Western Europe E-commerce Logistics Market

Western Europe E-commerce Logistics Market Research By Services (Transportation Services, Warehousing Services and Other), By Product (Baby Products, Personal Care Products, Books, Home Furnishing Products, Apparel Products, Electronics Products, Automotive Products and Other), and By Location (International and Local) Forecast 2021-2027 Update Available - Forecast 2025-2035

The Western Europe e-commerce logistics market is growing at a considerable CAGR of 2.8% during the forecast period. Developed modes of transportation is one of the prime factors affecting and driving the market. Developed infrastructure and easy-going trade in cross border is also estimated to be the prime factors that are contributing significantly towards the growth of the market. However, fluctuation in prices of crude oil along with high tax involvement are some major factors constraints that are hindering the growth of the Western Europe e-commerce logistics market across the globe.

Further, deliveries through air drone is one of the key factors that are creating opportunity for the market. New product launches in the market are likely to drive the growth of the Western Europe e-commerce logistics market. For instance, in October 2020, Royal Mail Group Ltd. had come up with the concept of a new service related to parcel across UK. This service is known as parcel collect through this postmen or postwomen would not only support in delivering the parcels however, they will also collect them from customer.

Impact of COVID-19 on the Western Europe E-commerce logistics market

The Western Europe e-commerce logistics market is hardly hit by the COVID-19 pandemic since December 2019. The COVID-19 pandemic had disrupted the manufacturing and transportation along with warehousing activities. Moreover, disturbance due to the COVID-19 pandemic had also made many retailers to cancel the order for next delivery date due to lockdown in the region.

Segmental Outlook

The market is segmented based on services, product and location. Based on services, the market is segmented into transportation services, warehousing services and other. By product, the market is segmented into baby products, personal care products, books, home furnishing products, apparel products, electronics products, automotive products and other. Further, by location, market is segmented into international and local.

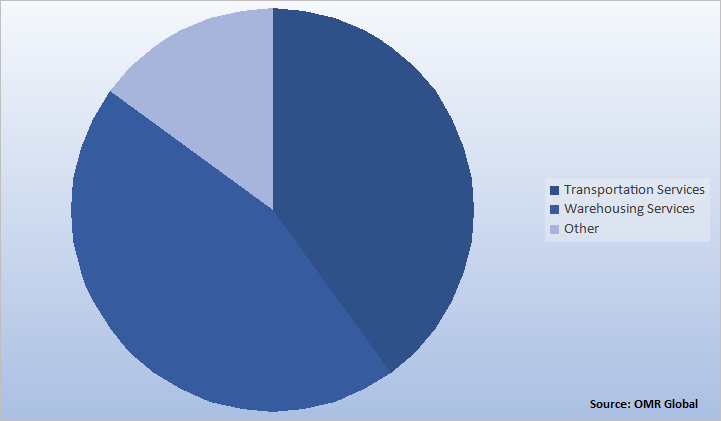

Western Europe E-commerce logistics market Share by Services 2020 (%)

Based on the services, warehousing holds significant share in the market. Warehousing is also a very prime part of the logistics management system. As it is demanded and needed to provide storage for the finished goods along with packing and shipping of the order. Efficient warehousing provides an important economic benefit to the business along with the customers. Additionally, through this effective inventory allocation and process digitization can be done. Therefore, the high demand of warehousing in order to store various things are driving the growth of Western Europe e-commerce logistics market in this segment.

Regional Outlooks

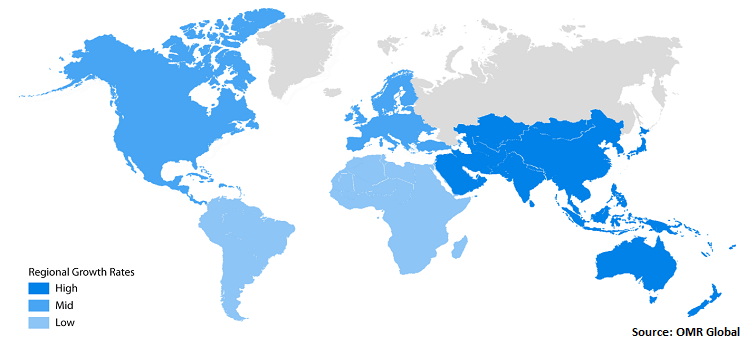

The Western Europe e-commerce logistics market is analyzed based on the geographical regions that are contributing significantly towards the growth of the market. Based on the geography, the market is segmented into UK, Germany, Italy, Spain, France and Rest of Europe. UK held a considerable share in 2020 in the Western Europe e-commerce logistics market. Some factors that are boosting the market growth in UK are growing of cross border activity along with broad range of products offering by manufacturer in the country. Moreover, in Germany increasing usages of smart phones and tablets are driving the market in the country.

