Viscosity Index Improver Market

Viscosity Index Improver Market Size, Share & Trends Analysis Report by Type (Polymethacrylate (PMA), Ethylene propylene copolymer (OCP), Hydrostyrene Diene Copolymer (HSD), Polyisobutylene (PIB) and Others), and by Application (Vehicle Lubricants, Industrial Lubricants and Transmission Fluids), Forecast Period (2024-2031)

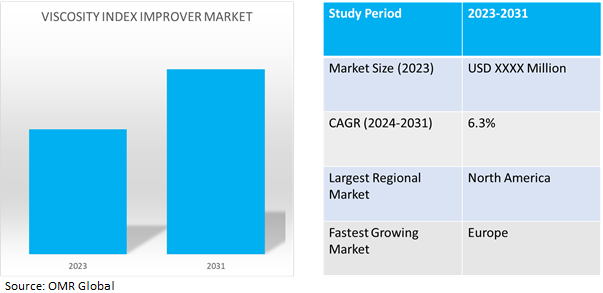

Viscosity index improver market is anticipated to grow at a considerable CAGR of 6.3% during the forecast period (2024-2031).A viscosity index improver used in lubricating oil can benefit to enhance their viscosity-temperature characteristics. The viscosity of oil plays a crucial role in defining its ability to protect and lubricate machinery at different operating temperatures. Viscosity index improvers are used to ensure ideal lubrication in a variety of scenarios by minimizing the change in viscosity with temperature fluctuations.

Market Dynamics

Rising Uses In the Automotive Industry

Lubricants play a critical role in the automotive industry by regulating engine friction, preventing rust, cooling pistons, and shielding engine oil from combustion fumes. Viscosity index improvers, or VIIs, are lubricant additives used to improve the quality and performance of motor oil due to a rise in automotive sales, particularly in Asia-Pacific region. Viscosity-temperature properties of lubricating oils are enhanced by VIIs. These reduce viscosity variations in response to temperature changes, providing optimal lubrication under a variety of conditions.

The trend is further aided by the increasing manufacturing of electric vehicles (EVs). Even though EVs don't require as much lubrication as conventional cars with internal combustion engines, electric drivetrain components like bearings and gears still need special lubricants that contain VIIs. According to IEA, In 2023, nearly 14 million new electric cars were registered globally, bringing the total number of electric cars on the road to 40 million. This is a 35% year-on-year increase from 2022, when sales exceeded 10 million.

Market Segmentation

Our in-depth analysis of the global viscosity index improver market includes the following segments by type and application:

- Based on type, the market is segmented into polymethacrylate (PMA), ethylene propylene copolymer (OCP), hydrostyrene diene copolymer (HSD), polyisobutylene (PIB) and others.

- Based on application, the market is segmented into vehicle lubricants, industrial lubricants, and transmission fluids.

Ethylene Propylene Copolymer (OCP) is Projected to Emerge as the Largest Segment

OCP's market share is expected to increase usage across various sectors. Due to their flexibility and adaptability, ethylene-propylene copolymers are becoming more and more common in a variety of industries, such as automotive parts, industrial components, and elements. Due to environmental restrictions and sustainability, the VII market is moving toward bio-based OCPs, which is in line with the growing demand for eco-friendly materials across a range of industries. Plant closures, changes in the price of crude oil, and disruptions in the supply chain all have an impact on OCP production, therefore stable industry supply must be maintained through efficient management.

Vehicle Lubricants Segment to Hold a Considerable Market Share

Through their ability to lower friction and wear, vehicle lubricants are essential to preserving engine longevity and optimal performance. Enhancing lubricants' viscosity-temperature connection with additives ensures constant performance over a wide temperature range. This is known as viscosity index improvement. There is an increasing need for premium lubricants with enhanced viscosity index properties in the automobile sector, where durability and efficiency are critical. Growing awareness of the value of maintenance and stricter pollution rules, along with rising vehicle production, are some of the causes driving this demand. Since passenger cars, commercial vehicles, and other automotive applications require better-performing lubricants, the vehicle lubricants segment is anticipated to lead the viscosity index improver market.

