research And Analysis By Deployment Type, 2023-2031 ($ Million)

12. Global On Premises Based Video Streaming Market Research And Analysis By Region, 2023-2031 ($ Million)

13. Global On-Cloud Based Video Streaming Market Research And Analysis By Region, 2023-2031 ($ Million)

14. Global Video Streaming Market Research And Analysis By End-User, 2023-2031 ($ Million)

15. Global Video Streaming For BFSI Market Research And Analysis By Region, 2023-2031 ($ Million)

16. Global Video Streaming For Education Market Research And Analysis By Region, 2023-2031 ($ Million)

17. Global Video Streaming For Broadcasters, Media & Operators Market Research And Analysis By Region, 2023-2031 ($ Million)

18. Global Video Streaming For Healthcare Market Research And Analysis By Region, 2023-2031 ($ Million)

19. Global Video Streaming For Government Market Research And Analysis By Region, 2023-2031 ($ Million)

20. Global Video Streaming For Other End-Users Market Research And Analysis By Region, 2023-2031 ($ Million)

21. Global Video Streaming Market Research And Analysis By Region, 2023-2031 ($ Million)

22. North American Video Streaming Market Research And Analysis By Country, 2023-2031 ($ Million)

23. North American Video Streaming Market Research And Analysis By Solution, 2023-2031 ($ Million)

24. North American Video Streaming Market Research And Analysis By Streaming Type, 2023-2031 ($ Million)

25. North American Video Streaming Market Research And Analysis By Deployment Type, 2023-2031 ($ Million)

26. North American Video Streaming Market Research And Analysis By End-User, 2023-2031 ($ Million)

27. European Video Streaming Market Research And Analysis By Country, 2023-2031 ($ Million)

28. European Video Streaming Market Research And Analysis By Solution, 2023-2031 ($ Million)

29. European Video Streaming Market Research And Analysis By Streaming Type, 2023-2031 ($ Million)

30. European Video Streaming Market Research And Analysis By Deployment Type, 2023-2031 ($ Million)

31. European Video Streaming Market Research And Analysis By End-User, 2023-2031 ($ Million)

32. Asia-Pacific Video Streaming Market Research And Analysis By Country, 2023-2031 ($ Million)

33. Asia-Pacific Video Streaming Market Research And Analysis By Solution, 2023-2031 ($ Million)

34. Asia-Pacific Video Streaming Market Research And Analysis By Streaming Type, 2023-2031 ($ Million)

35. Asia-Pacific Video Streaming Market Research And Analysis By Deployment Type, 2023-2031 ($ Million)

36. Asia-Pacific Video Streaming Market Research And Analysis By End-User, 2023-2031 ($ Million)

37. Rest Of The World Video Streaming Market Research And Analysis By Region, 2023-2031 ($ Million)

38. Rest Of The World Video Streaming Market Research And Analysis By Solution, 2023-2031 ($ Million)

39. Rest Of The World Video Streaming Market Research And Analysis By Streaming Type, 2023-2031 ($ Million)

40. Rest Of The World Video Streaming Market Research And Analysis By Deployment Type, 2023-2031 ($ Million)

41. Rest Of The World Video Streaming Market Research And Analysis By End-User, 2023-2031 ($ Million)

1. Global Video Streaming Market Research And Analysis By Solution, 2023 Vs 2031 (%)

2. Global Video Transcoding & Processing Streaming Market Share By Region, 2023 Vs 2031 (%)

3. Global Video Analytics Streaming Market Share By Region, 2023 Vs 2031 (%)

4. Global Video Delivery And Distribution Streaming Market Share By Region, 2023 Vs 2031 (%)

5. Global Video Management Streaming Market Share By Region, 2023 Vs 2031 (%)

6. Global Video Security Streaming Market Share By Region, 2023 Vs 2031 (%)

7. Global Video Others Streaming Market Share By Region, 2023 Vs 2031 (%)

8. Global Video Streaming Market Share By Streaming Type, 2023 Vs 2031 (%)

9. Global Video Live Streaming Market Share By Region, 2023 Vs 2031 (%)

10. Global Video On Demand Streaming Market Share By Region, 2023 Vs 2031 (%)

11. Global Video Streaming Market Share By Deployment Type, 2023 Vs 2031 (%)

12. Global On Premises Based Video Streaming Market Share By Region, 2023 Vs 2031 (%)

13. Global On-Cloud Based Video Streaming Market Share By Region, 2023 Vs 2031 (%)

14. Global Video Streaming Market Share By End-Users, 2023 Vs 2031 (%)

15. Global Video Streaming For BFSI Market Share By Region, 2023 Vs 2031 (%)

16. Global Video Streaming For Education Market Share By Region, 2023 Vs 2031 (%)

17. Global Video Streaming For Broadcasters, Media & Operators Market Share By Region, 2023 Vs 2031 (%)

18. Global Video Streaming For Healthcare Market Share By Region, 2023 Vs 2031 (%)

19. Global Video Streaming For Government Market Share By Region, 2023 Vs 2031 (%)

20. Global Video Streaming For Others End-Users Market Share By Region, 2023 Vs 2031 (%)

21. Global Video Streaming Market Share By Region, 2023 Vs 2031 (%)

22. US Video Streaming Market Size, 2023-2031 ($ Million)

23. Canada Video Streaming Market Size, 2023-2031 ($ Million)

24. UK Video Streaming Market Size, 2023-2031 ($ Million)

25. France Video Streaming Market Size, 2023-2031 ($ Million)

26. Germany Video Streaming Market Size, 2023-2031 ($ Million)

27. Italy Video Streaming Market Size, 2023-2031 ($ Million)

28. Spain Video Streaming Market Size, 2023-2031 ($ Million)

29. Rest Of Europe Video Streaming Market Size, 2023-2031 ($ Million)

30. India Video Streaming Market Size, 2023-2031 ($ Million)

31. China Video Streaming Market Size, 2023-2031 ($ Million)

32. Japan Video Streaming Market Size, 2023-2031 ($ Million)

33. South Korea Video Streaming Market Size, 2023-2031 ($ Million)

34. Rest Of Asia-Pacific Video Streaming Market Size, 2023-2031 ($ Million)

35. Rest Of The World Video Streaming Market Size, 2023-2031 ($ Million)

36. Latin America Video Streaming Market Size, 2023-2031 ($ Million)

37. Middle East And Africa Video Streaming Market Size, 2023-2031 ($ Million)