Western Europe E-commerce Logistics Market, by Region 2021-2027

Market Player Outlook

Key players of the Western Europe e-commerce logistics market are DHL, Deutsche Bahn AG, FedEx, InPost, and Koninklijke PostNL among others. To survive in the market, these players adopt different marketing strategies such as product launches. For instance, in April 2021, Asendia Management SAS had completely acquired the e-shop world which is one of the cross border e-commerce companies. Through this acquisition company can make safer, simple and faster process in cross border activity along with supporting the retailers in order to develop their business at international level in e-commerce.

In March 2021, InPost had acquired 100% share of one of the company’s name as mondial relay. This acquisition was being done in around EUR 565 million and the company would put step forward in European countries for e-commerce logistics.

In December 2020, FedEx had acquired one of the e-commerce platforms name as shop runner in order to connect various brands with people who do online shopping. Through this acquisition the company will diversify the portfolio of e-commerce by connecting and adding 100 brands and merchants of shop runner in it to offer effective services to its millions of consumers.

The Report Covers

• Market value data analysis of 2020 and forecast to 2027.

• Annualized market revenues ($ million) for each market segment.

• Country-wise analysis of major geographical regions.

• Key companies operating in the Western Europe e-commerce logistics market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

• Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

• Analysis of market-entry and market expansion strategies.

• Competitive strategies by identifying ‘who-stands-where in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Western Europe E-commerce Logistics Industry

• Recovery Scenario of Western Europe E-commerce Logistics Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Western Europe E-Commerce Logistics Market by Services

