Waterproofing Membrane Market

Waterproofing Membrane Market Size, Share & Trends Analysis Report by Application (Waste & Water Management, Roofing & Walls, Building Structures, Bridges and Highways, Tunnel Liners, and Others), by Type PVC (Poly Vinyl Chloride), TPO (Thermoplastic Polyolefin), EPDM (Ethylene Propylene Diene Monomer), HDPE (High-Density Polyethylene), LDPE (Low-Density Polyethylene), Modified Bitumen, and Others), Forecast Period (2024-2031)

Waterproofing membrane market is anticipated to grow at a significant CAGR of 8.5% during the forecast period (2024-2031). The market growth is attributed to the increasing demand for waterproofing membranes with global infrastructure development and urbanization. The product's demand is being driven up by its capacity to protect buildings and structures from water strains. Demand is also further boosted by the product's growing usage for water-saving applications.

Market Dynamics

Growing Construction and Infrastructure Projects

The demand for waterproofing membranes is being driven by the rising expenditures in the infrastructural, commercial, and residential sectors. To maintain the longevity and structural integrity of buildings and infrastructure, there is a strong need for waterproofing solutions due to the rapid urbanization and industrialization that has occurred in nations such as China, India, and Brazil. Furthermore, strict laws and building requirements that require high-performance waterproofing materials in building projects have supported the market's expansion even further. PVC waterproofing membranes are becoming the go-to option for developers, contractors, and architects looking for dependable waterproofing solutions for a range of applications since they provide good resistance to water infiltration and are reasonably simple to install. Further market expansion is being driven by technological breakthroughs and product innovations that aim to improve the performance and sustainability of PVC waterproofing membranes.

Increasing Adoption of Liquid Applied Membranes

Liquid-applied membranes (LAMs) are gaining popularity due to their ease of application and ability to cover complex surfaces and geometries. Liquid-applied membranes, or LAMs, represent one of the construction industry's fastest-growing segments. Systems are gaining traction as a preferred option for commercial roofing projects owing to their adaptability, dependability, and longevity. They offer seamless coverage and are ideal for both new construction and renovation projects. With the extended warranties that systems provide, LAMs are an excellent option for both new construction and renovation projects. They assist in prolonging the roof's lifespan without having to replace it and are appropriate for overlay. Systems often work with a variety of roof substrates, such as wood, metal, PVC, reinforced bituminous membranes (RBM), and single-ply.

Market Segmentation

- Based on the type, the market is segmented into PVC (polyvinyl chloride), TPO (thermoplastic polyolefin), EPDM (ethylene propylene diene monomer), HDPE (high-density polyethylene), LDPE (low-density polyethylene), modified bitumen, and others (polymethyl methacrylate (PMMA)).

- Based on the application, the market is segmented into waste & water management, roofing & walls, building structures, bridges and highways, tunnel liners, and others (landfills, roadways).

PVC (Poly Vinyl Chloride) Membrane Holds the Largest Share

The primary factors supporting the growth include high compatibility of PVC membrane with common construction materials such as concrete, concrete masonry units (CMUs), stone, metal, plastic (PVC and ABS), wood (pressure-treated and fire-treated), rigid insulation, and insulating concrete forms (ICF). In October 2022, Polyglass U.S.A. announced a new waterproofing membrane for the building envelope. Mapeseal GC is a single-component, fast-curing, cold-fluid-applied, monolithic waterproofing membrane ideal for vertical and horizontal surfaces and damp and green concrete applications. Such developments are further aiding the growth of this market segment.

Regional Outlook

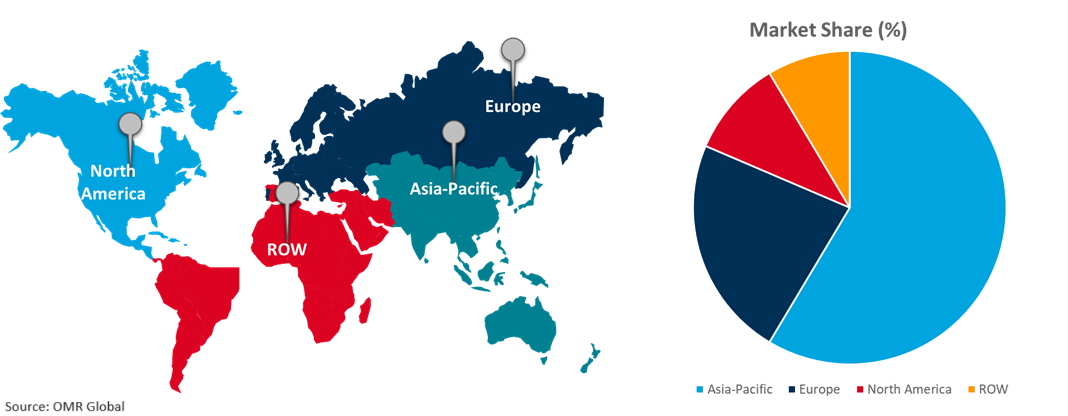

Global waterproofing membrane market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Waterproofing Membrane Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Asia-Pacific holds a significant share owing to the presence of waterproofing membrane offering companies such as Oriental Yuhong Waterproof Technology Co., Ltd., Toray Industries, Inc., Toyo Chemical Co., Ltd., and others. The market growth is attributed to rapid industrialization, particularly in China and India, and expanding infrastructure investments are responsible for the expansion. The expansion is also anticipated to be fueled by the usage of waterproofing membranes in mining applications. The waterproofing technologies are specially formulated to prevent the migration or rise of moisture to extend the duration and improve the durability of the construction build. For instance, in March 2023, Bostik introduced smart waterproofing solutions seal & block in India. The launch highlighted the value of innovative waterproofing technology with the seal & block range in achieving more sustainable infrastructures, which is key to economic growth.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the waterproofing membrane market include BASF Corp., IKO Industries, Inc., Sika AG, SOPREMA Group, and The Dow Chemical Co. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global waterproofing membrane market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. BASF Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. IKO Industries, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Sika AG

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. SOPREMA Group

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. The Dow Chemical Co.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Waterproofing Membrane Market by Type

4.1.1. PVC (Poly Vinyl Chloride)

4.1.2. TPO (Thermoplastic Polyolefin)

4.1.3. EPDM (Ethylene Propylene Diene Monomer)

4.1.4. HDPE (High-Density Polyethylene)

4.1.5. LDPE (Low-Density Polyethylene)

4.1.6. Modified Bitumen

4.1.7. Others (Polymethyl Methacrylate (PMMA)

4.2. Global Waterproofing Membrane Market by Application

4.2.1. Waste & Water Management

4.2.2. Roofing & Walls

4.2.3. Building Structures

4.2.4. Bridges and Highways

4.2.5. Tunnel Liners

4.2.6. Others (Landfills, Roadways)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Carlisle Coatings & Waterproofing

6.2. CHRYSO S.A.S.

6.3. Firestone Building Products Co., LLC

6.4. Flex Membrane International Corp.

6.5. Fosroc Inc.

6.6. GAF Materials, LLC

6.7. GCP Applied Technologies Inc.

6.8. Groupe Solmax Inc.

6.9. Henry Company LLC

6.10. Johns Manville Corp. (A Berkshire Hathaway Inc. Company)

6.11. Juta, Ltd. Renolit SE

6.12. KEMPER SYSTEM GmbH & Co. KG

6.13. Mapei S.p.A

6.14. Polyglass S.p.A.

6.15. RPM International Inc.

6.16. Saint-Gobain Weber

6.17. Schluter Systems L.P.

6.18. Tremco CPG Inc.

6.19. W. R. Grace and Co.