Waste-to-Energy Technologies Market

Waste-to-Energy Technologies Market Size, Share & Trends Analysis Report by Application (Electricity and Heat), by Technology (Thermochemical and Biochemical), and by Waste type (Municipal Solid Waste, Process Waste, Agricultural Waste, and Others) Forecast Period (2023-2030) Update Available - Forecast 2025-2035

Waste-to-energy technologies market is anticipated to grow at a CAGR of 5.8% during the forecast period. The market growth is attributed to factors such as the increasing waste generation, stringent waste management regulations and technological advancements. Governments and environmental agencies across the globe are implementing stringent regulations and policies to reduce landfill waste and promote sustainable waste management practices. According to the US Energy Information Administration (EIA), municipal solid waste (MSW) is usually burned at special waste-to-energy plants that use the heat from the fire to make steam for generating electricity or to heat buildings. In 2021, 64 U.S. power plants generated about 13.6 billion kilowatt-hours of electricity from burning about 28 million tons of combustible MSW for electricity generation. Biomass materials accounted for about 61% of the weight of combustible MSW and for about 45% of the electricity generated. The remainder of the combustible MSW was no biomass combustible material, mainly plastics. Many large landfills also generate electricity by using the methane gas that is produced from decomposing biomass in landfills. Many countries use waste-to-energy plants to capture the energy in MSW. The use of waste-to-energy plants in some European countries and in Japan is relatively high, in part because those countries have little open space for landfills.

Segmental Outlook

The global waste-to-energy technologies market is segmented based on the application, technology, and waste type. Based on the application, the market is segmented into electricity and heat. Based on technology, the market is sub-segmented into thermochemical and biochemical. Further, based on waste type, the market is segmented into MSW, process waste, agricultural waste, and others). Among the application segment, the electricity sub-segment is expected to hold a prominent share of the global market owing to the growing demand for the electricity as it is being used for sustainable development globally.

The Municipal Solid Waste (MSW)Sub-Segment Is Anticipated to Hold Prominent Share in the Global Waste-To-Energy Technologies Market

Among the waste type, the municipal solid waste sub-segment is expected to hold a prominent share of the global waste-to-energy technologies market across the globe, owing to the large volume of waste generated across the globe and the need for sustainable waste management solutions. In addition, the global population's growth, urbanization, and changing consumption patterns have resulted in a significant increase in municipal solid waste generation. Waste-to-energy technologies offer an efficient and sustainable solution to manage and convert this waste into valuable energy resources. An enabling atmosphere for waste-to-energy technology has been created by stringent environmental rules and policies that aim to reduce landfill trash and mitigate greenhouse gas emissions. Governments all over the world are encouraging the adoption of these technologies through encouraging policies and financial incentives.

The US Department of Energy (DOE) announced nearly $34 million in funding for 11 projects that will support high-impact research and development to improve and produce biofuels, biopower, and bioproducts. These biomass resources, otherwise known as feedstocks, can be produced by municipal solid waste (MSW) streams and algae and converted into low-carbon fuels that can significantly contribute to the decarbonization of transportation sectors that face barriers to electrification, such as aviation and marine.

Regional Outlook

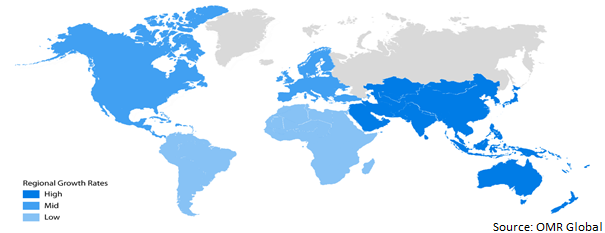

The global waste-to-energy technologies market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). Among these, the Asia-Pacific region is expected to hold a prominent growth over the forecast period owing to the increasing waste generation along with the supportive government policies and growing focus on renewable energy. Governments in the Asia-Pacific region are increasingly recognizing the importance of sustainable waste management and renewable energy sources. Many countries including India have implemented favorable policies, regulations, and financial incentives to promote waste-to-energy projects. For instance, the Indian government's Swachh Bharat Abhiyan (Clean India Mission) and the focus on renewable energy integration provide a conducive environment for the growth of the waste-to-energy market.

