Wheat Flour Market

Global Wheat Flour Market Size, Share & Trends Analysis Report by Application (All-Purpose Flour, Bread, Cakes, Cookies, & Crackers, Noodles & Cereals, Others) Forecast Period, 2020-2026

The global wheat flour market is projected to grow at a CAGR of around 2% during the forecast period. The primary factor driving the market is the increasing popularity of wheat flour and the rising importance of an active and healthy lifestyle. Further, the growing awareness regarding the health benefits provided by wheat flour is another major factor propelling the growth of the market. Wheat flour offers several benefits including lowering cholesterol levels, controlling obesity, and improving metabolism. In addition to this, wheat flour is inexpensive as compared to other flour made from grains and is easily available to consumers that belong to a socio-economic group. Apart from this, the macro-economic factors driving the growth of the wheat flour market include strengthening economic conditions, increasing purchasing power, protein-rich diets, and increasing health awareness.

Impact of COVID-19 Pandemic on Global Wheat Flour Market

COVID-19 pandemic led to a positive impact on the growth of the global wheat flour market. The pandemic has resulted in increased consumption of packaged wheat flour instead of loose flour to avoid the spread of the virus. However, the pandemic caused little effect (negative) to the manufacturers and production units of wheat flour due to lockdown, and travel restrictions which led to disruptions in the supply chain. So, the overall impact of the COVID-19 pandemic on the wheat flour market was normalized.

Segmental Outlook

The global wheat flour market is segmented based on application. Based on application, the market is segmented into all-purpose flour, bread, cakes, cookies, & crackers, noodles & cereals, others. Among the application, the all-purpose flour segment of the market is estimated to hold a prominent share in the market. The segmental dominance is attributed to the fact that it is widely used flour and can be universally used for a range of baked products including yeast bread, cookies, and others.

Cakes, Cookies & Crackers Segment to Exhibit Considerable Growth During the Forecast Period

The cakes & cookies segment is projected to exhibit considerable growth during the forecast period. The factor contributing to the segmental growth of the market include the rising consumption of whole wheat flour in the making of cakes and cupcakes. Wheat flour is lighter in color, has a mild flavor, and offers whole grains benefits as its bran, germ, and endosperm are left intact. For this reason, whole wheat flour is an excellent ingredient to use in whole grain baking for cupcakes, cakes, and everything in between.

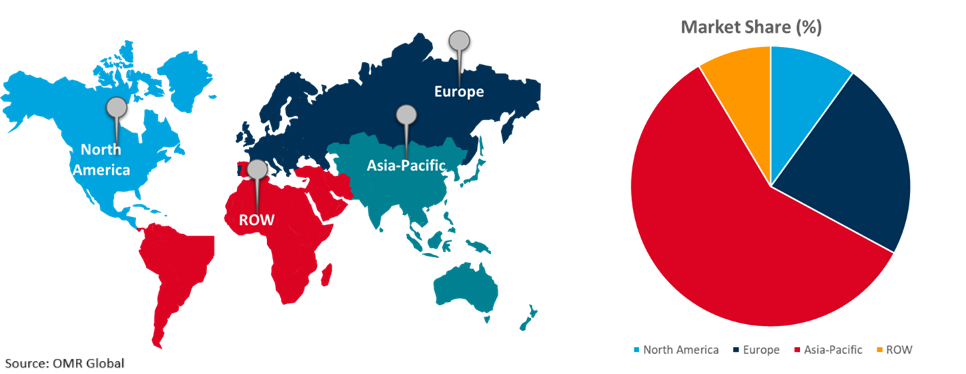

Regional Outlook

The global Wheat Flour market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World. The Asia-Pacific region is projected to hold a significant market share. China, India, and Japan are the major economies primarily contributing to the growth of the market in the region. The regional growth of the market is attributed to the changing consumer lifestyle coupled with rising disposable income in the economies such as China and India. Europe is the second-largest market in 2020 owing to increased emphasis on a healthy lifestyle.

Global Wheat Flour Market Growth by Region, 2020-2026

Latin America & Middle East Region is Projected to Have a Considerable Growth Rate in the Global Wheat Flour Market

Latin America is anticipated to exhibit considerable growth in the global wheat flour market. The growth factors for the regional market include the high consumer awareness regarding health and knowledge about the product and its benefit. Further, high disposable income, acquisition of companies by local players, the establishment of mills, and modernization are other factors driving the growth of the market. For an instance, in May 2018, Bunge North America opened a new wheat milling facility in Yucatán, Mexico, which aimed to improve the company's ability to serve clients in Southeast Mexico. Bunge stated that since the mill is 20 kilometers outside of Puerto Progresso, wheat can be efficiently brought from the port to be processed, and the flour produced can be easily shipped to other Latin American markets.

