The Digital Economy is Boosting Data Center Numbers and Liquid Cooling Technology

Indian data center liquid cooling solution market is projected to grow at a CAGR of 13.2% during the forecast period (2024-2031). The market growth is primarily driven by the advancements in IT equipment technology, owing to the rising demand for cloud, IoT, AI, and edge applications, among others. According to the National Association of Software and Services Companies (NASSCOM), India’s technology industry is expected to cross $245 billion in 2023 based on an 8.4% annual growth rate. The data center infrastructure is rapidly evolving to meet growing demands for security, scalability, and efficiency. The market growth is attributed to the nation's large base of digital consumers, the surge in virtual work culture, and the adoption of new technologies. Additionally, the expanding digital economy and rising demand for data localization contribute to market expansion.

The data center liquid cooling market is classified based on the type, end-user, liquid cooling technology, product, cooling liquid, and region. Based on type, the market is segmented into indirect liquid cooling, and direct liquid cooling. Based on end-users, the market is segmented into banking & financial services, healthcare, IT & telecommunication, entertainment & media, manufacturing, government, and others. Based on liquid cooling technology, the market is segmented into direct-to-chip cooling (cold plate cooling, and heat pipe-based cooling), immersion cooling (single-phase immersion cooling, and two-phase immersion cooling), rear-door heat exchangers (integrated heat exchanger-based cooling, and modular systems-based cooling), and spray cooling. Based on product the market is segmented into single-phase, and two-phase. Based on cooling liquid, the market is segmented into mineral oil, fluorocarbon-based fluids, deionized water, and others (synthetic cooling fluids). Based on region the market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World.

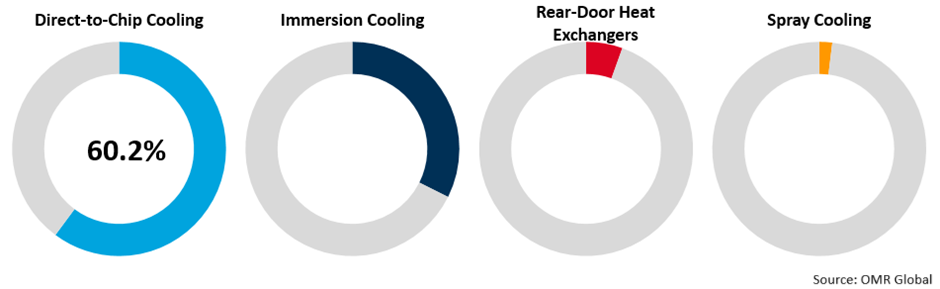

Data Center Liquid Cooling Solution Market Size and Forecast By Liquid Cooling Technology, 2023 (%)

Direct-to-Chip Cooling held the highest market share of 60.2%, in 2023. It is a preferred method for High-Performance Computing (HPC), owing to its efficiency in cooling individual components such as CPUs and GPUs. It is often recognized for its precision and growing adoption, especially in data centers that prioritize energy efficiency.

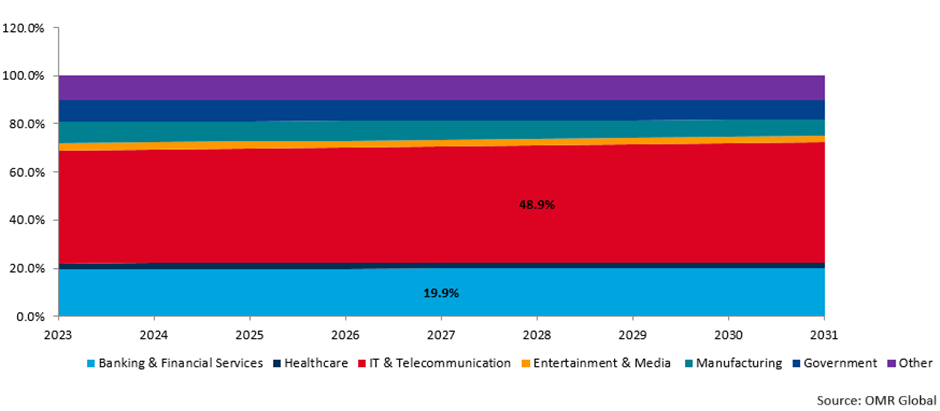

Data Center Liquid Cooling Solution Market Size and Forecast by End-User, 2023-2031(%)

The IT & telecommunication segment is anticipated to hold the largest market share during the forecast period and is projected to grow growing at a CAGR of 14.2%. The segment growth is attributed to the rising demand for faster and more reliable connectivity. IT and telecom companies are expanding their data center infrastructure to support emerging technologies such as 5G, edge computing, AI, and cloud services. These technologies generate substantial heat due to the high-density computing environments required to process vast amounts of data, making traditional air cooling methods insufficient, and escalating the demand for liquid cooling solutions.

Major Market Players

The major market players in the global data center liquid cooling solutions market include 3M, The Dow Chemical Company, Exxon Mobil Corp., Honeywell International Inc., and Shell Group, among others. The market players are investing in product innovation, new product launches, strategic partnerships & collaborations, and contracts to remain competitive. For instance, in May 2023, Amazon Web Services (AWS) announced a significant investment of INR 1,05,600 crores ($12.7 billion) in India to expand its cloud infrastructure. This major investment will enhance AWS’s data center capabilities and support the growing demand for cloud services across the country. The expansion aims to drive digital transformation and innovation for businesses in India, supporting the country's technological growth and development.