Waterborne Coatings Market

Global Waterborne Coatings Market Size, Share & Trends Analysis Report by Type (Acrylic, Epoxy, Polyurethane, Alkyd, and Others), By Application (Architectural and Industrial), and Forecast 2020-2026 Update Available - Forecast 2025-2031

The global waterborne coatings market is projected to grow at a considerable CAGR during the forecast period. The increasing application of waterborne coatings in the construction, packaging, textile, and electronics industry among others is a key factor to drive the growth of the global water coating market. The waterborne coatings use water as a solvent to disperse a resin. The waterborne coatings contain upto 80% of water and 20% of some other solvents. Therefore, the waterborne coatings are having low toxicity easy to apply and are eco-friendly.

The waterborne coatings have a volatile organic compound (VOC) content of fewer than 3.5 pounds per gallon of water. The high VOC emitting compounds are restricted for use in the US and EU. Strict government regulation related to the restriction of using high VOC emitting compounds in the region is the major factor to promote the huge adoption of waterborne coatings by major companies in Europe such as UK, Spain, France, Italy, Germany among others. In addition to this, the growing awareness related to the eco-friendly advantage of waterborne coating among the consumers is promoting the end-user to use waterborne coating as compared to the other coating types.

Excellent adhesion, high surface area, no requirement for other additive, thinners, or hardeners, low air emission, and in-flammability are the other key characteristics of the waterborne coating that are supporting its market growth. Due to the flame-resistant capability of this coating, it provides safety to the structure to which it has been applied. The transition of the market players from the solvent-based to water-based coating technology requires huge capital cost and fixed cost. Hence, many small-scale manufacturers in emerging regions are reluctant to opt for this transition and are continuing their production with the use of solvent-based coatings.These, came out to be a factor that is hindering the growth of the waterborne coatings market in the emerging nations across the globe.

Segmental Outlook

The global waterborne coatings market is classified on the basis of type and application. Based on type, the market is segmented into acrylic, epoxy, polyurethane, alkyd, and others. Based on application the market is segmented into architectural and industrial. Architectural applications include residential application in new construction and remodel & repaint. While the industrial segment includes its application in automotive, packaging, paper, and others. Based on the application segment, the industrial segment is anticipated to showcase considerable growth over the forecast period. The rising use of waterborne coatings in the packaging of paper and paperboard that includes boxes, folding cartons, and paper bags is a key factor contributing to the growth of this market segment.

Acrylic Will be a Considerable Segment by Type

The acrylic segment is anticipated to hold significant market share during the forecast period. Acrylic waterborne coatings are having unique aesthetic properties. This is owing to the fact that this material is highly versatile due to the acrylic ester functionality. Acrylic possesses properties such as low volatile organic compound emission rate and higher durability as compared to various solvent-based resins. The acrylic is the preferred coating solution for numerous applications in end-user industries such as building and construction and paint and coatings. The acrylic waterborne coatings are a suitable replacement for solvent-based emulsion due to the harmful effects of solvent-based emulsion on the environment. The growth in the demand for acrylic waterborne coating from the adhesives manufacturers primarily in label application and medical tapes has led to the increased market share of the acrylic segment.

Regional Outlook

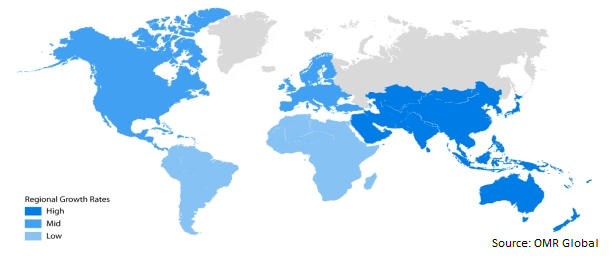

The global waterborne coatings market is further segmented on the basis of geography into North America, Europe, Asia-Pacific, and Rest of the World. Asia-Pacific region is anticipated to exhibit considerable growth during the forecast period. The growing environmental concerns along with stringent government regulations towards the emission of VOC in the environment in the region are the key factors that are driving the growth of the market in the Asia-Pacific region. The increasing construction activities in the region owing to the rising foreign investment in the construction sector in emerging economies such as India and China are anticipated to further fuel the market growth in the region. The presence of a huge number of chemical industry players in the region such as China is anticipated to make a considerable contribution to market growth.

