Wood Adhesives Market

Global Wood Adhesives Market Size, Share & Trends Analysis Report By Resin Type (Natural, and Synthetic) By Technology (Solvent-Based, and Water-Based) By Application (Furniture, Flooring & Decks, Furniture, Windows & Doors, and Others) Forecast 2021-2027 Update Available - Forecast 2025-2031

The global wood adhesives market is anticipated to grow at a CAGR during the forecast period (2021-2027). The global wood adhesive market is majorly driven by the factors which include growing construction activities which are increasing the applications of wood adhesives, growth in the housing sector due to urbanization, infrastructure development, and increasing consumer spending on home décor and luxury furniture products in high-income countries. For instance, Midwestern states such as Indiana, Iowa, Illinois, and Wisconsin, spend the most on average on home decor and renovations every year. Indiana spends over 25% above the national average. On the other hand, as per the survey conducted by Home Decors in the US, the average household spending on home services in 2020 was $13,138, an increase from 2019’s average of $9,081. The spending comprises designing a home furniture, flooring, among others. Furthermore, growing urbanization is also the factor driving market growth. According to the United Nations, 55.0% of the global population is residing in urban areas in 2018. Therefore, this increasing rate will pose a positive effect on the demand for home décor and design in the forecast period.

Besides these, the volatility in raw material prices associated with wood adhesive, and regulations associated with the use of wood adhesive which is derived from petrol and crude oil and have a negative impact on the environment, may expected slowdown their demand and market value during the forecast period. Therefore manufacturers are focusing on the development of eco-friendly adhesives such as green adhesive, which will provide growth opportunities in the market during the forecast period.

Impact of COVID-19 on Global Wood Adhesives Market

The wood adhesives market has registered a decline in growth due to the COVID-19 pandemic. The halt in transportation facilities due to restrictions imposed by the Government of major economies has resulted in disruption in the raw material supply chain for wood adhesive. Due to the lockdown, the revenues of non-edible products such as hand sanitizers, disinfectants, and paper goods, were in high demand while sales of chemicals and materials such as adhesive, and resins were declined as demand for wood adhesive from end-user verticals has been decreased. Furthermore, the unavailability of raw material availability, which caused improper furniture manufacture also impacted the market during the COVID-19 pandemic. Post COVID-19, the market is expected to gain momentum with an increase in the number of remodeling and renovation, and growth in wooden houses in middle-income countries.

Segmental Outlook

The global wood adhesives market is segmented based on resin type, technology, and application. Based on resin type, the market is sub-segmented into natural, and synthetic. Among these, synthetic resin is anticipated to be the largest resin type segment during the forecast period. This is attributed to the increasing demand for wood adhesive in various applications such as furniture, flooring, plywood, and cabinets owing to their properties which include strong, durable adhesion at normal temperatures, and others. On the basis of technology, the market is bifurcated into solvent-based, and water-based. Whereas, on the basis of application, the market is categorized into Furniture, flooring & decks, furniture, windows & doors, and others.

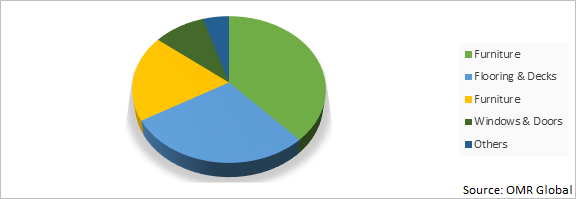

Global Wood Adhesives Market Share by Application, 2020 (%)

The Furniture Segment is Projected to Hold Significant Share in the Global Wood Adhesive Market

Among applications of wood adhesive, the furniture & decks segment is anticipated to account for significant market share during the forecast period. Due to urbanization, the residential and industrial sectors are growing, which is generating the demand for wood adhesive in furniture construction for these sectors. A wood adhesive has numerous benefits east-to-use, durable, cost-effective, among others, due to these, they are high in demand in various applications of wood construction and designing. Moreover, In high-income population countries, due to changing standard of leaving, people are inclining towards remodeling & renovation of their house. This is leading to the increasing in the number of remodeling & renovation activities which comprises designing of furniture and others.

