Video Surveillance as a Service Market

Global Video Surveillance as a Service (VsaaS) Market Market Size, Share & Trends Analysis Report By End-Users (Commercial, Infrastructure, Residential, Military & Defense, Industrial), By Type (Analog Video Surveillance, IP Based Video Surveillance) Forecast Period 2020-2026 Update Available - Forecast 2025-2035

Global Video Surveillance as a Service (VsaaS) market is anticipated to grow at a CAGR of 16.8% during the forecast period (2020-2026). The application of video surveillance in business is growing significantly due to the increasing need for physical security and the use of cloud-based services for centralized data. The introduction of new IP-based digital technologies, to detect and prevent undesirable behaviors, such as shoplifting, thefts, vandalism, and terror attacks is expected to fuel the growth of the VSaaS market. Additionally, favorable government policies and regulations related to the application of video surveillance devices in commercial & residential buildings further promote the market growth. VSaaS held a major market share in developed nations such as the US, UK, Germany, and Canada owing to their stringent safety measures.

Certain issues associated with the market such as high bandwidth & high capacity storage requirements may have a negative impact on the growth of the market. Additionally, hacking and other piracy issues can restrain market growth during the forecast period. However, technological advancements in VSaaS and rising safety concerns are posing potential growth opportunities for the VSaaS market in near future. Moreover, emerging economies of the Asia-Pacific region such as India, China, and South Korea are creating splendid opportunities for market growth.

Segmental Outlook

Global Video Surveillance as a Service (VSaaS) market is segmented on the basis of end-users and type. Based on the end-user segment, the market is segmented into commercial, infrastructure, residential, military & defense, and industrial. The commercial segment is anticipated to exhibit considerable growth during the forecast period. The rising cases related to theft in banking & financial, retail, and media & entertainment industries is creating demand for effective VSaaS to limit such cases is expected to drive the growth of this market segment. Based on the type, the market is segmented into analog video surveillance and IP-based video surveillance.

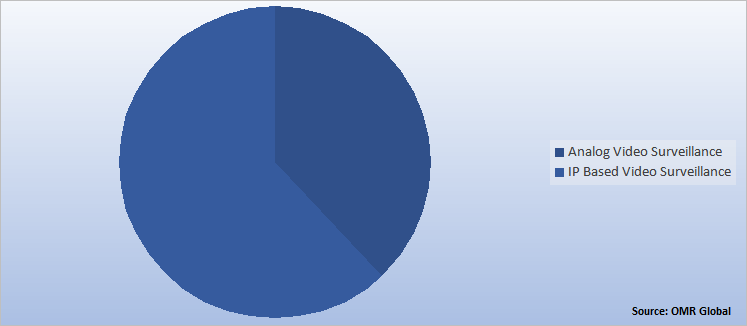

Global Video Surveillance as a Service Market Share by Type, 2019 (%)

IP Based Video Surveillance Held Major Market Share Based on Type

IP Based video surveillance segment held a major market share in 2019. The inherent advantages of quality, scalability, better resolution, and built-in analytics engines in IP-based video surveillance, as compared to analog video surveillance are promoting more adoption of such services which in turn will drive the growth of this market segment. There are many advantages of the IP-based video surveillance that an IP camera CCTV system offers over an analog format. IP security cameras send their signal over a network, which allows greater information transfer than an analog signal sent to a DVR, which acts as a major driver for the IP video surveillance. Network cameras can be wireless and work through a network. IP-based cameras are used in big departmental stores, malls, video chains, factories, workshops, and many other public places to keep a check of the ongoing activities, which assist in the growth of IP video surveillance globally.

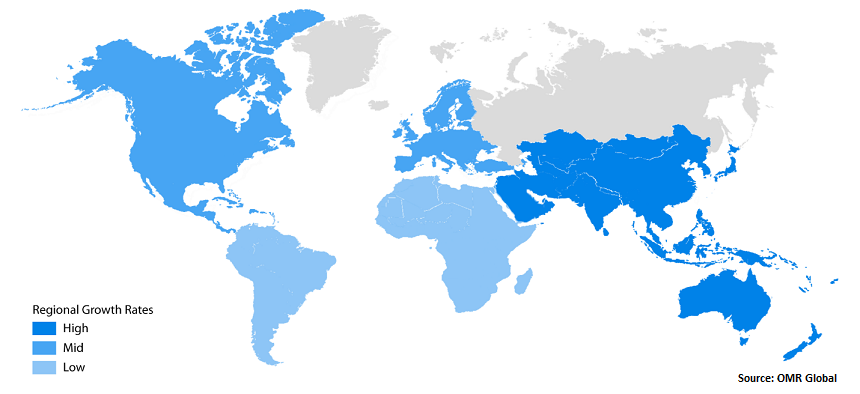

Regional Outlooks

On the basis of geography, the market is segmented into North America, Europe, Asia Pacific, and the Rest of the World. North America is estimated to a held major share in the global VSaaS market followed by Europe. High adoption of this service among the population owing to increase safety around their premises is one of the major factors contributing to the high share of the regional market.

