Warehouse Robotics Market

Warehouse Robotics Market Size, Share & Trends Analysis Report, By Type (Mobile, Articulated, SCARA, Cartesian, and Others), By Function (Pick & Place, Transportation, Packaging, Assembling & Dissembling and Others), By End-User (Retail, Food & Beverage, Pharmaceutical, Automotive, Electronics, and Others) and Forecast, 2019-2025 Update Available - Forecast 2025-2035

The global warehouse robotics market is estimated to grow at a CAGR of 10.8% during the forecast period. Warehouse robots are gaining significance to carry out several activities in warehouses, such as pick & place, transportation, packaging, assembling & dissembling, and transshipment. Most warehouse managers are looking for robots to minimize human movement and increase safety in the facility. The developments in sensors, artificial intelligence (AI) and mobility support robots to be easily deployed virtually at any place. Companies, including Bleum, IAM Robotics, and GreyOrange offer mobile robotic picking solutions that can increase efficiency in the operations. Such robots usually carry carts and are programmed for traveling flexible routes within the facility.

The major factors contributing to the growth of warehouse robotics industry include the rising e-commerce industry and rapid industrialization across the globe. Growing internet penetration and adoption of smartphones are primarily encouraging the growth of the e-commerce industry. As per the United Nations Conference on Trade and Development (UNCTAD), the global e-commerce sales increased 13% in 2017, hitting an estimated $29 trillion. In 2017, the top countries by e-commerce sales were the US, Japan, China, and Germany with nearly $8.9 trillion, $3 trillion, $1.9 trillion and $1.5 trillion, respectively.

To keep up with the demand for online sales, there is a significant need for warehouse centers which results in the adoption of warehousing robots. The robots are used to speed up picking and loading processes and reduces the need for manual tasks. As a result, e-commerce companies are adopting warehouse robots to increase efficiency in the process. For instance, Amazon is using robots at its warehouse facilities in the US to scan and box items to be sent to the customers. The emerging focus on warehousing automation leads the adoption of robots in the facility, which in turn, is encouraging the growth of the market.

Segmentation

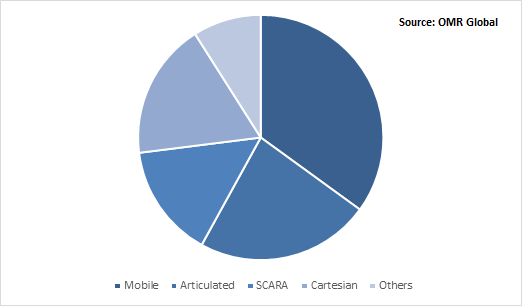

The global warehouse robotics market is segmented on the basis of type, function, and end-user. Based on the type, the market is classified into mobile warehouse robots, articulated warehouse robots, SCARA warehouse robots, cartesian warehouse robots, and other warehouse robots. Based on function, the market is classified into pick & place, transportation, packaging, assembling & dissembling, and others. Pick & place is expected to hold a significant share in the market. Based on end-user, the market is classified into retail, food & beverage, pharmaceutical, automotive, electronics, and others.

Mobile Robots to Exhibit a Significant CAGR in the Market

The autonomous mobile robot employs robotic goods-to-person technology for automated pick & place, inventory storage and order picking in distribution and fulfillment centers. While integrated with RFID-tagged products and devices, such robots can perform their inventory sweeps autonomously at schedules. In the case of manual operations, inventory counts are not conducted frequently, however, the robots can perform it in every two hours with real-time data. This allows warehouse managers to make better storage and layout decisions regarding their facility.

With the use of onboard sensors, maps, and cameras, which combine with warehouse execution software, autonomous mobile robots can be utilized to carry out a range of functions, from transporting materials and goods to simplifying an existing pick strategy. As a result, mobile robots are being significantly employed in warehousing facilities.

Global Warehouse Robotics Market Share by Type, 2018 (%)

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global warehouse robotics market. Based on the availability of data, information related to products and services, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. ABB Ltd.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Fanuc Corp.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Amazon Robotics

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Toshiba Corp

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Honeywell International, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Warehouse Robotics Market by Type

5.1.1. Mobile

5.1.2. Articulated

5.1.3. SCARA

5.1.4. Cartesian

5.1.5. Others (Cylindrical and Delta)

5.2. Global Warehouse Robotics Market by Function

5.2.1. Pick & Place

5.2.2. Transportation

5.2.3. Packaging

5.2.4. Assembling & Dissembling

5.2.5. Others (Transshipment)

5.3. Global Warehouse Robotics Market by End-User

5.3.1. Retail

5.3.2. Food & Beverage

5.3.3. Pharmaceutical

5.3.4. Automotive

5.3.5. Electronics

5.3.6. Others (Paper & Printing and Metal)

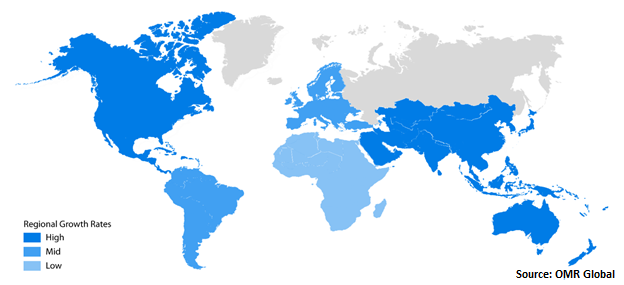

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ABB Ltd.

