Wave and Tidal Energy Market

Global Wave and Tidal Energy Market Size, Share & Trends Analysis Report by Technology (Tidal Stream Generator, Oscillating Water Columns, Barrage and Others), by End-User (Residential, Commercial and Industrial) Forecast Period (2021-2027) Update Available - Forecast 2025-2035

The global wave and tidal energy market is anticipated to grow at a significant CAGR of 17% during the forecast period. The global wave and tidal energy market is witnessing increase in demand owing to a rise in project expansion across countries, resulting in huge electricity cost reductions. Moreover, an increase in investments and new rules by local governments encouraging technology innovators to commercialise their energy converter devices is another factor contributing to the growth of the market. For instance, in November 2021, the UK government announced to invest $27.11 million per year in Tidal Stream electricity across the UK, starting a new chapter for Wales' tidal industry and creating jobs across the Welsh coastal regions as part of its flagship renewable energy auction scheme. The UK Government will ensure that $27.11 million per year is ringfenced for Tidal Stream projects as part of the fourth allocation round of the Contracts for Difference Scheme, giving Wales' marine energy sector a chance to develop technology and lower their costs. This brings the overall funding for this round of allocation to $386.37 million each year across the UK. This opens up a lot of opportunities for new businesses to enter the industry by offering cutting-edge technologies.

Impact of COVID-19 Pandemic on Global Wave and Tidal Energy Market

The global economy has suffered a severe shock since the outbreak of the COVID-19 pandemic. Due to lockdown, the government restricted the movement of labor as a result new plant of wave and tidal energy has not been installed in most of the places around the globe. Due to the pandemic, the wave and tidal energy market is faced significant challenges including non-availibility of raw materials, and components, which in turn caused delay in development of projects.

Segmental Outlook

The global wave and tidal energy is segmented based on the technology and end user. Based on the technology , the market is segmented into tidal stream generator,oscillating water columns,barrage and others. Based on the end user, the market is sub-segmented into the residential, commercial and industrial. Among technology, oscillating water columns is the most commonly used technology across the globe, as it is indigenous, renewable, and produce electricity without greenhouse gas emissions with highest power densities than other sources of energy.

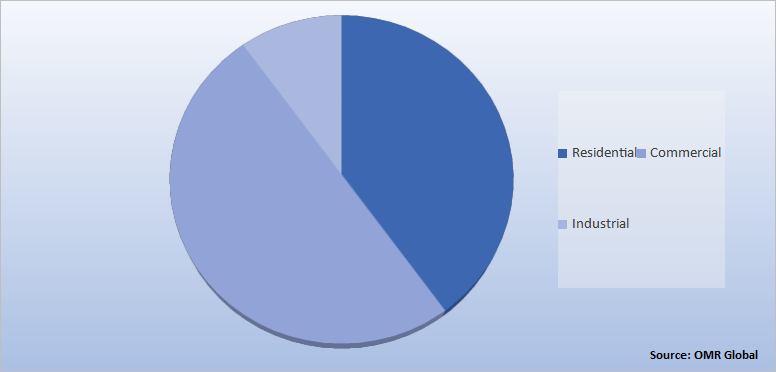

Global Wave and Tidal Energy Market Share by End User, 2020 (%)

The Industrial Segment Holds the Major Share in Wave and Tidal Energy Market

Based on end-user, the market is segmented into residential, commercial and industrial. Among these, the industrial segment holds the major share in the global wave and tidal energy market. The development in wave and tidal energy is linked to small and micro-enterprises. Owing to development of new technologies in wave and tidal energy, industries are more inclined towards adopting the use of renewable energy. The industrial sector requirs renewable at a large scale to produce, and manufacture the products at a large scale. Industrialization, and urbanization is the major factor contributing to the growth of the wave and tidal energy market during the forecast period.

Regional Outlooks

The global wave and tidal energy market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America).

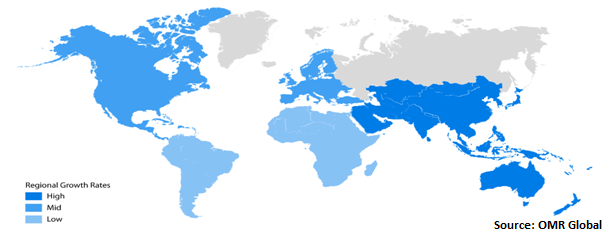

Global Wave and Tidal Energy Market Growth by Region, 2020 (%)

