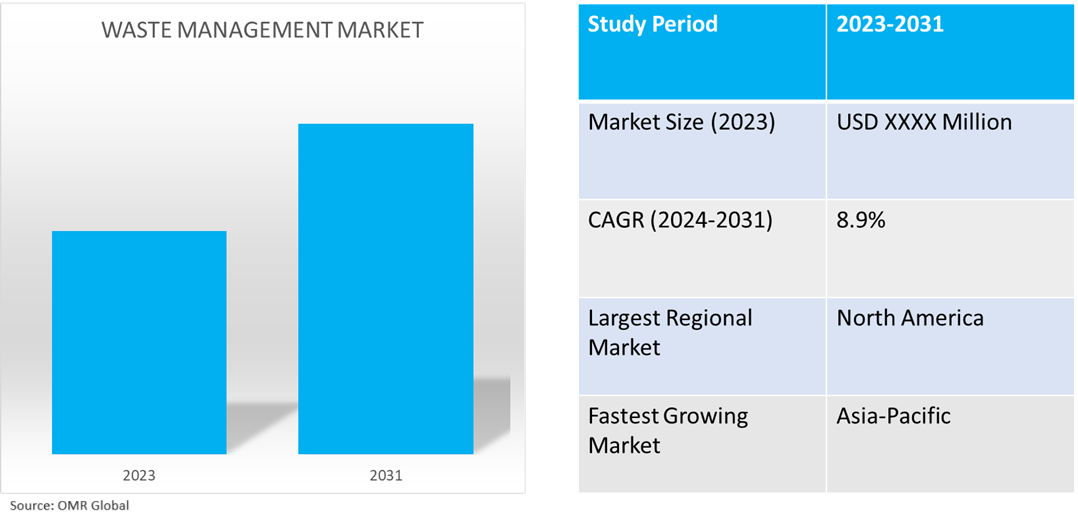

Waste Management Market

Waste Management Market Size, Share & Trends Analysis Report by Waste Type (Industrial Waste, Municipal Solid Waste, Hazardous Waste, E-Waste, Plastic Waste, and Bio-medical Waste), by Disposal Methods (Landfills, Incineration, and Recycling), and by End-User (Residential, Commercial, and Industrial) Forecast Period (2024-2031)

Waste management market is anticipated to grow at a significant CAGR of 8.9% during the forecast period (2024-2031). The market growth is attributed to stringent waste management regulations, such as governments and international organizations implementing extended producer responsibility and aggressive plastic waste reduction targets. The circular economy's emphasis on a never-ending cycle of resource repurposing, reuse, and recycling led to waste management transformation. According to the United Nations Environment Programme, Global Waste Management Report 2024, the total global cost of municipal solid waste in 2050 is projected to reach $640.3 billion, including $4,430.0 billion in externalities. In contrast, with the waste under control scenario of implementing upstream and downstream actions, the cost of externalities can be limited to a projected $263.6 billion, demonstrating the potential for cost savings through implementing controlled waste management methods.

Market Dynamics

Increasing Demand for Advanced Recycling Screening and Sorting

Accurate screening and sorting are growing increasingly necessary for effective waste management. Innovations in recycling methods are growing with a high emphasis on sustainability. Modern waste management includes the use of robotics, artificial intelligence, and innovative sensors. By accurately sorting plastics, metals, and other recyclables according to their unique qualities, technologies such as near-infrared (NIR) and hyperspectral imaging help lower contamination. AI-powered systems are improving their accuracy and adjusting to the constantly changing product material landscape. This equates to higher recycling rates, less contamination, and a more sustainable resource-handling strategy for the waste management industry. These innovative techniques are essential for successful recycling in the quest for increased sustainability. According to the US Environmental Protection Agency, in March 2024, Waste management increased by 2.0 billion pounds (7.0%) from 2013 to 2022. For 2022, 87.0% of waste was managed on-site.

Growing Adoption for Innovations in Decomposition

Innovative developments in decomposition are offering significant alternatives for waste management as garbage accumulation puts ecosystems at risk. Scientific and technological developments are enabling the breakdown of both synthetic and organic materials more quickly and effectively. Biodegradable plastics are currently being improved to break down at speeds that were thought to be unattainable. Simultaneously, natural processes such as composting are being accelerated using enzymes and bacteria that have been specifically engineered to break down organic waste more quickly. Research is exploring the possibility of using microbes to recover rare minerals and metals from electronic trash. Additionally, circular economies are being developed in sustainable industries by utilizing these advancements. Products are made with their eventual decomposition in mind, in addition to their intended use, to provide a sustainable lifecycle from manufacturing to disposal.

