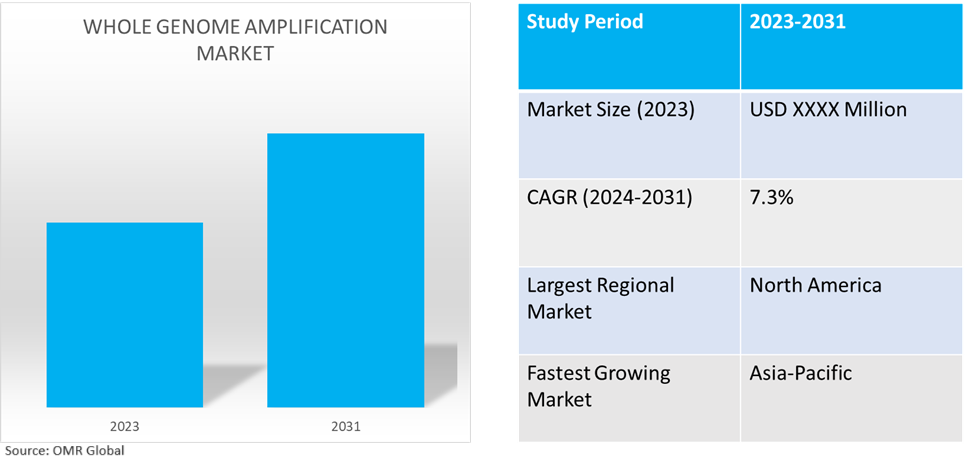

Whole Genome Amplification Market

Whole Genome Amplification Market Size, Share & Trends Analysis Report by Product Type (Instruments, Kits and Reagents, and Services), by Application (Drug Discovery and Development, Disease Diagnosis, Agriculture, Veterinary Research, Forensics, and Others), and by End-User (Pharma and Biotech Companies, Contract Research Organizations, Academic Institutes, and Others) Forecast Period (2024-2031)

Whole genome amplification market is anticipated to grow at a CAGR of 7.3% during the forecast period (2024-2031). Whole genome amplification is the process of amplifying the entire genome from nanogram quantities of DNA to microgram quantities of amplified products. It has been used to amps up material from a single DNA cell and is an important tool for the preservation of small samples of DNA products. Numerous techniques, such as primer extension preamplification, multiple displacement amplification, and degenerate oligonucleotide PCR, have been developed for whole genome amplification.

Market Dynamics

Growing demand for research and development in genetic testing

One of the main factors driving market expansion is the increasing requirement for research and development in the fields of genetic testing, genomics, biological research, and molecular diagnostics. In January 2024, Sano Genetics, a software company accelerating precision medicine research raised $11.4 million in new funding, led by Plural with participation from existing investors including MMC Ventures, Episode 1 and Seedcamp. The growing funding for genetic testing startups is further aiding the research related to genetic testing.

Rising DNA multiplication technologies

The market is driven primarily by the rapidly growing array of improved DNA multiplication technologies. Due to the advances in technology related to loop-mediated amplification, a great deal of research has been done on advanced technologies and their alternatives, including Nucleic Acid Sequence Based Amplification (NASBA), Rolling Circle Amplification (RCA), and Loop-Mediated Isothermal Amplification (LAMP). These methods are becoming more popular due to their benefits, which include facile multiplication from a single cell, fast amplification kinetics, and no need for costly heat cycles. These elements are anticipated to increase consumer demand for the goods sold in this market and, as a result, boost organic revenue growth.

Market Segmentation

- Based on product type, the market is segmented into instruments, kits and reagents, and services.

- Based on application, the market is segmented into drug discovery and development, disease diagnosis, agriculture, veterinary research, forensics, and others including precision medicine.

- Based on end-user, the market is segmented into pharma and biotech companies, contract research organizations, academic institutes, and others including hospitals & clinics.

Drug Discovery Holds Major Share Based on Application

The growing research on diseases including cancer and genetic disorders, increasing technological developments, and new drug discovery techniques implemented are key contributors to the high share of this market segment. For instance, in July 2021, Eli Lilly and Verge Genomics entered a partnership to research and create new drugs for treatment of amyotrophic lateral sclerosis (ALS). With this new partnership, Verge developed an all-in-human, artificial-intelligence (AI)-driven drug discovery and development platform to develop treatments for serious genetic diseases. This new platform is being used to advance them into clinical trials and markets.

