X-Ray Detectors Market

X-Ray Detectors Market Size, Share & Industry Analysis Report by Type (Flat Panels Detectors, Computed Radiography Detectors, CCD detectors, and Others), by Portability (Portable and Fixed), and by Application (Medical, Dental, Security, Industrial, and Others) and Forecast, 2019-2025 Update Available - Forecast 2025-2035

The technological advancement in wireless communications has led to the miniaturization process, which includes the availability of efficient and cost-effective biomedical devices and x-ray health-monitoring systems. X-ray detectors are used to measure the flux, spatial distribution, spectrum and other properties of x-rays. The energy in x-ray detectors is transported by radiation and is converted into forms that can be recognized visually and electronically. These detectors find its applications in various verticals, such as medical, dental, industrial, security along with other industries. Moreover, the x-ray detectors serve as an appropriate replacement for analog x-ray systems, as it emits less radiation and is environmental-friendly. This, in turn, has increased the adoption of digital x-ray detectors in hospitals and clinics, giving rise to the increased market share of x-ray detectors. The rising number of mammography among the female population, growing cardiovascular and orthopedic procedures are some other factors offering the market growth. Increased demand for the digital imaging system and rising disposable income in emerging economies has provided opportunities for x-ray detectors manufacturers and supplier to tap into the emerging market, such as India. Furthermore, increasing demand for x-ray detectors in defense services against the smuggling of drugs, weapons, and explosives is substantially increasing the market share of x-ray detectors at a global level.

Segmental Outlook

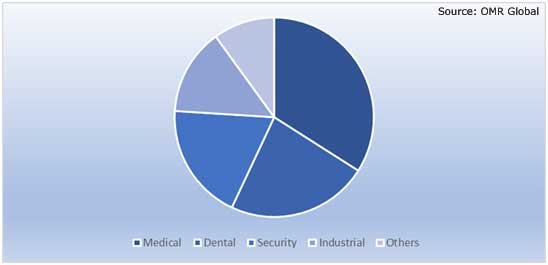

The x-ray detector market is segmented on the basis of type, portability, and application. Based on the type, the market is segmented into flat panels detectors, computed radiography detectors, CCD detectors, and others. On the basis of portability, the market is bifurcated into portable and fixed. Based on application, the market is segmented into medical, dental, security, industrial, and others.

X-Ray Detector Market Share by Application, 2018(%)

Flat-panel detectors segment is estimated to have significant market share in the x-ray detector market

Flat panels segment is expected to register significant growth in the market during the forecast period. The growing demand for interventional and fluoroscopic imaging procedures for pediatric patients across the globe has become more prevalent due to the less-invasive nature of these procedures as compared to surgery. This has considerably surged the demand for flat panels detectors across the globe. Moreover, the flat panel detectors are faster and more sensitive than conventionally used films, and it offers much less image distortion than x-ray image intensifiers.

X-ray detectors find its significant application in the medical sector

Medical segment is expected to register significant growth in the market during the forecast period. The rising geriatric population is leading to the increasing volume of orthopedic and cardiovascular procedures, which in turn, is increasing the demand for x-ray detectors in the medical sector. X-ray detectors have wide usage in the medical field, which includes computed tomography, radiography, angiography, mammography, and volumetric imaging data, among others. For instance, in March 2016, a new highly sensitive x-ray detector is built by the researchers in the US, Netherland, and China that could be used for medical imaging. This x-ray detector allows the images to be taken using smaller doses of ionizing radiation and reduces cancer risks to patients.

Regional Outlook

Global x-ray detector market is further classified on the basis of geography into North America, Europe, Asia-Pacific, and Rest of the World. Among which, North America is expected to register significant growth in the market during the forecast period. The rising demand for minimally-invasive medical procedures along with the technological advancement in the medical sector has led to an increase in demand for x-ray detectors in the region. Moreover, favorable government initiatives and rising investment from government and private sector to strengthen the security systems across the region has led to an increase in the adoption of x-ray detector solutions.

X-ray detector Market Growth, by Region 2019-2025

Asia-Pacific is Projected to Exhibit Considerable Growth in the Global X-ray detector Market

The x-ray detector market is rapidly expanding in Asia-Pacific and witnessing a significant growth specifically in the countries including China, India, Thailand, Indonesia, Vietnam, and the Philippines. The rising investment in R&D activities in medical sciences is one of the major factor propelling the market growth in the region. Moreover, the favorable government regulations to improve the security systems and rising demand for high-end security systems which can detect hazardous weapons in the freight has led to the increasing demand for x-ray detector system in Asia-Pacific.

Market Players Outlook

The major players that contribute to the growth of the global x-ray detector market include Agfa-Gevaert NV, Hamamatsu Photonics, K.K., Varex Imaging Corp., FUJIFILM Corp., Canon Inc., and Teledyne DALSA Inc. These market players are contributing to the market by adopting various market approaches including product launch and approvals, merger and acquisition, partnerships and collaborations, and others for gaining a strong position in the market.