Market Segmentation

- Based on the waste type, the market is segmented into industrial waste, municipal solid waste, hazardous waste, e-waste, plastic waste, and bio-medical waste.

- Based on the disposal methods, the market is segmented into landfills, incineration, and recycling.

- Based on the end-users, the market is segmented into residential, commercial, and industrial.

Municipal Solid Waste Holds the Major Market Share

The primary factors supporting the growth include increasing population and industrialization resulting in higher waste generation. According to the United Nations Environment Programme (UNEP), in February 2024, municipal solid waste generation is predicted to grow from 2.1 billion tons in 2023 to 3.8 billion tons by 2050. In 2020, the global direct cost of waste management was an estimated $252.0 billion. When factoring in the hidden costs of pollution, poor health, and climate change from poor waste disposal practices, the cost rises to $361.0 billion. Without urgent action on waste management, by 2050 this global annual cost could almost double to a staggering $640.3 billion. The transition from conventional methods of disposing of waste to eco-friendly and creative approaches is going to encourage the growth of the industry. As mitigating the effects of climate change is imperative, there has been a surge in demand for clean energy in recent years. This has led to the use of waste as a renewable energy source, with the help of waste-to-energy plants that burn municipal solid waste (MSW) and turn it into steam, which in turn helps produce electricity by spinning generator turbines.

Industrial Waste Segment to Hold a Considerable Market Share

Growing industrialization and urbanization are two of the main causes of the rise in the production of industrial waste. Industrial waste management is necessary as improper handling of this garbage can harm plants and wildlife as well as contaminate lakes and groundwater. According to the US Environmental Protection Agency, in March 2024, 1,674 manufacturing facilities initiated over 3,400 pollution prevention activities to reduce TRI chemical use and waste creation in 2022. The most reported type of pollution prevention activity was process and equipment modifications. The waste products from the industry include masonry and concrete, mud and gravel, oil, chemicals, solvents, scrap metal, scrap lumber, and even leftover vegetables from restaurants. Waste from manufacturing can be liquid, semi-solid, or solid.

Regional Outlook

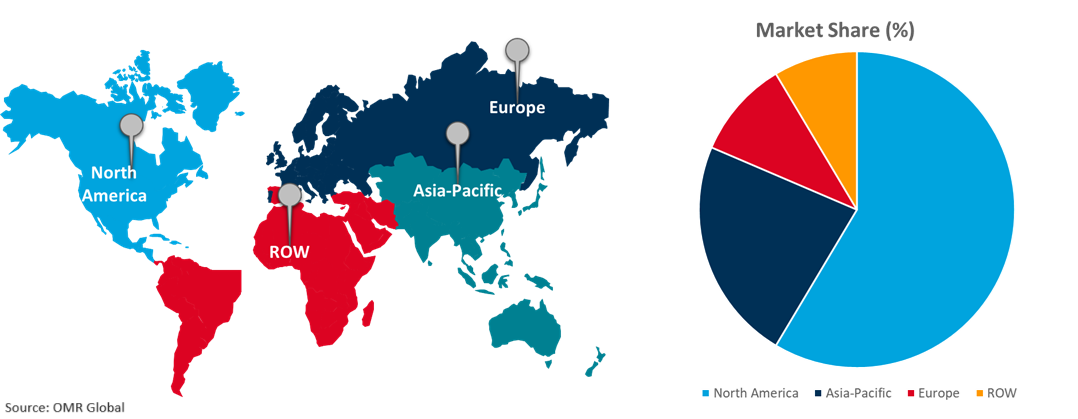

Global waste management market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Waste Management in Asia-Pacific

The regional growth is attributed to ongoing technical developments that improve the efficacy and efficiency of Asia-Pacific mining waste management goods and services. This covers improvements in digital technology, production methods, and materials. The increase in the Asia-Pacific waste management market is mostly driven by the growing demand for plastic waste and effective waste management strategies, Infrastructure for contemporary waste treatment is required owing to the rising output of industrial waste brought about by rapid industrialization in countries such as China, India, Japan, and others.