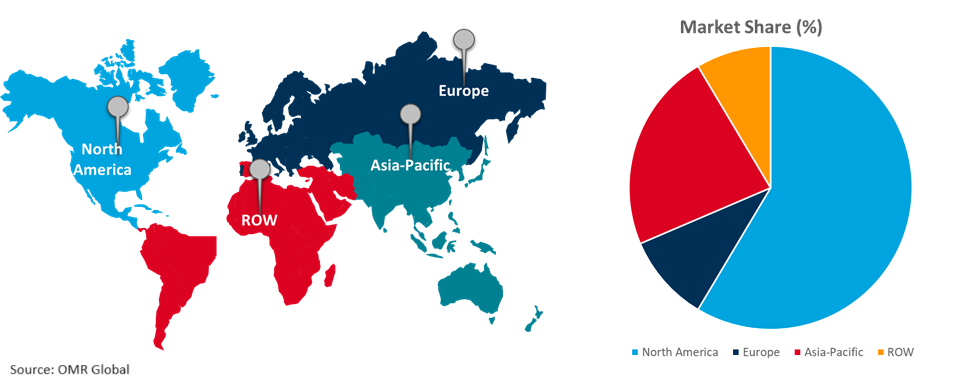

Regional Outlook

The global whole genome amplification market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific countries to invest in healthcare sector

- The Asia-Pacific market is growing as it has favorable government initiatives to develop better healthcare infrastructure.

- The market expansion in nations, such as China and India, has been boosted the easy availability of skilled labor and increased research effort in the field of genomics and molecular diagnostics.

Global Whole Genome Amplification Market Growth by Region 2024-2031

North America Holds Major Market Share

The presence of robust biotechnology R&D infrastructure in the region along with the significant presence of numerous genetic research initiatives are key contributors to the high share of the regional market. Furthermore, a sizable portion of businesses involved in production and marketing of gene amplification solutions that are kits, reagents, and instruments have their headquarters in the US. This element also played a role in the region's high revenue generation. Apart from this, the growing geriatric population and the high healthcare expenditure of the regional population is further aiding the demand for regional market.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global whole genome amplification market include GE Healthcare, Illumina, Inc., Agilent Technologies, Inc., Merck KGaA, and Thermo Fisher Scientific Inc. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions among others to stay competitive in the market. For instance, in April 2021, Hologic acquired Mobidiag, an innovator in near-patient, acute care diagnostic testing, for approximately $795 million. With this acquisition, the company intends to expand its footprints in the diagnostic testing market.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global whole genome amplification market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Agilent Technologies Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. GE Healthcare

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Illumina Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Thermo Fisher Scientific Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Whole Genome Amplification Market by Product Type

4.1.1. Instruments

4.1.2. Kits & Reagents

4.1.3. Services

4.2. Global Whole Genome Amplification Market by Application

4.2.1. Drug Discovery and Development

4.2.2. Disease Diagnosis

4.2.3. Agriculture

4.2.4. Veterinary Research

4.2.5. Forensics

4.2.6. Others (Precision Medicine)

4.3. Global Whole Genome Amplification Market by End-User

4.3.1. Pharma and Biotech Companies

4.3.2. Contract Research Organizations

4.3.3. Academic Institutes

4.3.4. Others (Hospitals & Clinics)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. 23&Me Inc.

6.2. Bio-Rad Laboratories, Inc.

6.3. Danaher Corp.

6.4. Eurofins Scientific SE

6.5. F. Hoffmann-La Roche Ltd.

6.6. Luminex Corp.

6.7. Merck KGaA

6.8. Myriad Genetics Inc.

6.9. Oxford Nanopore Technologies

6.10. Pacific Biosciences of California Inc.

6.11. Perkilenmer Inc.

6.12. Promega Corp.

6.13. Qiagen NV

6.14. Quest Diagnostics

6.15. Silicon Biosystems

6.16. Takara Bio Inc.

6.17. Vazyme Biotech Co. Ltd.

1. GLOBAL WHOLE GENOME AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

2. GLOBAL WHOLE GENOME AMPLIFICATION INSTRUMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL WHOLE GENOME AMPLIFICATION KITS & REAGENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL WHOLE GENOME AMPLIFICATION SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL WHOLE GENOME AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

6. GLOBAL WHOLE GENOME AMPLIFICATION FOR DRUG DISCOVERY AND DEVELOPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL WHOLE GENOME AMPLIFICATION FOR DISEASE DIAGNOSIS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL WHOLE GENOME AMPLIFICATION FOR AGRICULTURE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL WHOLE GENOME AMPLIFICATION FOR VETERINARY RESEARCH MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL WHOLE GENOME AMPLIFICATION FOR FORENSICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL WHOLE GENOME AMPLIFICATION FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL WHOLE GENOME AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

