Virtual Machines Market

Virtual Machines Market Size, Share & Trends Analysis Report by Type (System Virtual Machines, Process Virtual Machines), and by Industry Vertical (BFSI, Telecommunications & ITES, Government & Public Sector, Healthcare & Life Sciences, and Others) Forecast Period (2024-2031)

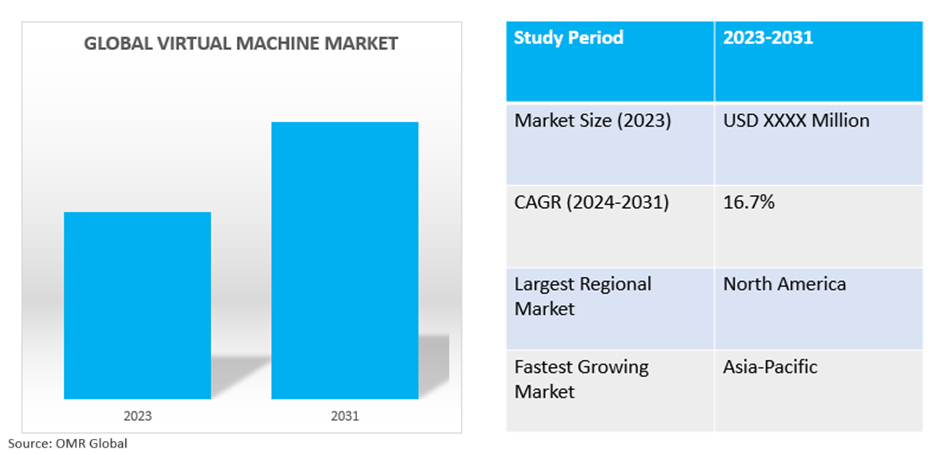

Virtual machines market is anticipated to grow at a significant CAGR of 16.7% during the forecast period (2024-2031). A Virtual Machine (VM) is a software emulation of a physical computer system that offers extended processing power, memory, storage, and the ability to run its operating system. The market growth is attributed to the increasing adoption of the VMs by the various industry verticals and data centers. The global advancement in the IT industry is also contributing towards market growth. Additionally, the rising adoption of various information technology tools such as cloud infrastructure, advanced applications, and container integration by organizations and end-users is positively impacting the industry's growth.

Market Dynamics

Virtual Machines: The Backbone of IaaS and PaaS in Cloud Computing

The spread of cloud computing models, especially Infrastructure as a Service (IaaS) and Platform as a Service (PaaS) is highly dependent on VMs’ ability to provide a virtualized layer of computing resources. For instance, in September 2023, Microsoft's revenue from server products and cloud services surged by 21.0%, primarily fueled by a 29.0% growth in Azure and other cloud services revenue (an increase of 28.0% in constant currency). IaaS offerings, for instance, rent out virtualized computing resources such as servers, storage, and networking on a pay-as-you-go basis. This enables businesses to scale their IT infrastructure up or down dynamically based on their needs, eliminating the capital expenditure required for physical hardware. Similarly, PaaS offerings provide a platform for developing, deploying, and managing applications on a virtualized infrastructure. This eliminates the need for businesses to manage the underlying hardware and software stack, allowing them to focus on core application development activities.

Unleashing Hardware Potential Virtual Machines and Cost-Effective IT Infrastructure

Traditional data center management often faces a significant challenge of underutilized physical servers. These machines consume resources and inflate IT expenditures despite offering minimal computing power. VMs enable consolidation, by creating multiple, isolated virtual environments on a single physical server. This approach strategically matches workloads to available resources, optimizing hardware utilization. The direct benefit translates to cost savings. Businesses no longer require investment in the maintenance of numerous underutilized physical servers. VMs essentially act as a catalyst for maximizing the return on investment for IT infrastructure. VMs empower businesses to achieve significant cost reduction, by ensuring efficient hardware utilization and transforming previously idle resources into valuable computing assets.

Market Segmentation

- Based on type, the market is bifurcated into system virtual machines, and process virtual machines.

- Based on industry vertical, the market is segmented into BFSI, telecommunications & ITES, government & public sector, healthcare & life sciences, and others.