Regional Outlook

Geographically, the global wood adhesives market is classified into four major regions including North America (the US and Canada), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, ASEAN, and Rest of Asia-Pacific), and Rest of the World (Latin America and the Middle East and Africa (MEA)). North America is likely to show a lucrative growth rate in the market during the forecast period. The factors such as increasing disposable income, changing standard of leaving, growing industrial wood construction activities, and growth in wood houses in the region are driving the market growth. Europe is expected to foresee moderate growth owing to the significant investment in renovation activities during the forecast period. However, environmental regulations in European countries act as a major restraint impacting the growth of the global wood adhesives market.

Global Wood Adhesives Market Growth, By Region 2021-2027

Asia-Pacific is Anticipated to be the Fastest Growing Region in Global Wood Adhesive Market

Geographically, Asia-Pacific region leads the global wood adhesive market, in terms of value and volume. China and India are major markets for wood adhesives in the Asia-Pacific region. The increasing investment across construction industries and infrastructural development are driving the Asia-Pacific wood adhesives market. Moreover, due to high population base, the residential sector is growing due to which the demand for remodeling and renovation activities are increasing in the region, which in turn, driving the market growth. Moreover, stringent regulations associated with the use of volatile chemical compound (VOCs) used in wood adhesive, is the factor that may hamper the market growth.

Market Players Outlook

The key players in the wood adhesives market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include 3M Co., Arkema Group, Akzo Nobel NV, Ashland Inc., Bostik SA, The Dow Chemical Co, Henkel AG & Co. KGaA, Jubilant Industries Ltd., Pidilite Industries Ltd., among others. These market players are adopting several market strategies including product launch and approvals, merger and acquisition, partnership collaboration, business, and capacity expansion, and others. For instance, in March 2021, Sika AG has acquired the flooring adhesives business of DriTac, a US-based floor covering adhesives company. The acquisition will contribute to Sika’s increased presence among floor covering installers and distributors, while accelerating Sika’s expansion in the Interior Finishing market in the USA.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global wood adhesives market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Wood Adhesives Industry

• Recovery Scenario of Global Wood Adhesives Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Trade Analysis

2.2.3. Porter’s Analysis

2.2.4. Recommendations

2.2.5. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on key players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Wood Adhesives Market, By Resin Type

5.1.1. Natural

5.1.2. Synthetic

5.2. Global Wood Adhesives Market, By Technology

5.2.1. Solvent-Based

5.2.2. Water-Based

5.3. Global Wood Adhesives Market, By Application

5.3.1. Flooring & Decks

5.3.2. Furniture

5.3.3. Particle Board

5.3.4. Windows & Doors

5.3.5. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

6.4.1. Latin America

6.4.2. Middle East & Africa

7. Company Profiles

7.1. 3M Co.

7.2. AICA Kogyo Co. Ltd

7.3. Arkema Group

7.4. Akzo Nobel NV

7.5. Ashland Global Holdings Inc

7.6. Bostik SA

7.7. Dana Lim A/S

7.8. The Dow Chemical Co

7.9. Dynea Oy

7.10. GP Chemicals LLC

7.11. H.B. Fuller Co

7.12. Henkel AG & Co. KGaA

7.13. Jubilant Industries Ltd

7.14. The Lubrizol Corp

7.15. Pidilite Industries Ltd

7.16. Sika AG

7.17. Wanhua Chemical Group Co., Ltd

1. GLOBAL WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY RESIN TYPE, 2020-2027 ($ MILLION)

2. GLOBAL NATURAL WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL SYNTHETIC WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

5. GLOBAL SOLVENT-BASED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL WATER-BASED WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

8. GLOBAL WOOD ADHESIVES FOR FLOORING & DECKS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL WOOD ADHESIVES FOR FURNITURE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL WOOD ADHESIVES FOR PARTICLE BOARD MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL WOOD ADHESIVES FOR WINDOWS & DOORS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL WOOD ADHESIVES FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