Europe is expected hold Major Share in Wave and Tidal Energy Market

Among the region, Europe is expected to hold major share in the wave and tidal energy market. The attributable factors for the growth of the segment is increase in investment, partnerships by local companies and government initiatives. For instance, in October 2021, wave power technology company, Mocean Eenergy has opened an office in Aberdeen to fulfill the interest of the rising oil and gas industry, in the decarbonization of North Sea assets. The project has been handover to Bluestar, an Edinburgh-based company to develop a wave energy device. It will offer zero-carbon power to subsea equipment. Further, Novige AB, a developer of wave energy technology in Sweden, got financing from the Swedish Energy Agency in April 2021 for their NoviOcean wave energy converter concept. The Swedish Energy Agency approved a budget of $652,201 for Novige, with the company contributing $USD 157,263. Novige stated that $128,140 would be allocated to Uppsala University and KTH University for further study and development of the new concept. Such initiatives, new development by key players present in the region is contributing to the growth of the market during the forecast period.

Market Players Outlook

The major companies operating in the global wave and tidal energy market include Ocean Power Technologies, Seabased, Verdant Power Inc., Blue Water, and Bigmoon Power and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, In January 2021, Verdant Power's half-scale demonstration project, consisting of a grid-connected array of three five-meter diameter rotor tidal power turbines, was operated and performed admirably. The turbines worked well at the Roosevelt Island Tidal Energy (RITE) Project site in the East River, where they were mounted on a single TriFrameTM mount. The RITE Project activity is a technology demonstration of the Company's fifth-generation tidal power system and its novel TriFrameTM mounting system, which is the next step on a path to global commercialization and profitable commercial operations as the first U.S. licenced tidal power project site.

Verdant Power's turbine array was installed on October 22, 2020, and began producing sustainable electricity to Roosevelt Island seven days later via a distributed generation connection to Con Edison's New York City grid. The array has produced 100 MWh in only 85 days of continuous operation, setting a new US record for marine energy output. This is significantly ahead of schedule, implying that it will generate more than 430 MWh per year into the local grid. The RITE Project generates electricity under the terms of a pilot project licence granted by the Federal Energy Regulatory Commission in the US. It will be the first maritime renewable energy project to be validated to international standards anywhere on the planet. New York State Energy Research and Development Authority and the US Department of Energy, as well as New York private equity investors, are supporting the project.

The Report Covers

• Market value data analysis of 2020 and forecast to 2027.

• Annualized market revenues ($ million) for each market segment.

• Country-wise analysis of major geographical regions.

• Key companies operating in the global wave and tidal energy market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

• Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

• Analysis of market-entry and market expansion strategies.

• Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Wave and Tidal Energy Market

• Recovery Scenario of Global Wave and Tidal Energy Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1 Ocean Power Technologies

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.2.Key Company Analysis

3.2.1 Seabased

3.2.2.1 Overview

3.2.2.2 Financial Analysis

3.2.2.3 SWOT Anlaysis

3.2.2.4 Recent Developments

3.3 Key Company Analysis

3.3.1 Verdant Power. Inc

3.3.3.1 Overview

3.3.3.2 Financial Analysis

3.3.3.3 SWOT Anlaysis

3.3.3.4 Recent Developments

3.4 Key Company Analysis

3.4.1 Blue Water

3.4.4.1 Overview

3.4.4.2 Financial Analysis

3.4.4.3 SWOT Anlaysis

3.4.4.4 Recent Developments

3.5 Key Company Analysis

3.5.1 Bigmoon Power

3.5.5.1 Overview

3.5.5.2 Financial Analysis

3.5.5.3 SWOT Anlaysis

3.5.5.4 Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Wave and Tidal Energy Market by Technology

4.1.1. Tidal Stream Generator

4.1.2. Oscillating Water Columns

4.1.3. Barrage

4.1.4. Others

4.2. Global Wave and Tidal Energy Market by End-User

4.2.1. Residential

4.2.2. Commercial

4.2.3. Industrial

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. AAWW – Energy Oy

6.2. ANDRITZ AG.

6.3. Aquanet Power

6.4. Biopower Systems Pty. Ltd.

6.5. Blue Water

6.6. Carnegie Clean Energy

6.7. CorPower Ocean AB

6.8. Eco Wave Power Global AB

6.9. European Marine Energy Centre Ltd.

6.10. Minesto AB

6.11. Nova Innovation Ltd.

6.12. Orbital Marine Power

6.13. Pacific Northwest National Laboratory

6.14. SIMEC Atlantics Energy

6.15. Tidal Lagoon Power Ltd

6.16. TOCARDO B.V

6.17. Verdict Media Ltd.

6.18. Wello OY

6.19. Yam Pro Energy

1. GLOBAL WAVE AND TIDAL ENERGY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

2. GLOBAL TIDAL STREAM GENERATOR MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL OSCILLATING WATER COLUMNS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL BARRAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL WAVE AND TIDAL ENERGY MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