Telecom & ITES are the fastest-growing segments of the virtual machine market

The telecommunications & ITES segment is experiencing the highest market growth, in the virtual machines market. This is attributed to the surging adoption of cloud-based solutions, necessitating scalable and efficient infrastructure. For instance, in March 2024, Telcos aims to optimize network management, cut expenses, and offer innovative services by utilizing cloud platforms effectively. The shift to telco cloud entails embracing virtualization tech and transferring services and infrastructure to cloud settings. VMs meet this need by enabling resource management, optimizing server utilization, and effortlessly scaling cloud deployments. Additionally, the rise of Network Function Virtualization (NFV) and Software-Defined Networking (SDN) technologies propels virtual machine industry growth.

Regional Outlook

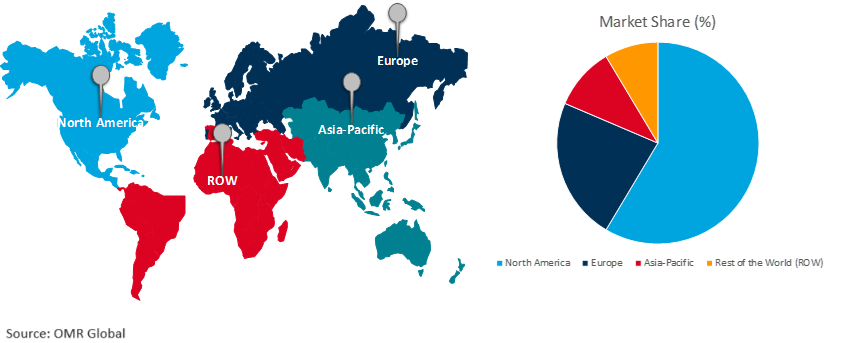

The global virtual machines market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America holds the largest market share

The strong technological infrastructure in the North American region, particularly the US contributes towards the establishment of a well-established and technologically advanced IT sector. For instance, according to the International Trade Administration of the US Department of Commerce, the US commands one-third of the $5.0 trillion global Information Technology (IT) market, solidifying its position as the largest tech market globally. Additionally, the US is home to over 557,000 software and IT services companies, with approximately 13,400 tech startups established in 2019 alone. This translates to a significant capability for developing and utilizing VM technologies.

Global Virtual Machines Growth by Region 2024-2031

Asia Pacific is the fastest-growing region

The VM market is experiencing significant growth in the Asia Pacific region. This surge is driven by several key factors. The rapid economic growth in countries such as China and India translates to increased IT spending, with businesses and governments investing in digital infrastructure. For instance, the Digital India initiative has played a pivotal role in attaining this objective, and its impact continues to be significant. This initiative has been extended with a total budget allocation of approximately INR 14,903 crore ($2.0 billion) from 2021-22 to 2025-26. Additionally, government initiatives focused on digital transformation involve significant investments in cloud computing and virtualization technologies. As cloud adoption flourishes, the demand for VMs to manage these environments rises proportionally. Finally, businesses across diverse sectors in Asia Pacific are readily adopting VMs due to their ability to improve efficiency, scalability, and cost-effectiveness. This widespread adoption across industries further fuels the regional market growth.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global VM market include Amazon Web Services, Inc., Huawei Technologies Co., Ltd., IBM Corp., Microsoft Corp., and Oracle Corp. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in December 2023, Microsoft Azure introduced confidential VMs, utilizing 4th Gen Intel Xeon processors with Intel Trust Domain Extensions (TDX). These VMs are available in multiple regions and offer enhanced privacy, compliance, and data security. They support up to 128 vCPUs, 768 GiB memory, and provide up to 2.8 TB local disk storage. Also, Microsoft has expanded its Linux partnership, working with the Confidential Computing Consortium to enhance encryption and Windows support for VMs. Canonical Ubuntu Server 22.04 LTS now supports Full Disk Encryption on Azure, with SUSE Linux Enterprise Server and Red Hat Enterprise Linux expected to follow. This collaboration ensures robust, secure solutions for regulated industries.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global virtual machine market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Amazon Web Services, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Huawei Technologies Co., Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. IBM Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Microsoft Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Oracle Corp.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Virtual Machines by Type

4.1.1. System Virtual Machines

4.1.2. Process Virtual Machines

4.2. Global Virtual Machines by Industry Vertical

4.2.1. BFSI (Banking, Financial Services, and Insurance)

4.2.2. Telecommunications & ITES (Information Technology Enabled Services)

4.2.3. Government & Public Sector

4.2.4. Healthcare & Life Sciences

4.2.5. Others (Manufacturing, Education, Retail, Media & Entertainment, Non-profit Organizations)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Citrix