Regional Outlook

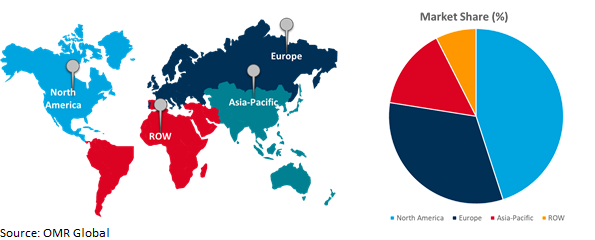

The global viscosity index improver market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Europe is anticipated to exhibit the fastest CAGR during the forecasted period

The need for high-performance lubricants with the right viscosity has increased due to the growing use of high-performance engines for energy consumption, oil and gas, automotive, metal and fabrication, power and energy transmission, chemicals, and general manufacturing industries, which need lubricants such as transmission oils, process oils, metalworking fluids, drilling fluids, and other lubricants. Region-wide production of sophisticated integrated systems is also noteworthy. A few geographic areas include the majority of the nation's aerospace manufacturing businesses, according to data from the Italian Aerospace Industry Federation (AIAD). These areas are Campania, Umbria, Lazio, Piedmont, Puglia, and Lombardy.

Global Viscosity Index Improver Market Growth by Region 2024-2031

North America Holds Major Market Share

The country's need for automotive lubricants is expected to rise as a result of an increase in the sales of commercial vehicles, especially light trucks and pick-up trucks used for transportation and short-distance trade. As the automotive industry grows, viscosity index improver use will increase during the predicted period. Furthermore, it is anticipated that the need for lubricant additives like viscosity index improvers will be driven by higher production and exports of chemicals for better industrial output. It is anticipated that the US will continue to hold the top spot in the regional market. The automobile sector has been steadily growing. The demand for automotive lubricants in the nation is expected to rise as a result of an increase in the sales of commercial vehicles, especially light trucks and pick-up trucks used for short-distance trading and logistics.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global viscosity index improver market include Mitsui Chemicals Inc., Infineum International Ltd., Chevron Oronite Company LLC, BASF SE, and The Lubrizol Corp., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in August 2022, Evonik Oil Additives announced a new distributor in the CIS region. The Oil Additives business line of Evonik has restructured its distribution setup for its products in CIS countries, announcing ADCO as its new distribution partner. The lubricant additives business develops formulation solutions and base oil technologies that improve fuel economy and flow efficiency of automotive lubricants for passenger cars and commercial vehicles and increase energy efficiency and productivity of industrial lubricants for construction, mining, agricultural, and manufacturing equipment.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global viscosity index improver market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Chevron Oronite Company LLC

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Infineum International Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Mitsui Chemicals, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Viscosity Index Improver Market by Type

4.1.1. Polymethacrylate (PMA)

4.1.2. Ethylene propylene copolymer (OCP)

4.1.3. Hydrostyrene Diene Copolymer (HSD)

4.1.4. Polyisobutylene (PIB)

4.1.5. Others

4.2. Global Viscosity Index Improver Market by Application

4.2.1. Vehicle Lubricants

4.2.2. Industrial Lubricants

4.2.3. Transmission Fluids

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Asian Oil Company

6.2. Afton Chemical Corp.

6.3. BASF SE

6.4. BPT Chemicals

6.5. Chevron Oronite Company LLC

6.6. Croda International Plc

6.7. Evonik Industries AG

6.8. Jilin Xingyun Chemical Co., Ltd.

6.9. Jinzhou Kangtai Lubricant Additives Co., Ltd.

6.10. Lanxess AG

6.11. Lubrizol Corporation

6.12. Nanjing Runyou Chemical Industry Additive Co., Ltd.

6.13. Petronas

6.14. Sanyo Chemical Industries

6.15. Shenyang Great Wall Lubricating Oil Manufacturing Co., Ltd.

6.16. The Lubrizol Corp.

6.17. Versalis SpA

1. GLOBAL VISCOSITY INDEX IMPROVER MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL POLYMETHACRYLATE (PMA) VISCOSITY INDEX IMPROVER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL ETHYLENE PROPYLENE COPOLYMER (OCP) VISCOSITY INDEX IMPROVER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL HYDROSTYRENE DIENE COPOLYMER (HSD) VISCOSITY INDEX IMPROVER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL POLYISOBUTYLENE (PIB) VISCOSITY INDEX IMPROVER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL OTHERS VISCOSITY INDEX IMPROVER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL VISCOSITY INDEX IMPROVER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