5.1.1. Transportation Services

5.1.2. Warehousing Services

5.1.3. Other

5.2. Western Europe E-Commerce Logistics Market by Product

5.2.1. Baby Products

5.2.2. Personal Care Products

5.2.3. Books

5.2.4. Home Furnishing Products

5.2.5. Apparel Products

5.2.6. Electronics Products

5.2.7. Automotive Products

5.2.8. Other

5.3. Western Europe E-Commerce Logistics Market by Location

5.3.1. International

5.3.2. Local

6. Regional Analysis

6.1. Western Europe

6.1.1. UK

6.1.2. Germany

6.1.3. Italy

6.1.4. Spain

6.1.5. France

6.1.6. Rest of Europe

7. Company Profiles

7.1. Asendia Management SAS

7.2. Bpost

7.3. Deutsche Bahn AG

7.4. DHL

7.5. FedEx

7.6. General Logistics Systems B.V.

7.7. Hermes Germany GmbH

7.8. InPost

7.9. Jet Box International.

7.10. Koninklijke PostNL

7.11. Whistl Ltd.

7.12. Pillow Logistics

7.13. Royal Mail Group Ltd.

7.14. SMART DELIVERY SERVICES

7.15. United Parcel Service of America, Inc.

7.16. World Logistics Management Ltd.

1. WESTERN EUROPE E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

2. WESTERN EUROPE E-COMMERCE LOGISTICS MARKET BY SERVICES, 2020-2027 ($ MILLION)

3. WESTERN EUROPE TRANSPORTATION SERVICES MARKET BY COUNTRY, 2020-2027 ($ MILLION)

4. WESTERN EUROPE WAREHOUSING SERVICES MARKET BY COUNTRY, 2020-2027 ($ MILLION)

5. WESTERN EUROPE OTHER MARKET BY COUNTRY, 2020-2027 ($ MILLION)

6. WESTERN EUROPE E-COMMERCE LOGISTICS MARKET BY PRODUCT, 2020-2027 ($ MILLION)

7. WESTERN EUROPE BABY PRODUCTS MARKET BY COUNTRY, 2020-2027 ($ MILLION)

8. WESTERN EUROPE PERSONAL CARE PRODUCTS MARKET BY COUNTRY, 2020-2027 ($ MILLION)

9. WESTERN EUROPE BOOKS MARKET BY COUNTRY, 2020-2027 ($ MILLION)

10. WESTERN EUROPE HOME FURNISHING PRODUCTS MARKET BY COUNTRY, 2020-2027 ($ MILLION)

11. WESTERN EUROPE APPAREL PRODUCTS MARKET BY COUNTRY, 2020-2027 ($ MILLION)

12. WESTERN EUROPE ELECTRONICS PRODUCTS MARKET BY COUNTRY, 2020-2027 ($ MILLION)

13. WESTERN EUROPE AUTOMOTIVE PRODUCTS MARKET BY COUNTRY, 2020-2027 ($ MILLION)

14. WESTERN EUROPE OTHER MARKET BY COUNTRY, 2020-2027 ($ MILLION)

15. WESTERN EUROPE E-COMMERCE LOGISTICS MARKET BY LOCATION, 2020-2027 ($ MILLION)

16. WESTERN EUROPE INTERNATIONAL MARKET BY COUNTRY, 2020-2027 ($ MILLION)

17. WESTERN EUROPE LOCAL MARKET BY COUNTRY, 2020-2027 ($ MILLION)

18. WESTERN EUROPE E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

19. UK E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY SERVICES

20. UK E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT

21. UK E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY LOCATION

22. GERMANY E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY SERVICES

23. GERMANY E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT

24. GERMANY E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY LOCATION

25. ITALY E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY SERVICES

26. ITALY E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT

27. ITALY E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY LOCATION

28. SPAIN E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY SERVICES

29. SPAIN E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT

30. SPAIN E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY LOCATION

31. FRANCE E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY SERVICES

32. FRANCE E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT

33. FRANCE E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY LOCATION

34. REST OF EUROPE E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY SERVICES

35. REST OF EUROPE E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT

36. REST OF EUROPE E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY LOCATION

1. IMPACT OF COVID-19 ON WESTERN EUROPE E-COMMERCE LOGISTICS MARKET , 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON WESTERN EUROPE E-COMMERCE LOGISTICS MARKET SHARE BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF WESTERN EUROPE E-COMMERCE LOGISTICS MARKET 2021-2027 (%)

4. WESTERN EUROPE E-COMMERCE LOGISTICS MARKET SHARE BY SERVICES, 2020 VS 2027 (%)

5. WESTERN EUROPE E-COMMERCE LOGISTICS MARKET SHARE BY PRODUCT, 2020 VS 2027 (%)

6. WESTERN EUROPE E-COMMERCE LOGISTICS MARKET SHARE BY LOCATION, 2020 VS 2027 (%)

7. WESTERN EUROPE E-COMMERCE LOGISTICS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027, (%)

8. WESTERN EUROPE TRANSPORTATION SERVICES MARKET BY COUNTRY, 2020 VS 2027 (%)

9. WESTERN EUROPE WAREHOUSING SERVICES MARKET BY COUNTRY, 2020 VS 2027 (%)

10. WESTERN EUROPE OTHER MARKET BY COUNTRY, 2020 VS 2027 (%)

11. WESTERN EUROPE BABY PRODUCTS MARKET BY COUNTRY, 2020 VS 2027 (%)

12. WESTERN EUROPE PERSONAL CARE PRODUCTS MARKET BY COUNTRY, 2020 VS 2027 (%)

13. WESTERN EUROPE BOOKS MARKET BY COUNTRY, 2020 VS 2027 (%)

14. WESTERN EUROPE HOME FURNISHING PRODUCTS MARKET BY COUNTRY, 2020 VS 2027 (%)

15. WESTERN EUROPE APPAREL PRODUCTS MARKET BY COUNTRY, 2020 VS 2027 (%)

16. WESTERN EUROPE ELECTRONICS PRODUCTS MARKET BY COUNTRY, 2020 VS 2027 (%)

17. WESTERN EUROPE AUTOMOTIVE PRODUCTS MARKET BY COUNTRY, 2020 VS 2027 (%)

18. WESTERN EUROPE OTHER MARKET BY COUNTRY, 2020 VS 2027 (%)

19. WESTERN EUROPE INTERNATIONAL MARKET BY COUNTRY, 2020 VS 2027 (%)

20. WESTERN EUROPE LOCAL MARKET BY COUNTRY, 2020 VS 2027 (%)

21. UK E-COMMERCE LOGISTICS MARKET SIZE, 2020-2027 ($ MILLION)

22. GERMANY E-COMMERCE LOGISTICS MARKET SIZE, 2020-2027 ($ MILLION)

23. ITALY E-COMMERCE LOGISTICS MARKET SIZE, 2020-2027 ($ MILLION)

24. SPAIN E-COMMERCE LOGISTICS MARKET SIZE, 2020-2027 ($ MILLION)

25. FRANCE E-COMMERCE LOGISTICS MARKET SIZE, 2020-2027 ($ MILLION)

26. REST OF EUROPE E-COMMERCE LOGISTICS MARKET SIZE, 2020-2027 ($ MILLION)