Global Waste-to-Energy Technologies Market Growth, by Region 2023-2030

North America is Anticipated to Cater Prominent Growth in the Global Waste-to-Energy Technologies Market

Among all regions, North America is anticipated to cater prominent growth over the forecast period owing to the favorable government policies, advanced technology adoption, energy security goals, and organic waste valorization. Advanced waste-to-energy technologies includes advanced incineration systems, anaerobic digestion with biogas recovery, and thermal gasification. These technologies offer higher efficiency, lower emissions, and improved waste treatment capabilities. In this region, the governments have implemented stringent waste management regulations and environmental policies. These initiatives promote the adoption of waste-to-energy technologies as an environmentally friendly alternative to landfilling. For instance, in March 2023, The US Department of Energy’s Bioenergy Technologies Office (BETO) and the National Renewable Energy Laboratory (NREL) are launching the next phase of the organic Waste-to-Energy (WTE) Technical Assistance for Local Governments. This technical assistance program provides municipalities with the most relevant data to help with decision making. Municipalities can use the most pertinent data from this technical assistance program to aid in decision-making. Communities can utilise the data from this program to assess the practical final uses for their waste, such as reusing it for on-site heat/power, transportation fuels, fertiliser recovery, or other purposes.

Market Players Outlook

The major companies serving the global Waste-to-Energy Technologies market include Abu Dhabi National Energy Company PJSC (TAQA), John Wood Group Plc, Babcock & Wilcox Enterprises, Inc., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in June 2021, the Asian Development Bank (ADB) and China Everbright Environment Group Limited (CEEGL) signed a memorandum of understanding (MOU) to promote the development of enhanced solid waste management systems in Asia to encourage public-private partnerships (PPP) in waste collection, transportation, and recycling, and to reduce land-based sources of marine debris and related impacts to marine life, coastal livelihoods, and human health.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global waste-to-energy technologies market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Abu Dhabi National Energy Co. Pjsc (Taqa)

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Babcock & Wilcox Enterprises, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. John Wood Group Plc

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Waste-to-Energy Technologies Market by Application

4.1.1. Electricity

4.1.2. Heat

4.2. Global Waste-to-Energy Technologies Market by Technology

4.2.1. Thermochemical

4.2.2. Biochemical

4.3. Global Waste-to-Energy Technologies Market by Waste Type

4.3.1. Municipal Solid Waste

4.3.2. Process Waste

4.3.3. Agricultural Waste

4.3.4. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. China Jinjiang Environment Holding Co. Ltd

6.2. Hitachi Zosen Corp

6.3. MVV Energie AG

6.4. Martin GmbH

6.5. Veolia Environnement SA

6.6. Mitsubishi Heavy Industries Ltd

6.7. Waste Management Inc.

6.8. Suez Group

6.9. Martin GmbH

6.10. Xcel Energy Inc.

6.11. A2A S.p.A.

6.12. China Everbright Limited

6.13. Wheelabrator Technologies Holdings Inc.

6.14. Covanta Holding Corp.

6.15. Plasco Energy Group Inc

1. GLOBAL WASTE-TO-ENERGY TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

2. GLOBAL ELECTRICITY BY WASTE-TO-ENERGY TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL HEAT BY WASTE-TO-ENERGY TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL WASTE-TO-ENERGY TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

5. GLOBAL THERMOCHEMICAL WASTE-TO-ENERGY TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL BIOCHEMICAL WASTE-TO-ENERGY TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL WASTE-TO-ENERGY TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY WASTE TYPE, 2022-2030 ($ MILLION)

8. GLOBAL WASTE-TO-ENERGY TECHNOLOGIES FOR MUNICIPAL SOLID WASTE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL WASTE-TO-ENERGY TECHNOLOGIES FOR PROCESS WASTE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL WASTE-TO-ENERGY TECHNOLOGIES FOR AGRICULTURAL WASTE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL WASTE-TO-ENERGY TECHNOLOGIES FOR OTHER WASTES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL WASTE-TO-ENERGY TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

13. NORTH AMERICAN WASTE-TO-ENERGY TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

14. NORTH AMERICAN WASTE-TO-ENERGY TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

15. NORTH AMERICAN WASTE-TO-ENERGY TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

16. NORTH AMERICAN WASTE-TO-ENERGY TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY WASTE TYPE, 2022-2030 ($ MILLION)

