Workwear Market

Global Workwear Market Size, Share & Trends Analysis Report By Product Type (Apparel, Accessories, and Luxury) By Category (Men, Women, and Children) By Distribution Channel (Online, and Offline) Forecast 2022-2028 Update Available - Forecast 2025-2035

The global workwear market is anticipated to grow at a considerable CAGR of 4.3 % during the forecast period. The term workwear is not limited to only the attire which is worn by corporate professionals. It is a broader term, which includes, industrial workwear, and uniforms that have upper wear and bottom wear clothing. Different workwear has different features, such as industrial workwear providing durability, comforts, and safety to industrial workers, and sometimes protecting them from external hazards. Moreover, the workers who are working in the manufacturing and allied sector, such as automobile, and oil and gas are aware of the external damages and hazards caused during the working, thus prefer specific uniforms rather than casual clothes. Further, increasing women's participation in the corporate world has resulted in the global workwear market in the coming years. Traditionally, women supposed to do all household work, and men used to work.

Nowadays, women in developed countries are given equal weightage and opportunity to work in the organized sector and the companies are making it mandatory to wear the workwear during working hours. For instance, in September 2021, The Women in Apprenticeship and Nontraditional Occupations (WANTO), granted $3,349 to Moore Community House, Inc., Per Scholars, Inc., SER Jobs for the progress of the Texas Gulf Coast, Inc., Tradeswomen Inc., and Wisconsin Regional Training Partnership Inc., to develop pre-apprenticeship or nontraditional skills training to prepare women for their careers. For instance, in March 2021, Libaerty, LLC announced the launch of its online store. With this launch the company offers women workwear attire ranging from industries to construction, manufacturing to agriculture, which is equipped with features for tough work and designed to look good.

Impact of COVID-19 Pandemic on Workwear Market

COVID-19 has disrupted all the sectors of the economy. The lockdown announced by the government of all the countries has drastically affected the operations of the manufacturing and service industry. Strict lockdown stops the transportation of raw materials, labor, and supply chain, which disturbs the manufacturing of goods and services. Moreover, shutting down industries restricted the labor work, which in turn affected the production of workwear on a large scale. Further, after attainting a normal situation, the workwear market again attained a boost, by providing industrial workwear to laborers. As the manufacturing and production units start boosting their production of materials on a large scale. ?

Segmental Outlook

The global workwear market is segmented based on product type, category, and distribution channel. Based on product type, the market is bifurcated into apparel, accessories, and luxury. Based on category, the market is sub-segmented into men, women, and children. Based on distribution channel the market is divided into online, and offline. Online distribution channel has seen a tremendous boom over the recent years, as consumers feel more convenient and comfortable making wardrobe purchases from their handheld devices and laptops. Increasing penetration of smartphone users, expansion of many e-commerce startups, and various discounts and offers offered through online distribution channels, have augmented the growth of the global workwear market in the coming year.

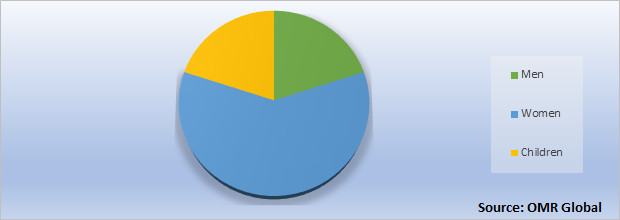

Global Workwear Market Share by Category, 2022 (%)

The Women Holds the Major Share in the Global Workwear Market

The women category is expected to expand at the fastest rate in the coming years. The major factor contributing to the growth of this segment is the reduction in gender discrimination across the globe, which is increasing the number of women workforce in corporate, industrial, and business sectors. The rising number of women workforce and specific percentage reserved for women in multinational companies has boosted the growth of the global workwear market. By understanding these trends, many companies have started offering comfortable, fashionable, corporate-oriented women's workwear. Hence, results in rising demand for workwear market over the forecast period 2022-2028. ?