7. GLOBAL RESIDENTIAL WAVE AND TIDAL ENERGY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL COMMERCIAL WAVE AND TIDAL ENERGY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL INDUSTRIAL WAVE AND TIDAL ENERGY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL WAVE AND TIDAL ENERGY MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

11. NORTH AMERICAN WAVE AND TIDAL ENERGY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

12. NORTH AMERICAN WAVE AND TIDAL ENERGY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY , 2020-2027 ($ MILLION)

13. NORTH AMERICAN WAVE AND TIDAL ENERGY MARKET RESEARCH AND ANALYSIS BYEND-USER, 2020-2027 ($ MILLION)

14. EUROPEAN WAVE AND TIDAL ENERGY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

15. EUROPEAN WAVE AND TIDAL ENERGY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY , 2020-2027 ($ MILLION)

16. EUROPEAN WAVE AND TIDAL ENERGY MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

17. ASIA-PACIFIC WAVE AND TIDAL ENERGY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

18. ASIA-PACIFIC WAVE AND TIDAL ENERGY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY , 2020-2027 ($ MILLION)

19. ASIA-PACIFIC WAVE AND TIDAL ENERGY MARKET RESEARCH AND ANALYSIS BYEND-USER, 2020-2027 ($ MILLION)

20. REST OF THE WORLD WAVE AND TIDAL ENERGY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

21. REST OF THE WORLD WAVE AND TIDAL ENERGY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY , 2020-2027 ($ MILLION)

22. REST OF THE WORLD WAVE AND TIDAL ENERGY MARKET RESEARCH AND ANALYSIS BYEND-USER, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL WAVE AND TIDAL ENERGY MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL WAVE AND TIDAL ENERGY MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL WAVE AND TIDAL ENERGY MARKET, 2021-2027 (%)

4. GLOBAL WAVE AND TIDAL ENERGY MARKET SHARE BY TECHNOLOGY , 2020 VS 2027 (%)

5. GLOBAL TIDAL STREAM GENERATOR MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

6. GLOBAL OSCILLATING WATER COLUMNS MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL BARRAGE MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL OTHERS MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

9. GLOBAL WAVE AND TIDAL ENERGY MARKET SHARE BYEND-USER, 2020 VS 2027 (%)

10. GLOBAL RESIDENTIAL WAVE AND TIDAL ENERGY MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

11. GLOBAL COMMERCIAL WAVE AND TIDAL ENERGY MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

12. GLOBAL INDUSTRIAL WAVE AND TIDAL ENERGY MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

13. US WAVE AND TIDAL ENERGY MARKET SIZE, 2020-2027 ($ MILLION)

14. CANADA WAVE AND TIDAL ENERGY MARKET SIZE, 2020-2027 ($ MILLION)

15. UK WAVE AND TIDAL ENERGY MARKET SIZE, 2020-2027 ($ MILLION)

16. FRANCE WAVE AND TIDAL ENERGY MARKETMARKET SIZE, 2020-2027 ($ MILLION)

17. GERMANY WAVE AND TIDAL ENERGY MARKET SIZE, 2020-2027 ($ MILLION)

18. ITALY WAVE AND TIDAL ENERGY MARKETMARKET SIZE, 2020-2027 ($ MILLION)

19. SPAIN WAVE AND TIDAL ENERGY MARKET SIZE, 2020-2027 ($ MILLION)

20. REST OF EUROPE WAVE AND TIDAL ENERGY MARKET SIZE, 2020-2027 ($ MILLION)

21. INDIA WAVE AND TIDAL ENERGY MARKET SIZE, 2020-2027 ($ MILLION)

22. CHINA WAVE AND TIDAL ENERGY MARKET SIZE, 2020-2027 ($ MILLION)

23. JAPAN WAVE AND TIDAL ENERGY MARKET SIZE, 2020-2027 ($ MILLION)

24. SOUTH KOREA WAVE AND TIDAL ENERGY MARKET SIZE, 2020-2027 ($ MILLION)

25. REST OF ASIA-PACIFIC WAVE AND TIDAL ENERGY MARKET SIZE, 2020-2027 ($ MILLION)

26. REST OF THE WORLD WAVE AND TIDAL ENERGY MARKET SIZE, 2020-2027 ($ MILLION)