Wound Care Biologics Market

Global Wound Care Biologics Market Size, Share & Trends Analysis Report, By Product (Skin Substitute and Topical Agent), By Wound Type (Ulcers, Surgical and Traumatic Wounds, and Burns), By End-Use (Hospitals and Clinics, Burn Center, and Homecare) and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global wound care biologics market is estimated to grow at a CAGR of 8.2% during the forecast period. Biologic wound healing therapies are intended to facilitate the re-establishment of the natural repair mechanisms. Moreover, wound care biologics may also involve the application of active biological agents, such as plant-derived active biomolecules which exhibit antioxidant, antimicrobial, or anti-inflammatory attributes. Biologic dressings prevent evaporative water loss, heat loss, protein and electrolyte loss, and contamination. They also permit autolytic debridement and develop a granular wound bed. Thereby, they are mostly preferred to treat different wound type including ulcers, surgical and traumatic wounds, and burns.

The increasing prevalence of chronic wounds such as ulcers is propelling the growth of the global wound care biologics market. According to the Agency for Healthcare Research and Quality (AHRQ) in 2017, more than 2.5 million individuals develop pressure ulcers in the US each year. In addition, according to the National Healthcare Systems England, 24,674 patients were reported to have developed a new pressure ulcer between April 2015 and March 2016 and treating pressure damage costs the NHS more than $4.3 million every day. The increasing burden of pressure ulcer surge the demand for the treatment of such chronic wounds which can be prevented and treated using biologics and dressing; thereby, contributing to the growth of the global wound care biologics industry.

Segmental Outlook

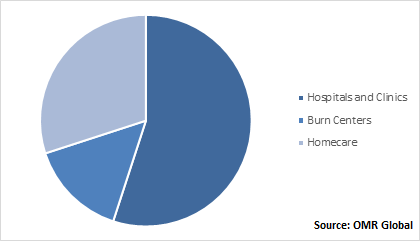

The global wound care biologics market is segmented on the basis of product, wound type, end-use, and region. On the basis of the product, the market is sub-segmented into a skin substitute and topical agent. Based on the wound type, the market is classified into ulcers, surgical and traumatic wounds, and burns. Based on the end-use, the market is classified into hospitals and clinics, burn centers and homecare.

Global Wound Care Biologics Market Share by End-Use, 2018 (%)

Ulcers Wound Type Biologics Segment is Estimated to Hold the Maximum Share

Chronic wounds are a major health concern globally and considered as the key challenge to wound care professionals. There are several kinds of chronic wounds, such as diabetic ulcers, vascular ulcers (such as venous and arterial ulcers) and pressure ulcers. According to the National Center for Biotechnology Information (NCBI), chronic wounds affect nearly 6.5 million people in the US. It claims that more than $25 billion is invested annually on chronic wound treatment.

This result in the demand for wound care biologics for the treatment of chronic wounds. Wound care biologics offer a warm, moist environment that is needed for healing after the removal of damaged tissues. The incidence of chronic wounds is expected to grow rapidly due to the sharp rise in the incidence of diabetes and an aging population around the globe. This, in turn, will create significant opportunity for the growth of the market.

Regional Outlook

Geographically, the study of the global wound care biologics market covers the study of four major regions including North America (the US and Canada), Europe (Germany, UK, Italy, France, Italy, Spain, and Rest of Europe), Asia-Pacific (Japan, China, India, and Rest of Asia-Pacific), and Rest of the World (RoW). Asia-Pacific is estimated to register the fastest growth rate over the forecast period. A significant increase in the number of burn injuries coupled with the increase in the prevalence of types of ulcers such as PU and diabetic ulcers is further influencing the market growth of the region.

North America Held the Dominating Market Share in the Global Wound Care Biologics Market

North America led the global wound care biologics market in 2018 and is further estimated to follow the same trend over the forecast period. The growth of the region is due to the presence of significant market players such as Johnson & Johnson Services, Inc., Anika Therapeutics Inc., and others. Moreover, the prevalence of chronic wounds, increased burn injuries create demand for wound care biologics and hence drive the regional growth of the market.

According to the American Burn Association, scald burns comprise around 35% of overall burn injuries admitted in the US burn centers in 2017. However, nearly 65% of these injuries occur to children less than 5 years old. Moreover, as per the aforementioned association, over 300 children are admitted to emergency rooms and burn injuries cause mortality of around two children each day. Moreover, the presence of burn centers across the economies of the region such as the US and Canada is further influencing the market growth of the region.

Market Players Outlook

Additionally, the market consists of several market players that are designing, developing, and marketing a variety of wound care biologics solutions to cater to a wide range of customers across the globe. The global wound care biologics industry is fragmented in nature, thereby players operating in the industry faces tough competition in terms of prices and quality of products. Key players of the market include Johnson & Johnson Services, Inc., Smith & Nephew PLC, Anika Therapeutics Inc., Integra LifeSciences Holdings Corp., Wright Medical Group N.V., Mölnlycke Health Care AB, Organogenesis Inc., and others. In order to remain competitive in the market, these market players adopt various strategies such as mergers and acquisitions, product offering expansion, geographical expansion, partnerships and collaborations, and others. For instance, in May 2017, Organogenesis Inc. acquired NuTech Medical to expand its portfolio of advanced and next-generation products for the surgical biologics and sports medicine market.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global wound care biologics market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Johnson & Johnson Services, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Smith & Nephew PLC

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Anika Therapeutics Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Integra LifeSciences Holdings Corp.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Wright Medical Group N.V

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Wound Care Biologics Market by Product

5.1.1. Skin Substitute

5.1.2. Topical Agent

5.2. Global Wound Care Biologics Market by Wound Type

5.2.1. Ulcers

5.2.2. Surgical and Traumatic Wounds

5.2.3. Burns

5.3. Global Wound Care Biologics Market by End-Use

5.3.1. Hospitals and Clinics

5.3.2. Burn Center

5.3.3. Homecare

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. Japan

6.3.3. India

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. 3M Co.

