Growth Trajectory of the Global Distribution Automation Market

Distribution automation has become a crucial technology for modernizing the grid. It uses digital sensors and switches, in collaboration with advanced control and communication technologies, to optimize the use of energy sources at both distributed and centralized levels. Distribution automation is utilized in automating feeder switching, monitoring voltage, and equipment health, and managing outages, voltage, and power. Thus, distribution automation enhances the speed, cost-effectiveness, and precision of operations, reliably reducing operational costs for customers.

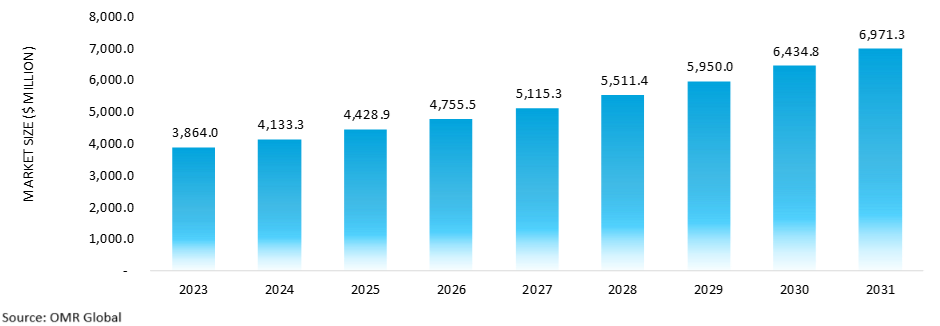

Global Distribution Automation Market Research and Analysis, 2023-2031 ($ Million)

The global distribution automation market was valued at $16.5 billion in 2023 and is estimated to reach $28.8 billion in 2031, growing at a CAGR of 7.3% during the forecast period (2024-2031). The market growth is driven by grid modernization and upward distribution lines and circuits infrastructure backed by growing power demand. Energy diversification and security are contributing significantly toward market growth. For instance, global energy investment is expected to exceed $3.0 trillion for the first time in 2024, with $2.0 trillion going to clean energy technology and infrastructure. Additionally, the growing demand for smart grids is creating an opportunity for market growth. For instance, the European Commission expects about $633.0 billion investment in the European electricity grid by 2030.

Digital twins can be used in power distribution automation to improve grid performance and reliability and support decision-making. This would help in generating a single source of data for utilities, enabling automated data exchange between systems. Digital twins maximize grid reliability, by unifying protection data from different systems and enabling automated synchronization with field data. Additionally, they can be used in improving power supply reliability, by using state evaluation, simulation deduction, and load prediction functions.

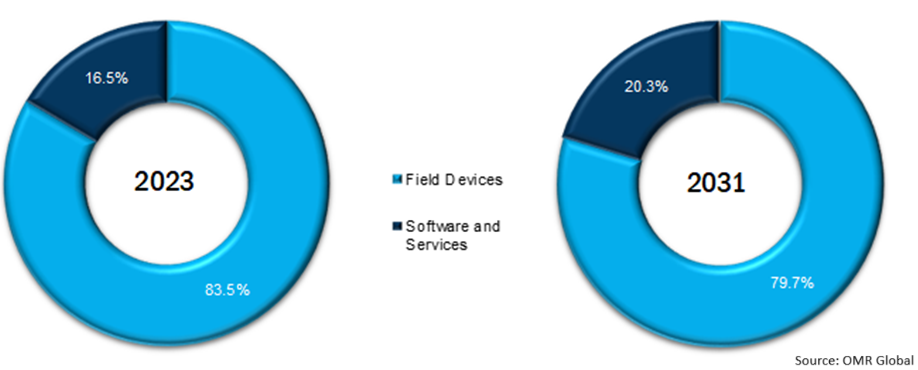

Global Distribution Automation Market Share Analysis by Component, 2023 Vs 2031 (%)

Based on components, the distribution automation market is segmented into field devices, and software & services. Among these, the field devices segment held the largest market share of 83.5% in 2023, accounting for $13.8 billion, and is estimated to reach $23.0 billion in 2031, growing at a CAGR of 6.7% during the forecast period.

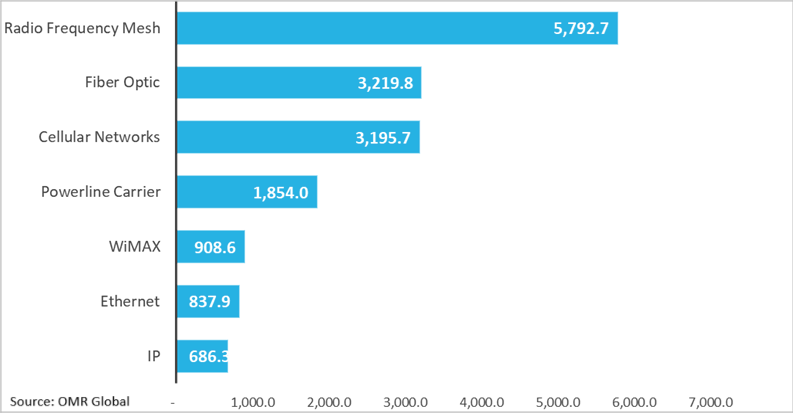

Global Distribution Automation Market Size by Communication Technology, 2023 ($ Million)

Most utilities use at least two-layer communication systems to communicate between field devices and information and control systems. Distribution automation is implemented using, wireless radio frequency and wired optical fiber, to transmit data to collection points and ultimately back to utility control centers. Robust communication systems, are required to optimize the control and performance of distribution automation operations.