7.2. Addverb Technologies Pvt. Ltd.

7.3. Aethon, Inc. (Singapore Technologies Engineering Ltd.)

7.4. Amazon Robotics

7.5. ATS Automation Tooling Systems Inc.

7.6. Bastian Solutions, Inc.

7.7. Bleum, Inc.

7.8. Daifuku Co., Ltd.

7.9. Falcon Autotech Private Ltd.

7.10. Fanuc Corp.

7.11. Fetch Robotics, Inc.

7.12. Grey Orange Pte. Ltd.

7.13. Honeywell International, Inc.

7.14. IAM Robotics

7.15. inVia Robotics, Inc.

7.16. John Bean Technologies (JBT) Corp.

7.17. Kawasaki Heavy Industries, Ltd.

7.18. KION Group AG

7.19. KNAPP AG

7.20. Kuka AG

7.21. Locus Robotics

7.22. Magazino GmbH

7.23. Omron Corp.

7.24. RA Rodriguez (UK) Ltd.

7.25. Robert Bosch GmbH

7.26. SSI SCHAEFER Group

7.27. System Logistics Spa

7.28. Toshiba Corp.

7.29. Yamaha Motor Co., Ltd.

7.30. YASKAWA Electric Corp.

1. GLOBAL WAREHOUSE ROBOTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

2. GLOBAL MOBILE WAREHOUSE ROBOTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL ARTICULATED WAREHOUSE ROBOTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL SCARA WAREHOUSE ROBOTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL CARTESIAN WAREHOUSE ROBOTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL OTHER WAREHOUSE ROBOTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL WAREHOUSE ROBOTICS MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2018-2025 ($ MILLION)

8. GLOBAL WAREHOUSE ROBOTICS FOR PICK & PLACE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL WAREHOUSE ROBOTICS FOR TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL WAREHOUSE ROBOTICS FOR PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL WAREHOUSE ROBOTICS FOR ASSEMBLING & DISSEMBLING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL WAREHOUSE ROBOTICS FOR OTHER FUNCTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL WAREHOUSE ROBOTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

14. GLOBAL WAREHOUSE ROBOTICS IN RETAIL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

15. GLOBAL WAREHOUSE ROBOTICS IN FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

16. GLOBAL WAREHOUSE ROBOTICS IN PHARMACEUTICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

17. GLOBAL WAREHOUSE ROBOTICS IN AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

18. GLOBAL WAREHOUSE ROBOTICS IN ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

19. GLOBAL WAREHOUSE ROBOTICS IN OTHER END-USERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

20. GLOBAL WAREHOUSE ROBOTICS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

21. NORTH AMERICAN WAREHOUSE ROBOTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

22. NORTH AMERICAN WAREHOUSE ROBOTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

23. NORTH AMERICAN WAREHOUSE ROBOTICS MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2018-2025 ($ MILLION)

24. NORTH AMERICAN WAREHOUSE ROBOTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

25. EUROPEAN WAREHOUSE ROBOTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

26. EUROPEAN WAREHOUSE ROBOTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

27. EUROPEAN WAREHOUSE ROBOTICS MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2018-2025 ($ MILLION)

28. EUROPEAN WAREHOUSE ROBOTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

29. ASIA-PACIFIC WAREHOUSE ROBOTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

30. ASIA-PACIFIC WAREHOUSE ROBOTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

31. ASIA-PACIFIC WAREHOUSE ROBOTICS MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2018-2025 ($ MILLION)

32. ASIA-PACIFIC WAREHOUSE ROBOTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

33. REST OF THE WORLD WAREHOUSE ROBOTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

34. REST OF THE WORLD WAREHOUSE ROBOTICS MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2018-2025 ($ MILLION)

35. REST OF THE WORLD WAREHOUSE ROBOTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

1. GLOBAL WAREHOUSE ROBOTICS MARKET SHARE BY TYPE, 2018 VS 2025 (%)

2. GLOBAL WAREHOUSE ROBOTICS MARKET SHARE BY FUNCTION, 2018 VS 2025 (%)

3. GLOBAL WAREHOUSE ROBOTICS MARKET SHARE BY END-USER, 2018 VS 2025 (%)

4. GLOBAL WAREHOUSE ROBOTICS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. US WAREHOUSE ROBOTICS MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA WAREHOUSE ROBOTICS MARKET SIZE, 2018-2025 ($ MILLION)

7. UK WAREHOUSE ROBOTICS MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE WAREHOUSE ROBOTICS MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY WAREHOUSE ROBOTICS MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY WAREHOUSE ROBOTICS MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN WAREHOUSE ROBOTICS MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE WAREHOUSE ROBOTICS MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA WAREHOUSE ROBOTICS MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA WAREHOUSE ROBOTICS MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN WAREHOUSE ROBOTICS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC WAREHOUSE ROBOTICS MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD WAREHOUSE ROBOTICS MARKET SIZE, 2018-2025 ($ MILLION)