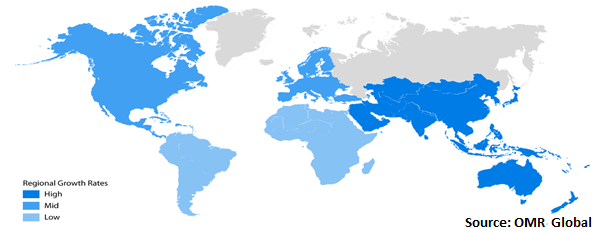

Regional Outlooks

The global workwear market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The North-America emerged as a leading region during the forecast period. Rising urbanization, industrialization, and well-established infrastructure result in creating opportunities for jobs, for the youth population in various sectors, which in turn increases the demand for workwear in the North-America region in the coming years.

Global Workwear Market Growth, by Region 2022-2028

The North-America Region Holds the Significant Share in the Global Workwear Market

North America is among the major markets for workwear. Owing to rising per capita income which shifts the consumers’ preferences towards adopting luxury lifestyles, influenced the purchasing power to opt for luxury and branded workwear in the region. Moreover, successful advertising strategies and a major focus in specialized markets help in allowing workwear companies to generate an increase in their revenue. Further, the increasing prevalence of fashion trends, along with a rising preference for branded workwear among the youths, have been the key factor for the booming global workwear market. Furthermore, the market players are contributing to the growth of the global workwear in the North-America region. For instance, in October 2021, Unifirst Corp. has entered into a three-year sponsorship agreement with Kraft Sports Entertainment. With this agreement, the company will become the official uniform supplier to the New England Patriots. Besides outfitting, the company delivered high-quality uniforms each workday, Unifirst also helps businesses to stay safe and hygienic by providing its array of the ancillary facility service program.

Market Players Outlook

The major companies serving the global workwear market are, Aditya Birla Fashion and Retail Ltd., Klopman International S.r.l., Levi Strauss & Co., Raymond, Teijin Group, The Donna Karan Co. Store LLC., Ballyclare International, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in January 2020, Levi Strauss & Co.(LEVI), announced the acquisition of operating assets related to Levi’s and Dockers brand from the jeans company. The agreement includes around 80 Levi's and dockers retail stores, which offer jeans, casual pants, jackets, and other related products.

The Report Covers

- Market value data analysis of 2022 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global workwear market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

- Current Industry Analysis and Growth Potential Outlook

- Impact of COVID-19 on the Global Workwear Market

- Recovery Scenario of Global Workwear Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Aditya Birla Fashion and Retail Ltd

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Klopman International S.r.l.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Levi Strauss & Co.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Raymond

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Teijin Group

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Workwear Market, by Product Type

5.1.1. Apparel

5.1.2. Accessories

5.1.3. Luxury

5.2. Global Workwear Market, by Category

5.2.1. Men

5.2.2. Women

5.2.3. Children

5.3. Global Workwear Market, by Distribution Channel

5.3.1. Online

5.3.2. Offline

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. 3M

7.2. Ansell Group

7.3. Aramark Uniform Services

7.4. Ballyclare International

7.5. Bragard

7.6. Carhartt Inc

7.7. Cetriko's

7.8. Cintas Corp.

7.9. Duluth Trading Co.

7.10. HAVEP

7.11. HejMar AB

7.12. Honeywell International Inc

7.13. Hultafors Group

7.14. Hunter Apparel Solutions Ltd

7.15. JKL Clothing Ltd

7.16. Johnson Service Group PLC

7.17. Mi Hub Ltd

7.18. Red Wing Brands of America, Inc.

7.19. Superior Group of Co. Inc.

7.20. TenCate

7.21. Tranemo Textil AB

7.22. VF Corp.

7.23. W. L. Gore & Associates, Inc.

7.24. Wolverine World Wide, Inc

1. GLOBAL WORKWEAR MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028($ MILLION)

2. GLOBAL WORKWEAR APPAREL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL WORKWEAR ACCESSORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL LUXURY WORKWEAR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL WORKWEAR MARKET RESEARCH AND ANALYSIS BY CATEGORY, 2021-2028 ($ MILLION)