Global Waste Management Market Growth by Region 2024-2031

North America Holds Major Market Share

The regional market growth is attributed to the high public awareness of the sustainable advantages and benefits of reusing and recycling waste materials, rising trash generation, stringent government laws for waste management, and unlawful dumping. Rapid technological developments are also anticipated to positively affect demand in North America. The market players in the region invest to improve the quality, value, and marketability of the finished recycled bales benefiting the economics of recycling for its commercial customers and municipal communities. For instance, in November 2022, WM announced plans to invest $75.0 million to construct the new WM Recycling South Florida facility in recognition of America Recycles Day. The state-of-the-art, 127,000-square-foot recycling facility is built on a 12-acre parcel adjacent to WM’s existing Reuter Recycling Facility in Pembroke Pines. The site is just north of the Miami-Dade/Broward County line and is already zoned for a recycling processing facility.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the waste management market include Hitachi Zosen Corp., Republic Services, Inc., SUEZ Group, Veolia Environment SA, and Waste Management, Inc. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

Recent Developments

- In June 2024, WM acquired Stericycle, in Medical Waste Services, for $7.2 Billion. The agreement under which WM acquired all outstanding shares of Stericycle for $62.00 per share in cash, representing a total enterprise value of approximately $7.2 billion when including approximately $1.4 billion of Stericycle’s net debt.

- In January 2023, Yokogawa Electric Corp. announced that it had made a $10 million Series B investment* in Ideation3X Pte. Ltd. (i3X), a Singapore-based venture company that is targeting the rapidly expanding integrated solid waste management (ISWM) sector in India with a process that adopts a circular economy approach. The two companies have also signed a business collaboration agreement. With this investment in the high-growth ISWM field, Yokogawa aims to develop its business in the Indian market.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global waste management market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Hitachi Zosen Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Republic Services, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. SUEZ Group

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Veolia Environment SA

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Waste Management, Inc.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Waste Management Market by Waste Type

4.1.1. Industrial Waste

4.1.2. Municipal Solid Waste

4.1.3. Hazardous Waste

4.1.4. E-Waste

4.1.5. Plastic Waste

4.1.6. Bio-medical Waste

4.2. Global Waste Management Market by Disposal Methods

4.2.1. Landfills

4.2.2. Incineration

4.2.3. Recycling

4.3. Global Waste Management Market by End-Users

4.3.1. Residential

4.3.2. Commercial

4.3.3. Industrial

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Averda International Ltd.

6.2. Bertin Medical Waste

6.3. Biffa Plc

6.4. Casella Waste Systems, Inc.

6.5. China Everbright International Ltd.

6.6. Clean Harbors, Inc.

6.7. Daiseki Co., Ltd.

6.8. Ecosage Ltd.

6.9. Envac Group

6.10. FCC Austria Abfall Service AG

6.11. GFL Environmental Inc.

6.12. Recology Inc.

6.13. Remondis SE & Co. KG

6.14. Renewi plc

6.15. Reworld Waste, LLC

6.16. Sembcorp Industries Ltd.

6.17. Stericycle, Inc.

6.18. TrashCon Labs Pvt. Ltd.

6.19. URBASER, S.A.U.

6.20. Waste Connections, Inc.

1. Global Waste Management Market Research And Analysis By Waste Type, 2023-2031 ($ Million)

2. Global Waste Management Market For Industrial Waste Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Waste Management Market For Municipal Solid Waste Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Waste Management Market For Hazardous Waste Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Waste Management Market For E-Waste Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global Waste Management Market For Plastic Waste Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Waste Management Market For Bio-medical Waste Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Waste Management Market Research And Analysis By Disposal Methods, 2023-2031 ($ Million)

9. Global Landfills Waste Management Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Incineration Waste Management Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global Recycling Waste Management Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global Waste Management Market Research And Analysis By End-User, 2023-2031 ($ Million)