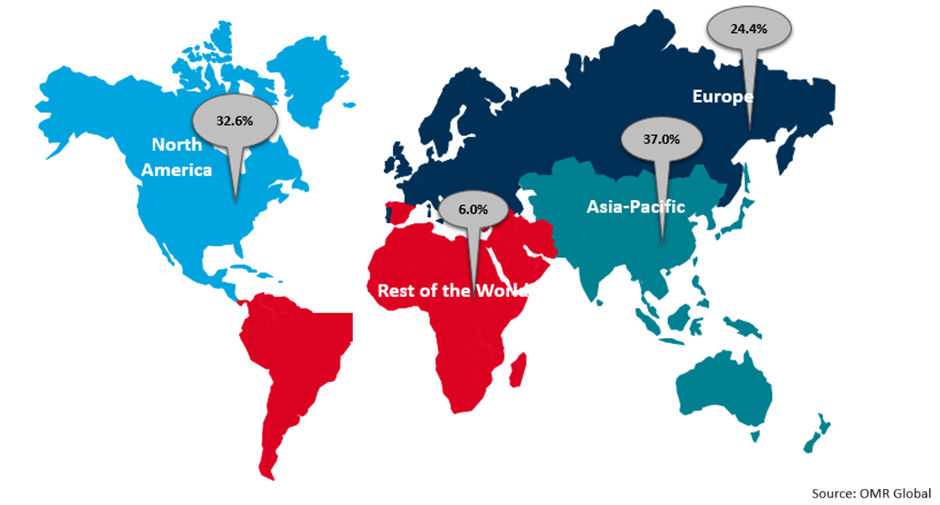

Global Distribution Automation Market by Region, 2023 (%)

Note: The rest of the World comprises Latin America, and Middle East, and Africa

Among all regions, Asia-Pacific held a major market share of 37.0% in the global distribution automation market. It accounted for a market value of $6.1 billion in 2023. Further, the number is projected to reach $11.0 billion in 2031, growing at the highest CAGR of 7.8% during the forecast period.

The Asia-Pacific distribution automation market is anticipated to grow considerably during the forecast period owing to supportive government regulations and incentives, a rise in electricity demand, a boost in smart grid infrastructure, and advancements in loT (Internet of Things) and communication technologies. Additionally, utilities are investing in automation technologies to improve operational efficiency and lower carbon emissions as energy conservation and sustainability become priorities. The need for energy efficiency and immediate fault detection in power distribution networks is also contributing to the market growth.

China Distribution Automation Market Research and Analysis, 2023-2031 ($ Million)

China's distribution automation market in the Asia-Pacific region held the highest share of 63.3%, accounting for a market value of $3.9 billion in 2023, and is projected to reach $7.0 billion in 2031, growing at a CAGR of 7.8% during the forecast period. India's distribution automation market in the Asia-Pacific is growing at the highest CAGR of 9.2% during the forecast period.

The growth of China is attributed to supportive government regulations and incentives, a rise in electricity demand, and an increase in infrastructure development such as EV (Electric vehicle) charging points and smart cities. As energy conservation and sustainability become more important, utilities invest in automation technology to increase operational efficiency and reduce carbon emissions. For instance, in October 2022, Nokia announced the extension of its existing relationship with the power utility, State Grid Corporation of China (SGCC), with the selection of its Optical Transport Network (OTN) solutions.

The North American region is expected to exhibit exponential growth during the forecast period, owing to the growing adoption of smart grid infrastructure, increasing investment in modernizing aging distribution infrastructure, rising demand for electricity, regional goals for energy diversification, and the growth of industrial consumption. For instance, as per the International Energy Agency, in 2021, the North American region produced 5,397,346 GWh of electricity, while recording an 11.0% upside between 2000 and 2021 and accounting for 19.0% of global production. The US distribution automation market in North America held the largest market share of 85.6% and is anticipated to grow at the highest CAGR of 7.6% during the forecast period.

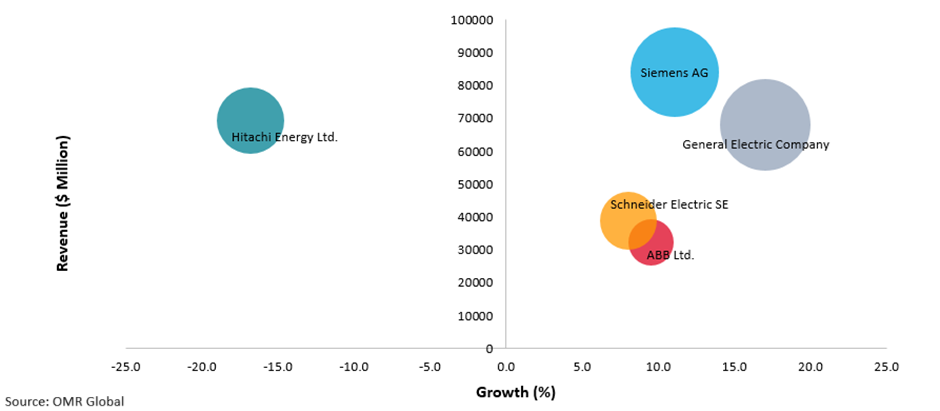

Competitive Landscape 2023

The bubble graph demonstrates the competitive landscape of the global distribution automation market. General Electric Company marks the highest growth of (+17.0%), over the past financial year (FY2023). Additionally, the company held the largest amount of total assets, by value, at the end of the financial year, in comparison to its competitors. The total assets of General Electric Company amounted to $163,045 million, in 2023. Siemens AG reported a revenue of $84,153.8 million, in 2023, the largest among its competitors. On the contrary, the revenue of, Hitachi Energy Ltd., decreased by 16.8%, in 2023, compared to 2022.