Global Waterborne Coatings Market Growth by Region,2020-2026

Market Players Outlook

BASF SE, Arkema Group, Dow Inc., AkzoNobel NV, East Chemical Co., ALLNEX Netherlands B.V., Celanese Corp., Covestro AG, DIC Corp., and Double Bond Chemical Ind. Co., Ltd., are some of the key market players operating in the global waterborne coatings market. These market players are actively involved in the adoption of organic and inorganic growth strategies such as product lunch, mergers and acquisitions to sustain their position in the market place.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global waterborne coatings market. Based on the availability of data, information related to available products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Strategy Analysis

3.2. Key Company Analysis

3.2.1. BASF SE

3.2.1.1. Overview

3.2.1.2. Financial Analysis

3.2.1.3. SWOT Analysis

3.2.1.4. Recent Developments

3.2.2. Arkema Group

3.2.2.1. Overview

3.2.2.2. Financial Analysis

3.2.2.3. SWOT Analysis

3.2.2.4. Recent Developments

3.2.3. AkzoNobel NV

3.2.3.1. Overview

3.2.3.2. Financial Analysis

3.2.3.3. SWOT Analysis

3.2.3.4. Recent Developments

3.2.4. Dow Inc.

3.2.4.1. Overview

3.2.4.2. Financial Analysis

3.2.4.3. SWOT Analysis

3.2.4.4. Recent Developments

3.2.5. Eastman Chemical Co.

3.2.5.1. Overview

3.2.5.2. Financial Analysis

3.2.5.3. SWOT Analysis

3.2.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Waterborne Coatings Market by Type

5.1.1. Acrylic

5.1.2. Epoxy

5.1.3. Polyurethane

5.1.4. Alkyd

5.1.5. Others

5.2. Global Waterborne Coatings Market by Application

5.2.1. Architectural

5.2.2. Industrial

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ALLNEX Netherlands B.V.

7.2. AkzoNobel NV

7.3. Arkema Group

7.4. Axalta Coating Systems LLC

7.5. BASF SE

7.6. Celanese Corp.

7.7. Covestro AG

7.8. DIC Corp.

7.9. Double Bond Chemical Ind. Co., Ltd.

7.10. Dow Inc.

7.11. Eastman Chemical Co.

7.12. Gellner Industrial, LLC

7.13. Henkel AG & Co., KGaA

7.14. Hexion Inc.

7.15. Kraton Corp.

7.16. Lanxess Corp.

7.17. OMNOVA Solutions Inc.

7.18. PPG Industries, Inc.

7.19. Reichhold, LLC

7.20. Specialty Polymers, Inc.

7.21. The Lubrizol Corp.

1. GLOBAL WATERBORNE COATINGS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL ACRYLIC MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL EPOXY MARKET RESEARCH AND ANALYSIS BY REGION,2019-2026 ($ MILLION)

4. GLOBAL POLYURATHENE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL ALKYD MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL OTHER WATERBORNE COATINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL WATERBORNE COATINGS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

8. GLOBAL WATERBORNE COATINGS IN ARCHITECTURAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL WATERBORNE COATINGS IN INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL WATERBORNE COATINGS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

11. NORTH AMERICAN WATERBORNE COATINGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026($ MILLION)

12. NORTH AMERICAN WATERBORNE COATINGS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

13. NORTH AMERICAN WATERBORNE COATINGS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

14. EUROPEAN WATERBORNE COATINGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. EUROPEAN WATERBORNE COATINGS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

16. EUROPEAN WATERBORNE COATINGS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

17. ASIA-PACIFIC WATERBORNE COATINGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC WATERBORNE COATINGS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC WATERBORNE COATINGS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

20. REST OF THE WORLD WATERBORNE COATINGS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

21. REST OF THE WORLD WATERBORNE COATINGS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL WATERBORNE COATINGS MARKET SHARE BY TYPE, 2019 VS 2026 (%)

2. GLOBAL WATERBORNE COATINGS MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

3. GLOBAL WATERBORNE COATINGS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US WATERBORNE COATINGS MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA WATERBORNE COATINGS MARKET SIZE, 2019-2026 ($ MILLION)

6. UK WATERBORNE COATINGS MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE WATERBORNE COATINGS MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY WATERBORNE COATINGS MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY WATERBORNE COATINGS MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN WATERBORNE COATINGS MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE WATERBORNE COATINGS MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA WATERBORNE COATINGS MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA WATERBORNE COATINGS MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN WATERBORNE COATINGS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC WATERBORNE COATINGS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD WATERBORNE COATINGS MARKET SIZE, 2019-2026 ($ MILLION)