6.2. Datacom Group Ltd

6.3. Hewlett Packard Enterprise Development LP

6.4. Nasstar

6.5. NComputing Co. LTD

6.6. Nutanix Group

6.7. Parallels International GmbH

6.8. Proxmox Server Solutions GmbH

6.9. Red Hat, Inc.

6.10. Scale Computing

6.11. VMware (Broadcom, Inc.)

1. GLOBAL VIRTUAL MACHINES MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL VIRTUAL MACHINES SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL VIRTUAL MACHINES MARKET PROCESS RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL VIRTUAL MACHINES MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2023-2031 ($ MILLION)

5. GLOBAL VIRTUAL MACHINES FOR BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL VIRTUAL MACHINES FOR TELECOMMUNICATIONS & ITES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL VIRTUAL MACHINES FOR GOVERNMENT & PUBLIC SECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL VIRTUAL MACHINES FOR HEALTHCARE & LIFE SCIENCES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL VIRTUAL MACHINES MARKET FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL VIRTUAL MACHINES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. NORTH AMERICAN VIRTUAL MACHINES RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

12. NORTH AMERICAN VIRTUAL MACHINES RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

13. NORTH AMERICAN VIRTUAL MACHINES RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2023-2031 ($ MILLION)

14. EUROPEAN VIRTUAL MACHINES RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. EUROPEAN VIRTUAL MACHINES RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

16. EUROPEAN VIRTUAL MACHINES RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2023-2031 ($ MILLION)

17. ASIA-PACIFIC VIRTUAL MACHINES RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. ASIA- PACIFIC VIRTUAL MACHINES RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC VIRTUAL MACHINES RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2023-2031 ($ MILLION)

20. REST OF THE WORLD VIRTUAL MACHINES RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. REST OF THE WORLD VIRTUAL MACHINES RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

22. REST OF THE WORLD VIRTUAL MACHINES RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2023-2031 ($ MILLION)

1. GLOBAL VIRTUAL MACHINES MARKET RESEARCH AND ANALYSIS BY TYPE, 2023 VS 2031 (%)

2. GLOBAL VIRTUAL MACHINES SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBAL VIRTUAL MACHINES PROCESS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL VIRTUAL MACHINES RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2023 VS 2031 (%)

5. GLOBAL VIRTUAL MACHINES FOR BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

6. GLOBAL VIRTUAL MACHINES FOR TELECOMMUNICATIONS & ITES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

7. GLOBAL VIRTUAL MACHINES FOR GOVERNMENT & PUBLIC SECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

8. GLOBAL VIRTUAL MACHINES FOR HEALTHCARE & LIFE SCIENCES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

9. GLOBAL VIRTUAL MACHINES MARKET FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

10. GLOBAL VIRTUAL MACHINES RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

11. US VIRTUAL MACHINES MARKET SIZE, 2023-2031 ($ MILLION)

12. CANADA VIRTUAL MACHINES MARKET SIZE, 2023-2031 ($ MILLION)

13. UK VIRTUAL MACHINES MARKET SIZE, 2023-2031 ($ MILLION)

14. FRANCE VIRTUAL MACHINES MARKET SIZE, 2023-2031 ($ MILLION)

15. GERMANY VIRTUAL MACHINES MARKET SIZE, 2023-2031 ($ MILLION)

16. ITALY VIRTUAL MACHINES MARKET SIZE, 2023-2031 ($ MILLION)

17. SPAIN VIRTUAL MACHINES MARKET SIZE, 2023-2031 ($ MILLION)

18. REST OF EUROPE VIRTUAL MACHINES MARKET SIZE, 2023-2031 ($ MILLION)

19. INDIA VIRTUAL MACHINES MARKET SIZE, 2023-2031 ($ MILLION)

20. CHINA VIRTUAL MACHINES MARKET SIZE, 2023-2031 ($ MILLION)

21. JAPAN VIRTUAL MACHINES MARKET SIZE, 2023-2031 ($ MILLION)

22. SOUTH KOREA VIRTUAL MACHINES SIZE, 2023-2031 ($ MILLION)

23. REST OF ASIA-PACIFIC VIRTUAL MACHINES SIZE, 2023-2031 ($ MILLION)

24. LATIN AMERICA VIRTUAL MACHINES MARKET, 2023-2031 ($ MILLION)

25. MIDDLE EAST & AFRICA VIRTUAL MACHINES MARKET, 2023-2031 ($ MILLION)