8. GLOBAL VISCOSITY INDEX IMPROVER FOR VEHICLE LUBRICANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL VISCOSITY INDEX IMPROVER FOR INDUSTRIAL LUBRICANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL VISCOSITY INDEX IMPROVER FOR TRANSMISSION FLUIDS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL VISCOSITY INDEX IMPROVER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. NORTH AMERICAN VISCOSITY INDEX IMPROVER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. NORTH AMERICAN VISCOSITY INDEX IMPROVER MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

14. NORTH AMERICAN VISCOSITY INDEX IMPROVER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

15. EUROPEAN VISCOSITY INDEX IMPROVER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. EUROPEAN VISCOSITY INDEX IMPROVER MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

17. EUROPEAN VISCOSITY INDEX IMPROVER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC VISCOSITY INDEX IMPROVER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC VISCOSITY INDEX IMPROVER MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC VISCOSITY INDEX IMPROVER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

21. REST OF THE WORLD VISCOSITY INDEX IMPROVER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. REST OF THE WORLD VISCOSITY INDEX IMPROVER MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

23. REST OF THE WORLD VISCOSITY INDEX IMPROVER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL VISCOSITY INDEX IMPROVER MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL POLYMETHACRYLATE (PMA) VISCOSITY INDEX IMPROVER MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL ETHYLENE PROPYLENE COPOLYMER (OCP) VISCOSITY INDEX IMPROVER MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL HYDROSTYRENE DIENE COPOLYMER (HSD) VISCOSITY INDEX IMPROVER MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL POLYISOBUTYLENE (PIB) VISCOSITY INDEX IMPROVER MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL OTHERS VISCOSITY INDEX IMPROVER MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL VISCOSITY INDEX IMPROVER MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

8. GLOBAL VISCOSITY INDEX IMPROVER FOR VEHICLE LUBRICANTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL VISCOSITY INDEX IMPROVER FOR INDUSTRIAL LUBRICANTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL VISCOSITY INDEX IMPROVER FOR TRANSMISSION FLUIDS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL VISCOSITY INDEX IMPROVER MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. US VISCOSITY INDEX IMPROVER MARKET SIZE, 2023-2031 ($ MILLION)

13. CANADA VISCOSITY INDEX IMPROVER MARKET SIZE, 2023-2031 ($ MILLION)

14. UK VISCOSITY INDEX IMPROVER MARKET SIZE, 2023-2031 ($ MILLION)

15. FRANCE VISCOSITY INDEX IMPROVER MARKET SIZE, 2023-2031 ($ MILLION)

16. GERMANY VISCOSITY INDEX IMPROVER MARKET SIZE, 2023-2031 ($ MILLION)

17. ITALY VISCOSITY INDEX IMPROVER MARKET SIZE, 2023-2031 ($ MILLION)

18. SPAIN VISCOSITY INDEX IMPROVER MARKET SIZE, 2023-2031 ($ MILLION)

19. REST OF EUROPE VISCOSITY INDEX IMPROVER MARKET SIZE, 2023-2031 ($ MILLION)

20. INDIA VISCOSITY INDEX IMPROVER MARKET SIZE, 2023-2031 ($ MILLION)

21. CHINA VISCOSITY INDEX IMPROVER MARKET SIZE, 2023-2031 ($ MILLION)

22. JAPAN VISCOSITY INDEX IMPROVER MARKET SIZE, 2023-2031 ($ MILLION)

23. SOUTH KOREA VISCOSITY INDEX IMPROVER MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF ASIA-PACIFIC VISCOSITY INDEX IMPROVER MARKET SIZE, 2023-2031 ($ MILLION)

25. LATIN AMERICA VISCOSITY INDEX IMPROVER MARKET SIZE, 2023-2031 ($ MILLION)

26. MIDDLE EAST AND AFRICA VISCOSITY INDEX IMPROVER MARKET SIZE, 2023-2031 ($ MILLION)