Virtual Desktop Infrastructure (VDI) Market

Virtual Desktop Infrastructure (VDI) Market Size, Share, Trends, Growth & Forecast, 2019-2025 Update Available - Forecast 2025-2031

The global virtual desktop infrastructure (VDI) market was valued at USD 8,210 million in 2018 and expected to grow at a CAGR of 11.4% during the forecast period. VDI is virtualization technology that hosts a desktop operating system on a centralized server in a data center. Moreover, it is a service that allows a user to use a desktop environment anytime and anywhere through a device connected to a network all the time as per user requirement. The global VDI market is positively influenced by the increasing demand for virtual solutions and services in small and large enterprises. The enterprises are moving to desktop virtualization to explore the challenges and opportunities of the evolving workplace. The VDI offers a wide range of benefits to the enterprises such as strong security, data protection, desktop access from multiple devices and others that propel the demand of VDI. However, system complexity and compatibility issues reted to VDI are some of the barriers to the global VDI market growth during the forecast period.

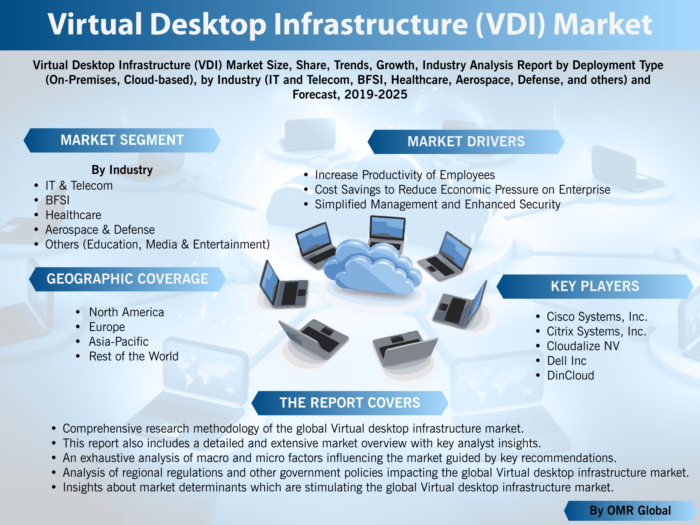

The global virtual desktop infrastructure market is classified on the basis of deployment type, and industry. Based on deployment type, the global VDI market is further segmented into on-premises and cloud-based. The cloud-based VDI segment is estimated to have considerable market growth in the market due to the rising adoption of cloud-based services by the enterprises owing to the capability and efficiency offered by the cloud services. Based on the industry, the global VDI market is further classified into IT & telecom, BFSI, healthcare, aerospace & defense and others such as education, media & entertainment. Among these, IT & Telecom segment is estimated to have significant market share due to the rising demand for desktop virtualization owing to the increasing trend of worfforce flexibility in IT industry.

Moreover, the global VDI market further analyzed on the basis of geography, including North America, Europe, Asia-Pacific and Rest of the World. North America is estimated to have a significant market share in the global VDI market due to the adoption of cloud virtualization by the enterprises coupled with developed IT infrastructure. Further, the presence of major virtual data infrastructure platform vendors will augment the growth of the market in the region. Moreover, Asia-Pacific is estimated to exhibit considerable market growth in the global VDI market owing to the rising number of small enterprises that raises the demand for the virtual desktop in the region.

Some of the players that contribute to the growth of the global virtual desktop infrastructure market include Cisco Systems, Inc., Citrix Systems, Inc., Microsoft Corp., Oracle Corp., Dizzion, Inc., Evolve IP, LLC., NetApp, Inc., VMware, Inc., and others. These market players are contributing to the market by adopting various market approaches including product launch & approvals, merger & acquisition, partnerships & collaborations, and others, for gaining a strong position in the market. For instance, in September 2018, VMware, Inc. announced the upgradation in personal desktop virtualization with its workstation 15 and Fusion 11. This upgradation includes user interface improvements and new developer-oriented controls. With this upgradation, the company is aimed at gaining a sustainable position in the VDI market.

Research Methodology:

The market study of the global virtual desktop infrastructure market is incorporated by extensive primary and secondary research conducted by the research team. Secondary research has been conducted to refine the available data to breakdown the market in various segments, derive total market size, market forecast, and growth rate. Different approaches have been worked on to derive the market value and market growth rate. Our team collects facts and data related to the market from different geography to provide a better regional outlook. In the report, the country level analysis is provided by analyzing various regional players, regional tax laws and policies, consumer behavior, and macro-economic factors. Numbers extracted from secondary research have been authenticated by conducting proper primary research. It includes tracking down key people from the industry and interviewing them to validate the data. This enables our analyst to derive the closest possible figures without any major deviations in the actual number. Our analysts try to contact as many executives, managers, key opinion leaders, and industry experts. Primary research brings the authenticity of our reports.