Market Players Outlook

Some of the prominent players operating in the global wheat flour market include Acarsan Holding, Allied Pinnacle Pty Ltd., Archer-Daniels-Midland Co., Ardent Mills (Conagra Foods) among others. These key manufacturers are adopting various strategies such as new product launches and approvals, mergers and acquisitions, partnerships and collaborations, and many others to thrive in a competitive environment. For instance, in March 2021, Ardent Mills, one of the leading flour-milling and ingredient firms has launched its Keto Certified Net Carb Flour Blend, the industry's first major net carb flour blend for keto and low net carb baked goods. The new formulation can be used as a substitute for regular flour. As consumers seek solutions that match their unique health ideals and preferences, interest in a low-carbohydrate diet continues to grow. And, while this market presents a huge potential, it also presents a significant challenge for manufacturers.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Wheat Flour market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Volume Analysis

2.4. Porter’s Five Analysis

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

4. Market Segmentation

4.1. Global Wheat Flour Market by Application

4.1.1. All Purpose Flour

4.1.2. Bread

4.1.3. Cakes, Cookies, & Crackers

4.1.4. Noodles & Cereals

4.1.5. Others (Pasta)

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East

6. Company Profiles

6.1. Acarsan Holding

6.2. Allied Pinnacle Pty Ltd.

6.3. Archer-Daniels-Midland Co.

6.4. Ardent Mills (Conagra Foods)

6.5. Canowindra Produce Co Pty Ltd.

6.6. Cofco Corp.

6.7. General Mills

6.8. Hayden Flour Mills

6.9. HIDIROGLU Flour Mills

6.10. Kale Flour Milling

6.11. King Milling Co.

6.12. Korfez Flour Group

6.13. Manildra Milling Pvt Ltd.

6.14. PT Indofood Sukses Makmur Tbk

6.15. Sunrise Flour Mill

6.16. UC-EL Flour Mill

6.17. Wilmar International

6.18. Wudeli Flour Mill Group

1. GLOBAL WHEAT FLOUR MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

2. GLOBAL WHEAT FLOUR MARKET VOLUME ANALYSIS, 2019-2026 (THOUSAND TONS)

3. GLOBAL WHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

4. GLOBAL WHEAT FOR ALL PURPOSE FLOUR MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL WHEAT FOR BREAD MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL WHEAT FOR CAKES, COOKIES, & CRACKERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL WHEAT FOR NOODLES & CEREALS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL WHEAT FOR OTHER APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL WHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

10. NORTH AMERICAN WHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

11. NORTH AMERICAN WHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

12. EUROPEAN WHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

13. EUROPEAN WHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

14. ASIA-PACIFIC WHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. ASIA-PACIFIC WHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

16. ROW WHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. ROW WHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL WHEAT FLOUR MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

2. GLOBAL WHEAT FLOUR MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

3. NORTH AMERICA WHEAT FLOUR MARKET VALUE, 2019-2026 ($ MILLION)

4. NORTH AMERICA WHEAT FLOUR MARKET VOLUME, 2019-2026 (THOUSAND TONS)

5. US WHEAT FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA WHEAT FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

7. EUROPE WHEAT FLOUR MARKET VALUE, 2019-2026 ($ MILLION)

8. EUROPE WHEAT FLOUR MARKET VOLUME, 2019-2026 (THOUSAND TONS)

9. UK WHEAT FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

10. UK WHEAT FLOUR MARKET VOLUME, 2019-2026 (THOUSAND TONS)

11. FRANCE WHEAT FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

12. FRANCE WHEAT FLOUR MARKET VOLUME, 2019-2026 (THOUSAND TONS)

13. GERMANY WHEAT FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

14. GERMANY WHEAT FLOUR MARKET VOLUME, 2019-2026 (THOUSAND TONS)

15. ITALY WHEAT FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

16. ITALY WHEAT FLOUR MARKET VOLUME, 2019-2026 (THOUSAND TONS)

17. SPAIN WHEAT FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

18. SPAIN WHEAT FLOUR MARKET VOLUME, 2019-2026 (THOUSAND TONS)

19. REST OF EUROPE WHEAT FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

20. ASIA-PACIFIC WHEAT FLOUR MARKET VALUE, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC WHEAT FLOUR MARKET VOLUME, 2019-2026 (THOUSAND TONS)

22. INDIA WHEAT FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

23. INDIA WHEAT FLOUR MARKET VOLUME, 2019-2026 (THOUSAND TONS)

24. CHINA WHEAT FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

25. CHINA WHEAT FLOUR MARKET VOLUME, 2019-2026 (THOUSAND TONS)

26. JAPAN WHEAT FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

27. JAPAN WHEAT FLOUR MARKET VOLUME, 2019-2026 (THOUSAND TONS)

28. REST OF ASIA-PACIFIC WHEAT FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

29. ROW WHEAT FLOUR MARKET VALUE, 2019-2026 ($ MILLION)

30. ROW WHEAT FLOUR MARKET VOLUME, 2019-2026 (THOUSAND TONS)

31. LATIN AMERICA WHEAT FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

32. LATIN AMERICA WHEAT FLOUR MARKET VOLUME, 2019-2026 (THOUSAND TONS)

33. MIDDLE EAST WHEAT FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

34. MIDDLE EAST WHEAT FLOUR MARKET VOLUME, 2019-2026 (THOUSAND TONS)