17. EUROPEAN WASTE-TO-ENERGY TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

18. EUROPEAN WASTE-TO-ENERGY TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

19. EUROPEAN WASTE-TO-ENERGY TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($MILLION)

20. EUROPEAN WASTE-TO-ENERGY TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY WASTE TYPE, 2022-2030 ($ MILLION)

21. ASIA-PACIFIC WASTE-TO-ENERGY TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

22. ASIA-PACIFIC WASTE-TO-ENERGY TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

23. ASIA-PACIFIC WASTE-TO-ENERGY TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

24. ASIA-PACIFIC WASTE-TO-ENERGY TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY WASTE TYPE, 2022-2030 ($ MILLION)

25. REST OF THE WORLD WASTE-TO-ENERGY TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

26. REST OF THE WORLD WASTE-TO-ENERGY TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

27. REST OF THE WORLD WASTE-TO-ENERGY TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

28. REST OF THE WORLD WASTE-TO-ENERGY TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY WASTE TYPE, 2022-2030 ($ MILLION)

1. GLOBAL WASTE-TO-ENERGY TECHNOLOGIES MARKET SHARE BY APPLICATION, 2022 VS 2030 (%)

2. GLOBAL ELECTRICITY BY WASTE-TO-ENERGY TECHNOLOGIES MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL HEAT BY WASTE-TO-ENERGY TECHNOLOGIES MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL WASTE-TO-ENERGY TECHNOLOGIES MARKET SHARE BY TECHNOLOGIES, 2022 VS 2030 (%/)

5. GLOBAL THERMOCHEMICAL WASTE-TO-ENERGY TECHNOLOGIES MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL BIOCHEMICAL WASTE-TO-ENERGY TECHNOLOGIES MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL WASTE-TO-ENERGY TECHNOLOGIES MARKET SHARE BY WASTE TYPE, 2022 VS 2030 (%)

8. GLOBAL WASTE-TO-ENERGY TECHNOLOGIES FOR MUNICIPAL SOLID WASTE MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL WASTE-TO-ENERGY TECHNOLOGIES FOR PROCESS WASTE MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL WASTE-TO-ENERGY TECHNOLOGIES FOR AGRICULTURAL WASTE MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL WASTE-TO-ENERGY TECHNOLOGIES FOR OTHER WASTES MARKET SHARE BY REGION, 2022 VS 2030 (%)

12. GLOBAL WASTE-TO-ENERGY TECHNOLOGIES MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. US WASTE-TO-ENERGY TECHNOLOGIES MARKET SIZE, 2022-2030 ($ MILLION)

14. CANADA WASTE-TO-ENERGY TECHNOLOGIES MARKET SIZE, 2022-2030 ($ MILLION)

15. UK WASTE-TO-ENERGY TECHNOLOGIES MARKET SIZE, 2022-2030 ($ MILLION)

16. FRANCE WASTE-TO-ENERGY TECHNOLOGIES MARKET SIZE, 2022-2030 ($ MILLION)

17. GERMANY WASTE-TO-ENERGY TECHNOLOGIES MARKET SIZE, 2022-2030 ($ MILLION)

18. ITALY WASTE-TO-ENERGY TECHNOLOGIES MARKET SIZE, 2022-2030 ($ MILLION)

19. SPAIN WASTE-TO-ENERGY TECHNOLOGIES MARKET SIZE, 2022-2030 ($ MILLION)

20. REST OF EUROPE WASTE-TO-ENERGY TECHNOLOGIES MARKET SIZE, 2022-2030 ($ MILLION)

21. INDIA WASTE-TO-ENERGY TECHNOLOGIES MARKET SIZE, 2022-2030 ($ MILLION)

22. CHINA WASTE-TO-ENERGY TECHNOLOGIES MARKET SIZE, 2022-2030 ($ MILLION)

23. JAPAN WASTE-TO-ENERGY TECHNOLOGIES MARKET SIZE, 2022-2030 ($ MILLION)

24. SOUTH KOREA WASTE-TO-ENERGY TECHNOLOGIES MARKET SIZE, 2022-2030 ($ MILLION)

25. REST OF ASIA-PACIFIC WASTE-TO-ENERGY TECHNOLOGIES MARKET SIZE, 2022-2030 ($ MILLION)

26. REST OF THE WORLD WASTE-TO-ENERGY TECHNOLOGIES MARKET SIZE, 2022-2030 ($ MILLION)