13. Global Waste Management In Residential Market Research And Analysis By Region, 2023-2031 ($ Million)

14. Global Waste Management In Commercial Market Research And Analysis By Region, 2023-2031 ($ Million)

15. Global Waste Management In Industrial Market Research And Analysis By Region, 2023-2031 ($ Million)

16. Global Waste Management Market Research And Analysis By Region, 2023-2031 ($ Million)

17. North American Waste Management Market Research And Analysis By Country, 2023-2031 ($ Million)

18. North American Waste Management Market Research And Analysis By Waste Type, 2023-2031 ($ Million)

19. North American Waste Management Market Research And Analysis By Disposal Methods, 2023-2031 ($ Million)

20. North American Waste Management Market Research And Analysis By End-User, 2023-2031 ($ Million)

21. European Waste Management Market Research And Analysis By Country, 2023-2031 ($ Million)

22. European Waste Management Market Research And Analysis By Waste Type, 2023-2031 ($ Million)

23. European Waste Management Market Research And Analysis By Disposal Methods, 2023-2031 ($ Million)

24. European Waste Management Market Research And Analysis By End-User, 2023-2031 ($ Million)

25. Asia-Pacific Waste Management Market Research And Analysis By Country, 2023-2031 ($ Million)

26. Asia-Pacific Waste Management Market Research And Analysis By Waste Type, 2023-2031 ($ Million)

27. Asia-Pacific Waste Management Market Research And Analysis By Disposal Methods, 2023-2031 ($ Million)

28. Asia-Pacific Waste Management Market Research And Analysis By End-User, 2023-2031 ($ Million)

29. Rest Of The World Waste Management Market Research And Analysis By Region, 2023-2031 ($ Million)

30. Rest Of The World Waste Management Market Research And Analysis By Waste Type, 2023-2031 ($ Million)

31. Rest Of The World Waste Management Market Research And Analysis By Disposal Methods, 2023-2031 ($ Million)

32. Rest Of The World Waste Management Market Research And Analysis By End-User, 2023-2031 ($ Million)

1. Global Waste Management Market Research And Analysis By Waste Type, 2023 Vs 2031 (%)

2. Global Waste Management Market For Industrial Waste Market Share By Region, 2023 Vs 2031 (%)

3. Global Waste Management Market For Municipal Solid Waste Market Share By Region, 2023 Vs 2031 (%)

4. Global Waste Management Market For Hazardous Waste Market Share By Region, 2023 Vs 2031 (%)

5. Global Waste Management Market For E-Waste Market Share By Region, 2023 Vs 2031 (%)

6. Global Waste Management Market For Plastic Waste Market Share By Region, 2023 Vs 2031 (%)

7. Global Waste Management Market For Bio-medical Waste Market Share By Region, 2023 Vs 2031 (%)

8. Global Waste Management Market Share By Disposal Methods, 2023 Vs 2031 (%)

9. Global Landfills Waste Management Market Share By Region, 2023 Vs 2031 (%)

10. Global Incineration Waste Management Market Share By Region, 2023 Vs 2031 (%)

11. Global Recycling Waste Management Market Share By Region, 2023 Vs 2031 (%)

12. Global Waste Management Market Share By End-User, 2023 Vs 2031 (%)

13. Global Waste Management In Residential Market Share By Region, 2023 Vs 2031 (%)

14. Global Waste Management In Commercial Market Share By Region, 2023 Vs 2031 (%)

15. Global Waste Management In Industrial Market Share By Region, 2023 Vs 2031 (%)

16. Global Waste Management Market Share By Region, 2023 Vs 2031 (%)

17. US Waste Management Market Size, 2023-2031 ($ Million)

18. Canada Waste Management Market Size, 2023-2031 ($ Million)

19. UK Waste Management Market Size, 2023-2031 ($ Million)

20. France Waste Management Market Size, 2023-2031 ($ Million)

21. Germany Waste Management Market Size, 2023-2031 ($ Million)

22. Italy Waste Management Market Size, 2023-2031 ($ Million)

23. Spain Waste Management Market Size, 2023-2031 ($ Million)

24. Rest Of Europe Waste Management Market Size, 2023-2031 ($ Million)

25. India Waste Management Market Size, 2023-2031 ($ Million)

26. China Waste Management Market Size, 2023-2031 ($ Million)

27. Japan Waste Management Market Size, 2023-2031 ($ Million)

28. South Korea Waste Management Market Size, 2023-2031 ($ Million)

29. Rest Of Asia-Pacific Waste Management Market Size, 2023-2031 ($ Million)

30. Rest Of The World Waste Management Market Size, 2023-2031 ($ Million)

31. Latin America Waste Management Market Size, 2023-2031 ($ Million)

32. Middle East And Africa Waste Management Market Size, 2023-2031 ($ Million)