6. GLOBAL MEN WORKWEAR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL WOMEN WORKWEAR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL CHILDREN WORKWEAR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL WORKWEAR MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

10. GLOBAL ONLINE WORKWEAR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL OFFLINE WORKWEAR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL WORKWEAR MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

13. NORTH AMERICAN WORKWEAR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

14. NORTH AMERICAN WORKWEAR MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

15. NORTH AMERICAN WORKWEAR MARKET RESEARCH AND ANALYSIS BY CATEGORY, 2021-2028 ($ MILLION)

16. NORTH AMERICAN WORKWEAR MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL , 2021-2028 ($ MILLION)

17. EUROPEAN WORKWEAR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

18. EUROPEAN WORKWEAR MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

19. EUROPEAN WORKWEAR MARKET RESEARCH AND ANALYSIS BY CATEGORY , 2021-2028 ($ MILLION)

20. EUROPEAN WORKWEAR MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

21. ASIA-PACIFIC WORKWEAR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

22. ASIA-PACIFIC WORKWEAR MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

23. ASIA-PACIFIC WORKWEAR MARKET RESEARCH AND ANALYSIS BY CATEGORY, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC WORKWEAR MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

25. REST OF THE WORLD WORKWEAR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

26. REST OF THE WORLD WORKWEAR MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

27. REST OF THE WORLD WORKWEAR MARKET RESEARCH AND ANALYSIS BY CATEGORY, 2021-2028 ($ MILLION)

28. REST OF THE WORLD WORKWEAR MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL , 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL WORKWEAR MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL WORKWEAR MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL WORKWEAR MARKET, 2021-2028 (%)

4. GLOBAL WORKWEAR MARKET SHARE BY PRODUCT TYPE , 2021 VS 2028 (%)

5. GLOBAL WORKWEAR APPAREL MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL WORKWEAR ACCESSORIES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL LUXURY WORKWEAR MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL WORKWEAR MARKET SHARE BY PRODUCT CATEGORY, 2021 VS 2028 (%)

9. GLOBAL MEN WORKWEAR MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL WOMEN WORKWEAR MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL CHILDREN WORKWEAR MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL WORKWEAR MARKET SHARE BY DISTRIBUTION CHANNEL , 2021 VS 2028 (%)

13. GLOBAL ONLINE WORKWEAR MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL OFFLINE WORKWEAR MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. GLOBAL WORKWEAR MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16. US WORKWEAR MARKET SIZE, 2021-2028 ($ MILLION)

17. CANADA WORKWEAR MARKET SIZE, 2021-2028 ($ MILLION)

18. UK WORKWEAR MARKET SIZE, 2021-2028 ($ MILLION)

19. FRANCE WORKWEAR MARKET SIZE, 2021-2028 ($ MILLION)

20. GERMANY WORKWEAR MARKET SIZE, 2021-2028 ($ MILLION)

21. ITALY WORKWEAR MARKET SIZE, 2021-2028 ($ MILLION)

22. SPAIN WORKWEAR MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF EUROPE WORKWEAR MARKET SIZE, 2021-2028 ($ MILLION)

24. INDIA WORKWEAR MARKET SIZE, 2021-2028 ($ MILLION)

25. CHINA WORKWEAR MARKET SIZE, 2021-2028 ($ MILLION)

26. JAPAN WORKWEAR MARKET SIZE, 2021-2028 ($ MILLION)

27. SOUTH KOREA WORKWEAR MARKET SIZE, 2021-2028 ($ MILLION)

28. REST OF ASIA-PACIFIC WORKWEAR MARKET SIZE, 2021-2028 ($ MILLION)

29. REST OF THE WORLD WORKWEAR MARKET SIZE, 2021-2028 ($ MILLION)