Secondary Sources Include:

- Financial reports of companies involved in the market

- Whitepapers, research-papers, and news blogs

- Company websites and their product catalogue

The report is intended for VDI systems providers, IT companies, government, and private organizations, for overall market analysis and competitive analysis. The report provides an in-depth analysis of the market size and growth opportunities. The report will serve as a source for 360-degree analysis of the market thoroughly delivering insights into the market for better business decisions.

Market Segmentation:

- Global VDI Market Research and Analysis, By Deployment Type

- Global VDI Market Research and Analysis, By Industry

The Report covers:

- Comprehensive research methodology of the global Virtual desktop infrastructure market.

- This report also includes a detailed and extensive market overview with key analyst insights.

- An exhaustive analysis of macro and micro factors influencing the market guided by key recommendations.

- Analysis of regional regulations and other government policies impacting the global Virtual desktop infrastructure market.

- Insights about market determinants which are stimulating the global Virtual desktop infrastructure market.

- Detailed and extensive market segments with regional distribution of forecasted revenues.

- Extensive profiles and recent developments of market players.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Cisco Systems, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. Swot Analysis

3.3.1.4. Recent Developments

3.3.2. Citrix Systems, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. Swot Analysis

3.3.2.4. Recent Developments

3.3.3. Microsoft Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. Swot Analysis

3.3.3.4. Recent Developments

3.3.4. Oracle Corp.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. Swot Analysis

3.3.4.4. Recent Developments

3.3.5. VMware, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. Swot Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global VDI Market by Deployment Type

5.1.1. On-Premises

5.1.2. Cloud-based

5.2. Global VDI Market by Industry

5.2.1. IT & Telecom

5.2.2. BFSI

5.2.3. Healthcare

5.2.4. Aerospace & Defense

5.2.5. Others (Education, Media & Entertainment)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Cisco Systems, Inc.

7.2. Citrix Systems, Inc.

7.3. Cloudalize NV

7.4. Dell Inc.

7.5. dinCloud

7.6. Dizzion, Inc.

7.7. Ericom Software Ltd.

7.8. Evolve IP, LLC.

7.9. Fujitsu Ltd.

7.10. Hewlett-Packard Development Company, L.P.

7.11. Huawei Technologies Co., Ltd.

7.12. Leostream Corp.

7.13. Microsoft Corp.

7.14. MTM Technologies, Inc.

7.15. Navisite, LLC

7.16. NComputing Co. LTD

7.17. NetApp, Inc.

7.18. NTT Communications India Pvt Ltd.

7.19. Nutanix, Inc.

7.20. Oracle Corp.

7.21. OVH

7.22. Parallels International GmbH

7.23. PC Connection, Inc.

7.24. Proact IT Group AB

7.25. Red Hat, Inc.

7.26. Stratodesk Corp.

7.27. tocario GmbH

7.28. VMware, Inc.

1. GLOBAL VDI MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2018-2025 ($ MILLION)

2. GLOBAL ON-PREMISES VDI MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL CLOUD BASED VDI MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL VDI MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2018-2025 ($ MILLION)

5. GLOBAL VDI IN IT & TELECOM MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL VDI IN BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL VDI IN HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL VDI IN AEROSPACE & DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL VDI IN OTHER INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL VDI MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

11. NORTH AMERICAN VDI MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

12. NORTH AMERICAN VDI MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2018-2025 ($ MILLION)

13. NORTH AMERICAN VDI MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

14. EUROPEAN VDI MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

15. EUROPEAN VDI MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2018-2025 ($ MILLION)

16. EUROPEAN VDI MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

17. ASIA-PACIFIC VDI MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC VDI MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC VDI MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

20. REST OF THE WORLD VDI MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2018-2025 ($ MILLION)

21. REST OF THE WORLD VDI MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

1. GLOBAL VDI MARKET SHARE BY DEPLOYMENT TYPE, 2018 VS 2025 (%)

2. GLOBAL VDI MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

3. GLOBAL VDI MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US VDI MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA VDI MARKET SIZE, 2018-2025 ($ MILLION)

6. UK VDI MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE VDI MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY VDI MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY VDI MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN VDI MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE VDI MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA VDI MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA VDI MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN VDI MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC VDI MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD VDI MARKET SIZE, 2018-2025 ($ MILLION)