13. GLOBAL WHOLE GENOME AMPLIFICATION FOR PHARMA AND BIOTECH COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL WHOLE GENOME AMPLIFICATION FOR CONTRACT RESEARCH ORGANIZATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL WHOLE GENOME AMPLIFICATION FOR ACADEMIC INSTITUTES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL WHOLE GENOME AMPLIFICATION FOR OTHER END-USERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL WHOLE GENOME AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. NORTH AMERICAN WHOLE GENOME AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. NORTH AMERICAN WHOLE GENOME AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

20. NORTH AMERICAN WHOLE GENOME AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

21. NORTH AMERICAN WHOLE GENOME AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

22. EUROPEAN WHOLE GENOME AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. EUROPEAN WHOLE GENOME AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

24. EUROPEAN WHOLE GENOME AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

25. EUROPEAN WHOLE GENOME AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC WHOLE GENOME AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC WHOLE GENOME AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC WHOLE GENOME AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC WHOLE GENOME AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

30. REST OF THE WORLD WHOLE GENOME AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

31. REST OF THE WORLD WHOLE GENOME AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

32. REST OF THE WORLD WHOLE GENOME AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

33. REST OF THE WORLD WHOLE GENOME AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL WHOLE GENOME AMPLIFICATION MARKET SHARE BY PRODUCT TYPE, 2023 VS 2031 (%)

2. GLOBAL WHOLE GENOME AMPLIFICATION INSTRUMENTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL WHOLE GENOME AMPLIFICATION KITS & REAGENTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL WHOLE GENOME AMPLIFICATION SERVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL WHOLE GENOME AMPLIFICATION MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

6. GLOBAL WHOLE GENOME AMPLIFICATION FOR DRUG DISCOVERY AND DEVELOPMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL WHOLE GENOME AMPLIFICATION FOR DISEASE DIAGNOSIS MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL WHOLE GENOME AMPLIFICATION FOR AGRICULTURE MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL WHOLE GENOME AMPLIFICATION FOR VETERINARY RESEARCH MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL WHOLE GENOME AMPLIFICATION FOR FORENSICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL WHOLE GENOME AMPLIFICATION FOR OTHER APPLICATIONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL WHOLE GENOME AMPLIFICATION MARKET SHARE BY END-USER, 2023 VS 2031 (%)

13. GLOBAL WHOLE GENOME AMPLIFICATION FOR PHARMA AND BIOTECH COMPANIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL WHOLE GENOME AMPLIFICATION FOR CONTRACT RESEARCH ORGANIZATIONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL WHOLE GENOME AMPLIFICATION FOR ACADEMIC INSTITUTES MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL WHOLE GENOME AMPLIFICATION FOR OTHER END-USERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL WHOLE GENOME AMPLIFICATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. US WHOLE GENOME AMPLIFICATION MARKET SIZE, 2023-2031 ($ MILLION)

19. CANADA WHOLE GENOME AMPLIFICATION MARKET SIZE, 2023-2031 ($ MILLION)

20. UK WHOLE GENOME AMPLIFICATION MARKET SIZE, 2023-2031 ($ MILLION)

21. FRANCE WHOLE GENOME AMPLIFICATION MARKET SIZE, 2023-2031 ($ MILLION)

22. GERMANY WHOLE GENOME AMPLIFICATION MARKET SIZE, 2023-2031 ($ MILLION)

23. ITALY WHOLE GENOME AMPLIFICATION MARKET SIZE, 2023-2031 ($ MILLION)

24. SPAIN WHOLE GENOME AMPLIFICATION MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF EUROPE WHOLE GENOME AMPLIFICATION MARKET SIZE, 2023-2031 ($ MILLION)

26. INDIA WHOLE GENOME AMPLIFICATION MARKET SIZE, 2023-2031 ($ MILLION)

27. CHINA WHOLE GENOME AMPLIFICATION MARKET SIZE, 2023-2031 ($ MILLION)

28. JAPAN WHOLE GENOME AMPLIFICATION MARKET SIZE, 2023-2031 ($ MILLION)

29. SOUTH KOREA WHOLE GENOME AMPLIFICATION MARKET SIZE, 2023-2031 ($ MILLION)

30. REST OF ASIA-PACIFIC WHOLE GENOME AMPLIFICATION MARKET SIZE, 2023-2031 ($ MILLION)

31. LATIN AMERICA WHOLE GENOME AMPLIFICATION MARKET SIZE, 2023-2031 ($ MILLION)

32. MIDDLE EAST AND AFRICA WHOLE GENOME AMPLIFICATION MARKET SIZE, 2023-2031 ($ MILLION)