Global Video Surveillance as a Service Market Growth, by Region 2020-2026

Asia-Pacific to Exhibit Considerable Growth in VSaaS Market during Forecast Period 2020-2026

Asia-Pacific will have considerable growth in the global VSaaS market. Increasing installation of surveillance equipment in China and India, as well as increased expenditure on infrastructure safety in the region, is one of the major factors driving the regional growth of the market. Favorable government initiatives, an increasing number of retail chains, small businesses, residential apartments, banks, and financial institutions, and hospitality businesses to meet the growing demand of the rising population are some other factors that are creating demand for smart video surveillance solutions across the region. The growing penetration of new technologies such as facial recognition, people counting, retail management, remote asset management, and crowd management is providing potential growth opportunities to the regional market.

Market Players Outlook

Key players of the VSaaS market include ADT Security Services, Bosch Security Systems Inc., Canon, Inc., CISCO Systems Inc., Eyewitness Surveillance, and others. In order to survive in the market, these players adopt different marketing strategies such as mergers & acquisitions, R&D, product launch, and geographical expansion so on.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global video surveillance as a service market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. ADT Security Services, Inc.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Cisco Systems Inc.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Canon Inc.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Honeywell International, Inc.

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Bosch Security System, Inc.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Video Surveillance as a Service Market by End-Users

5.1.1. Commercial

5.1.2. Infrastructure

5.1.3. Residential

5.1.4. Military & Defense

5.1.5. Industrial

5.2. Global Video Surveillance as a Service Market by Type

5.2.1. Analog Video Surveillance

5.2.2. IP-Based Video Surveillance

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. 3GC Group

7.2. Agent Video Intelligence Ltd.

7.3. Artec Technologies AG

7.4. CBC Group

7.5. Cisco Systems Inc.

7.6. Coreveillance, LLC

7.7. D-Link Corp.

7.8. Eyewitness Acquisition LLC

7.9. Genetec, Inc.

7.10. Geovision, Inc.

7.11. Hangzhou Hikvision Digital Tehnology Co., Ltd.

7.12. Hanwa Techwin Co., Ltd.

7.13. LC Realtech Inc.

7.14. The Infinova Group

7.15. Iveda Solutions, Inc.

7.16. Jvalley Software Solutions

7.17. Konica Minolta Inc. (Mobotix AG)

7.18. Lab Information Technology Inc.

7.19. Motorola Solutions

7.20. Nice System Ltd.

7.21. Nortek Security & Control, LLC

7.22. Panasonic System Networks Co. Ltd.

7.23. Pivot3 (Nexgen Storage)

7.24. Promise Technology Inc.

7.25. Riverside Company (Pro-Vigil, Inc.)

7.26. Vintech Systems Inc.

1. GLOBAL VIDEO SURVEILLANCE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY END-USERS, 2019-2026 ($ MILLION)

2. GLOBAL VIDEO SURVEILLANCE AS A SERVICE IN COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL VIDEO SURVEILLANCE AS A SERVICE IN INFRASTRUCTURE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL VIDEO SURVEILLANCE AS A SERVICE IN RESIDENTIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL VIDEO SURVEILLANCE AS A SERVICE IN MILITARY & DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL VIDEO SURVEILLANCE AS A SERVICE IN INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL VIDEO SURVEILLANCE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

8. GLOBAL ANALOG VIDEO SURVEILLANCE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL IP-BASED VIDEO SURVEILLANCE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL VIDEO SURVEILLANCE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. NORTH AMERICAN VIDEO SURVEILLANCE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN VIDEO SURVEILLANCE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY END-USERS, 2019-2026 ($ MILLION)

13. NORTH AMERICAN VIDEO SURVEILLANCE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

14. EUROPEAN VIDEO SURVEILLANCE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. EUROPEAN VIDEO SURVEILLANCE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY END-USERS, 2019-2026 ($ MILLION)

16. EUROPEAN VIDEO SURVEILLANCE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

17. ASIA-PACIFIC VIDEO SURVEILLANCE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC VIDEO SURVEILLANCE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY END-USERS, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC VIDEO SURVEILLANCE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

20. REST OF THE WORLD VIDEO SURVEILLANCE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

21. REST OF THE WORLD VIDEO SURVEILLANCE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY END-USERS, 2019-2026 ($ MILLION)

22. REST OF THE WORLD VIDEO SURVEILLANCE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

1. GLOBAL VIDEO SURVEILLANCE AS A SERVICE MARKET SHARE BY END-USERS, 2019 VS 2026 (%)

2. GLOBAL VIDEO SURVEILLANCE AS A SERVICE MARKET SHARE BY TYPE, 2019 VS 2026 (%)

3. GLOBAL VIDEO SURVEILLANCE AS A SERVICE MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US VIDEO SURVEILLANCE AS A SERVICE MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA VIDEO SURVEILLANCE AS A SERVICE MARKET SIZE, 2019-2026 ($ MILLION)

6. UK VIDEO SURVEILLANCE AS A SERVICE MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE VIDEO SURVEILLANCE AS A SERVICE MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY VIDEO SURVEILLANCE AS A SERVICE MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY VIDEO SURVEILLANCE AS A SERVICE MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN VIDEO SURVEILLANCE AS A SERVICE MARKET SIZE, 2019-2026 ($ MILLION)

11. REST OF EUROPE VIDEO SURVEILLANCE AS A SERVICE MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA VIDEO SURVEILLANCE AS A SERVICE MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA VIDEO SURVEILLANCE AS A SERVICE MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN VIDEO SURVEILLANCE AS A SERVICE MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC VIDEO SURVEILLANCE AS A SERVICE MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD VIDEO SURVEILLANCE AS A SERVICE MARKET SIZE, 2019-2026 ($ MILLION)