13. NORTH AMERICAN WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

14. NORTH AMERICAN WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY RESIN TYPE, 2020-2027 ($ MILLION)

15. NORTH AMERICAN WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

16. NORTH AMERICAN WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

17. EUROPEAN WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

18. EUROPEAN WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY RESIN TYPE, 2020-2027 ($ MILLION)

19. EUROPEAN WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

20. EUROPEAN WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

21. ASIA-PACIFIC WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

22. ASIA-PACIFIC WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY RESIN TYPE, 2020-2027 ($ MILLION)

23. ASIA-PACIFIC WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

24. ASIA-PACIFIC WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

25. REST OF THE WORLD WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

26. REST OF THE WORLD WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY RESIN TYPE, 2020-2027 ($ MILLION)

27. REST OF THE WORLD WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

28. REST OF THE WORLD WOOD ADHESIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL WOOD ADHESIVES MARKET, 2020-2027 (% MILLION)

2. IMPACT OF COVID-19 ON GLOBAL WOOD ADHESIVES MARKET BY SEGMENT, 2020-2027 (% MILLION)

3. RECOVERY OF GLOBAL WOOD ADHESIVES MARKET, 2020-2027 (%)

4. GLOBAL WOOD ADHESIVES MARKET SHARE BY RESIN TYPE, 2020 VS 2027 (%)

5. GLOBAL WOOD ADHESIVES MARKET SHARE BY TECHNOLOGY, 2020 VS 2027 (%)

6. GLOBAL WOOD ADHESIVES MARKET SHARE BY APPLICATION, 2020 VS 2027 (%)

7. GLOBAL WOOD ADHESIVES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL NATURAL WOOD ADHESIVES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

9. GLOBAL SYNTHETIC WOOD ADHESIVES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

10. GLOBAL WOOD ADHESIVES FOR FLOORING & DECKS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

11. GLOBAL WOOD ADHESIVES FOR FURNITURE MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

12. GLOBAL WOOD ADHESIVES FOR PARTICLE BOARD MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

13. GLOBAL WOOD ADHESIVES FOR WINDOWS & DOORS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

14. GLOBAL WOOD ADHESIVES FOR OTHER APPLICATIONS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

15. NORTH AMERICAN WOOD ADHESIVES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

16. GLOBAL WOOD ADHESIVES FOR FLOORING & DECKS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

17. GLOBAL WOOD ADHESIVES FOR FURNITURE MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

18. GLOBAL WOOD ADHESIVES FOR PARTICLE BOARD MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

19. GLOBAL WOOD ADHESIVES FOR WINDOWS & DOORS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

20. GLOBAL WOOD ADHESIVES FOR OTHER APPLICATIONS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

21. US WOOD ADHESIVES MARKET SIZE, 2020-2027 ($ MILLION)

22. CANADA WOOD ADHESIVES MARKET SIZE, 2020-2027 ($ MILLION)

23. UK WOOD ADHESIVES MARKET SIZE, 2020-2027 ($ MILLION)

24. FRANCE WOOD ADHESIVES MARKET SIZE, 2020-2027 ($ MILLION)

25. GERMANY WOOD ADHESIVES MARKET SIZE, 2020-2027 ($ MILLION)

26. ITALY WOOD ADHESIVES MARKET SIZE, 2020-2027 ($ MILLION)

27. SPAIN WOOD ADHESIVES MARKET SIZE, 2020-2027 ($ MILLION)

28. REST OF EUROPE WOOD ADHESIVES MARKET SIZE, 2020-2027 ($ MILLION)

29. INDIA WOOD ADHESIVES MARKET SIZE, 2020-2027 ($ MILLION)

30. CHINA WOOD ADHESIVES MARKET SIZE, 2020-2027 ($ MILLION)

31. JAPAN WOOD ADHESIVES MARKET SIZE, 2020-2027 ($ MILLION)

32. SOUTH KOREA WOOD ADHESIVES MARKET SIZE, 2020-2027 ($ MILLION)

33. REST OF ASIA-PACIFIC WOOD ADHESIVES MARKET SIZE, 2020-2027 ($ MILLION)

34. REST OF THE WORLD WOOD ADHESIVES MARKET SIZE, 2021-2027($ MILLION