7.2. ACell Inc.

7.3. Anika Therapeutics Inc.

7.4. Applied Biologics LLC

7.5. Integra LifeSciences Holdings Corp.

7.6. Johnson & Johnson Services, Inc.

7.7. Kerecis

7.8. Marine Polymer Technologies, Inc.

7.9. MiMedx Group, Inc.

7.10. Mölnlycke Health Care AB

7.11. Organogenesis Inc.

7.12. Smith & Nephew PLC

7.13. Solsys Medical LLC

7.14. Vericel Corp.

7.15. Wright Medical Group NV

1. GLOBAL WOUND CARE BIOLOGICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

2. GLOBAL SKIN SUBSTITUTES WOUND CARE BIOLOGICS PRODUCT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL TOPICAL AGENT WOUND CARE BIOLOGICS PRODUCT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL WOUND CARE BIOLOGICS MARKET RESEARCH AND ANALYSIS BY WOUND TYPE, 2018-2025 ($ MILLION)

5. GLOBAL WOUND CARE BIOLOGICS FOR ULCERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL WOUND CARE BIOLOGICS FOR SURGICAL AND TRAUMATIC WOUNDS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL WOUND CARE BIOLOGICS FOR BURNS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL WOUND CARE BIOLOGICS MARKET RESEARCH AND ANALYSIS BY END-USE, 2018-2025 ($ MILLION)

9. GLOBAL WOUND CARE BIOLOGICS IN HOSPITALS AND CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL WOUND CARE BIOLOGICS IN BURN CENTER MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL WOUND CARE BIOLOGICS IN HOMECARE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL WOUND CARE BIOLOGICS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

13. NORTH AMERICAN WOUND CARE BIOLOGICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

14. NORTH AMERICAN WOUND CARE BIOLOGICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

15. NORTH AMERICAN WOUND CARE BIOLOGICS MARKET RESEARCH AND ANALYSIS BY WOUND TYPE, 2018-2025 ($ MILLION)

16. NORTH AMERICAN WOUND CARE BIOLOGICS MARKET RESEARCH AND ANALYSIS BY END-USE, 2018-2025 ($ MILLION)

17. EUROPEAN WOUND CARE BIOLOGICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. EUROPEAN WOUND CARE BIOLOGICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

19. EUROPEAN WOUND CARE BIOLOGICS MARKET RESEARCH AND ANALYSIS BY WOUND TYPE, 2018-2025 ($ MILLION)

20. EUROPEAN WOUND CARE BIOLOGICS MARKET RESEARCH AND ANALYSIS BY END-USE, 2018-2025 ($ MILLION)

21. ASIA-PACIFIC WOUND CARE BIOLOGICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

22. ASIA-PACIFIC WOUND CARE BIOLOGICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

23. ASIA-PACIFIC WOUND CARE BIOLOGICS MARKET RESEARCH AND ANALYSIS BY WOUND TYPE, 2018-2025 ($ MILLION)

24. ASIA-PACIFIC WOUND CARE BIOLOGICS MARKET RESEARCH AND ANALYSIS BY END-USE, 2018-2025 ($ MILLION)

25. REST OF THE WORLD WOUND CARE BIOLOGICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

26. REST OF THE WORLD WOUND CARE BIOLOGICS MARKET RESEARCH AND ANALYSIS BY WOUND TYPE, 2018-2025 ($ MILLION)

27. REST OF THE WORLD WOUND CARE BIOLOGICS MARKET RESEARCH AND ANALYSIS BY END-USE, 2018-2025 ($ MILLION)

1. GLOBAL WOUND CARE BIOLOGICS MARKET SHARE BY PRODUCT, 2018 VS 2025 (%)

2. GLOBAL WOUND CARE BIOLOGICS MARKET SHARE BY WOUND TYPE, 2018 VS 2025 (%)

3. GLOBAL WOUND CARE BIOLOGICS MARKET SHARE BY END-USE, 2018 VS 2025 (%)

4. GLOBAL WOUND CARE BIOLOGICS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. US WOUND CARE BIOLOGICS MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA WOUND CARE BIOLOGICS MARKET SIZE, 2018-2025 ($ MILLION)

7. UK WOUND CARE BIOLOGICS MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE WOUND CARE BIOLOGICS MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY WOUND CARE BIOLOGICS MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY WOUND CARE BIOLOGICS MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN WOUND CARE BIOLOGICS MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE WOUND CARE BIOLOGICS MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA WOUND CARE BIOLOGICS MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN WOUND CARE BIOLOGICS MARKET SIZE, 2018-2025 ($ MILLION)

15. INDIA WOUND CARE BIOLOGICS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC WOUND CARE BIOLOGICS MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD WOUND CARE BIOLOGICS MARKET SIZE, 2018-2025 ($ MILLION)