Recent Developments

- In March 2019, Varex Imaging Corp. has announced to acquire at least 90% of the shares of common stock of Direct Conversion AB, manufacturer and marketer of linear array digital detectors utilizing direct conversion and photon counting technology. The acquisition was aimed to expand product portfolio and to extend geographical outreach.

- In March 2018, Teledyne Technologies Inc. announced that the company’s subsidiary, Teledyne DALSA, Inc., is expanding its manufacturing facility due to the increasing demand for company’s proprietary complementary metal-oxide-semiconductor-based x-ray detectors across the globe.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global x-ray detectors market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Agfa-Gevaert NV

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. FUJIFILM Corp.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Hamamatsu Photonics, K.K.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Canon Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Teledyne DALSA Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global X-Ray Detector Market by Type

5.1.1. Flat Panel Detectors

5.1.2. Computed Radiography Detectors

5.1.3. Charge Coupled Device (CCD) Detectors

5.1.4. Others (Line Scan Detectors)

5.2. Global X-Ray Detector Market by Portability

5.2.1. Portable

5.2.2. Fixed

5.3. Global X-Ray Detector Market by Application

5.3.1. Medical

5.3.2. Dental

5.3.3. Security

5.3.4. Industrial

5.3.5. Others (Veterinary)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Agfa-Gevaert NV

7.2. Amptek, Inc.

7.3. Analogic Corp.

7.4. Canon Inc.

7.5. Carestream Health, Inc., a company of Koninklijke Philips N.V.

7.6. Detection Technology PLC

7.7. FUJIFILM Corp.

7.8. Hamamatsu Photonics, K.K.

7.9. Idetec Medical Imaging

7.10. KA Imaging Inc.

7.11. Konica Minolta, Inc.

7.12. Moxtek, Inc.

7.13. Nova Medical Imaging Technology Co., Ltd.

7.14. PerkinElmer Inc.

7.15. Rayence Inc.

7.16. Rigaku Corp.

7.17. Teledyne DALSA Inc.

7.18. Thales Group

7.19. Trixell SAS

7.20. Varex Imaging Corp.

7.21. Vieworks Co., Ltd.

7.22. YXLON International GmbH

1. GLOBAL X-RAY DETECTOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

2. GLOBAL FLAT PANELS DETECTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL COMPUTED RADIOGRAPHY DETECTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL CCD DETECTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL OTHER DETECTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL X-RAY DETECTOR MARKET RESEARCH AND ANALYSIS BY PORTABILITY, 2018-2025 ($ MILLION)

7. GLOBAL PORTABLE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL FIX MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL X-RAY DETECTOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

10. GLOBAL MEDICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL DENTAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

15. GLOBAL X-RAY DETECTOR MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

16. NORTH AMERICAN X-RAY DETECTOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

17. NORTH AMERICAN X-RAY DETECTOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

18. NORTH AMERICAN X-RAY DETECTOR MARKET RESEARCH AND ANALYSIS BY PORTABILITY, 2018-2025 ($ MILLION)

19. NORTH AMERICAN X-RAY DETECTOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

20. EUROPEAN X-RAY DETECTOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

21. EUROPEAN X-RAY DETECTOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

22. EUROPEAN X-RAY DETECTOR MARKET RESEARCH AND ANALYSIS BY PORTABILITY, 2018-2025 ($ MILLION)

23. EUROPEAN X-RAY DETECTOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

24. ASIA-PACIFIC X-RAY DETECTOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

25. ASIA-PACIFIC X-RAY DETECTOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

26. ASIA-PACIFIC X-RAY DETECTOR MARKET RESEARCH AND ANALYSIS BY PORTABILITY, 2018-2025 ($ MILLION)

27. ASIA-PACIFIC X-RAY DETECTOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

28. REST OF THE WORLD X-RAY DETECTOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

29. REST OF THE WORLD X-RAY DETECTOR MARKET RESEARCH AND ANALYSIS BY PORTABILITY, 2018-2025 ($ MILLION)

30. REST OF THE WORLD X-RAY DETECTOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

1. GLOBAL X-RAY DETECTOR MARKET SHARE BY TYPE, 2018 VS 2025 (%)

2. GLOBAL X-RAY DETECTOR MARKET SHARE BY PORTABILITY, 2018 VS 2025 (%)

3. GLOBAL X-RAY DETECTOR MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

4. GLOBAL X-RAY DETECTOR MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. US X-RAY DETECTOR MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA X-RAY DETECTOR MARKET SIZE, 2018-2025 ($ MILLION)

7. UK X-RAY DETECTOR MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE X-RAY DETECTOR MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY X-RAY DETECTOR MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY X-RAY DETECTOR MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN X-RAY DETECTOR MARKET SIZE, 2018-2025 ($ MILLION)

12. REST OF EUROPE X-RAY DETECTOR MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA X-RAY DETECTOR MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA X-RAY DETECTOR MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN X-RAY DETECTOR MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC X-RAY DETECTOR MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD X-RAY DETECTOR MARKET SIZE, 2018-2025 ($ MILLION)